The game changer. As AI penetrates deeper into banking, institutions look past its novelty to make sure their investment yields value.

The integration of artificial intelligence into the financial sector is moving beyond the experimental stage as the new technology becomes a cornerstone of modern banking operations. Take DBS Bank, for example, whose former CEO Piyush Gupta proclaims AI an “absolute game changer.”

DBS has deployed over 800 AI models across 350 use cases, projected to yield over $1 billion Singapore dollars (about $778 million) in economic impact in 2025 and reflecting a broader industry trend. Banks are revolutionizing everything from treasury and cash management to fraud detection and client-facing services, driven by AI’s promise to deliver value to the institution and its clients.

Catering to this strategic approach is SmartStream Air, an AI-driven software-as-a-service platform launched in 2019, which aims to help financial institutions derive better insights from data and make them actionable. The latest version of Air, version 9.0, introduced last year, includes Air Data and Air Cash modules. These offer scalable, AI-powered data processing and reconciliation, critical for handling growing data volumes, especially from low-value, high-volume payment transactions.

“This enables diverse dataset analysis, enhancing data quality and matching,” says SmartStream CEO Akbar Jaffer. “Applications range from traditional domains such as cash and securities to general business needs.”

AI is becoming a fundamental data-processing tool, he observes, “When data is ingested, our AI engine recommends ways to enhance and enrich its quality. It also helps define matching criteria. The AI engine learns from user activity, identifies recurring issues, and offers suggestions while monitoring for discrepancies.”

Data Fuels AI Transformation

AI helps banks not just to collect data, but to understand, act upon, and derive strategic value from it. The goal is better decision-making, improved customer satisfaction, reduced costs, and enhanced security.

Citi is building a high-quality, authoritative data source for reference and transaction data across its Treasury and Trade Solutions division. It also aims for an automated, insightful, and predictive future in treasury and cash management, harnessing client-facing generative AI (Gen AI) tools to transition from historical data analysis to more-insightful large language models (LLM).

BNP Paribas is leveraging AI to transform its operations and enhance client experience. This year, the bank launched an internal LLM-as-a-service platform, providing secure and unified access to LLMs. The platform accelerates GenAI development, supporting enhanced customer personalization and operational performance. Existing use cases include internal assistants, document generation, and information retrieval, with the platform scaling deployment and facilitating integration.

Meanwhile, BNP is leveraging RFPGPT, an AI offering designed for cash management Requests for Proposals. The GenAI-powered tool delivers precise, rapid, and relevant responses by integrating proprietary information, improving efficiency and quality of proposal creation. The bank says that RFPGPT has yielded significant time savings while increasing response quality. Externally, it better meets clients’ cash management needs, strengthening the bank’s competitive position.

At tech consultant CGI, Andy Schmidt, vice president and global industry lead for Banking, expects AI to drive the next generation of treasury management services.

“Our research on transaction banking clearly shows that corporates demand better services and insights into their cash positions as well as their inbound and outbound payments,” Schmidt says. “The good news is that the necessary data already exists. We know—or can aggregate and/or interpolate—their cash positions, line availability, accounts payable, and accounts receivable. What we don’t know is the precise timing of incoming cash.”

Improved traceability—akin to Swift gpi, but for all payments, not just cross-border—will enable banks to leverage their cash forecasting and liquidity management capabilities, Schmidt suggests, helping corporate treasurers make better decisions and keep funds flowing.

Revolutionizing Cash Management

AI holds the potential to revolutionize cash management by integrating insights on incoming payments, cash availability, and payables. “If the bank knew a payment was coming in, it would be able to use AI to query cash and line availability, query payables, and add a dash of cash forecasting,” says Schmidt. “Given the cash on hand—or with a specified line draw—you can take advantage of these trade terms for less than the cost of borrowing the funds until your next invoice is received.”

In theory, this would give CFOs greater control of their business while providing banks a value-added cash stream that is more resistant to market forces than, say, the interest rate on a line of credit.

Bank of East Asia offers another innovative AI application with its Scenario Financing platform, which integrates AI-powered Risk View with supply chain platforms. This enables business customers to apply for and receive financing in seconds. For internal users, it automates risk assessment, loan approval, and financing—utilizing Gen AI to analyze customer, supply chain, legal, and compliance data for credit approval.

Raiffeisen Bank International (RBI) showcases a holistic approach to AI integration, leveraging it to enhance an assortment of banking operations. These include automated document verification, risk assessment, and fraud detection, across critical areas such as know-your-customer requirements, due diligence, cash management, compliance, and sanctions monitoring. RBI launched its own ChatGPT in 2023, initially to 2,000 users. This has since expanded to over 20,000 active users, significantly boosting internal productivity.

Furthering RBI’s transformation, it offers a comprehensive internal AI learning program, the Data Science Academy, which trains employees to become data scientists. Additionally, under RBI’s AI Pioneer Program, a change management initiative, the bank lets employees dedicate a portion of their time to assisting colleagues in developing AI skills, sharing knowledge, and implementing new AI use cases. This initiative has grown to include over 1,000 AI pioneers across the RBI group. RBI’s AI Center of Excellence, meanwhile, partners with individual departments to develop innovative use cases.

The pervasive adoption of AI across banking functions, from enhancing data management and streamlining operations to developing sophisticated client solutions and fostering talent, underscores its critical role in shaping the future of finance.

