KNOWING where to invest your cash is difficult as there are thousands of companies to choose from.

That’s why Holly Mead, a financial journalist with 14 years’ experience, spoke to investing experts to reveal the top 20 stocks they are banking on to make them rich this year – and the five to avoid.

Choosing individual stocks can be riskier than an investment fund, where an expert manager picks for you, usually spreading your cash across dozens of companies they think will do well.

This helps to spread your risk as your eggs are not all in one basket.

But putting a small portion of your money in individual shares can be exciting – and profitable, if you pick the right ones.

You should always do your research first and be prepared to invest for at least three to five years – and remember there could be ups and downs along the way.

Just because a stock has done well recently, there is no guarantee it will continue to do so.

Similarly, stocks that have fallen are not always to be avoided, as long as you think they could bounce back.

You should always make sure you have enough – around three months’ salary – in cash savings that you can access, before you start thinking about investing.

We asked experts about the stocks they are banking on to make them rich while explaining why and what a £50 investment five years ago would equal now.

But it’s worth bearing in mind that it’s the future performance that will determine how much your cash could increase by.

The 20 stocks to buy

Investment experts have revealed their top stock picks they hope will make them rich this year.

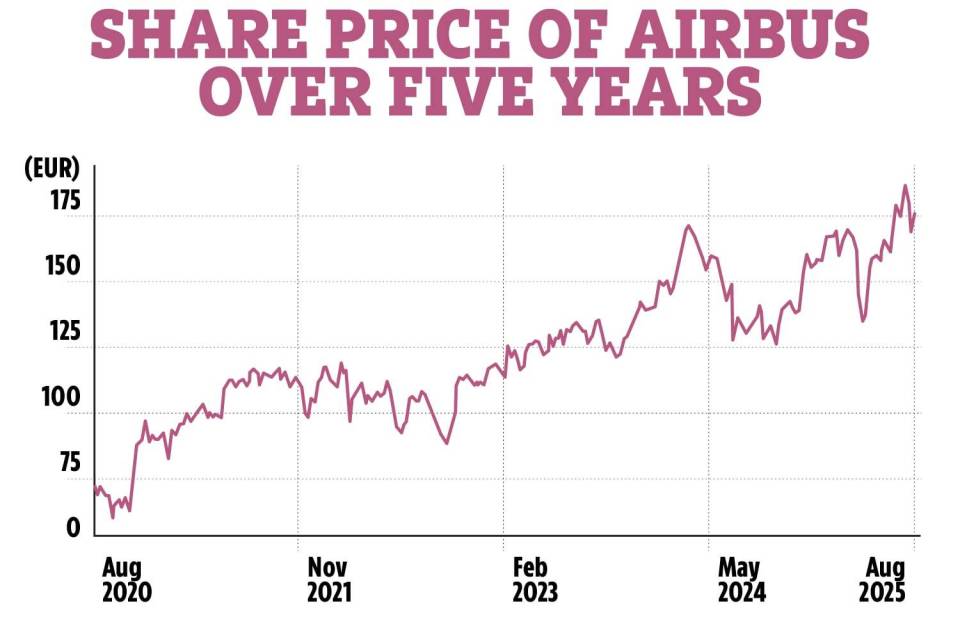

Airbus

Airbus makes some of the world’s biggest passenger aeroplanes. Appetite for travel remains strong and the company has an “enormous orderbook that provides a long runway for growth”, says Derren Nathan, head of equity analysis at Hargreaves Lansdown.

However, potential obstacles include supply chain issues and trade tariffs.

Shares are up 33% over the past year, and £50 invested five years ago would have grown to £127.50.

