- XRP continues its recovery after breaking the 100-day EMA hurdle amid market-wide bullish sentiment.

- Ripple applies for a national banking charter with the US OCC to advance compliant stablecoin and cross-border payments.

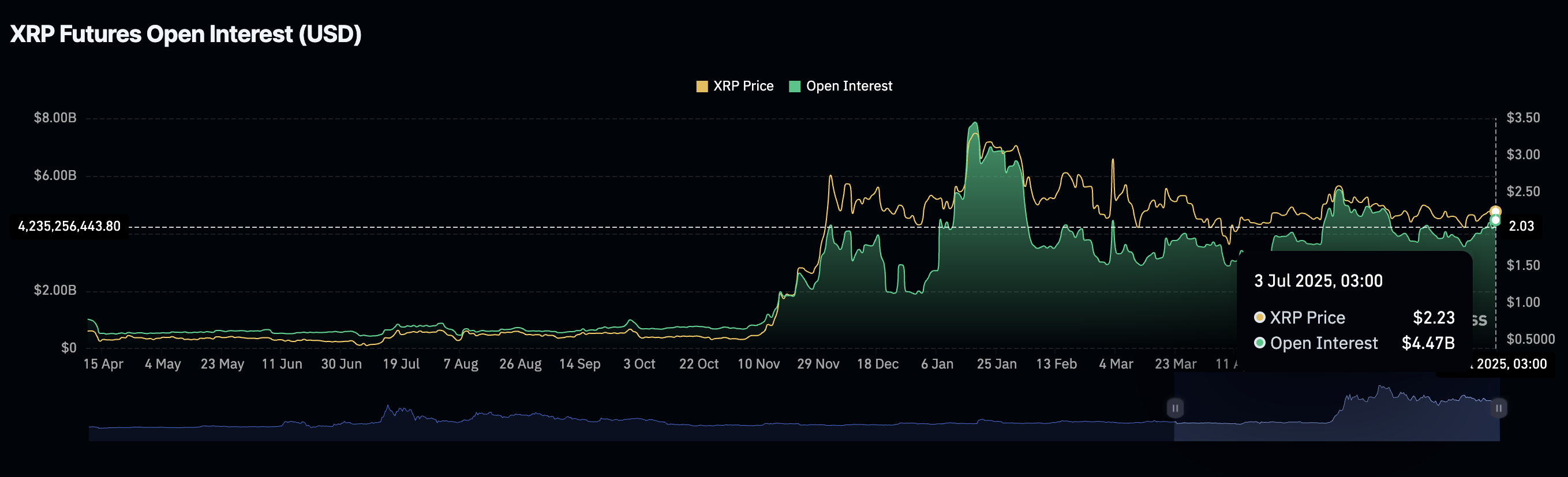

- Interest in XRP surges as Open Interest increases to $4.47 billion, alongside a rise in volume to $7.31 billion.

Ripple’s (XRP) price advances momentum on Thursday, returning above a key resistance hurdle to exchange hands at $2.29 at the time of writing. The cross-border money remittance token adopted for the Ripple Payments network is up over 2.5% on the day, reflecting positive sentiment in the broader cryptocurrency market.

Interest in XRP surged following the recovery from Wednesday’s levels, which had largely been capped below resistance at $2.22. CoinGlass data highlights a significant jump in the cumulative Open Interest (OI), now standing at $4.47 billion, accompanied by a substantial increase in trading volume, up 93% to $7.31 billion.

XRP futures Open Interest data | Source: CoinGlass

Ripple applies for US national banking license

Ripple’s CEO, Brad Garlinghouse, announced on Wednesday via X that the blockchain payments company had applied for a national bank charter from the United States (US) Office of the Comptroller of the Currency (OCC).

If approved, Ripple would be regulated both at the state level under the New York Department of Financial Services (NYDFS) and by federal oversight, setting a new and unique benchmark for trust in the market that is advancing quickly toward mass stablecoin adoption.

According to the Wall Street Journal (WSJ), Ripple joins other institutions seeking to bridge the gap between cryptocurrencies and mainstream finance. Ripple is the issuer of RLUSD, a US Dollar (USD) backed stablecoin valued at $469 million.

Ripple’s interest in obtaining a national banking license comes a few days after the company applied for a Federal Reserve (Fed) Master account, which would allow it to hold RLUSD reserves directly with the Fed. Garlinghouse stated that this would mark a significant milestone in ensuring an additional layer of security and fostering trust in RLUSD.

“Ripple always has and will continue to build trusted, battle-tested and secure infrastructure. In a $250B+ market, RLUSD stands out for putting regulation first, setting the standard that institutions expect,” Garlinghouse said in an X post.

Ripple’s partnership with OpenPayd, announced on Monday, aims to expand cross-border transfers by integrating fiat currencies such as the Euro (EUR) and the Pound Sterling (GBP) with the support of Ripple Payments.

The collaboration underscores Ripple’s intentional efforts to provide regulated, institutional-grade infrastructure with unique functionalities, including cross-border transfers, treasury management, and access to USD liquidity.

Technical Outlook: XRP uptrend anchored

XRP’s price remains slightly above previous technical hurdles, as highlighted by the 50-day Exponential Moving Average (EMA) at $2.21 and the 100-day EMA at $2.22. The cross-border money transfer token appears technically predisposed to extend the uptrend above the descending trendline resistance, as shown on the daily chart below.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator, maintained since Saturday, upholds the bullish outlook, encouraging traders to elevate their risk appetite.

XRP/USDT daily chart

The Relative Strength Index (RSI), which has advanced to 57 from lows around 35, suggests that buyers have the upper hand. XRP’s uptrend could steady as the RSI moves toward overbought territory.

Still, traders should tread with caution, considering the trendline resistance and the RSI position as it approaches overbought territory, as this could be a precursor to a trend reversal.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023:

For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token.

While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at.

Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say.

Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation.

While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.