This week was quite eventful for the crypto market due to the release of fresh economic data, changing trends, and digital assets’ reaction to these events. Notably, sudden price swings were also noticed in Bitcoin, Ethereum, and others, but many new milestones were also made. Despite this complexity and volatility, many tokens grew to an all-time high, whereas others bowed to bears, making the week memorable for investors in a different context.

Top Crypto Events Highlights and Their Impact on the Market

The performance of the crypto market doesn’t necessarily go as expected, as multiple factors decide its trajectory. This week, multiple crypto events, including the release of macro events, took place, which influenced its trajectory.

August 11, 2025 – XRP Lawsuit Closure and ETH ETF Milestone

The week began with bulls as massive news centered around XRP was released just days before. After four plus years of legal battle, the Ripple vs SEC lawsuit nearly ended, as they filed to withdraw their significant appeals. This influenced the bullish trends in the crypto market, fueling the token’s prices.

#XRPCommunity #SECGov v. #Ripple #XRP BREAKING: The parties have filed a Joint Dismissal of the Appeals. The case is over. pic.twitter.com/QMATRLnxnS

— James K. Filan 🇺🇸🇮🇪 (@FilanLaw) August 7, 2025

New updates on August 16 also highlighted that the case would end with the Second Circuit Court approving the appeal dismissal request. Notably, another bullish news hit Ethereum on the same day.

The spot Ethereum ETFs pulled a $1 billion net inflow on August 11, which is record-breaking. It signaled strong demand for ETH products in the crypto market. However, volatility persisted, with the release of various key macroeconomic events, including U.S. CPI, PPI, and others.

August 12, 2025 – U.S. CPI Data Release

On Tuesday, August 12, the July CPI data was released, which came up to 0.2% MoM, as expected. It also added to the bullishness of the market, as it influenced hopes around the Fed’s September rate cuts.

The same trend remained persistent for the next few days, resulting in Bitcoin price hitting a new ATH of $124.4k on Thursday. BNB also surged to a new ATH of $868.68; Ethereum, XRP, and the rest of the altcoins’ prices also grew significantly.

However, their prices crashed from the peak, amid the impact of the U.S. PPI data release.

August 14, 2025 – U.S. PPI and Crypto Market Crash

The U.S. PPI came hotter-than-expected, with the July figures rising +0.9% MoM and +3.3% YoY. Experts noted it as the biggest leap in months, generating fear among investors for the upcoming Fed’s decision on interest rates.

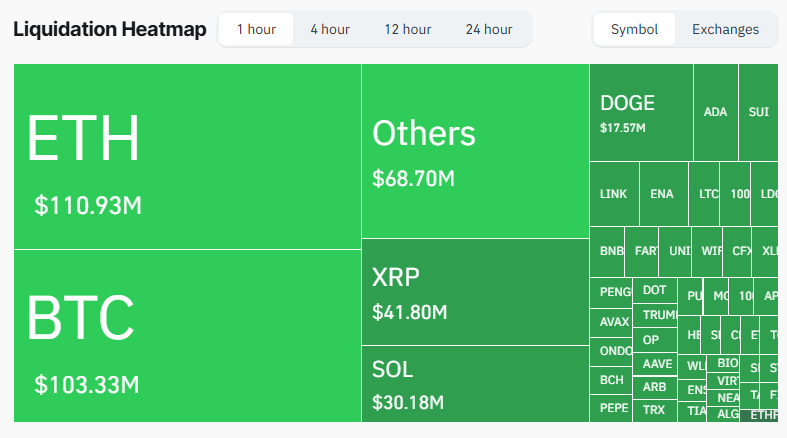

The data triggered a massive liquidation in Bitcoin and other assets, wiping out over $538M in longs.

- Source: CoinGlass, Bitcoin, Ethereum, etc, Liquidation Data

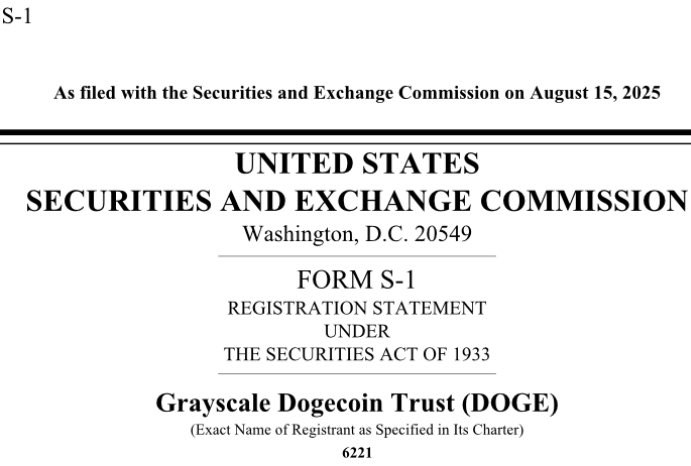

August 15, 2025 – Grayscale Filed for Dogecoin ETF

Amid the building crypto ETFs hype, Grayscale has filed with the SEC to launch a spot Dogecoin ETF. Notably, if approved, this will become the first-ever meme coin ETF and would give investors exposure to DOGE without holding the asset.

- Source: SEC Filing

On this news, DOGE price grew significantly, jumping 2.25% within hours. However, most of the tokens remained down, as overall bearish trends remain persistent.

August 16, 2025 – XRP Lawsuit Update, Crypto ETF Inflows

Despite a major turbulence in the middle of the week, the overall performance remains favorable for the investors. The net volume of the crypto ETFs hit $40 billion, led by the Ethereum ones with $2.85 billion in inflows.

Notably, on the same day, the SEC presented a status report to the U.S. Second Circuit Court after submitting an appeal dismissal at the beginning of the week. Experts claim that the case is already near the end, and the Second Circuit’s approval would mark the final closure of the XRP lawsuit.

Interestingly, despite the week’s ups and downs, crypto whales remained quite active, purchasing billions worth of assets, especially Ethereum. Sentiments also reported that ETH is outperforming BTC in the current market.

Crypto Market’s Best Performers of the Week

This week may be full of changing trends and key macroeconomic events. However, despite the turmoil, a few crypto assets managed to rise higher than expected due to their demand, individual bullish news, and strong investor confidence in them.

According to CoinMarketCap, the top gainers of the week are meme coins like TSLA, DOGO, FARTCOIN, and others. In the top cryptos list, OKB, Mantle, and Cardano performed the best.

Bitcoin, Ethereum, and XRP were also at the top performers in the middle of the week, but by the end, their trends declined respectively.

Frequently Asked Questions (FAQs)

The major events of the week are XRP lawsuit updates, record crypto ETF inflows, U.S. CPI and PPI data release, and more.

Bitcoin hit a new ATH at $124.4k this week before declining to $117.0k amid high volatility.

Cryptos like TSLA, DOGO, Fartcoin, ADA, and many others were top performers this week.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: