Bangladesh Bank plans to increase number of agents to 25,000 in near future

Illustration: TBS

“>

Illustration: TBS

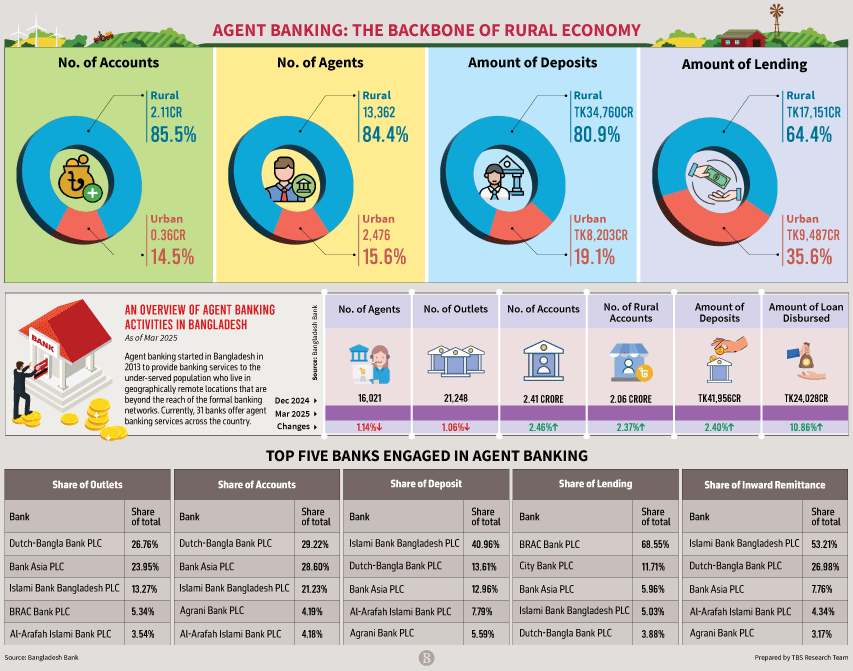

Bangladesh’s banking sector has experienced remarkable growth in agent banking, a model that has transformed financial inclusion across the country. Today, the number of agent outlets is more than double that of conventional bank branches, significantly contributing to the development of saving habits among rural communities and bringing millions of unbanked citizens into the formal financial system.

According to Bangladesh Bank data, as of March 2025, 31 scheduled banks are offering agent banking services through 21,023 active outlets managed by 15,838 agents. Impressively, 85.68% of these outlets are in rural areas—regions that were traditionally underserved by mainstream banking channels. By contrast, banks operate 11,362 branches across the country, of which 46.29% are located in rural areas and 53.71% in urban locations.

To accelerate this momentum, Bangladesh Bank is now planning to ensure agent banking reaches every village, aiming to expand the number of outlets to 25,000 in the coming years.

A push for women’s financial inclusion

In an exclusive conversation with The Business Standard, Bangladesh Bank Governor Ahsan H Mansur underscored the importance of using agent banking as a tool for empowering women.

“Women remain the most underserved segment in financial inclusion,” he said. “That is why we see agent banking as a powerful solution. In just a decade, we have grown to 20,000 agents and expect this number to cross 25,000 soon. My target is to have at least one agent in every village. To achieve this, we have made licensing easier so that banks can recruit as many agents as needed. Moreover, we have made it mandatory for 50% of new agents to be women.”

Explaining the rationale behind this initiative, he added, “Female agents can visit homes, help other women open accounts, and collect deposits discreetly—tasks that male agents often cannot do. In many cases, this means rural or home-bound women can participate in banking without needing approval from their husbands or in-laws. This is how true financial inclusion is achieved.”

The strategy is already paying off. As of December 2024, nearly half (49.32%) of all deposit accounts opened through agent banking channels belonged to women, reflecting a major shift toward gender-inclusive banking.

From concept to transformation

Agent banking was first introduced in Bangladesh in 2013 to create an alternative delivery channel for essential financial services. It was designed specifically to serve populations living in remote and hard-to-reach regions where establishing traditional bank branches was impractical.

