Digital banking has become an essential part of everyday life for many Australians, offering convenience, speed, and new ways to manage finances from home.

Over recent years, more people have embraced online banking, using laptops and tablets to pay bills, check balances, and track spending.

If you’re one of the seven million Australians who bank with ANZ, get ready: big changes are coming to how you manage your money.

The bank’s new chief executive officer (CEO), Nuno Matos, has wasted no time signalling a major digital transformation that will affect every retail customer, including those who joined ANZ through its recent Suncorp Bank acquisition.

But what does this mean for you, and how will it impact your day-to-day banking? Let’s break down what’s happening, what you need to know, and how to prepare for the future of banking at ANZ.

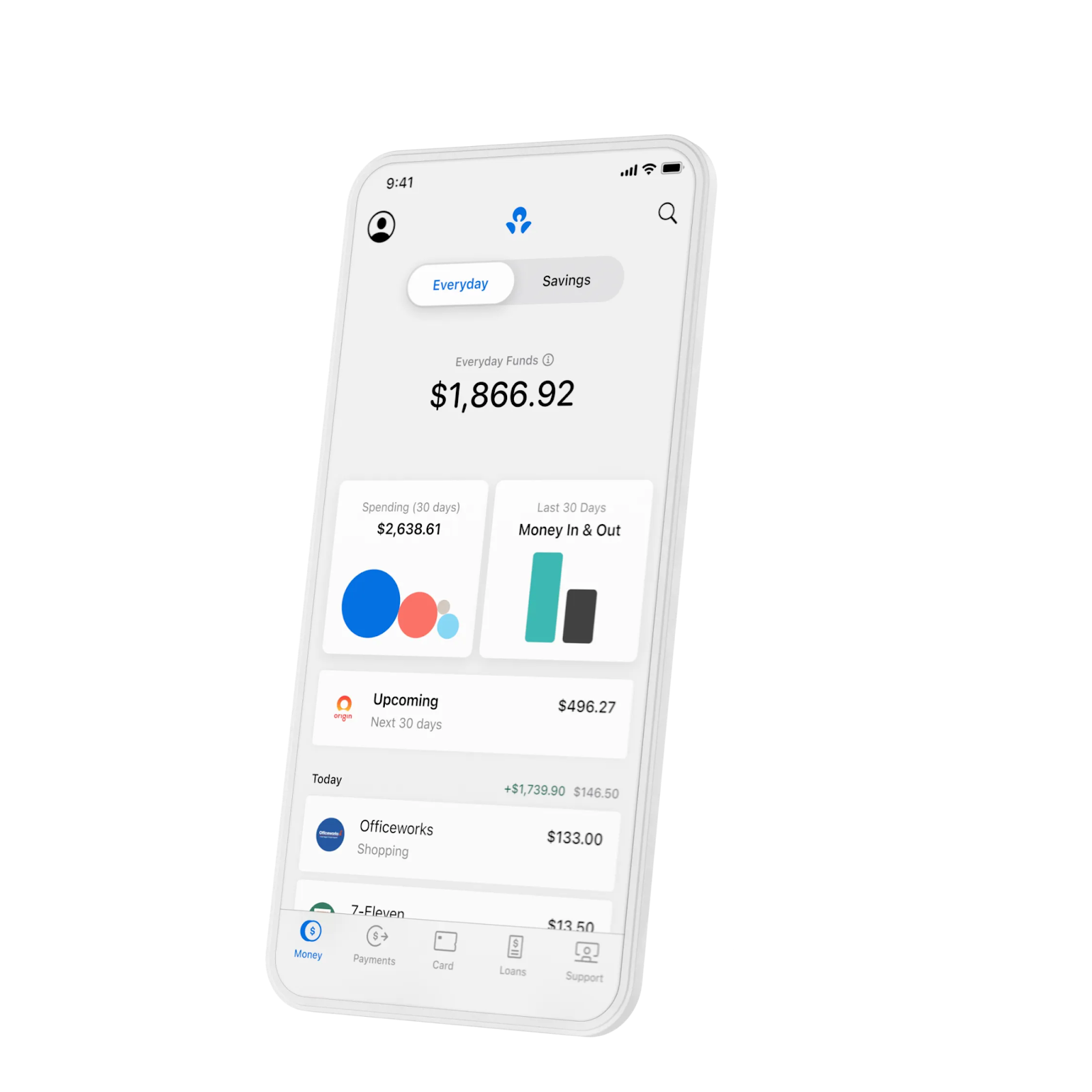

ANZ Plus is the bank’s new digital platform, launched in 2022 as a modern, app-based alternative to traditional banking.

It’s designed to offer more innovative tools for saving, spending, and managing your finances, with features like automatic round-ups, bill predictions, and a streamlined, user-friendly interface.

More than one million customers have already switched to ANZ Plus. But under Matos’s leadership, the bank is accelerating its plans to move all retail customers—six million existing ANZ customers and 1.2 million Suncorp customers—onto the new platform by 2029.

In his first week as CEO, Matos made it clear: ‘I would like to see it in front of every customer, tomorrow.’

He acknowledged that the bank has not moved fast enough in the past and is determined to pick up the pace.

The former head of HSBC’s wealth and personal banking division is eager to swiftly integrate the Suncorp Bank acquisition and enhance ANZ’s risk management strategies.

Matos, who just stepped in for Shayne Elliott, emphasised exciting ‘immediate priorities’: fostering a ‘high-performance, winning culture, with no shortcuts from a values and behaviours perspective’.

Matos will receive a competitive base salary of $2.5 million per year in his exciting new role, with the potential for a $2.5 million short-term bonus and a remarkable $3.4 million long-term bonus in his first year.

What changes can you expect?

1. A new digital experience

ANZ Plus is built for the digital age, focusing on mobile and online banking. Expect a fresh look, new features, and a more intuitive way to manage your money.