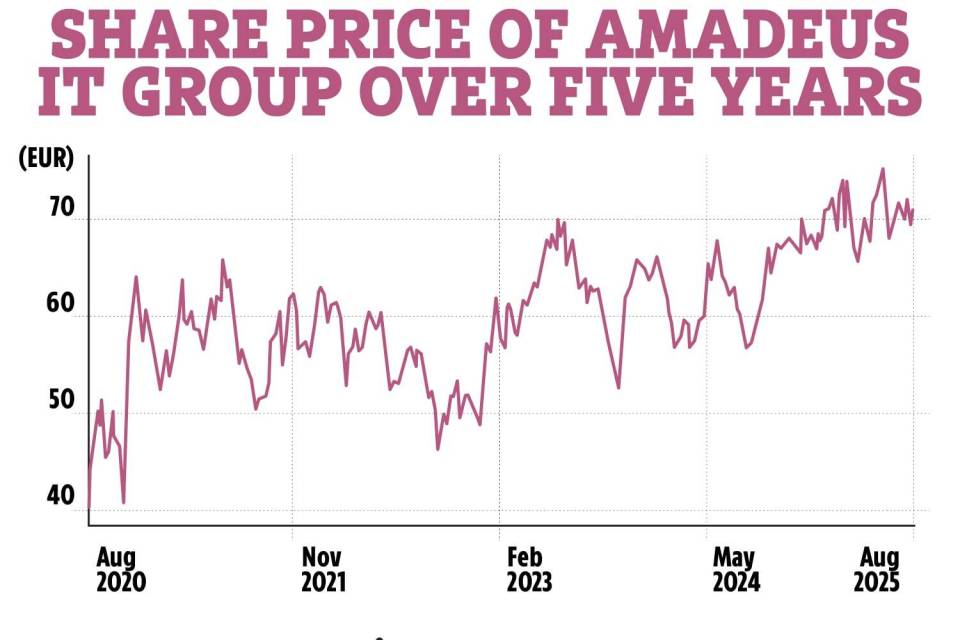

Amadeus

A booking platform for the hotel and airline industries, Amadeus has been investing in its business to gain an edge over its rivals, says Marcel Stötzel, co-portfolio manager of the Fidelity European Fund.

The company, headquartered in Madrid, reported a 12.3% increase in profit to €727 million in the first half of the year.

Shares are up 27.4% over one year, and £50 invested five years ago would have grown to about £79.

What are the risks?

BEFORE you start investing, you need to understand the risks.

The return you make will depend on how much you invest and where.

As we have seen recently, the stock market can dramatically fall.

The American stock market recently saw its biggest drop since the start of the Covid pandemic after US President Donald Trump announced plans to introduce punitive tariffs on goods imported to the US from other countries.

The UK’s own stock market, the FTSE 100, fell by more than 10 per cent after the news.

You must be prepared to lose it all – so only invest money you can afford to sacrifice.

You need to be willing to invest cash for at least five years to mitigate any dips and allow your money to recover. If you can’t afford to lock up your money for this long, investing may not be right for you.

It’s usually better to drip feed money into your investments instead of putting down a big chunk of money in one go.

ASML

European company ASML specialises in semiconductor manufacturing equipment, making it “virtually indispensable to the global chip industry”, says Chris Beauchamp, chief market analyst at IG.

The firm is an industry leader and has a substantial pipeline of orders from customers well into the future, he says, with demand for chips showing no signs of slowing.

Shares are down 19% over the past year, but £50 invested five years ago would have grown to £93.20.

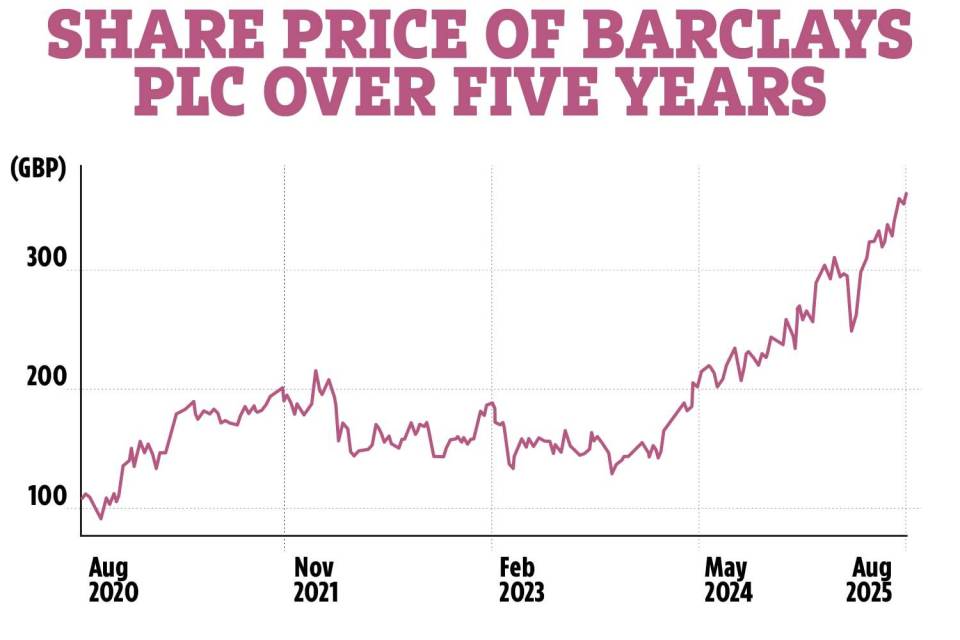

Barclays

Falling interest rates and a struggling UK economy can impact banks’ profits, but Ed Smith, co-chief investment officer of Rathbones Investment Management, thinks Barclays offers the best combination of profitability and share price valuation of all UK banks.

“Barclays has been on a tear lately, and its one-year performance is almost double the Magnificent Seven,” he says.

“It reported strong results in the first half of the year, with a substantial increase in profitability.”

