With over 430 agent outlets nationwide, City Bank is expanding banking access beyond traditional branches. Prioritizing security, compliance, and customized products, the bank supports small traders, women entrepreneurs, and farmers to foster economic growth at the grassroots level

Kamrul Mehedi, DMD, City Bank PLC. Sketch: TBS

“>

Kamrul Mehedi, DMD, City Bank PLC. Sketch: TBS

City Bank launched its Agent Banking operations in 2017 with a clear vision: to extend secure, affordable, and convenient banking services to underserved and unbanked populations, especially in rural and remote areas of Bangladesh. Our goal has always been to bridge the financial gap and bring banking closer to those traditionally left out.

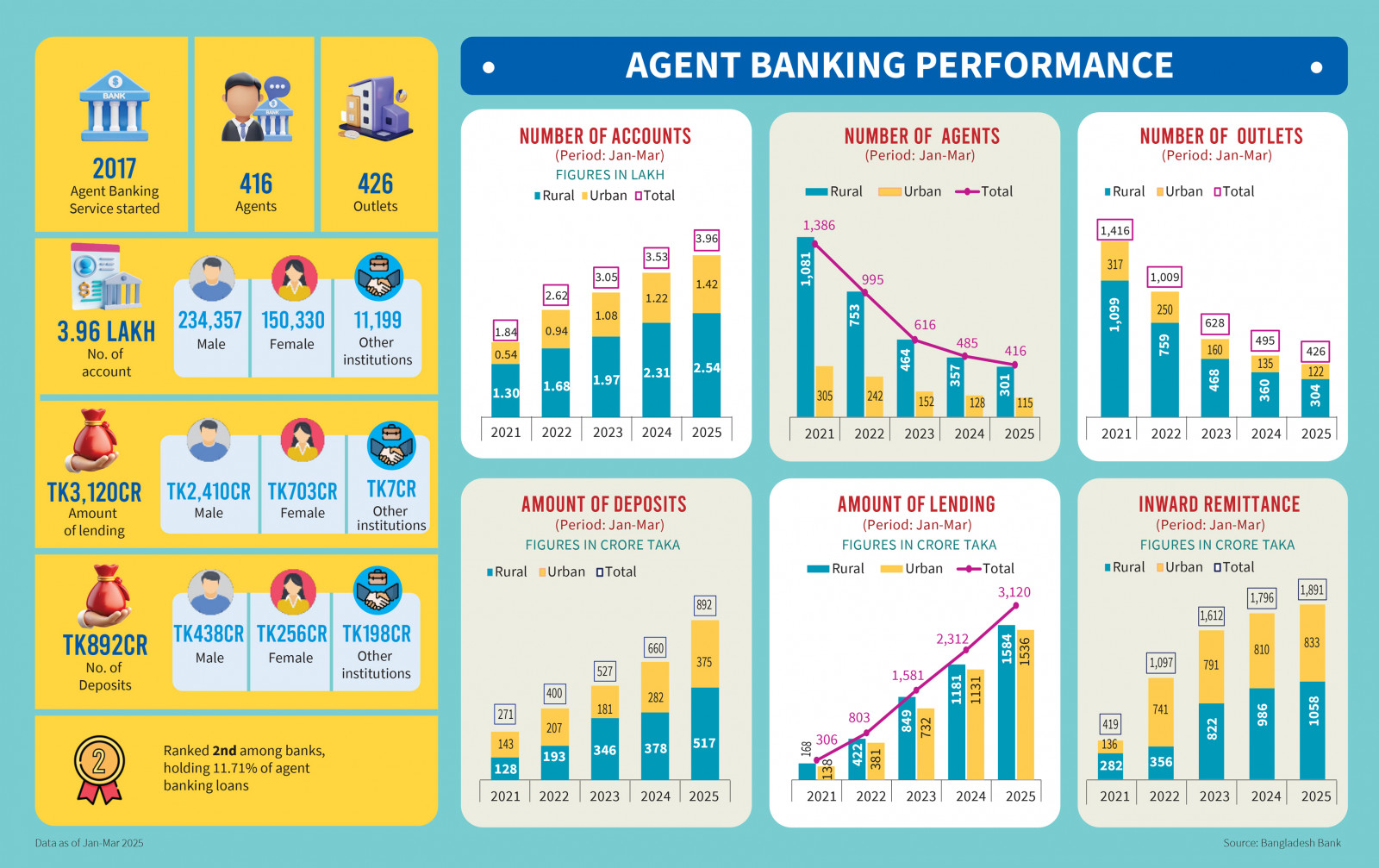

Agent Banking is central to our financial inclusion strategy. Beyond offering all banking services through agents, we focus strongly on providing loans to small traders, particularly women entrepreneurs, farmers, and middle-income individuals. I’m proud to say that our loan disbursement through Agent Banking is three times our deposit volume in this channel, placing us second nationally with an 11.71% share of Agent Banking loans.

We target remote, rural, and semi-urban areas where traditional banking infrastructure is limited. Our key demographics include farmers, small traders, day laborers, women, students, and CMSME clients—those underserved by conventional banks. Simply put, we serve where branch and sub-branch coverage ends.

As of June 2025, we operate over 430 agent outlets nationwide. We prioritize quality and compliance over sheer numbers. Our network has grown steadily but carefully to maintain standards. Although we planned strategic expansion this year, regulatory changes have made onboarding new agents challenging. We are engaging with regulators to address these issues.

Infographics: TBS

“>

Infographics: TBS

Our agent outlets offer a wide range of services: biometric e-KYC account opening, cash deposits and withdrawals, fund transfers, utility bill payments, remittance disbursement, CMSME loan distribution, and a unique Remittance Beneficiary Loan product for families of remittance recipients. Among these, fast account opening without physical documents, automated FD/DPS opening, remittance disbursement, and small trader loans are most popular.

