Bangladesh Bank is designing a Tk 20,000-crore plan to restructure troubled banks, backed by international audits and new legal powers to deal with failing lenders.

“The first phase will start in a month or so, and some banks will be restructured by December,” BB Governor Ahsan H Mansur told The Daily Star last week.

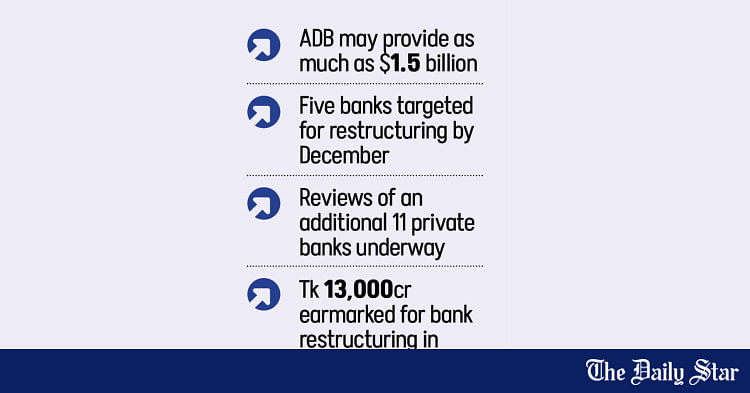

Further funds will be needed in later phases, with financing coming from both the national budget and development partners. The Asian Development Bank is expected to provide up to $1.5 billion, while the World Bank may contribute $1 billion.

The overhaul plan will start with at least five banks: First Security Islami Bank, Social Islami Bank, Global Islami Bank, Union Bank, and EXIM Bank. ICB Islamic Bank, also in trouble, will require a separate solution due to its foreign investment exposure. The others could be merged as part of the restructuring.

“Equity injections will be unavoidable. However, for banks involved in mergers, future business plans must be financially viable,” said Zahid Hussain, a member of the central bank’s reform task force. “It’s possible to merge these five banks by December,” he added.

Governor Mansur stressed that government recapitalisation funds, whether provided as equity or loans, will be repaid with a return, ensuring the government does not incur losses.

A donor-supported Asset Quality Review (AQR) is already underway in private banks to test compliance with new rules on asset classification and provisioning. The phased review will cover 17 private domestic banks, representing 35 percent of total banking assets.

The first phase, completed in May by KPMG and Ernst & Young Sri Lanka, examined six banks. The second and third phases, covering the remaining 11, are due to conclude by December. Bangladesh Bank has engaged an international consultant to review earlier special audits by local firms and identify gaps against the donor-agreed terms of reference.

International audits completed in May revealed significant capital deficits. As of December 2024, five banks — First Security Islami Bank, Social Islami Bank, Global Islami Bank, Union Bank, and ICB Islamic Bank — had a combined capital shortfall of about Tk 46,000 crore, which has since grown.

The central bank has established a three-tier governance structure — implementation, project management, and steering committees — along with special inspection teams to analyse the root causes of asset quality problems. A high-level AQR oversight committee was formed with representatives from the IMF, the World Bank, and ADB as observers.

The reform programme is supported by the Bank Resolution Ordinance 2025, issued in May, which gives the Bangladesh Bank formal authority to execute corrective actions and apply resolution tools in a structured, rule-based manner. The ordinance allows intervention when a scheduled bank is deemed non-viable.

Its powers include establishing bridge banks, implementing bail-ins, arranging purchase-and-assumption transactions, imposing temporary public ownership, and transferring assets to asset management companies. A new Banking Sector Crisis Management Council will coordinate crisis responses and maintain financial stability. Banks will be classified by financial health.

Finance Adviser Salehuddin Ahmed said the current budget includes allocations for bank restructuring.

According to finance ministry sources, Tk 13,000 crore has already been earmarked for bank restructuring in the current budget. Allocations under the “miscellaneous expenses” category have risen to Tk 17,442 crore this year, a 163 percent increase from last year, primarily for financing banking reforms. Historically, spending in this category ranged between Tk 4,000 crore and Tk 5,000 crore annually.

Under its IMF programme, the government will publish a banking sector stability and sustainability strategy. Agreed between Bangladesh Bank and the finance ministry, the plan will set out how to make weak banks healthy again, keep essential banking services running, and keep the cost to taxpayers as low as possible.

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.