Magnificent Seven refers to the seven largest tech companies, which are: Alphabet (parent company of Google), Amazon, Apple, Meta Platforms (parent company of Facebook and Instagram), Microsoft, Nvidia, and Elon Musk’s Tesla.

Shares in Barclays are up 75% over the past year, and £50 invested five years ago would have grown to £174.

Constellation Energy

Constellation is the largest nuclear operator in the US and Lale Akoner, global market analyst at eToro, thinks the company will benefit from the changing way that energy is produced and consumed.

“It stands out as a critical player in meeting America’s rising power demand, especially from AI-driven data centres,” she says.

“The company is already cutting deals with major tech giants to keep their server farms running, securing profitable, multi-year contracts.”

Shares are up 86.5% over the past year. Over five years, a £50 investment would have grown to £444.

Croda

A speciality chemicals firm that has struggled in recent years, and lately because of trade tariffs worries.

Croda makes ingredients used in everything from deodorants and shower gel to agricultural products and paints.

But Derren Nathan says concerns have been “overplayed” and now could be a good time to buy shares in a “quality business with a focused strategy”.

Shares are down 32% over the past year, and £50 invested five years ago would have fallen to £22.50.

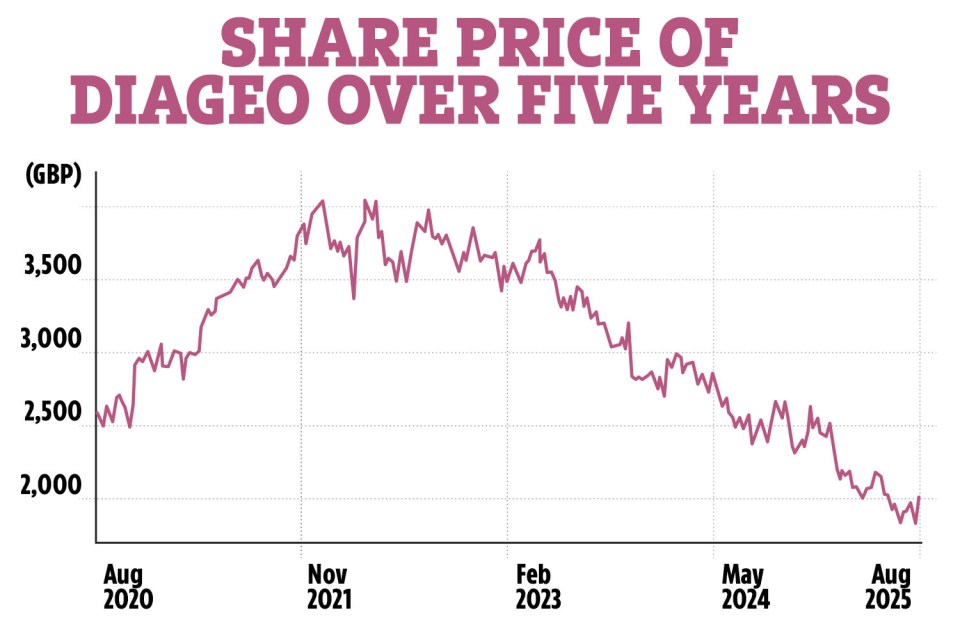

Diageo

Drinks companies like Diageo soared during Covid, when more people were drinking at home, but sales have since tailed off, particularly as younger generations are drinking less.

But Russ Mould, investment director at AJ Bell, likes Diageo’s stable of established brands, which include Guinness, Bailey’s and Smirnoff.

Although with the hunt for a new CEO underway, and the chance of a takeover, it could be a bumpy ride, he warns.

Shares are down almost 18% over one year. £50 invested five years ago would now be worth £38.

GSK

Formerly known as GlaxoSmithKline, this is one of the world’s biggest pharmaceutical companies.

Michael Field, strategist at Morningstar, says the firm has been in the doghouse with investors for a while, but thinks its strong pipeline of new drugs should see sales grow.

It’s also a reliable dividend payer (where the company returns a share of profits to investors), which is appealing to many.

Shares are down 8.8% over the past year, and £50 invested five years ago would be worth about £44 today.

Hikma Pharmaceutical

Shares in this global leader in medicines are down a quarter from their all-time high four years ago because of concerns about regulation in America, where Hikma generates about two thirds of its business.

But the firm is on track to grow its sales, says Russ Mould, and develop new medicines, potentially in the popular anti-obesity drug market.

Shares are up 5% over the past year, but if you’d invested £50 five years ago, you’d be down to £39.85.

