3

By Alenka Grealish, Principal Analyst, Celent

By Alenka Grealish, Principal Analyst, Celent

In a mere two years, generative artificial intelligence (GenAI) has gone from moonshot to reality. Frontrunners are already pursuing use cases across the banking value chain, ranging from marketing, sales and customer engagement to risk, IT (information technology) and operations. Given its strong potential, developing a GenAI blueprint is now imperative for banks to remain competitive.

Catalyst for action: early-adopter advantage

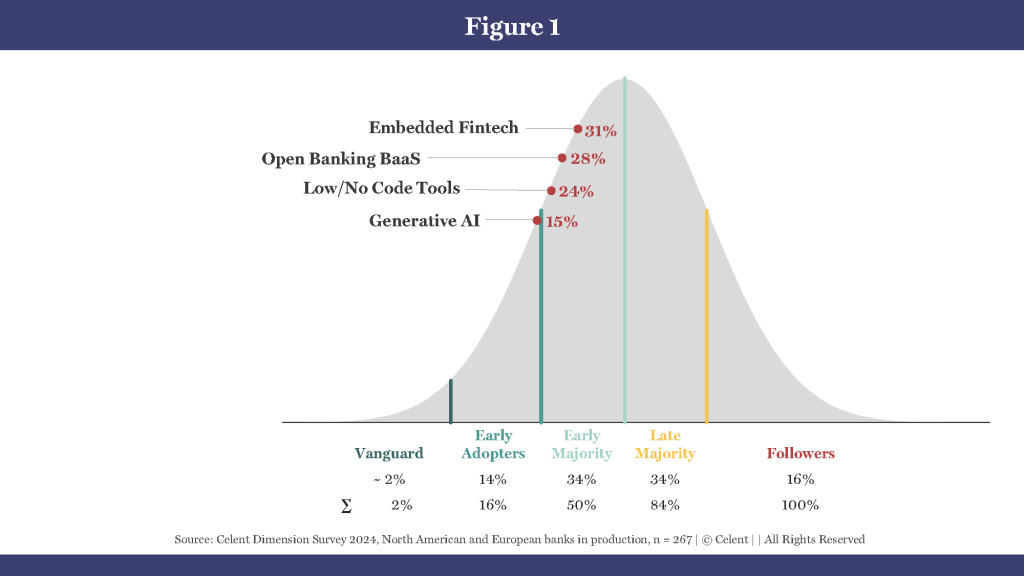

GenAI is a magnet for investment. To flesh out the reality for banks, Celent surveyed bank executives about their states of adoption across a variety of tech-related initiatives. The results showed that banks’ GenAI adoption (in production with any use case) was entering the early majority phase, not far behind the adoption of low/no-code tools but behind more mainstream initiatives, such as open banking, banking-as-a-service (BaaS) and embedded fintech (financial technology).

Early adopters stand to gain a competitive advantage. The returns on investment (for example, call-center productivity gains and code-development efficiency gains) are fueling the next round of GenAI investment, leading to a flywheel effect. Wherever your bank is on its path to GenAI adoption, now is the time to evaluate your preparedness and roadmap.

Develop your GenAI blueprint

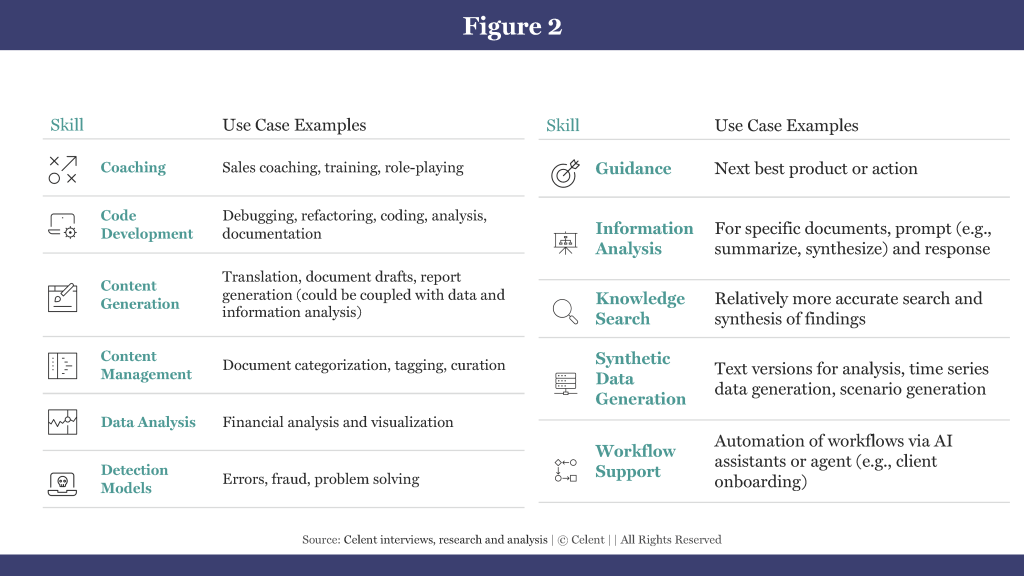

With the fire hose of GenAI opportunities, it can be challenging to architect a plan for how to harness GenAI, prioritize use cases and deliver tangible results. To avoid a death-by-use-case scenario, it’s useful to begin with a common language to define GenAI skills.

Celent has defined 11 skill categories. Many can be applied in numerous parts of a bank’s value chain, translating into greater returns when scaled across the enterprise.

Begin with pragmatic use cases. Celent has observed that successful use cases tend to be pragmatic. They deliver high productivity and efficiency gains in low-risk areas with relatively low integration costs. Prime examples include code development (e.g., debugging and testing), call-center productivity tools and AI assistants to interact with large information sources (e.g., a bank’s terms and conditions).

