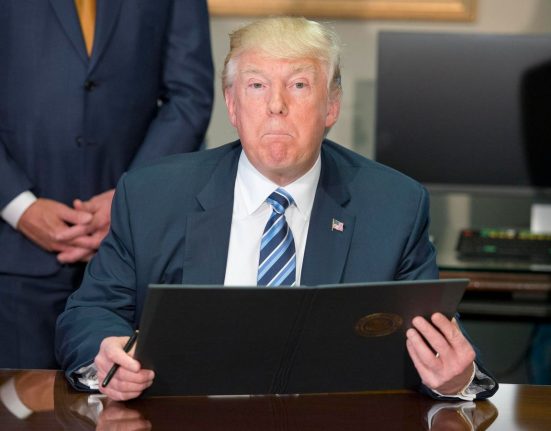

President Donald Trump signed an executive order easing access to private equity, real estate, cryptocurrency and other alternative assets in 401(k)s, a major victory for industries looking to tap some of the roughly $12.5 trillion held in those retirement accounts.

Trump signed the order Thursday, according to the White House. It directs the Labor Department to reevaluate guidance around alternative asset investments in retirement plans subject to the Employee Retirement Income Security Act of 1974 within six months.

The department is also directed to clarify the government’s position on the fiduciary responsibilities associated with offering asset allocation funds that include alternative holdings.

Trump also required Labor Secretary Lori Chavez-DeRemerto work with counterparts at the Treasury Department, Securities and Exchange Commission and other federal regulators to determine whether rule changes should be made to assist in the effort. The SEC is asked to facilitate access to alternative assets for participant-directed retirement plans.

It’s the biggest move yet by the Trump administration to bring private assets to defined-contribution accounts.

Top officials in Washington had weighed a directive for months that would relax legal concerns that have long kept alternative assets out of most worker defined-contribution plans. Retirement portfolios are mostly concentrated in stocks and bonds in part because corporate plan administrators are reluctant to venture into illiquid and complex products.

Elements of the effort mirror measures taken during Trump’s first term, when the Labor Department issued guidance that retirement plan administrators wouldn’t violate their responsibilities if they included private equity in their portfolios. That was later rolled back under former President Joe Biden.

Alternative and traditional asset managers are eager to grab a slice of the defined-contribution market, which they see as the next frontier of growth. Many institutional investors, including U.S. pension funds and endowments, have reached internal limits of what they can put into private equity amid a broader slowdown in dealmaking and a lack of distributions to clients.

Proponents argue that opening 401(k)s to private markets products would offer savers more investment options and greater potential upside. But with that comes higher risk and bigger fees that may leave retirement plan administrators vulnerable to lawsuits.

Money managers have pitched policymakers on the notion that savers’ portfolios don’t reflect changes in finance as public markets shrink. The number of publicly traded U.S. firms has greatly declined since a peak in the 1990s, while private equity assets more than doubled in the decade ending in 2023.

The initiative dovetails with Trump’s efforts to champion the cryptocurrency industry. Last month, Trump hosted a “Crypto Week” at the White House and signed the first federal law regulating stablecoins. Trump also tapped venture capitalist David Sacks of Craft Ventures LLC to be the first-ever White House artificial intelligence and crypto czar.

The president hosted industry leaders at the White House in March and signed an executive order calling for the creation of a Strategic Bitcoin Reserve and a separate stockpile of other digital assets. His administration has also vowed to elevate crypto-friendly regulators and dismissed or paused lawsuits and investigations whose targets included Coinbase, Robinhood, Uniswap Labs and OpenSea.

Trump and his family have launched multiple crypto ventures of their own, with the projects adding at least $620 million to his net worth in recent months, according to the Bloomberg Billionaires Index.