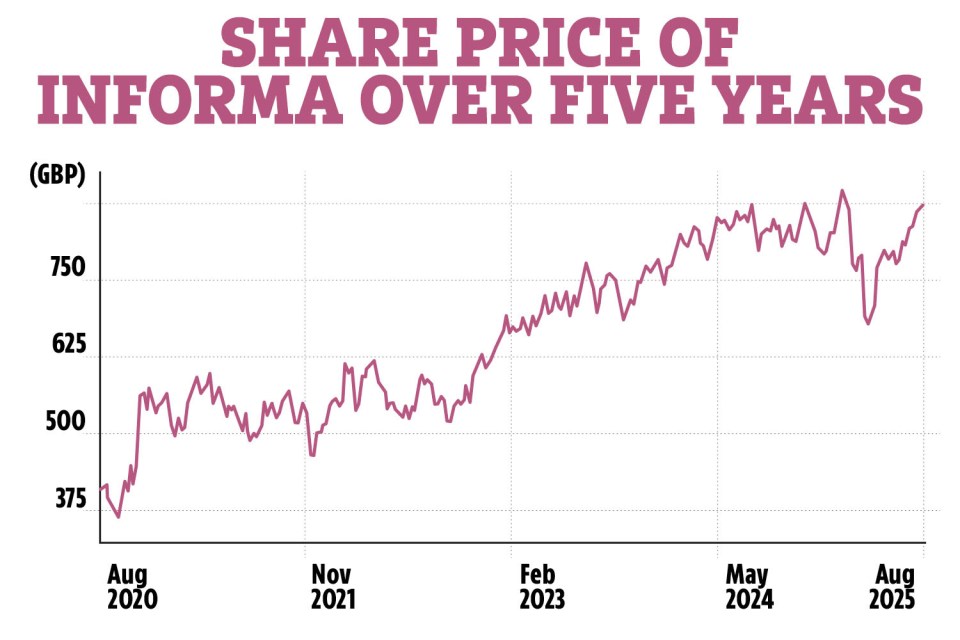

Informa

This FTSE 100 company provides businesses with services such as content, research and specialist events.

As well as providing large exhibitions, Giles Parkinson, head of equities at TrinityBridge, likes that the company has also adapted to the online age.

Shares are up 9.6% over the past year. Over five years, a £50 investment would have grown to £110.50

‘People think you’re rich if you invest, but that’s not true’

MARTHA Burns gradually turned an initial £100 investment into the stock market into a healthy £2,200 sized pot in two years.

She was inspired after watching YouTube videos about how to get started investing, and dipped her toes into the world of investing in June 2023.

“I have always saved and made sure I had enough for a rainy day, but I wanted my money to grow,” she said.

Martha, 39, who lives in Bermondsey, London, opened an account with investment firm Vanguard and set up a direct debit to invest £100 a month.

She chose the Vanguard US Equity Index fund, which tracks more than 3,500 American companies. It would have grown a £1,000 investment to £2,172 over five years.

“I wanted to invest in America because it is the most important economy in the world. I knew it had performed well and believe it will continue to do so,” said Martha, a comedian.

She selected Vanguard after reading positive reviews about the company and seeing it had low fees.

It charges £4 a month for a Stocks and Shares Isa plus her fund fee of 0.1 per cent. She plans to leave her money invested for at least 20 years and hopes she will be able to invest more in the future.

In less than two years, Martha’s pot has grown to more than £2,200. “The moment you mention that you invest, people assume you are secretly loaded, but that is not the case.

“You can start with a small amount and it is easier than you think,” said Martha.

Kering

If you can’t afford your own Gucci handbag, you could buy shares in the firm that makes them.

Luxury goods companies have struggled in recent years, but Michael Field thinks there that Kering shares could improve as demand for its products picks up.

Its other brands include Yves Saint Laurent and Balenciaga.

Shares are down 19% over the past year, and £50 invested five years ago would be worth £21.50 today.

Kone

Based in Finland, Kone manufactures lifts, including for major sites such as London Underground, the Shard and the CITIC tower in Beijing.

Its maintenance arm delivers most of the profits, says Marcel Stötzel, with Kone responsible for about 1.7 million lifts across the globe.

“This maintenance business is regulated, providing greater stability and visibility of returns over time across different macroeconomic scenarios,” he adds.

Shares are up 16% over one year. Over five years, a £50 investment would have fallen to £38.

