This is AI generated summarization, which may have errors. For context, always refer to the full article.

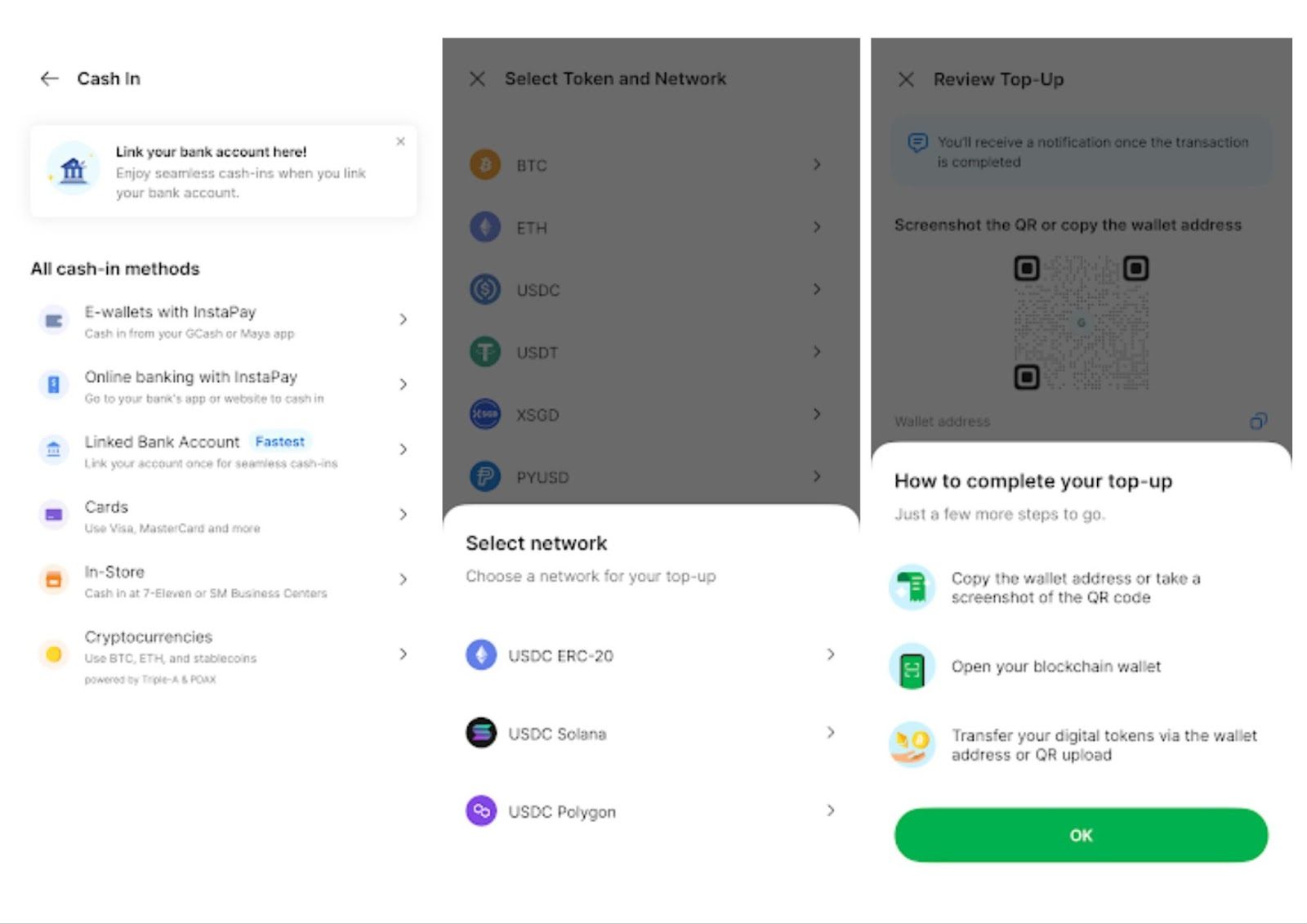

Philippine Grab users can use Bitcoin, Ether, the US dollar-backed stablecoin USDC, and USDT to top up their GrabPay wallets

MANILA, Philippines – Filipinos can now use select cryptocurrencies to top up their GrabPay wallets.

The new feature, announced earlier this month, comes on the heels of a successful 2024 launch in Singapore, and will allow Philippine Grab users to use Bitcoin (BTC), Ether (ETH), the US dollar-backed stablecoin USDC, and USDT (Tether) to top up their electronic wallets.

Topping up GrabPay accounts using crypto takes a few steps to complete:

- Select ‘Cryptocurrencies’ as the cash-in method on the Grab app.

- Choose a token and network from the supported list of cryptocurrencies and stablecoins.

- Enter the amount in pesos, and review the conversion rate and transaction details.

- Send the tokens from your preferred crypto wallet to the provided address.

- Confirm the top-up. Funds are instantly reflected in your GrabPay wallet.

The new feature is made possible through a partnership with payments provider Triple-A and local digital asset exchange PDAX.

Eric Barbier, CEO of Triple-A, said of the launch, “We had a successful launch of GrabPay top-ups with cryptocurrency in Singapore… Now, we’re looking forward to bringing this service to the Philippines, a market that’s ready for digital currencies. This is a big step in making digital currencies easier to use in everyday life across Southeast Asia.”

Meanwhile, CJ Lacsican, vice president for Cities and head of the Grab Financial Group in the Philippines, said of the new system, “Integrating cryptocurrency as a cash-in option for GrabPay reflects our commitment to advancing financial inclusion in the Philippines. By offering more accessible, digital-first solutions, we aim to empower a wider spectrum of Filipinos — especially those with limited access to traditional banking or those who prefer the convenience of digital currencies.” – Rappler.com