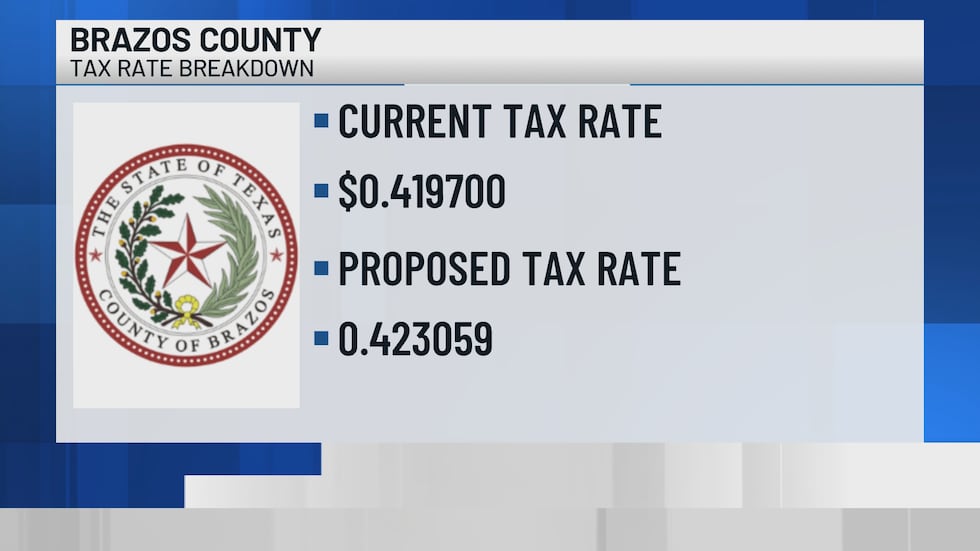

BRYAN, Texas (KBTX) -Brazos County commissioners proposed a new property tax rate Tuesday for the upcoming fiscal year.

The proposal sets the Voter Approval Rate at .423059 per $100 of property value as the ceiling for further discussion. That’s a fraction higher than the current rate of about 41 cents. For a $200,000 home, the county portion of property taxes would be about $846 a year.

Commissioners said they considered adopting the “no new revenue rate,” which would generate the same revenue as last year, but argued that it is not realistic given the county’s financial position and state legislative changes, and ongoing litigation disputes over property values.

Acting County Judge Kyle Kacal said that protests, lawsuits, and possible state caps on property tax revenue leave the county with limited options.

“The most important thing I want Brazos County residents to understand is that their Commissioners Court is doing their best under constraints of the Central Appraisal District and the Texas Legislature to deliver a budget that covers maintenance and operations and gives the county the ability to provide essential services that the people of Brazos County depend on,” Kacal said.

In a statement, First Assistant County Auditor Marci Turner said that the county already lost $128 million in appraised values after the 2024 tax rate was set. She added that $1.4 billion in property values from prior years is under litigation, which could reduce taxable values by about $112 million.

“We know not all of that will be removed, but we estimate an eight-percent loss, resulting in an additional $112-million coming off the current appraised values,” Turner said.

Kacal said the no new revenue rate could quickly drain county reserves.

“Considering the current litigation with the Brazos Central Appraisal District and the potential property tax rate cap coming from the state legislature, proposing the Voter Approval Rate is the only fiscally responsible action I could vote for to be a good steward of Brazos County tax dollars,” Kacal said.

“The No New Revenue rate, while appealing in the moment, would drain the County’s unbudgeted and uncommitted General Fund balance within two to three years and would force a tax hike in the near future just to keep the County’s services at current levels,” he added.

County leaders say that as the tax rate is set to cover the proposed budget, losing millions each year presents a challenge. They say throughout the budget process, county departments asked for items of necessity to continue providing excellent service to residents of Brazos County, making this a no-frills budget.

“There is no fluff in this budget. This is a very tight budget. I’m proud of all the department heads and all the departments within the county that came to us with just the bare essentials that they needed to provide the best service they can for the people of Brazos County,” Kacal said.

Kacal, a former state representative, also noted his focus on the ongoing debate in Austin.

“We land in certain spots and I’m glad that I have a good understanding of what’s happening in Austin and we’re able to watch the legislature and be prepared for what comes this way,” he said.

The Texas Senate has proposed lowering the property tax revenue growth cap for counties from 3.5 percent to 2.5 percent. The Texas House suggested cutting the cap further to 1 percent, with exceptions for public safety costs.

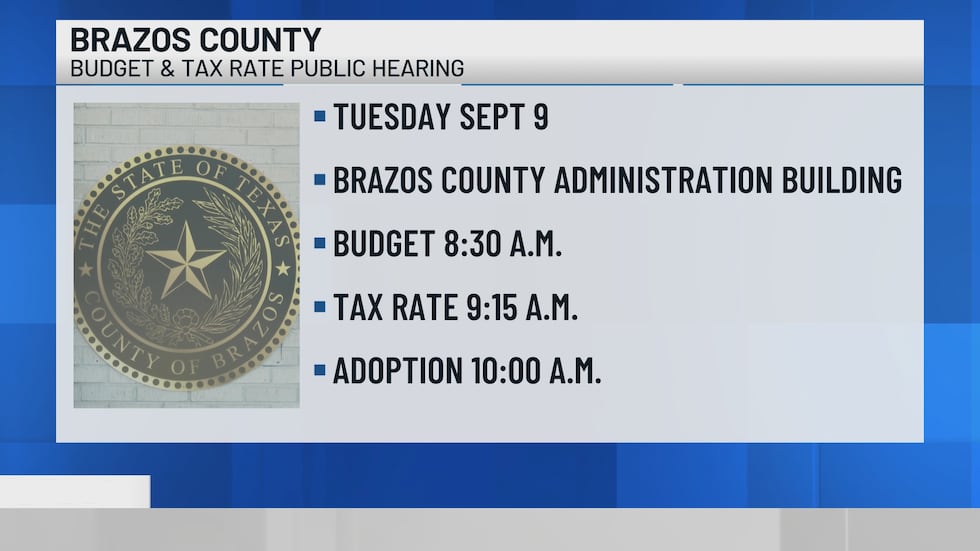

Public hearings on the budget and tax rate are scheduled for Sept. 9. The budget hearing will begin at 8:30 a.m., the tax rate hearing will follow at 9:15 a.m., and commissioners are expected to adopt both later that morning during their regular meeting.

Copyright 2025 KBTX. All rights reserved.