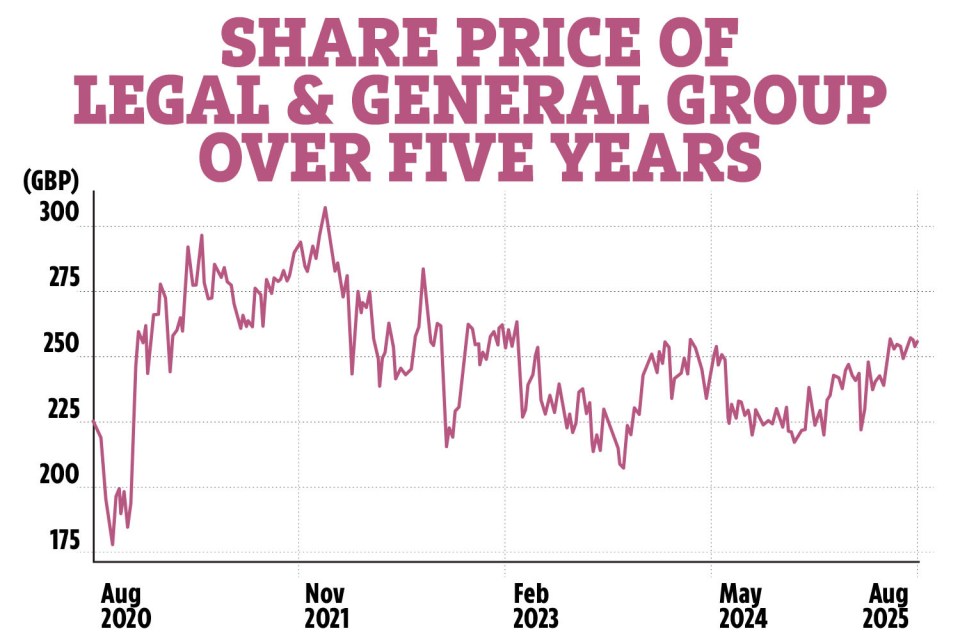

Legal and General

L&G is one of the UK’s leading workplace pensions and annuities companies – areas set to grow as more people save more money for retirement.

Russ Mould likes that the stock pays a reliable dividend and says shares could rise under the leadership of Anotnio Simoes, who took over as CEO last year.

Shares are up 18% over one year. £50 invested five years ago would now be worth £56.45.

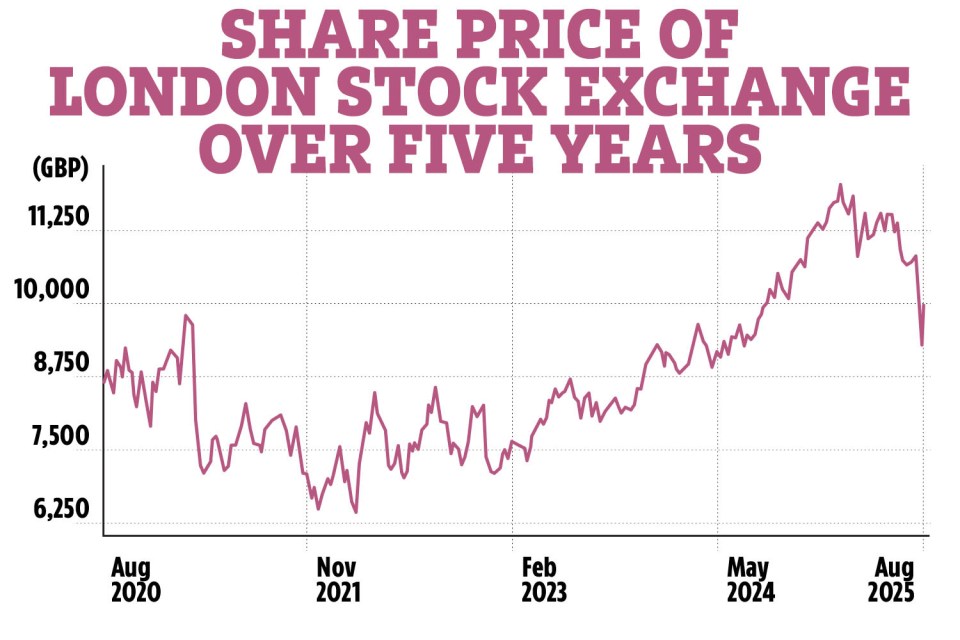

London Stock Exchange Group

The company behind the infrastructure for the UK’s stock market, LSEG is a world leader in financial data and technology.

Derren Nathan thinks it is “well placed to benefit from growing trends around the electronification of trading” in the long-term.

Shares are up 3.9% over the past year. A £50 investment five years ago would have grown to about £57.

