The Japanese government agreed as part of a trade deal to invest $550B into a fund that President Donald Trump will direct toward boosting U.S. production across various industries, stimulating industrial demand.

Japan’s Minister of State for Economic and Fiscal Policy Ryosei Akazawa and President Donald Trump meet in the Oval Office on April 16.

Japan’s investment will create an investment vehicle that could look similar to Trump’s sought-after sovereign wealth fund, giving him free rein over major investments, the Wall Street Journal reported.

The fund will support industries such as semiconductor manufacturing, energy infrastructure, pharmaceutical production and commercial shipbuilding, according to a White House fact sheet. The U.S. will keep 90% of profits on investments, the White House said.

“This is the single largest foreign investment commitment ever secured by any country and will generate hundreds of thousands of U.S. jobs, expand domestic manufacturing, and secure American prosperity for generations,” the fact sheet states.

Loans and loan guarantees will make up the vast majority of the fund, with Japan expecting only 1% to 2% of the $550B to be deployed as investment, Bloomberg reported. Financial institutions backed by the Japanese government will provide the financing, Japan’s Minister of State for Economic and Fiscal Policy Ryosei Akazawa said.

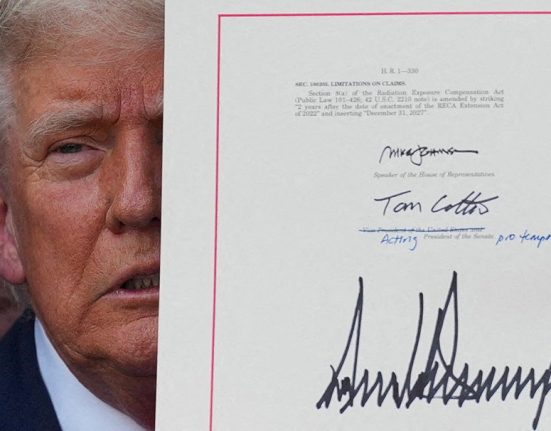

The investment fund is part of a deal that will implement 15% tariffs on Japanese automobiles and other goods, a reduction from the previously threatened 25%. Tokyo can save about $68B, or ¥10T, through the lower tariff rate, Akazawa said.

The fund will invest not only in projects supporting Japanese and U.S. companies, Akazawa said, citing a Taiwanese semiconductor company building a U.S. manufacturing plant as a potential example.

The fund will be separate from Japan-based SoftBank’s pledged $40B investment in the $500B Stargate data center development joint venture, the WSJ reported.

Trump floated the possibility of a U.S. sovereign wealth fund, which is often a major investor in commercial real estate, on the campaign trail last year. Shortly after taking office, he ordered the U.S. Treasury and Commerce departments to come up with a plan for a fund.

The departments privately completed their proposal by the May deadline, but the plans and potential methods of financing a fund remained unclear. Treasury Secretary Scott Bessent said later that month that Trump had set an American plan aside for now, but the White House was reportedly mulling a shared fund with Japan.

The $550B fund would give Trump unprecedented power to invest in his choice of projects, according to the WSJ. This would put the U.S. government in competition with the largest investment firms. But whether the fund materializes as Trump envisions is questionable.

This fund deviates from other trade agreements with investment pledges by allowing investment at Trump’s direction and reserving 90% of the profits for the U.S., Christina Davis, a Harvard University professor of Japanese politics, said to the WSJ.

“It makes it sound coercive, socialist and unprecedented in any sense of past trade negotiations,” Davis said.