It would be nice to get a 7% annual percentage yield (APY) on a savings account. This is virtually impossible right now, but a handful of banks currently offer rates above 5% — the highest on the market.

We at the MarketWatch Guides team will detail savings accounts with high yields and discuss alternative investments that could pay 7%. We’ll also offer tips on maximizing your earnings.

Key Takeaways

- Our picks for the best high-yield savings accounts include Bask Bank, Zynlo Bank and EverBank.

- While you likely won’t find 7% interest savings accounts in 2024, several financial institutions offer APYs around 5%.

- Online banks and credit unions typically offer high-yield savings accounts.

Featured Savings Accounts

FEATURED

Lending Club

APY

3.50%

Bonus

N/A

Min. Deposit Amount

$0

Earn up to 4.75% APY with $250+ deposits per month

SoFi Checking + Savings

APY

3.80%

Bonus

Up to $300

Min. Deposit Amount

$0

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi members with direct deposit are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Direct Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the total amount of Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 1/31/26. See full bonus and annual percentage yield (APY) terms at sofi.com/banking#1.

UFB Portfolio Savings

APY

4.01%

Bonus

N/A

Min. Deposit Amount

$0

Unlock up to 4.21% APY, Combine Freedom Checking with Portfolio Savings to boost your savings APY by up to 0.20%

Discover

APY

3.70%

Bonus

N/A

Min. Deposit Amount

$0

Our Picks for the Best High-Yield Savings Accounts

The best high-yield savings accounts listed below have APYs of 5% or higher and have low or no monthly fees. Many also have no minimum opening deposit, and all financial institutions on this list include Federal Deposit Insurance Corp. (FDIC) insurance of at least $250,000 per depositor, per bank.

| Bank | Our Savings Rating | APY | Minimum Deposit | Best For |

|---|---|---|---|---|

| Bask Bank | 4.7 | 4.20% | $0 | Best for Quick Account Set-up Process |

| Zynlo Bank | 4.5 | 4.40% | $10 | Best for Roundup Savings Tools |

| EverBank (formerly TIAA Bank) | 4.5 | 4.30% | $0 | Best for Fast Deposits |

If you want a high rate and don’t need immediate access to the money you deposit, the Bask Bank Interest Savings Account could work for you. Bask’s extremely competitive rate beats 95% of the banks we reviewed. Account holders can only make deposits via mobile check deposit, automated clearing house (ACH) transfer or wire transfer. The account has no monthly fees and there’s no minimum deposit requirement to open an account.

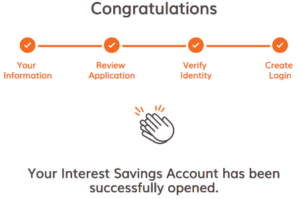

Bask Bank’s account opening process was one of our favorites. Here’s why we liked it:

- Simple application process: Opening an account with Bask Bank took us eight steps. Only one other company we tested (Upgrade) required fewer steps.

We also encountered a few issues with Bask Bank:

- Slow transfers: Transfers can take up to five business days to complete. This is among the longest transfer times of the banks we evaluated, according to our research.

- Chat isn’t instant: Unlike with some of its competitors, you’ll have to send a message and wait for a response from chat – up to 24 hours.

- ID required for login: You’ll need a government-issued ID to log in and complete your application. Not all banks require this, so while it adds a layer of security, we believe it’s unnecessary.

- No Zelle availability: While it’s not the only bank to not offer Zelle, it’s a convenience that many customers look for due to speed and safety of transactions.

Source: Baskbank.com via MarketWatch Guides user testing

Easy account-opening process

APY is more than 10 times the national average

No minimum balance or minimum opening deposit requirements

Offers mobile check deposit

No ATM or debit cards and no option to deposit cash

Monthly limit of six withdrawals via ACH transfers

Can take up to five business days to transfer funds

Most Praised Features

Competitive interest rates: Customers routinely praised the high interest rates offered, particularly on savings accounts and CDs.

Reliable money transfers: Once accounts are set up, customers noted that transfers between Bask Bank and other accounts are smooth and quick.

No-frills banking: Some reviewers mentioned that Bask provided a simple banking experience, with consistently high interest and no complicated services.

Most Common Complaints

Poor customer service: A common complaint was difficulty reaching customer support, further complicated by long wait times and no resolution to issues.

Cumbersome account setup and verification process: Many reviewers cited a difficult and frustrating experience setting up accounts, especially with biometric verification (such as uploading a driver’s license or using face recognition).

Account access issues: A few reviewers said they had issues with their accounts being locked or disabled with no explanation, which often required extensive efforts to restore.

We reached out to Bask Bank for comment on its negative customer reviews but did not receive a response.

*Reviews aggregated from Trustpilot, the Better Business Bureau (BBB), Consumer Affairs, WalletHub and Best Company. Read our customer review methodology to learn more.