Through agent banking outlets, customers can access a range of services, including deposits and withdrawals, loans, local and overseas remittances, utility and tax payments, and even government social safety-net benefits. This model has quickly gained traction as a cost-effective and convenient solution, especially in rural Bangladesh, where people often had to travel long distances to reach the nearest bank branch.

By March 2025, the total number of agent banking accounts had reached 24.67 million, with 85.52% of these accounts located in rural areas. Of these, 83.63% are savings accounts, demonstrating the growing tendency among rural households to save. Another 2.96% are current accounts, while 13.41% fall under other categories. This surge in savings accounts highlights a significant shift in financial habits in regions previously excluded from formal banking.

Illustration: Duniya Jahan/TBS Creative

“>

Illustration: Duniya Jahan/TBS Creative

Driving rural credit and economic participation

The agent banking model has also made credit more accessible for rural populations. As of March 2025, the total deposit balance in the agent banking channel stood at Tk 42,632 crore, while total loans reached Tk 10,467 crore, with 63% of those loans disbursed in rural areas. The loan-to-deposit ratio in agent banking stood at 62%, indicating a growing demand for credit in rural markets and a stronger focus on financing local businesses, small traders, and farmers.

Leading banks in agent banking include Dutch-Bangla Bank, Bank Asia, Islami Bank, BRAC Bank, and Al-Arafah Islami Bank, according to central bank data. These institutions have expanded their outreach aggressively, leveraging agent banking as a pillar of their financial inclusion strategies.

Voices from the banking sector

Bank leaders credit agent banking with reshaping the financial landscape:

- Sohail R K Hussain, Managing Director, Bank Asia:

“Our network focuses on rural, underserved, and economically excluded groups. By 2025, we’ve opened over 7.3 million accounts, 91% in rural areas and 63% held by women. This proves the effectiveness of agent banking in reaching the most marginalised segments.”

- Tareq Refat Ullah Khan, CEO (Current Charge), BRAC Bank:

“Agent banking is equally beneficial for businesses. We partner with corporates, particularly in pharmaceuticals, multinationals, and local firms, to provide digital collection solutions. This reduces cash dependency, minimises risks like counterfeit currency, and streamlines operations through secure, agent-driven collections.”

- Kamrul Mehedi, DMD, City Bank:

“For us, agent banking is central to our financial inclusion goals. We’ve prioritised lending to small traders, women entrepreneurs, farmers, and middle-income earners. Our loan disbursement through agent banking is three times higher than our deposits in this channel, making us second nationally with an 11.71% market share of agent banking loans.”

- M Nazeem A Choudhury, DMD, Prime Bank:

“Our long-term vision is near-total financial inclusion. In the next 3–5 years, we aim for every village and union to have at least one active agent outlet. Beyond basic banking, we plan to evolve agents into micro-entrepreneurs who can provide advisory, insurance, and value-added services, leveraging data analytics and AI to offer customised financial products.”

- Ali Reza Iftekhar, Managing Director, EBL:

“Agent banking sits at the heart of our inclusion strategy. It helps historically excluded communities save securely, access credit, and receive remittances without the need to travel long distances.”

- Md. Shafiul Azam, CEO, Modhumoti Bank PLC:

“Our focus has always been on rural, semi-urban, and underserved regions. We target low-income households, farmers, small entrepreneurs, women, and government aid recipients—the groups that need these services the most.”

A gateway to future growth

Over a decade since its introduction, agent banking has emerged as a cornerstone of Bangladesh’s financial inclusion efforts. Its rapid expansion has not only bridged the urban-rural divide in banking access but also empowered women, supported small businesses, and fostered a culture of savings in rural households.

With Bangladesh Bank’s ambitious plans to place at least one agent in every village, along with mandatory female representation among agents, this model is poised to become even more impactful. Banks are also looking ahead to innovations such as AI-driven credit scoring, insurance offerings, and advisory services, which could transform agents into full-fledged micro-financial hubs.

In a country where millions once had little to no access to formal banking, agent banking has rewritten the rules of financial inclusion. By combining technology, local reach, and innovative strategies, it is not only reshaping how people bank but also how they build secure financial futures.

Jebun Nesa Alo. Illustration: TBS

“>

Jebun Nesa Alo. Illustration: TBS