From rule-based to responsive. AI is transforming consumer lending. But to succeed, human capital must be as big a priority as technological advances.

Financial institutions worldwide are leveraging AI, marking a shift from traditional rule-based systems to responsive, intelligent solutions. Nowhere does the fusion of data and AI hold more potential than in one of banking’s core functions—consumer lending—which AI promises to make smarter, faster, more efficient, and potentially more inclusive.

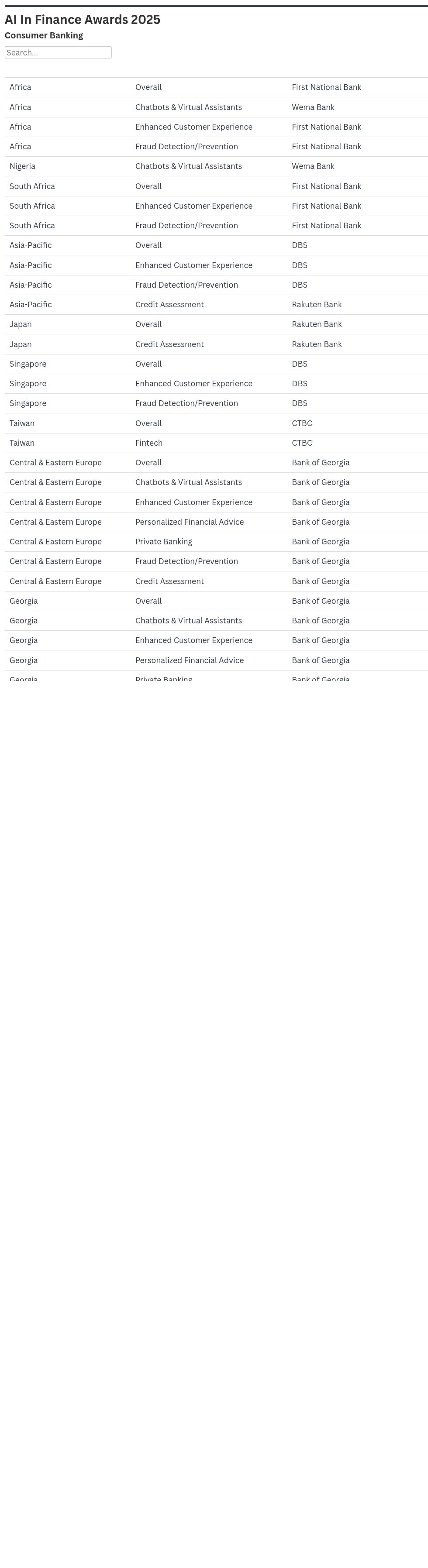

“Since launching our AI-powered lending solution, SME clients enjoy a much simpler and faster process for eligible applications,” says Mikheil Nadareishvili, chief analytics officer in the Data Analytics Department at the Bank of Georgia (BOG). Other data-driven innovations at BOG include AI-powered recommendations and an advanced AI-powered chatbot. “Automation has boosted accessibility and eliminated manual hurdles while AI-driven income and EBITDA models have sped up decision-making.” Nadareishvili reports that, since the launch, 46% of loans are confirmed through digital process and “time to yes” has dropped from over 2.5 days to just 11 minutes.

Chatbot Evolution

Data is the lifeblood of chatbots, which rely on it to learn, understand, respond effectively, and continuously improve over time, making them increasingly valuable tools for many financial applications. Bank of America first introduced Erica, its AI virtual financial assistant, to customers in 2018. The service has undergone significant development since then.

“Erica continues to evolve by ensuring our capabilities and investments are scalable and reusable across different lines of business,” says Hari Gopalkrishnan, head of consumer, business, and wealth management technology. “We continue to work on making Erica more anticipatory of client needs while enabling our associates to become more productive in navigating complex tasks in service of our clients.”

Clients have interacted with Erica over 2.7 billion times since it launched, notes Nikki Katz, head of digital. “That’s one example of what this era is shaping up to be: more personalized, with the client at the center of everything.”