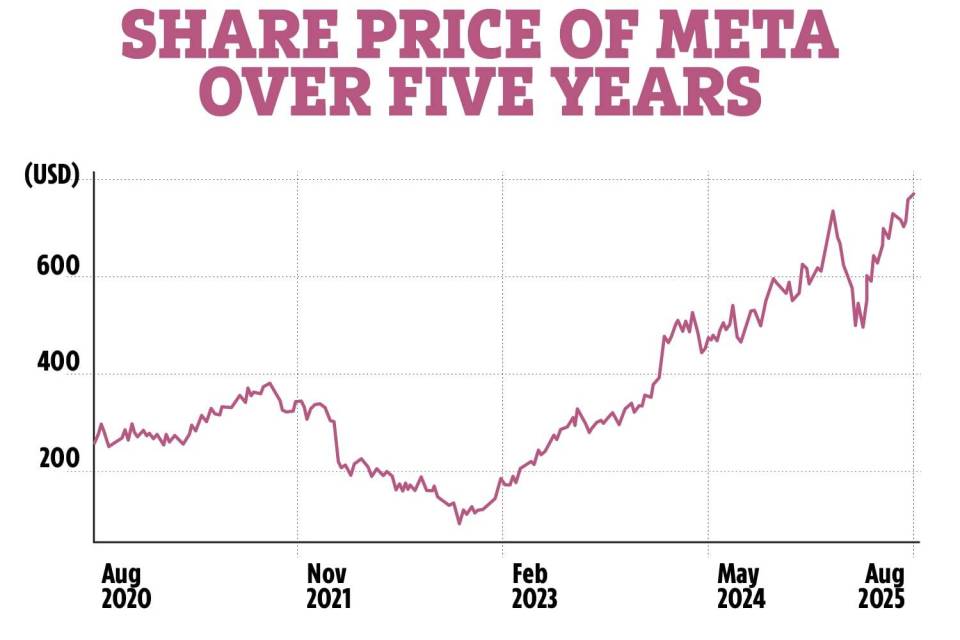

Meta

A recent quarterly update from the Facebook owner showed sales were up 22% and profits by 38%, as the firm continues to launch new tools and embrace artificial intelligence.

“Revenue and earnings momentum remained strong, with robust top-line and margin growth,” says Smith.

“That update highlighted why we continue to like this stock.”

Shares are up 54% over one year. If you had invested £50 five years ago, you’d now have about £142.

Microsoft

Microsoft is embedded as the go-to operating system for millions of computers across the world.

Now its expansion into artificial intelligence is providing opportunities for further growth.

Giles Parkinson says its “entrenched incumbency” as a software provider makes it a solid choice.

Shares are up 32% over the past year, and £50 invested five years ago would now be worth £124.

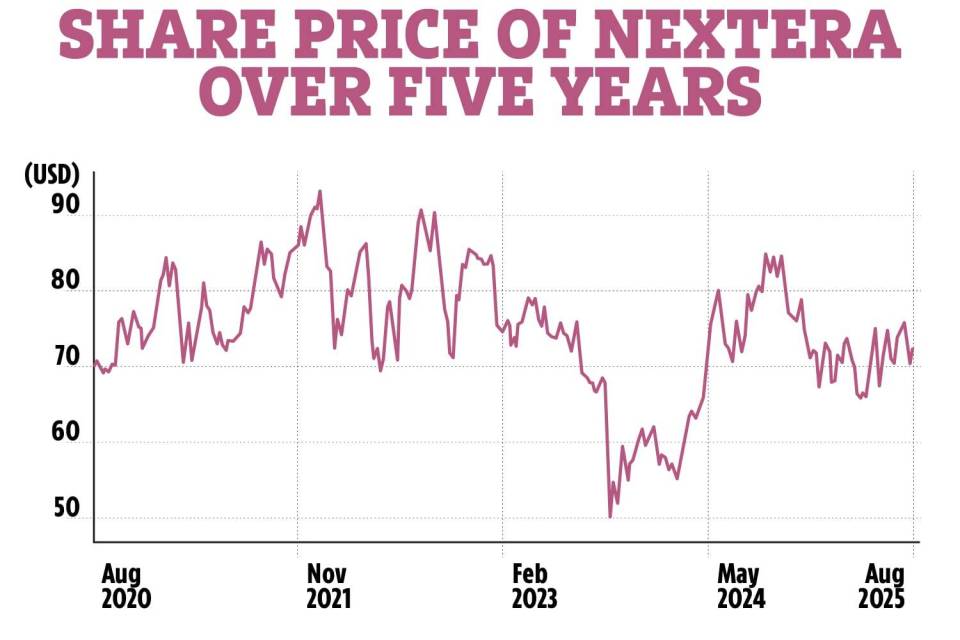

NextEra Energy

This company supplies renewable energy across America, and its rapid expansion in wind, solar and battery storage makes it well positioned for the energy transition, says Chris Beauchamp.

He calls it a “standout pick” in the utilities space, which also pays a reliable dividend.

Shares are down 7.5% over the past year. £50 invested five years ago would be worth £49.50.

Rheinmetall

Defence company Rheinmetall makes everything from weapons and ammunition to armoured vehicles and training systems.

Based in Germany, its shares have had “an amazing run over the last year or two”, says Michael Field, but could rise further as European governments look to plough more cash into defence.

Shares have soared 262% in the past year. £50 invested five years ago would be worth a massive £1,097.

