What if your digital bank wasn’t just a service, but a living companion? Over six months, we designed a groundbreaking AI-powered financial product that aimed to reshape how customers engage with their money. Here are some key insights and takeaways

from that journey.

This was not another static banking app. It was envisioned as an AI-powered product—a smart banking companion designed to anticipate needs, offer proactive guidance, and adapt seamlessly to each customer’s lifestyle.

A Financial Product Designed as a Living Advisor

Banks used to wait for customers to act. We asked: what if the bank acted first? What if your bank didn’t just wait for you—but spoke to you, guided you, and acted in your best interest every day?

The main driving force for the next-gen banking experience will be AI-powered hyper-personalization. 61% of customers want personalized recommendations from their banking provider, according to Salesforce Research 2023. And, according to a KMPG

survey of 300 executives worldwide, 77% expect AI to have the greatest impact on their business out of all emerging technologies.

NVIDIA’s fifth annual State of AI in Financial Services 2025 report marks the continued maturity of AI in the industry:

- 70% of respondents say AI has driven a revenue increase of 5% or more, with a notable rise in those seeing a 10-20% revenue boost;

- 60%+ indicate that AI has helped reduce annual costs by 5% or more;

- 25% of respondents plan to use AI to create new business opportunities and revenue streams;

- 25% of responses mark trading and portfolio optimization as the top generative AI use cases in terms of ROI;

- 21% highlight customer experience and engagement as the top generative AI use cases in terms of ROI;

- 50% of respondents have already deployed their first generative AI service or application;

- 28% plan to launch their generative AI service within the next 6 months;

- 50% fewer respondents indicated a lack of budget for AI;

- From 25% to 60% increased the use of generative AI for customer experience (e.g., chatbots, virtual assistants);

- 50%+ of financial professionals are employing generative AI to speed up and improve tasks like document processing and report generation;

- 2x ROI on AI investments predicted by financial industry leaders.