In Turkey, Akbank Mobile provides agentic conversational banking featuring AI-powered, retrieval-augmented reasoning. This form of agentic mobile banking leverages the customer footprint to deliver a personalized, proactive, beyond-banking experience, says Gökhan Gökçay, Akbank’s executive vice president of technology.

“AI-powered Akbank Asistan analyzes customer data, products, behavior, and transactional footprint, to generate tailored insights and recommendations,” he says, noting that the virtual assistant has boosted the offer-to-product conversion rate from 2% to 18%. Through seamless text or voice interactions, the assistant classifies over 1,000 intents and can autonomously perform over 200 banking transactions.

“Its design integrates advanced NLP [natural language processing] with large language models, enabling context-aware responses and intelligent search within milliseconds,” Gökçay says. “The assistant’s unified infrastructure supports all channels, from mobile to IVR [interactive voice response], and powers self-service capabilities that significantly reduce call center volumes.”

Akbank Asistan also supports the bank’s Help Me module, handling 250,000 monthly requests that would otherwise reach call centers, increasing both efficiency and customer satisfaction. Dynamic avatars created via GenAI reflect customers’ behavior, deepening their engagement with Akbank Mobile. The avatars update monthly based on a client’s financial behavior, offering users a more relatable and emotionally engaging interface.

“This personalized, omnichannel experience exemplifies how agentic AI transforms customer relationships—moving from reactive service to predictive, insight-driven banking,” Gökçay observes.

The Indispensable Human Element In AI Adoption

This shift toward intelligent, responsive banking is not only improving operational efficiency and decision-making but redefining the customer relationship, setting the stage for further transformative applications of AI in consumer banking. This is not to say that humans can be replaced. AI adoption requires investment in human capital, meaning that any technological advance must be intertwined with workforce transformation.

“Commitment to responsible AI extends beyond our technology,” says Nimish Panchmatia, chief data and transformation officer at DBS. “We recognize the potential impact on our workforce and are proactively investing in upskilling and reskilling initiatives.” DBS has identified some 13,000 employees who will benefit from its Gen AI programs. To date, over 10,000 are training, “demonstrating our dedication to a future-ready workforce that can thrive in this evolving technological landscape,” Panchmatia says.

At Jordan’s Arab Bank, “We aim to integrate AI assistance across all facets of our operations, decision-making, and customer interactions,” says Eric Modave, deputy CEO and COO. Becoming an AI-first organization necessitates a concentrated focus on four pivotal areas: personnel, systems, data, and a robust AI governance framework, he stresses.

“Firstly, our employees: We need to make sure they have the awareness and training to feel comfortable using AI,” Modave says. “They should clearly understand its benefits, limitations, risks, and guardrails. It’s also crucial for us to stay on top of evolving AI regulations as well as data privacy and cloud-usage rules, because these can significantly impact how we design our AI solutions.”

Technical teams need to understand the various technical solutions for embedding AI into the bank’s processes and decision-making, Modave adds. This includes traditional predictive models, machine learning, GenAI for complex tasks, agentic AI for process optimization, and conversational AI. Also important is building technical safety nets and proactive system monitoring to flag potential issues before they affect customers or staff.

“Having a consistent data strategy is also key,” he says. “It needs to meet our business needs while also having a strong control framework. This will allow us to provide data as a service—both structured and unstructured—to all bank functions, which will then use that data to build their AI models.” Any data strategy must explicitly address data access, quality, and anonymization, Modave emphasizes.

Finally, “We need to learn how to prioritize AI ideas to make sure our investments and development efforts truly pay off,” Modave says. Arab Bank has set up an AI Governance Committee that reviews every new AI idea, assessing the investment effort required versus the potential benefits at each stage of implementation: ideation, prototyping, proof of concept, and implementation. Once an AI solution is in production, the bank’s machine learning operations staff and risk team oversee performance and output to ensure delivery of the desired outcome at the expected cost.

Prioritizing workforce transformation through upskilling and reskilling initiatives, focusing on crucial AI and data analytics skills, is critical to AI success—ensuring that employees understand the technology’s benefits, limitations, and risks and that AI is seamlessly integrated with human expertise and ethical considerations. That being the case, AI has a chance to amplify human capabilities, leading to more-efficient, inclusive, and customer-centric consumer finance.