The Winklevoss twins are aiming for a $2.22 billion IPO for their cryptocurrency exchange Gemini, the company announced in a press release on Tuesday.

Crypto is having a moment thanks to the Trump administration’s lax regulatory policies. Meanwhile, the IPO market is heating up again with splashy debuts from other tech stocks like Chime and Figma. The two factors combined make for a particularly profitable environment for crypto-related stocks and IPOs.

When it debuts, Gemini will become the third publicly traded crypto exchange in the U.S., joining Coinbase and Bullish. Coinbase went public in 2021, and Bullish pulled off a blockbuster debut in August.

Gemini confidentially filed for an IPO back in June, and the company announced in a press release on Tuesday that it plans to sell 16.67 million shares at a price range of $17 to $19, under the ticker “GEMI.” Goldman Sachs and Citigroup are leading the deal.

If the market seems to agree with this valuation, the Winklevoss twins’ crypto platform could raise up to $317 million from the offering.

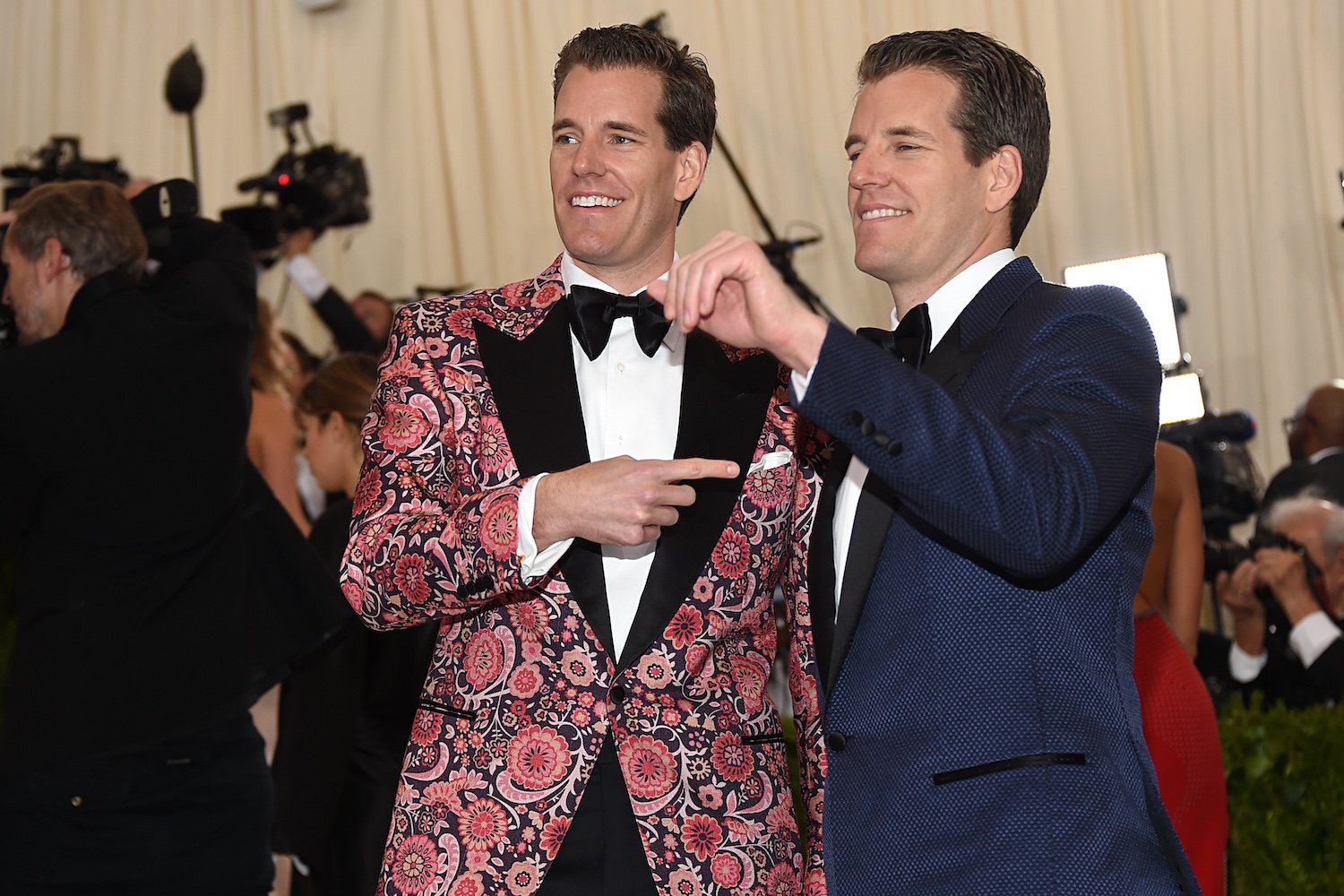

Cameron and Tyler Winklevoss founded Gemini in 2014, years after they first made headlines in their legal battle against Mark Zuckerberg over Facebook. They invested the money they got from that settlement into early bets on bitcoin, securing the nickname “Bitcoin Twins.”

The twins have found themselves in legal troubles of their own over Gemini. Back in 2022, the Commodity Futures Trading Commission filed a 28-page civil suit against Gemini, claiming that it made misleading statements to U.S. regulators in 2017 about whether its proposed bitcoin futures contract could be easily manipulated by traders. Gemini’s bitcoin futures contract at the time was one of the first to list digital assets. The company reached a $5 million settlement with the CFTC in January 2025.

The company was also sued by the New York attorney general in 2023 for an alleged $1 billion cryptocurrency fraud.

A win for the Winklevii

The pro-crypto regulatory shift in the U.S. government has led to a huge boom in the industry. The Winklevoss twins—referred to sometimes as the Winklevii—were among the crypto leaders who won big with the 2024 election.

With the exception of the fossil fuel industry, crypto outspent any other single industry on political candidates in the 2024 election. As a result, 253 pro-crypto candidates were elected to the House of Representatives as opposed to 115 anti-crypto candidates, and 16 pro-crypto candidates were elected to the Senate as opposed to 12 anti-crypto candidates.

The twins are staunch supporters of President Donald Trump. Ahead of Trump’s election, Cameron Winklevoss shared in a post on X that he donated $1 million in Bitcoin to his campaign because he would “put an end to the Biden Administration’s war on crypto.”

The twins’ support secured them access to the President’s ear, which they later used to press Trump to reconsider his nominee to lead the Commodity Futures Trading Commission.

Crypto pushes into the financial mainstream

Despite being heavily skeptical of cryptocurrency previously, Trump and his family now have a substantial stake in the game with crypto as well. In just a matter of seven months, his administration has overseen an onslaught of regulatory actions intended to push cryptocurrency further into the financial mainstream.

Trump signed the Genius Act into law in July, which established the first federal regulatory framework for stablecoins, a type of cryptocurrency that is pegged to the U.S. dollar in an effort to curb crypto’s notorious volatility.

Last month, the Trump-appointed SEC Chairman Paul Atkins launched “Project Crypto,” a roadmap detailing the Commission’s pro-crypto regulatory approach.

The change in the regulatory environment for crypto emboldened the financial aspirations of the industry, including IPOs.

Earlier this summer, stablecoin company Circle’s IPO on the New York Stock Exchange was met with great investor interest. Less than a month before Circle’s IPO, publicly traded Coinbase became the first U.S. crypto company to join the S&P 500, marking a huge milestone for the industry.

The Gemini IPO is set to be another win for the blockbuster year that the crypto industry is having, as with each successful IPO, crypto digs its way deeper into securing its place in the mainstream financial world.