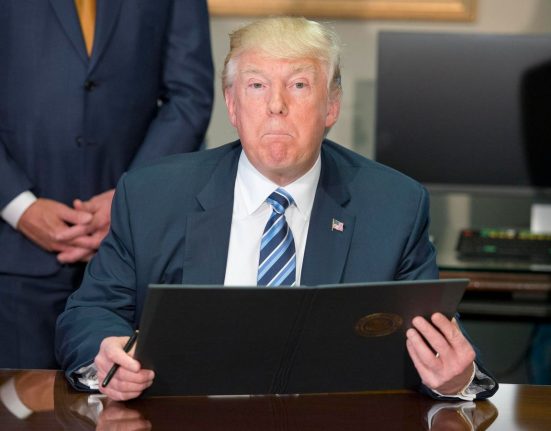

Retail trade organisations have responded positively to President Trump’s executive order titled “Guaranteeing Fair Banking for All Americans,” issued on 7 August 2025, which seeks to curb so-called “politicized or unlawful debanking”—the denial of banking services based on political, religious or lawful business affiliations.

The Merchants Payments Coalition, representing small retailers, supermarkets and convenience stores, commended the order for promoting unbiased banking access.

Its members say that when banks restrict services—particularly in payment processing—it hampers innovation and inflates costs for retailers, especially smaller operations.

One industry spokesperson noted that such banking practices undermine competition and burden local merchants.

Under the executive order, federal regulators must remove “reputational risk” from supervisory guidance within 180 days and conduct reviews of banks’ past and present debanking practices.

The Small Business Administration must work with banks to identify and reinstate clients or applicants who were denied services within 120 days, notifying them of renewed access.

Regulators may impose fines, consent decrees, or refer cases to the Justice Department.

Senator Tim Scott lauded the move as a pivotal step to protect Americans from banking discrimination. He had already led efforts to legislatively remove “reputational risk” as a subjective compliance standard.

Meanwhile, Congressman Andy Barr has announced forthcoming legislation to codify the executive order into law, citing repeated instances where crypto firms, religious organisations, firearms businesses, and other legally operating groups reportedly faced debanking.

The executive order may hold particular significance for the retail payments sector, where innovation and competition can be obstructed by restrictive banking policies.

By seeking to ensure fair access and transparency, the order could help protect economic participation for a wide range of lawful merchants.

Navigate the shifting tariff landscape with real-time data and market-leading analysis. Request a free demo for GlobalData’s Strategic Intelligence here.

“Trump’s order confronts banking policies affecting retail” was originally created and published by Retail Insight Network, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.