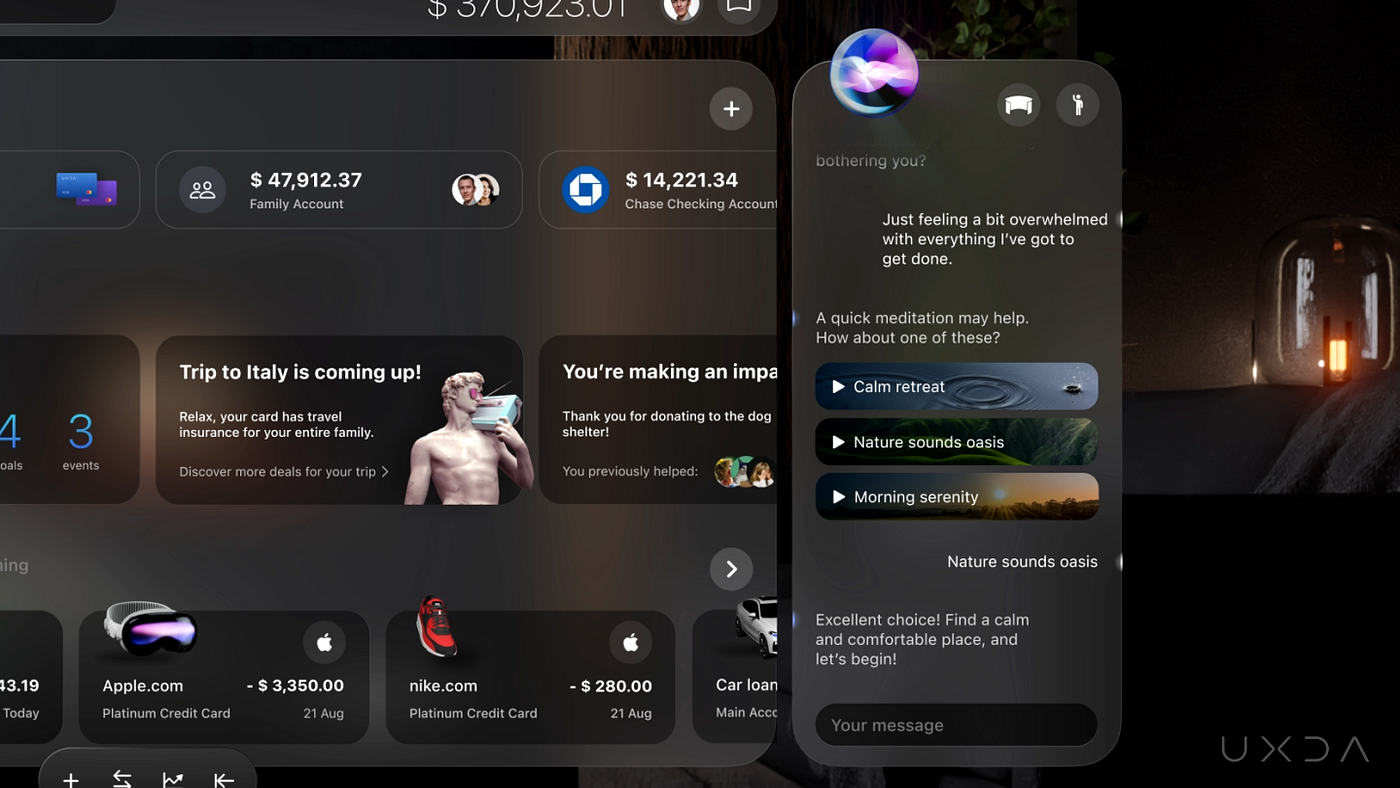

At the heart of this product was an always-available AI financial advisor. Unlike traditional dashboards that waited for users to act, this advisor maintained a constant dialogue, analyzing spending patterns, market trends, personal goals, and lifestyle

context to provide a depth of personalization unseen in financial services. AI advisor aimed to transform banking from cold transactions into a continuous, human-like partnership.

Imagine a bank that could:

-

Detect stress in financial patterns and suggest relief actions.

-

Instantly switch your card on a past purchase to secure better rewards.

-

Nudge you to save the leftover budget from your shopping category.

-

Act as your accountant during tax season by scanning documents and preparing reports.

Key Advantages Over Traditional Banking

Banking today is reactive, fragmented, and impersonal. Customers deserve more than delayed statements and generic advice. From cold numbers to living intelligence—why settle for outdated banking when AI can guide?

The living bank flipped the script by embedding AI at the center—making it proactive, personalized, and always present. Here’s what set it apart:

1. Personalization and Contextual Engagement

AI analyzes customer data to deliver tailored recommendations, offers, and financial products, creating a continuous dialogue through conversational UI. Unlike the one-size-fits-all model of traditional banks, the AI learns and adapts over time, ensuring

every interaction becomes more personal, relevant, and aligned with individual goals.

2. Proactive Financial Guidance

Instead of reacting after the fact, AI employs predictive analytics to anticipate risks and opportunities, providing forward-looking advice in real time. From reallocating surplus funds into savings or investments to forecasting potential shortfalls, it

empowers users to make confident financial decisions before problems arise.

3. Real-Time Insights

AI ensures instant access to balances, transactions, and market trends, eliminating the delays of traditional banking. By analyzing spending habits on the spot, it offers immediate suggestions for budget optimization, enabling users to act quickly and maximize

their financial outcomes.

4. Conversational Interaction

Through conversational UI, customers can interact naturally with their bank, asking questions, setting reminders, and receiving instant advice. This intuitive experience makes finance less intimidating, giving users control and transparency—whether it’s

checking account details or scheduling a bill reminder with a quick request.

5. Enhanced Security

AI continuously monitors behavior and transaction data to detect anomalies, blocking fraudulent activity in real time. This proactive protection not only strengthens digital security but also builds trust and confidence in every interaction.

6. Automation for Efficiency

AI streamlines routine tasks and provides instant answers, while escalating complex cases to human agents only when needed. By reducing errors, accelerating processes, and resolving issues quickly, it delivers the speed and efficiency traditional banking

struggles to match.

7. Financial Education

Every recommendation comes with clear, accessible explanations, helping customers understand fees, terms, and financial concepts. This educational layer builds trust, enhances literacy, and transforms banking into a transparent, empowering experience.

Product Architecture

Most banking apps are built around tools and menus. But what if architecture mirrored human needs instead of product catalogs? Behind every breakthrough experience lies a structure built around human, not bank processes.

We designed the living bank around three simple modules—Snapshot, Cash Flow, and Marketplace—each supported by an always-on AI panel. This structure made banking intuitive, contextual, and truly centered on life, not just money.