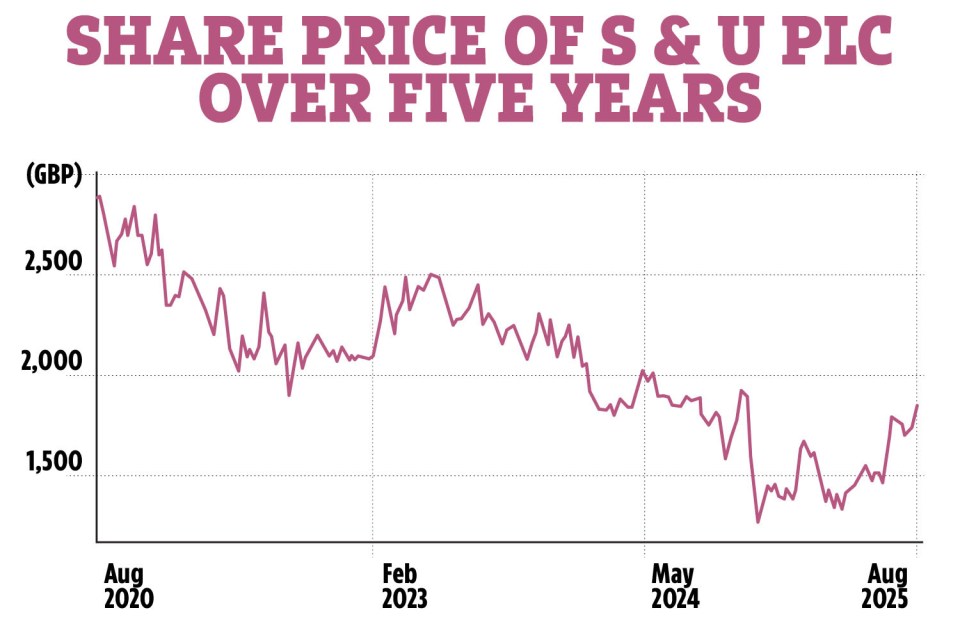

S&U

This specialist lender, which focuses on property bridging loans and car finance, has seen three consecutive years of falling annual profits.

Higher interest rates, a rise in defaults and regulatory pressures are concerns.

But the recent Supreme Court ruling on car finance could lift a cloud and tempt investors back to the stock, says Russ Mould.

Shares are up 2.6% over the past year. £50 invested five years ago would today be worth about £61.

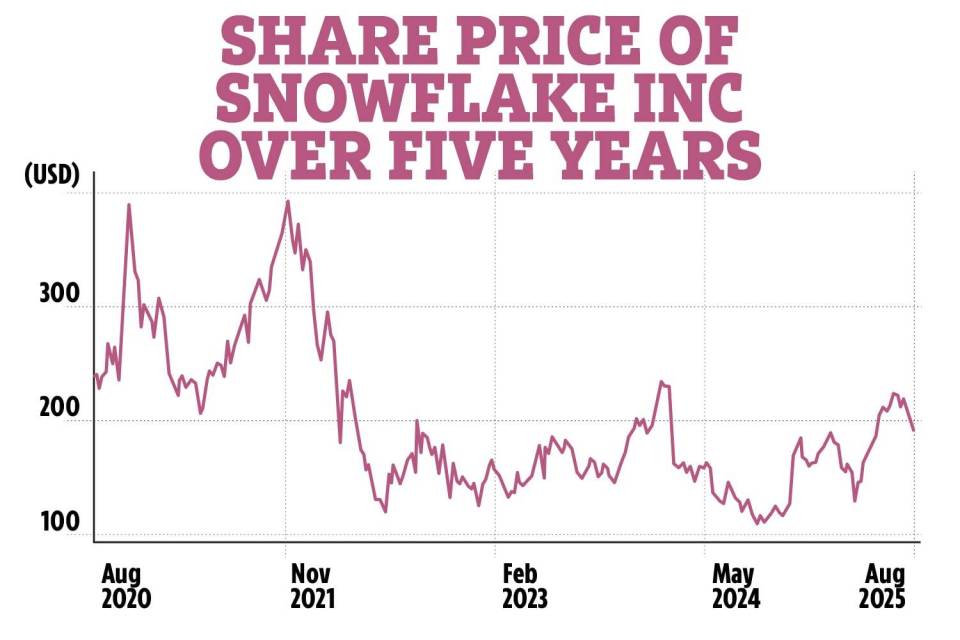

Snowflake

Snowflake is a cloud-based data warehouse that helps companies manage their data and run their AI models.

“After a quiet patch earlier this year, businesses are spending on AI again and we see Snowflake as a key player,” says Lale Akoner.

She thinks investors should look beyond the big household AI names to software companies that help companies build and deploy their AI tools.