While GenAI initiatives span a bank’s value chain, the potential in the front office is particularly exciting; it’s been a hotbed for early adopters. Currently, employee-facing use cases dominate. Based on interviews with early-mover banks, Celent has found that they are most comfortable starting with employee-facing initiatives. First, compared with customers, employees are more patient with new tools and can provide immediate, valuable feedback. Second, the bank can better identify and test change-management approaches with employees.

Most early adopters have tested and implemented GenAI in their call centers, with skills ranging from content generation (for call-transcript summarization) to guidance (providing an agent with next-best response suggestions). While branch implementations remain unique, branch use cases are clear extensions of the call-center ones. Commercial-banking use cases are budding, with a concentration on sales enablement and leveraging a variety of skills: knowledge search, content generation, information analysis (including internal systems and customer relationship managers [CRMs]) and coaching.

Customer-facing use cases are nascent and concentrate on enhancing intelligent virtual assistants (IVAs). Behind the scenes, GenAI is improving intent recognition, which is leading to measurable gains in containment, utilization and customer satisfaction. In addition, it reduces the time and effort required to train IVAs. New IVA implementations involving large language models (LLMs) can produce a time-to-value (TTV) metric measured in weeks, not months.

At the user-interface level, GenAI is delivering a more natural, conversational user experience overall with a greater ability to understand nested and/or multiple intents and remember context. Moreover, it can pull in both text and numbers to generate graphical responses as well as links to relevant documents.

Prepare to scale: organizational pillars

Once banks identify use cases that demonstrate sufficient value and feasibility to move to production, the heavy lifting starts. Celent has found that successful GenAI scaling rests on much more than technology. The load can be lightened by having critical organizational pillars in place. In fact, a Celent survey1 of innovation-forward banks found that they ranked “organizational and operational buy-in” as the number-one key success factor.

The four organizational pillars required for successful GenAI scaling are:

- An AI center of excellence (AI CoE): An AI CoE is essential for the effective development and adoption of responsible and scalable GenAI solutions. The AI CoE serves as a central hub for expertise and innovation, facilitating the creation of governance frameworks, best practices and streamlined processes for GenAI development. Additionally, it offers oversight and support for GenAI projects, ensuring that these initiatives align with the organization’s strategic objectives and deliver favorable returns on investment (ROIs).

- A robust AI/data-governance structure: The implementation of a comprehensive AI/data-governance framework is critical for ensuring the ethical and responsible use of AI and the underlying data inputs. Celent recommends that the framework encompass the integration of GenAI governance within broader AI-governance structures, emphasizing key principles such as fairness, ethics, accountability and transparency. These initiatives not only help mitigate potential risks but also prepare organizations for more stringent regulations while fostering trust among employees and customers.

- Talent: Attracting and developing talent presents a significant challenge for banks seeking to scale their AI/GenAI initiatives. Celent has observed that banks are implementing various strategies, including partnerships with universities, internship programs and executive-training opportunities. Additionally, they are creating positions that necessitate a blend of skills, effectively bridging the gap between technology and business. Celent has found that this approach ensures a holistic framework for talent development within a bank.

- A change-management plan: Ultimately, the successful adoption of GenAI requires cultivating a supportive organizational culture and effective change-management practices. This involves articulating a clear GenAI vision and a robust playbook, addressing employee concerns about job security and providing comprehensive training programs. By fostering an environment that embraces GenAI, organizations can ensure a smoother transition and maximize the technology’s benefits. For example, in corporate banking, the best relationship managers (RMs) pride themselves on not only their subject matter and client expertise but also their intuition. Hence, when developing AI assistants for RMs, a bank must ensure that RMs are in the development loop, that their feedback is acted upon and that they trust the data inputs. For example, if an IVA recommends that an RM contact a client regarding the resolution of a payment problem, it provides the rationale.

All four of these pillars are essential for successfully scaling GenAI initiatives. Collectively, they address the needs of these implementations, which extend well beyond the AI technology itself.

Capture available advantages

Over the next five years, GenAI will dramatically change the nature of bankers’ work as well as that of their customers. Use cases will shift from driving individual productivity to driving operational productivity and revenue growth. Agentic AI will power entire workflows as opposed to one step in a flow, with agentic workflows involving the deployment of various AI agents that can work autonomously together to complete a process. Banks will reach new frontiers, delivering highly personalized interactions (e.g., AI assistants for customers and AI generation of RFPs [requests for proposals]). The concept of augmented humans, in which technologies improve humans’ capabilities, will be widely embraced. As bias and hallucination risks are controlled and model accuracy becomes sufficiently high, banks will deliver prescriptive analytics, such as guidance and coaching.

Banks that accelerate their paths to value realization and competitive differentiation stand to gain not only market share but also a sustainable competitive lead. Because GenAI becomes more accurate with reinforcement learning from human feedback and additional training data, early-mover banks could achieve sustainable competitive leads. They’re already transitioning from merely delivering basic GenAI skills to their workforces to equipping them with advanced capabilities that drive value. This shift does more than enhance bankers’ productivity; it enriches their roles, making them more engaging and fulfilling. Consequently, banks that are pioneers in this transformation are poised to attract and retain top-tier talent, gaining a competitive edge in the industry.

ABOUT THE AUTHOR

Alenka Grealish is a Principal Analyst in the banking group at Celent (part of GlobalData), a research and advisory firm focused on technology for financial institutions globally. With more than 20 years of experience in the banking industry, Alenka leads consulting and research on emerging technologies.