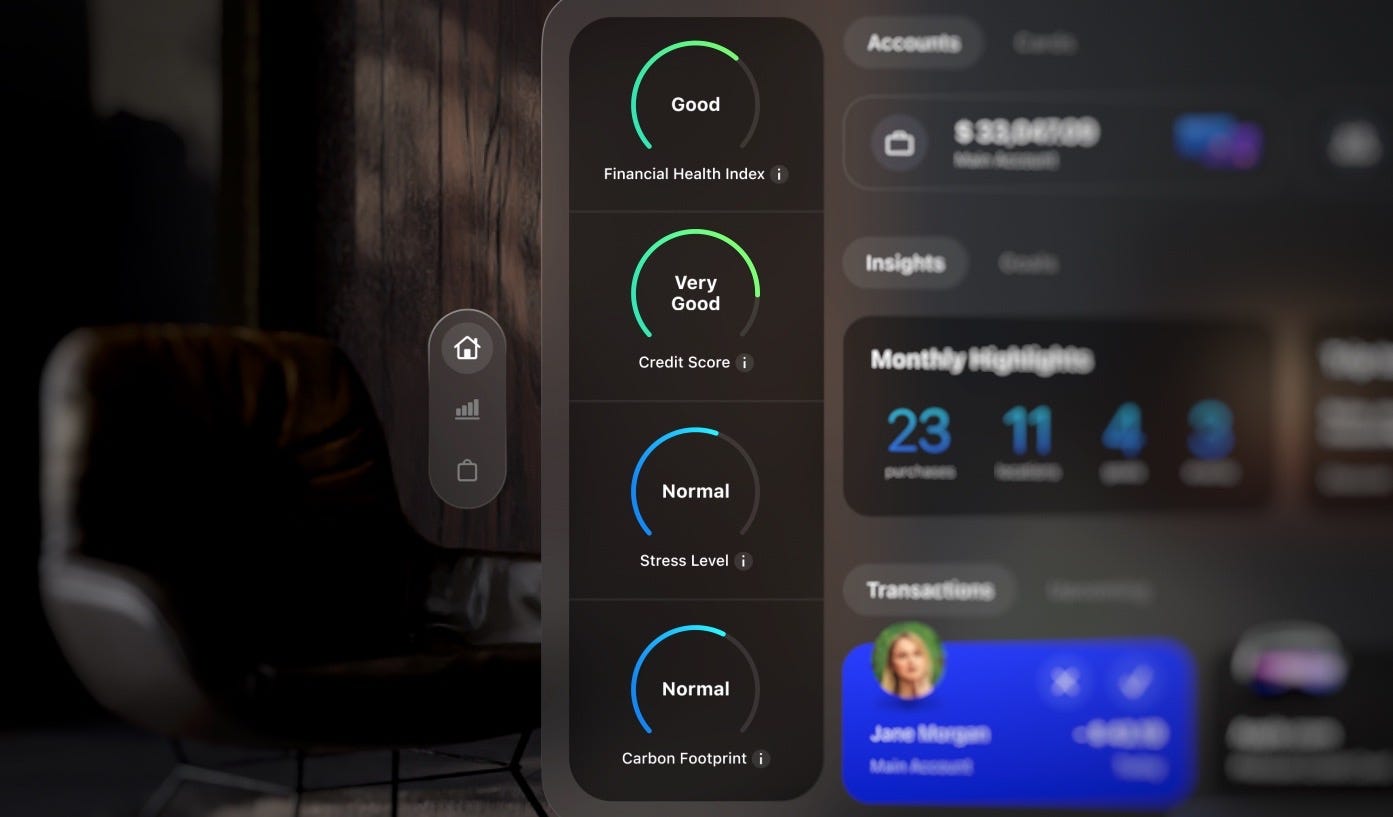

1. Snapshot

The Snapshot dashboard gave users a clear overview of their financial life with customizable cards showing KPIs, accounts, goals, transactions, and AI-driven insights. KPIs covered liabilities, risk protection, savings and investments, family care, credit

score, stress indicators, and even carbon footprint. AI analyzed spending and behavior to highlight accomplishments, recommend offers, suggest leisure activities, cut costs, and provide investment or savings advice. Users could also manage all accounts—from

checking to crypto—while AI ensured funds were automatically reallocated if balances dropped.

AI use cases: improve credit score plans, detect stress factors, auto-transfer funds between accounts, trigger notifications for specific transactions, suggest stock purchases, flag suspicious foreign payments, show trip expenses, or assist with tax prep

and report generation.

2. Cash Flow

Cash Flow provided a crystal-clear view of money movement through graphs, checkups, and asset lists. Users could track inflows and outflows, compare spending against budgets, and forecast potential shortfalls. AI acted as a personal advisor, suggesting asset

management strategies and highlighting problem areas. Features like 3D purchase views, 24-hour card switching, post-purchase BNPL, budgeting tools, and upcoming payment reminders gave customers unmatched flexibility.