The platform is designed to make everyday banking easier, whether checking your balance, paying bills, or setting savings goals.

2. Password-free banking

One of the most talked-about features is the move to passwordless web banking, which will be implemented in mid-2025.

Instead of remembering (and resetting) yet another password, you’ll use secure authentication methods like biometrics or one-time codes. This is part of a broader industry trend towards making banking safer and more straightforward.

3. Seamless transition

Are you worried about losing your account details or updating all your direct debits? ANZ says the migration will be as smooth as an app upgrade.

You’ll keep your existing BSB and account numbers, credit card details, and all your regular payments. The aim is to make the switch as painless as possible.

4. Smarter money management tools

ANZ Plus comes with built-in features to help you save and budget. For example, you can set up automatic round-ups (where purchases are rounded up to the nearest dollar and the difference goes into your savings), get predictions for upcoming bills, and track your spending in real time.

Why the rush to go digital?

The banking world is changing fast. More Australians are managing their money online than ever, and digital-first banks (sometimes called ‘neobanks’) are raising the bar for customers’ expectations.

Over the next few years, the bank will migrate millions of valued customers to ANZ Plus, ensuring a seamless transition.

While there is no set timeline for when each customer will be moved, the bank assures you will retain your existing BSB and account numbers, credit card details, direct debits, and all connections from your current accounts.

Christine Linden, general manager overseeing this transition, likened the experience to a simple app upgrade, making it easy and hassle-free for everyone.

With ANZ Plus, you’ll gain access to innovative tools designed to help you save more effectively, such as round-ups and upcoming bill predictions.

This shift can feel daunting for older Australians, but it brings opportunities. Digital banking can make life easier, especially if you have mobility issues or live in a rural area. No more waiting in line at the branch or worrying about lost paperwork.

Have you tried ANZ Plus, or are you worried about the switch to digital banking? What features would you like to see in your banking app? Share your thoughts and experiences in the comments below—we’d love to hear from you!

Also read: ANZ ditches passwords for 1 million accounts in bold shakeup