Stuart Mackinnon is Executive Vice President and Chief Operating Officer of NCR Atleos.

The term “artificial intelligence” (AI) was coined by John McCarthy in 1956 during the Dartmouth Conference, marking the birth of AI as a field. Between 1964 and 1966, MIT’s Joseph Weizenbaum created ELIZA, a program capable of carrying out conversations so realistic that users sometimes believed they were interacting with a human rather than a computer.

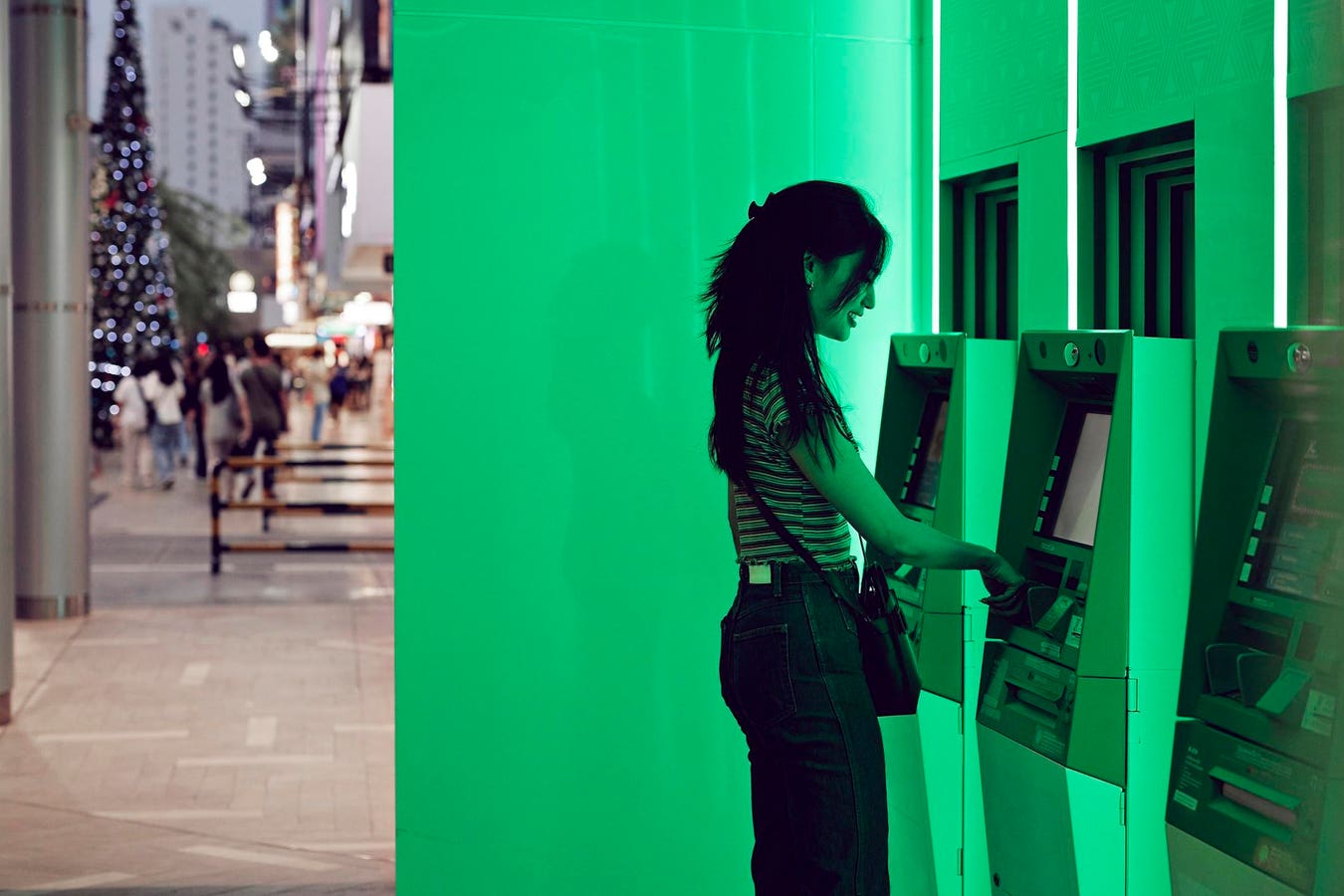

Since then, AI has rapidly evolved from an emerging technology to a business necessity. The recent rise of generative AI has significantly amplified the technology’s scale and impact. In self-service banking, including ATMs and interactive teller machines (ITMs), AI is set to transform the channel in three primary ways: service delivery, security and customer experience.