AI use cases: detect repeat transactions and automate them, review top upcoming payments, automate bill payments, flag suspicious subscriptions, provide spending insights, suggest savings rules, show category- or store-specific spending, and recommend asset

balance improvements.

3. Marketplace

The Marketplace let users explore thousands of financial and lifestyle products through a Netflix-style interface. AI curated offers by context, usage, and goals, extending beyond finance to lifestyle services like real estate, travel, food, or electronics.

In the My Products section, customers could view and manage active services such as loans, BNPL, insurance, or investments.

AI use cases: advise on real estate and mortgage terms, prepare furnishing checklists, recommend safety-net products for family protection, auto-activate insurance for trips, arrange rentals, track rent spending, and suggest creating dedicated savings goals.

AI in Action: Real Use Cases With Customer Benefits

It’s easy to talk about AI. It’s harder to show how it changes lives. It’s not about features—it’s about moments that change lives.

We crafted hundreds of use cases to prove that AI could be more than hype. Here’s how the AI-powered bank was designed to help customers in real, tangible ways—from reducing stress to unlocking better loan rates:

-

Credit Health: AI built personalized improvement plans → Better loan rates.

-

Stress Detection: Correlated financial strain with habits → Reduced anxiety.

-

Automated Transfers: Balanced accounts automatically → Prevented overdrafts.

-

Smart Notifications: Delivered reminders and alerts on wearables → Constant awareness.

-

Investment Triggers: Suggested stock buys at price drops → Maximized opportunities.

-

Fraud Protection: Flagged unusual transactions → Increased trust.

-

Travel Insights: Summarized trip spending → Full transparency abroad.

-

Tax Assistant: Scanned documents and prepared reports → Simplified compliance.

-

Recurring Payments: Identified repeats and automated → Saved time.

-

Subscription Checks: Flagged forgotten charges → Reduced waste.

-

Spending Coaching: Identified budget eaters → Improved saving habits.

-

Post-Purchase BNPL: Converted past purchases to installments → Financial flexibility.

-

Asset Optimization: Balanced cash, investments, and real estate → Wealth growth.

-

Mortgage Planning: Simulated affordability scenarios → Confident home buying.

-

Family Protection: Suggested safety nets like insurance → Household resilience.

-

Lifestyle Services: Delivered context-based offers → Extended value beyond money.

Design Challenges We Overcame

Designing a living, AI-powered bank was not just about possibilities—it was about overcoming real obstacles. If AI makes banking alive, how do you keep it human, safe, and trusted?

We faced tough questions: How do you simplify complexity? How do you build trust in AI? How do you humanize finance? Here’s how we tackled the hardest challenges.

Creating such an ambitious product brought unique design challenges:

-

Complexity vs. Simplicity: Balancing powerful AI with an approachable interface.

-

Trust in AI: Ensuring transparency so customers felt empowered, not controlled.

-

Security & Privacy: Safeguarding sensitive data as AI analyzed behavior.

-

Emotional Connection: Making the advisor feel empathetic, not robotic.

-

Scalability: Designing for both everyday users and high-net-worth individuals.

The Future Impact of AI-Powered Financial Products

Banking is on the brink of its biggest shift since the invention of the ATM. Tomorrow’s customers won’t just ask for digital banking—they’ll expect a living one.

AI-powered products won’t just raise customer expectations—they’ll redefine them. The living bank showed how financial institutions could stay ahead in a world where competition isn’t about rates or branches anymore, but about who delivers the most human

experience.

-

For Customers: Expectations will rise. They’ll demand proactive, personalized, life-oriented services.

-

For Banks: The battleground will shift from features to experiences.

-

For the Industry: Banks will evolve into living ecosystems guiding both money and lifestyle.

-

For Innovation: Early adopters will set the pace; laggards risk irrelevance.

Anticipated Impact

This AI-powered banking product was never about iteration—it was about ignition. The ultimate shift: from transactions to transformation.

By embedding AI at the core, the UXDA designed living bank promised to empower customers with proactive guidance and education; strengthen banks with loyalty, efficiency, and new revenue streams; elevate the industry by setting a benchmark for living, adaptive

financial products that feel intelligent, and empathetic.

Our ultimate goal was to design a next-gen financial product that aims to make banking alive—dynamic, proactive, and deeply connected to customers’ real lives.