Roman Elsohvili is the Founder and CEO of XData Group, a B2B software development company with a focus on the European banking sector.

The digital banking market continues to boom. Dimension Market Research has projected that it will reach $31.3 billion by 2033. However, growth doesn’t just happen by itself. The real champion behind this story is technology—more specifically, AI.

AI is consistently gaining a greater impact on banking and fintech. It’s fundamentally changing how applications are being developed, services are delivered and risks are managed.

Let’s take a closer look at how this works and what challenges are still ahead.

The AI-Powered Toolbox: What’s Driving Real Change?

Ask any fintech founder or bank CTO about where AI is making the biggest difference today, and a few clear answers are likely to come up—customer-facing chatbots, document generation, compliance automation and so on.

In onboarding, for example, AI can help automate document checks and ID verification, drastically cutting down the time it takes to bring in new clients. In compliance and transaction monitoring, AI can perform retrospective analysis, flagging unusual behavior even if it doesn’t fit preprogrammed patterns. This helps reduce false positives, which have long been a plague for compliance teams.

In customer service, AI-driven chatbots powered by large language models can handle routine queries, support customers 24/7 and often outperform human agents in both speed and consistency.

In credit scoring, machine learning (ML) models can evaluate a much broader range of data points, including alternative sources like mobile phone usage or utility bills. This results in faster, more accurate lending decisions and improved risk management.

When it comes to fraud prevention, AI is essential. With bad actors also using AI tools to improve their tactics, the industry has no choice but to adopt this tech to match the rising threat level.