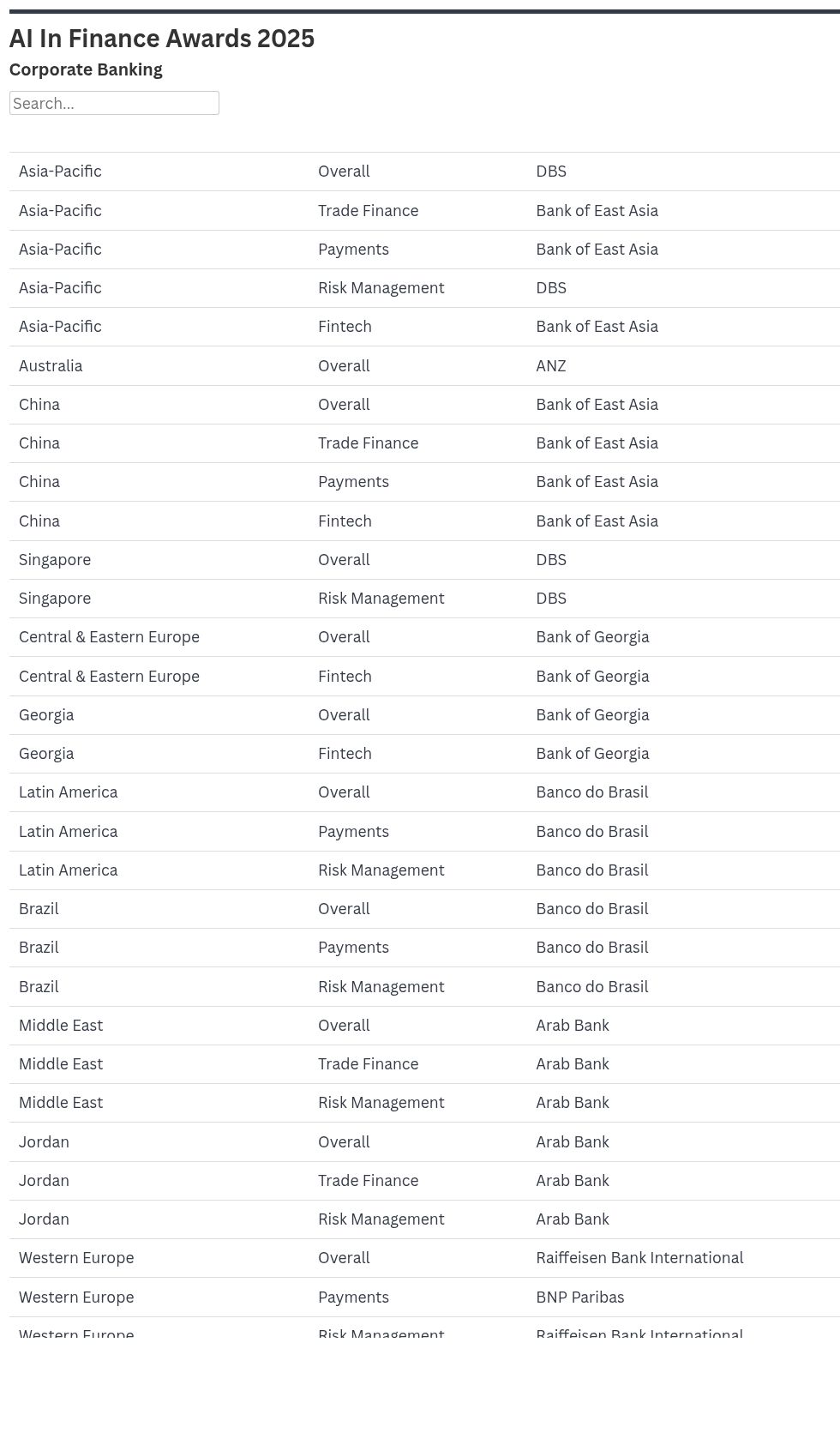

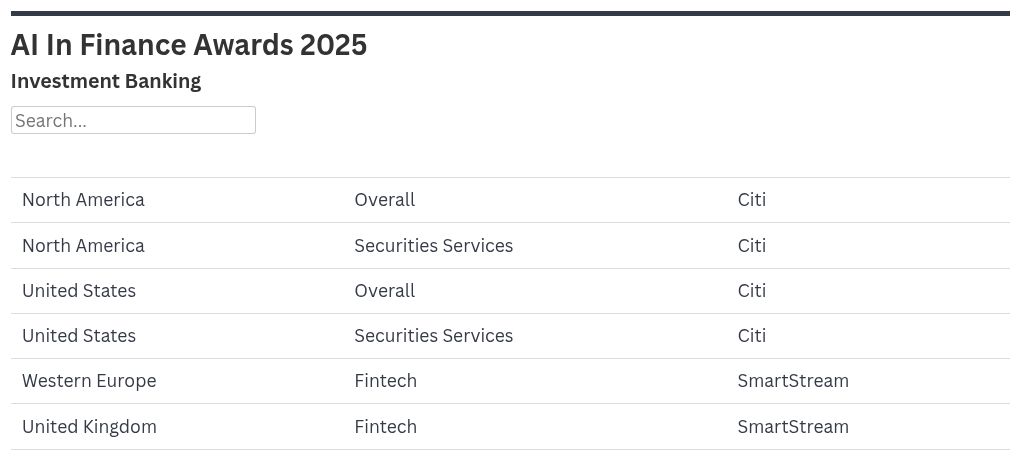

As evidenced by Global Finance’s inaugural AI in Finance award winners, not only is AI a tool for efficiency but it has become a strategic imperative enabling banks to unlock new revenue streams, mitigate risks, and deliver superior client outcomes.

Crucially, AI is also playing a pivotal role in fostering talent within the industry, freeing up human capital from mundane tasks to focus on higher-value activities that require critical thinking, creativity, and strategic insight.

This ubiquitous presence of AI unmistakably underscores its critical and increasingly indispensable role in shaping the future of finance. It’s no longer just a trend but a foundational shift.