Agent Banking often faces criticism for collecting deposits in rural areas but lending mainly to urban clients. City Bank is different. We work closely with our SME Small Business Division, which has representatives at most agent points to ensure local loan processing and disbursement. Agents receive a share of loan collection commissions, giving them better returns than competitors and encouraging active support.

Technology is key. We use biometric e-KYC verified against the Election Commission database for quick account opening, real-time API integrations for remittances, and a token management system providing two-factor authentication for cash transactions. Bangladesh Bank has praised and recommended our token system as an effective fraud deterrent.

We’ve introduced customized products tailored to agent banking clients: low-minimum savings accounts, small-ticket Deposit Pension Schemes, SME loans for women entrepreneurs, small traders, and farmers, and the unique Remittance Beneficiary Loan. These products reflect the income patterns and financial behavior of rural customers.

Challenges remain, notably gaps in financial and digital literacy and low awareness, which contribute to fraud risks. We seek greater regulator and government support for awareness campaigns through all media. A recent Bangladesh Bank circular requires a 50:50 male-female ratio in agent onboarding. While supporting gender inclusion, finding rural women entrepreneurs able and willing to run outlets remains difficult due to cultural, cash-handling, and solvency barriers.

Security and trust are paramount. We use biometric verification, transaction tokens, SMS alerts, printed receipts, and rigorous monitoring. Agents undergo strict screening and ongoing training. We run financial literacy programs, community meetings called “Uthan Boithak,” and customer engagement initiatives to build trust in rural and semi-urban areas.

In the short term, we plan to expand Agent Banking to every upazila, improve digital onboarding, and launch instant digital loan solutions. Long-term, we aim to introduce a merchant-led digital banking model in every village or pocket bazar, supporting a cashless Bangladesh.

We are onboarding a Merchant-Led Digital Model under current regulations with Bangladesh Bank approval. We advocate policy reforms to simplify agent onboarding, encourage digital innovation, and enhance customer protection. Collaborations with fintechs and NGOs help expand outreach and capacity building, ensuring continued growth and impact.