Shares are up 79% over the past year. £50 invested five years ago would have fallen to £43.

The five stocks to avoid

Here are the five stocks and shares that aren’t worth investing in.

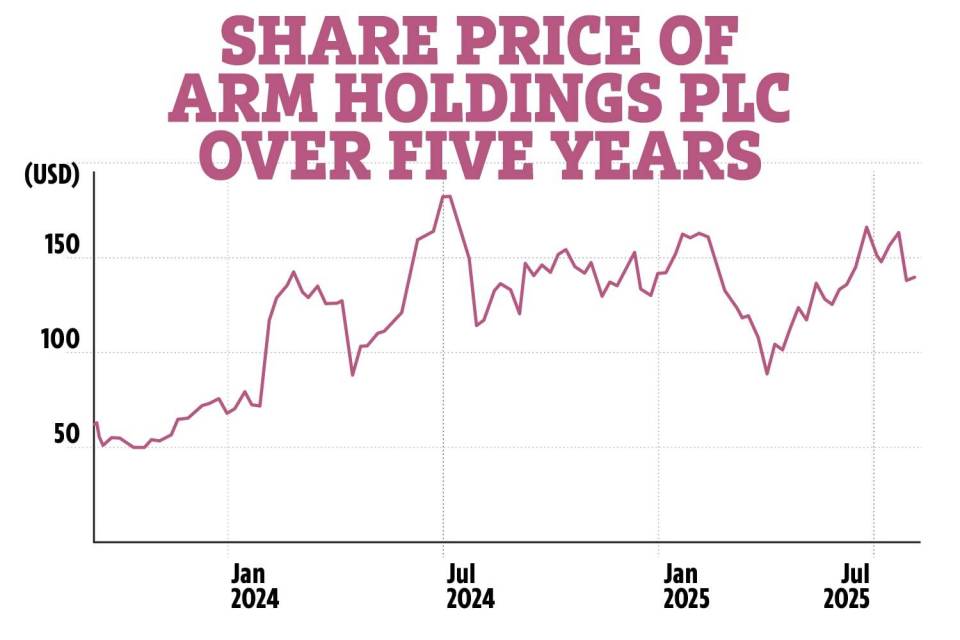

Arm Holdings

Europe’s answer to Nvidia, the world’s biggest chip-maker, Michael Field believes the shares are only worth half of what they currently trade for.

“The company is also very dependent on China for sales, which represents a material risk,” he says.

Shares are up 21% over the past year, and £50 invested five years ago would be worth £113 today – maybe time to take some of those profits.

Air France-KLM

The big legacy airlines have a reputation for better service, but Michael Field thinks low-cost competitors could chip away at their market share.

Air France-KLM operates the national carriers for France and the Netherlands.

“After a strong run, we believe these shares are now expensive,” he says.

Shares are up 62% over one year. If you’d invested £50 five years ago, you’d now have about £32.50.

Burberry

The fashion brand known for its iconic check has been one of the worst performers on the FTSE 350 in recent years.

Chris Beauchamp says: “Burberry was caught between weak demand in key Asian markets, particularly China, and heightened competition globally.”

With retail spending still in the doldrums and profit margins under pressure, he is not confident things will improve.

Shares are up 82% over the past year, but £50 invested five years ago would be now be worth £48.50

Chevron

Giles Parkinson is pessimistic about the oil price, and thinks there is too much supply for current demand.

This could impact companies in the energy sector, which could see profits hit.

However, he adds that firms such as Chevron tend to be “defensive”, meaning they do well at times of economic turmoil, so could recover if there were a global recession.

Shares are up 7.8% over the past year. £50 invested five years ago would now be worth about £89.

Gamestop

Gamestop is a US retailer selling video games and electronics.

It rose to fame in the Covid lockdown as a so-called meme stock, with share price surges based “more on hype than performance”, says Lale Akoner.

She says revenues have continued to shrink since then and profits remain elusive.

“With no strong turnaround plan and ongoing leadership uncertainty, it’s more of a meme-fuelled rollercoaster than a long-term investment,” she adds.

Shares are up 6.2% over one year. A £50 investment would have grown to £1,086 over five years.

Three things to always remember when investing

Ben Kumar, head of equity strategy at the wealth manager 7IM, says:

1. There is no right way to invest

“We all have different views on things, and that’s true in investing too.

“The key is to be clear on your reasons for investing: that could be because you like the company’s ethos, you know about the sector, or because it pays a dividend.”

2. You will get things wrong

“Even the best investors make bad choices.

“What’s important is how you behave after that happens – keep calm, take stock, do your research, and try to decide whether it will recover and you should stick it out, or whether it’s time to cut your losses.

3. Enjoy it

“Stock investing is risky, but that is also what makes it exciting.

“There is a real buzz about having the chance to own a piece of a business that is doing well.”