Zynlo is an FDIC-insured, online-only bank that provides services through PeoplesBank. We like this account for its easy opening process and cool savings features. Requiring the least amount of information, this account was one of the most streamlined to open. Also, you can create your savings goals right on your home screen and participate in automatic rounding from your checking account to deposit your spare change into savings.

Also, when you use your debit card, in addition to rounding up your purchases, Zynlo will match the roundup and transfer the match to savings. The website says this can help you earn an additional 4.11% return on your money.

We liked Zynlo Bank’s account opening process and its savings goals feature, but it does have a $10 minimum required opening deposit — a higher minimum than about half the banks we reviewed.

- Savings goals feature: Zynlo Bank allows you to create savings goals directly on your account’s home screen. This feature, called folders, tracks your progress and provides updates for motivation.

- Streamlined account opening process: Among the banks we tested, Zynlo was one that required the least amount of information to open an account.

- Low minimum deposit requirement: We only needed to deposit $10 to get started.

Source: Zynlobank.com via MarketWatch Guides user testing.

Zynlo fell short for us in website performance and customer service availability. Here’s our take:

- Lackluster website performance: We found the website to be slow, and it was difficult to navigate linking a new external account.

- No chat support: Zynlo doesn’t offer chat for customer service. FAQs are all that’s available online, but there’s phone support 24/7.

- No wire transfers: You’ll only be able to make deposits via mobile check deposit and electronic transfers.

With Zynlo’s Roundup Savings, customers with both high-yield checking and savings accounts from Zynlo can also have their debit card purchases rounded up to the next dollar, with the change going to their savings. Zynlo fully matches the rounded amount in the first 100 days after you open an account.

You can also continue to receive the full match if you keep a $5,000 minimum average daily balance in your checking account. You’ll receive a 25% match if your balance is lower.

Low minimum opening deposit

Matches some savings when paired with a checking account

No account fees or minimum balance

Doesn’t accept cash deposits

Most Praised Features

Interest rates: Several positive reviews mentioned Zynlo’s high interest rates for its savings accounts.

User-friendliness: Reviewers praised the convenience and simplicity of Zynlo’s mobile app and online banking systems.

Most Common Complaints

Account opening: One complaint cited difficulty opening accounts due to system verification issues.

Software limitations: Some reviews mentioned software issues that would not allow a manual account opening unless another person was added to a joint account.

*Zynlo Bank had only received three reviews at the time of publishing. Weigh this small sample size accordingly before making a decision.

We reached out to Zynlo for comment on its negative customer reviews but the bank declined to be quoted.

*Reviews aggregated from Trustpilot. Read our customer review methodology to learn more.

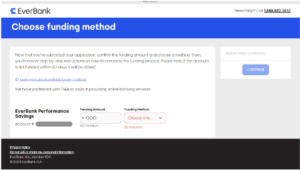

A few of the banks on our list have budgeting tools, and we found EverBank’s to be arguably the best. These tools allow you to link your bill payment accounts, categorize your spending, and even run reports to see where your money’s going.

We liked EverBank for its swift deposit speeds and handy budgeting tools, but our researchers found the application process frustrating and had multiple errors.

Here are our positive findings:

- Fast processing of deposits: EverBank impressed us by making deposits available within just one day.

- Robust budgeting tools: You can link your bill payment accounts to your EverBank savings account to set up budget categories and run spending reports.

- Online account closure: Unlike some competitors, EverBank lets you close your account online instead of by calling.

Source: Everbank.com via MarketWatch Guides user testing.

Here’s the problem we faced:

- Clunky website: We had issues getting through the account application process without errors. It took us three attempts to get past the form section. Also, we were often redirected to TIAA’s website. (TIAA’s banking segment became EverBank when it was sold in 2023.)

APY is more than 10 times the national average

No account maintenance fees or minimum balance requirements

No minimum opening deposit

Mobile check deposit available

Limited physical presence

Cash deposits only available at the bank’s nine Florida branches

Most Praised Features

Competitive interest rates: Several reviewers mentioned the higher-than-average interest rates offered on CDs and savings accounts.

Online banking features: Positive reviews highlighted useful online banking tools for depositing funds and recording transactions.

Easy to use: A few long-time users noted they were happy with the simplicity of the bank’s platform before recent changes.

Most Common Complaints

Customer service issues: The majority of negative reviews cited poor customer service with long wait times, unhelpful representatives and unresolved disputes.

Account access problems: Many reviewers said they had difficulties logging into their accounts and some reported inexplicably locked accounts or missing funds.

Issues with new platform rollout: Numerous negative reviews criticized EverBank’s new platform (after transitioning from TIAA), citing frequent technical issues with both the mobile app and website, and difficulty overall with the migration process.

We reached out to EverBank for comment on its negative customer reviews but the bank declined to be quoted.

*Reviews aggregated from Trustpilot, the Better Business Bureau (BBB), Consumer Affairs, WalletHub and Best Company. Read our customer review methodology to learn more.

Can You Get a 7% Interest Savings Account?

