NEW YORK, July 30, 2025 /PRNewswire/ — Ramp, the leading financial operations platform, announced its Series E-2, raising $500 million at a $22.5 billion valuation. ICONIQ led the round, with continued support from existing investors including all participants from the June 2025 Series E: Founders Fund, D1 Capital Partners, GIC, Coatue, Avenir Growth, Thrive Capital, Khosla Ventures, Sands Capital, 8VC, Lux Capital, Altimeter, Definition Capital, 137 Ventures, General Catalyst, and Stripes. New investors for this round include: Sutter Hill Ventures, Lightspeed Ventures, T. Rowe Price Associates, Inc., GV (Google Ventures), Emerson Collective, Operator Collective, and Pinegrove Capital Partners.

Ramp Fast Facts

-

To date, saved customers over $10 billion and 27.5 million hours.

-

Serves more than 40,000 companies, including CBRE, Shopify, Anduril, Notion, Cursor, Vercel, Barry’s, and the University of Tennessee Athletics Foundation.

-

Currently powers over $80 billion in annualized purchase volume across card transactions and bill payments.*

-

In July launched the first of many autonomous AI agents, helping customers catch 15x more policy violations with near-perfect accuracy.

-

Exceeded $1 billion in assets under management for Ramp Treasury, less than six months after launch.

-

Product line includes corporate cards and expense management, bill payments, procurement, travel booking, and treasury. A majority of Ramp customers use two or more products across its platform.

With this round, Ramp has raised $1.9 billion in total equity financing. The company began generating cash flow earlier this year.

“We’re focused on ensuring our only constraint is the scale of our ambition,” said Will Petrie, Chief Financial Officer at Ramp. “We have a fortress balance sheet and an accelerating core business. Both will allow us to play to win as AI reshapes the future of finance.”

What follows is a letter Eric Glyman, co-founder and CEO of Ramp, shared with customers here.

* Ramp does not include bank transfers or non-monetized payments when calculating Total Purchase Volume.

We Raised $500M To Build The Future of Finance.

Rewind to the year 2000.

My school computer lab just upgraded to Windows 98. You dial up a travel agent to book your summer vacation. Finance teams are running on spreadsheets.

Fast-forward to today. The same lab has kids writing software with AI agents. I can book a vacation with a few taps on my phone. Most finance teams? Still running on spreadsheets.

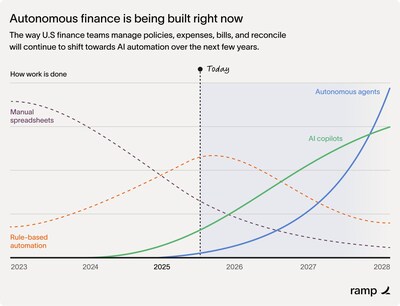

So, what’s the big rush? Well, how does any industry change? Gradually, then suddenly. Decades where nothing happens; months where decades happen.