PHNOM PENH, Cambodia, March 25, 2025 /PRNewswire/ — In a rapidly changing financial landscape, Cambodia’s banking sector is emerging as a beacon of trust and innovation. Through significant advancements in digital banking, stringent cybersecurity measures, and transparent regulatory frameworks, the nation is positioning itself as a leader in ethical banking practices.

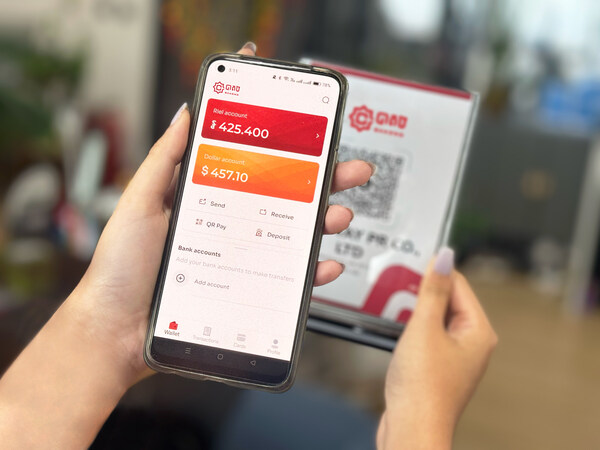

A user making a cashless payment via Bakong mobile banking app, reflecting Cambodia’s rapid adoption of digital financial services.

Digital Banking Surge Enhances Financial Inclusion

Recent data from the National Bank of Cambodia (NBC) reveals a notable shift towards mobile banking. In 2024, over 608 million transactions and payments, an increase of 334% from 2023, were made through the Bakong Payment System with the total value of 183 trillion KHR or 457 billion USD, a 127% increase from 2023. This trend underscores a growing consumer preference for accessible and user-friendly mobile platforms, reflecting its widespread adoption. NBC’s Bakong System has been instrumental in this digital transformation. By integrating e-wallets, mobile payments, and online banking into a single platform, Bakong has simplified transactions and broadened financial access, particularly in rural areas.

“Digital payments are transforming financial inclusion in Cambodia, especially for underserved communities. By using mobile banking and platforms like the Bakong system, we are making financial services more accessible, affordable, and secure-particularly for those in rural areas,” said Ms. Dith Nita, Chairwoman of the Cambodia Microfinance Association (CMA).

Strengthening Cybersecurity and Regulatory Transparency

To maintain financial stability amid rapid digitalization, Cambodia’s banking sector has prioritized cybersecurity and transparent regulatory practices. The Association of Banks in Cambodia (ABC), together with the Cambodia Microfinance Association (CMA) has been proactive in promoting consumer protection, financial literacy, and industry-wide cybersecurity initiatives, thereby fostering a stable and resilient financial environment.

In a significant regulatory development, NBC has introduced a framework that uses blockchain technology, providing clear guidelines to encourage innovation in digital finance while safeguarding financial stability. This move not only positions Cambodia as a responsible player in the global financial ecosystem but also attracts fintech firms seeking a regulated yet flexible environment for growth.

Commitment to Ethical Banking Practices

Cambodia’s financial institutions are dedicated to ethical banking, emphasizing responsible lending and financial inclusion. The NBC-UN Multi-Stakeholder Consultation on Microfinance, held in January 2025, highlighted key reforms such as prohibiting the use of Indigenous Communal Land Titles (ICLTs) as collateral and establishing a Financial Consumer Centre under the ABC and the Cambodia Microfinance Association (CMA) to assist borrowers in financial distress. These measures underscore the sector’s commitment to ethical practices and consumer protection.

ABC Chairman Rath Sophoan said, “As responsible providers, we are committed to ensuring financial access while contributing positively to the well-being of the population, always upholding the principles of transparency, fairness, and social responsibility.”

A Model for Regional Banking Excellence

With secure digital platforms, clear regulatory frameworks, and a steadfast commitment to ethical practices, Cambodia’s banking sector is setting a high standard in the region. As global investors seek stability and transparency, Cambodia is proving itself as a reliable and innovative financial hub.

By balancing technological advancement with ethical banking, Cambodia’s financial institutions are fostering long-term trust, ensuring the country remains a key player in Southeast Asia’s financial landscape-ready for the future, yet firmly grounded in stability.

For further details please contact:

ABC Secretariat

Mr. Sok Chan, Head of Financial Inclusion and Public Relations

Email: [email protected]

Phone: +855 92 683 330

CMA Secretariat

Mr. Tongngy Kaing, Head of Communications

Email: [email protected]

Phone: +855 95 262 111

About ABC

The Association of Banks in Cambodia was formed in 1994 and is recognized by the Royal Government as the official organization to represent the country’s private banking sector. Our purpose is to promote constructive dialogue amongst member banks, and to serve as an industry voice to the public and the Government.

About CMA

The Cambodia Microfinance Association is an NGO and professional association that aims to ensure the prosperity and sustainability of the microfinance sector in Cambodia. CMA plays a vital role in creating local and international networks as well as seeking equity and loan funds, new technologies and overseeing conflict resolution between microfinance operators. All of these activities have led each member microfinance institution to become stronger and more successful and thereby attract support from the international market to enable industry expansion.

For media inquiries:

TWPR

Ms. Pheng Kim Hoan, Managing Director

Email: [email protected]

Phone: +855 10 455 466