Service Delivery

AI is poised to enhance ATM operations through improved service delivery. With around three million ATMs worldwide, servicing them efficiently is a challenge. Technicians need the right parts, must be at the correct location and possess the necessary skills to solve complex machinery. AI can help increase the speed and accuracy of this process through the correlation of millions of data points, allowing more predictive maintenance.

Optimizing the dispatch process is also suited for AI. Rather than manually matching parts, availability and technician skills, AI can quickly analyze and correlate this information to ensure the best-suited technician is assigned to the call. AI models can consider factors like traffic patterns, weather, device type and age, minimizing downtime and speeding up time to resolution.

Utilizing AI, organizations can address the talent and staffing shortages by shortening the training time for technicians. Guided AI-based learning can provide on-site technicians with automatic repair suggestions and proactive videos or animations, eliminating the need to scan lengthy documentation for answers. This widens the shared experience database, allowing technicians to get up to speed more quickly.

Additionally, AI can help overcome human error in service delivery. By leveraging computer vision, AI can audit repairs, ensuring the technician has fully restored the machine. AI can scan millions of collected images to verify repairs before closing the ticket, making fixes more accurate and efficient.

Security

ATMs have long been targets of fraud, and AI can add a robust layer of protection. AI can make ATM cameras more effective by detecting malicious behavior as it happens or even before. For example, if a vehicle backs up straight toward an ATM instead of driving normally, AI could detect this and trigger responses like alerting employees, sounding alarms or shutting down machines.

AI could also detect if a person’s face shows signs of duress when withdrawing cash, prompting the machine to decline the transaction. This proactive fraud prevention helps financial services providers avoid monetary losses and maintain consumer trust.

Personalized Experiences

Personalizing experiences is not new, but AI brings the industry closer to leveraging ATMs as unique digital access points, adding value to customers and promoting relevant products and services. AI can expand ATM accessibility by enabling natural conversations and full audio AI-guided experiences, allowing customers to be authenticated via voice for a seamless experience.

An AI-powered digital human can address staffing challenges by integrating helpful, relevant prompts into the experience. For example, AI could proactively ask, “I see you missed your last car payment. Would you like to put more money in?” Future ATM and ITM interactions will enable consumers to engage with AI, ask clarifying questions and improve functionality and overall experience.

Considerations

Applying AI to the self-service banking and ATM industry introduces considerations that are not new but rather extensions of existing operational and security practices. For instance, concerns around data privacy, system reliability and fraud prevention have always been central to banking operations. AI does not inherently increase these risks, but it does require banks to continue applying the same diligence they already use with traditional systems. Technologies like facial recognition or voice authentication simply add new layers to existing identity verification methods, and with proper safeguards, they can be managed within the same frameworks banks already use.

As in any industry, the introduction of AI into operational and customer-facing solutions needs to be undertaken with an appropriate measure of risk analysis and oversight. AI policies need to be created as a first step, ensuring all stakeholders understand the guide rails and appropriate use cases the organization has adopted. Executive leadership level sponsorship is a critical component of successful adoption of new tools, particularly if they have potential interactions with customers.

When planning to implement AI in self-service channels, banks should approach it as an evolution of their current digital strategies. Key considerations include ensuring that AI tools are transparent, fair and well-integrated with existing infrastructure. These are the same principles that guide the deployment of any new technology in banking. AI should be seen as a complement to, not a replacement for, human oversight and established processes. By maintaining strong governance, regular audits and clear communication with customers, banks can ensure that AI enhances service delivery without introducing unfamiliar risks.

If challenges do arise—such as system errors, customer confusion or integration hiccups—they can be addressed using the same best practices already in place for managing technology in banking, including offering fallback options, such as human assistance or alternative authentication methods and continuously refining systems based on user feedback. Training staff and educating customers about how AI features work can also help build confidence and smooth adoption. In short, AI doesn’t fundamentally change the risk landscape—it simply requires banks to apply their existing expertise in new ways.

Call To Action

As AI transforms self-service banking by enhancing availability, security and customer experience, financial services organizations must act now to leverage these innovations. Staying informed about the technology, keeping up with updates and finding the right partners will be crucial.

Those who capitalize on AI integration in self-service banking will improve operational efficiencies, reduce costs and strengthen customer loyalty and growth.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?