Right now, 7% interest rates on savings accounts aren’t available. The FDIC reports that the national average rate for savings accounts is only 0.46%, and its national rate data going back to 2009 shows that savings rates have historically stayed even lower than that. Once the Federal Reserve started raising rates in 2022, savings rates began climbing and peaked in late 2023. Sources such as CME FedWatch predict that rates will fall again later this year.

If you can accept a lower return, some high-yield accounts offer above-average rates of around 5%. Getting this APY can involve catches, though. Your bank might set a high minimum balance requirement, require a minimum direct deposit amount or limit the top rate to a small account balance. Still, you can find many options without catches, monthly fees or hefty minimum opening deposit requirements.

Where To Find a 7% Interest Rate

Although a savings account won’t get you a 7% return, other investment strategies could provide higher earnings in exchange for more risk and no guarantee. For example, you could invest in stocks, which have a 10.4% average yearly return, or put money in bonds, which have a close 6.8% average yearly return, according to investment firm Charles Schwab. Other common options include exchange-traded funds and mutual funds, which are also good for diversification.

While you can access cash through gains and dividends with these investments, you should consider your financial situation and risk tolerance. Unlike with savings accounts, stocks and bonds have the potential to lose money, and the risk varies depending on the investment. Consider whether you can hold investments long enough to ride out the ups and downs and average a good return.

Also, your day-to-day cash needs are important to consider, since you would need to sell your investments if you need the cash. Someone on the market will need to be willing to buy them when you’re ready to sell. Plus, you risk getting less than you originally paid for them. High-yield savings account withdrawals are more straightforward.

How to Choose a High-Yield Savings Account

Before choosing a high-yield savings account, shop around for the highest APYs and lowest fees. But remember that you’re seeing variable rates that don’t promise a continued high return. Read the fine print for minimum deposit requirements and rules for the advertised APY. Make sure any minimum balance or account activity requirements are sustainable. You should also research features such as deposit options, ATM card access and savings tools.

Picking a reputable credit union or bank for your high-yield account is essential. To avoid losing your money from a potential bank failure, verify the institution has deposit insurance through the FDIC or National Credit Union Administration (NCUA). You should also check the financial strength rating on the Bauer Financial website. To see reviews and reputation information, look the bank up on the Better Business Bureau website.

Maximizing Savings Account Interest Earnings

If you open a high-yield savings account, take steps to reach any minimum balance requirement that gets you the highest rate. If you don’t make a large enough deposit upfront, you might plan on using direct deposit, setting up automatic transfers or putting future windfalls in the account. Try not to withdraw the money so you can maximize your interest and keep your balance up.

Carefully read your account documents for fine print about account activity requirements, fees and balance caps.

If required, use direct deposit or make the required number of card transactions to qualify for the top APY. Find out how you can waive any monthly maintenance fee. And if there’s a balance cap, consider saving excess money in another high-yield account.

The Bottom Line

Even though the highest available savings rates likely won’t last, opening your account now will help you start growing your savings. Just check out the bank and account carefully so that you find any catches that would make it hard for you to get the advertised rate. You should also compare rates alongside any fees and sign up only with a trusted, insured institution.

If you’re considering other investments to earn 7%, remember that you’ll deal with more risk than if you get a high-yield savings account. While the return might look appealing, there is no guarantee, and you could even lose money. Consider talking to an investment professional first.

Frequently Asked Questions About 7% Interest Savings Accounts

A common catch with some high-yield savings accounts is a minimum balance requirement. Other catches can include interest caps, short-time promotional rates and monthly activity requirements.

While traditional banks spend a lot to run their branches, online-only banks don’t have these costs, so they can afford to pay customers such high-yield savings rates. This often leads to lower fees as well.

Although managing multiple accounts takes more work, you can have high-yield savings accounts through as many banks as you want. You might do this to take advantage of certain promotions, including getting high rates on a capped balance.

Unless you have a fixed-rate account like a certificate of deposit, your earnings will decrease if your bank decides to lower interest rates. This makes variable-rate bank accounts less predictable as economic conditions change.

Financial institutions offering high-yield savings accounts are low risk when they have NCUA or FDIC insurance. Avoid uninsured institutions if you don’t want to risk potentially losing your deposit amount.

While both are places for storing money safely, a high-yield savings account should offer a much higher return than a traditional savings account. Another difference is that credit unions and online banks are the main providers of high-yield savings accounts.

Methodology

Our team researched more than 100 of the country’s largest and most prominent financial institutions, collecting information on each provider’s account options, fees, rates, terms and customer experience. We then scored each firm based on the data points and metrics that matter most to potential customers. Read our full methodology.

Our list of the best high-yield savings accounts is made up of the six financial institutions with the highest ratings in the savings account category of our reviews and an APY of 5% or higher.

Editor’s Note: Parts of this story were auto-populated using data from Curinos, a research firm that collects data from more than 3,600 banks and credit unions. For more details on how we compile daily rate data, check out our methodology here.