Why Banks And Fintechs Must Invest In Better Apps

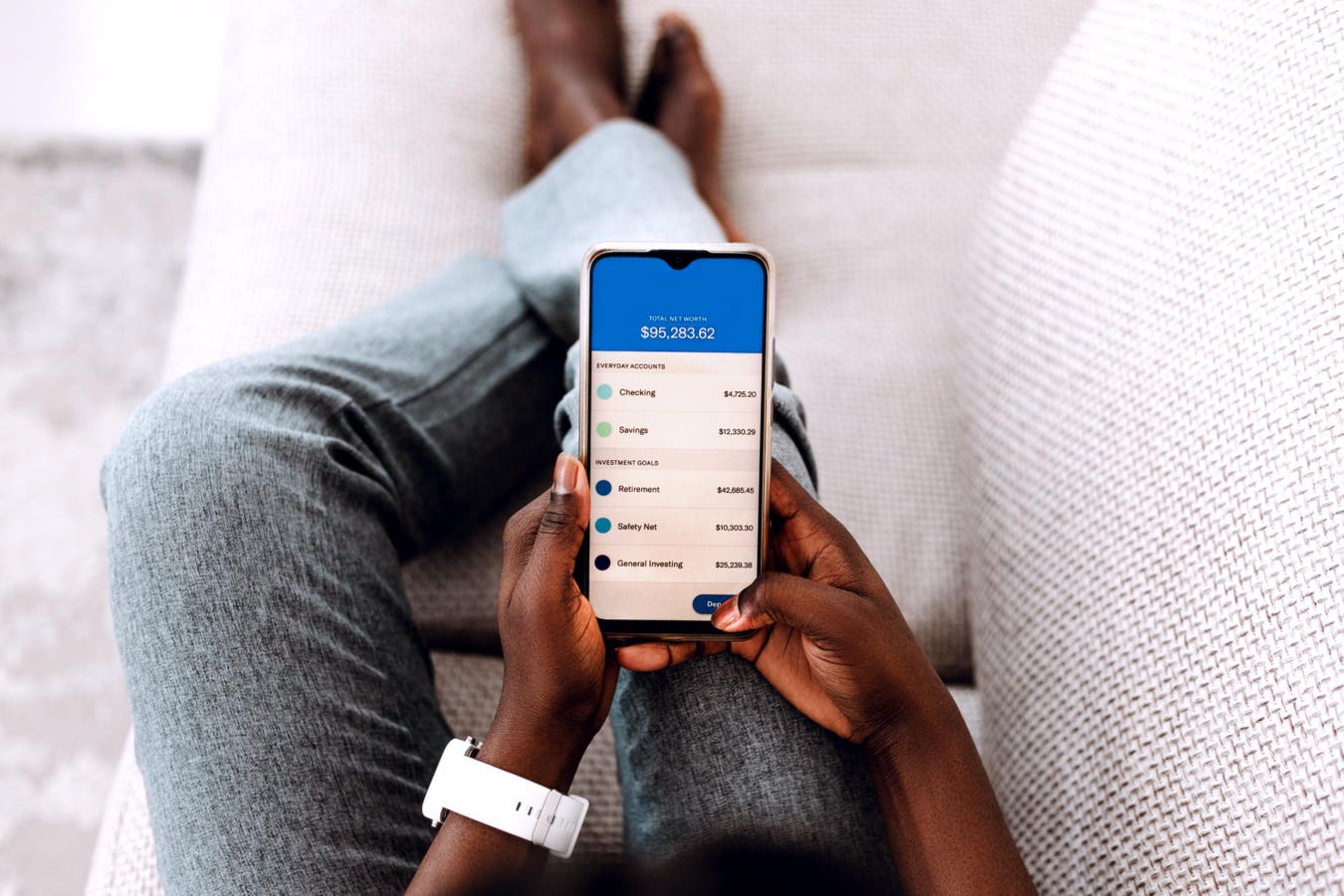

Let’s be honest: If your app isn’t good, you’re not in the game. Today, the mobile or web application is the main gateway between a financial service provider and its customers, and users’ expectations are very high. They compare your app not to the bank next door but to the best experience they’ve ever had—often from agile fintechs that put a lot of focus on smart, intuitive interfaces.

It’s no surprise that players stuck with legacy systems are feeling the pressure. According to OutSystems’ State of Application Development Report, nearly half of surveyed financial institutions cited outdated technology as their top innovation barrier, and over half reported that a lack of skilled developers was holding them back.

As a result, this is also a space where AI can play a prominent role.

How AI Is Reshaping The Way Applications Are Built

Setting aside customer-facing features, AI is changing the very architecture of fintech applications.

Today, more and more companies are moving to design their applications with AI in mind from day one. Data flows are structured to feed ML models, and the architecture is set up to integrate with internal or third-party ML services. This makes it easier to build smart features directly into the app, from personalized financial advice to automated document review.

For developers, AI is also a powerful productivity booster. From writing code snippets to generating test cases, it speeds up workflows and helps smaller teams ship faster. Tools are already available on the market that make it possible to build and deploy models without deep AI expertise.

There’s also a strategic element to consider here. AI models are becoming more affordable, and leading companies are already planning features that may not be cost-effective today but likely will be in just a few months. It’s a smart way to future-proof the roadmap.

Not All Smooth Sailing

Of course, AI adoption comes with challenges—technical, regulatory and ethical.

The biggest hurdle is data. Training robust AI models requires large, high-quality datasets. Established companies might have access to years of support chat transcripts or billions of transactions, but younger fintechs often don’t. That’s a tough gap to bridge.

There’s also the issue of regulation. With Europe’s AI Act and other global frameworks emerging, fintechs and banks are under pressure to ensure transparency and accountability in how their AI makes decisions. “Black box” systems just won’t cut it—especially in compliance and AML, where regulators need to understand the rationale behind every flagged transaction.

Security is another concern. When using external APIs or non-self-hosted AI models, protecting sensitive financial and customer data becomes even more critical. Once again, explainability is a must—not just for regulators but for internal teams and end users as well.

The good news is that there are ways to tackle these challenges.

Addressing The Challenges Proactively

First, responsible AI design starts with anticipating regulatory demands. The smarter fintech companies are already building explainability and transparency into their AI systems, documenting decision making steps and auditing model performance to detect bias or drift.

Techniques like explainable AI (XAI), which generate human-readable justifications for decisions, are becoming more common. These might look like simple cause-and-effect summaries that show why a transaction was flagged or why a loan was denied.

In high-stakes use cases like compliance or AML, many companies still leave the final decision to a human and use AI as a decision-support tool rather than a full replacement.

The road ahead is still long, and we shouldn’t expect AI to solve every problem a business has to deal with, but it’s already solving many of them. For banks and fintechs willing to experiment, invest and learn quickly, the payoff can be huge—smarter applications, happier customers, faster development and better compliance.

In a market where your app is your handshake, storefront and sales pitch all in one, using AI to make it better isn’t just an option. It’s the path forward.

Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify?