Join Our Telegram channel to stay up to date on breaking news coverage

Daily shifts in the crypto landscape continue to influence market behavior. Over the past few weeks, technical indicators and on-chain metrics have pointed to a favorable climate for altcoins, with rising trading volumes and breakout patterns supporting investor interest.

This article explores the next cryptocurrency to explode, spotlighting assets showing real potential. These newer projects may offer better upside than large-cap coins in the current cycle.

Next Cryptocurrency to Explode

Jupiter is gaining attention from its growing DeFi role on Solana, while The Sandbox could benefit from renewed metaverse interest after its successful LAND sale. Wormhole’s cross-chain technology and institutional partnerships are creating solid momentum. Sei is riding high on unmatched wallet activity and regulatory strides.

Meanwhile, Wall Street Pepe (WEPE), having raised over $70 million before launch, is now rallying on its Solana expansion and real-time trading tools like the Alpha Chat. With a current price of $0.0001233, it stands out as a meme coin with evolving utility, placing it firmly among the most promising tokens to track this season.

1. Jupiter (JUP)

Jupiter (JUP) has maintained a steady uptrend in recent days, gaining 2.89% in the past 24 hours, while its trading volume surged by over 75%. With a market cap of around $1.72 billion, JUP is steadily cementing its place in the Solana DeFi space. The RSI is currently hovering around 56 to 57, a neutral zone suggesting room for movement in either direction. At the same time, the MACD histogram shows slight positive momentum, adding to the short-term bullish sentiment.

JUP’s rise is fueled by developments surrounding JLP Loans, a system enabling users to borrow against JLP tokens without being forced to sell their positions. Jupiter recently allocated $150 million USDC to this system, making headlines across DeFi media outlets. This move shows confidence in the platform and increases JUP’s real-world utility.

Alongside this, Jupiter’s Q2 report revealed strong figures: $142 billion in transaction volume and over 8 million active wallets. With Jupiter Lend expected to launch in Q3, JUP’s utility could further deepen within the Solana ecosystem.

🚨Last call

Registration for Jupiter Lend closes on July 28, midnight UTC.

Get early access to the most advanced money market on @solana 👇

— Jupiter (🐱, 🐐) (@JupiterExchange) July 26, 2025

Even so, investors should be aware of a scheduled token unlock of 28.5 million JUP (1.78% of the supply) beginning July 28. Unlock events can introduce temporary selling pressure. Whether this impacts the current bullish setup depends on whether JUP’s growing product ecosystem, such as Jupnet and Lend, can outpace supply inflation.

2. The Sandbox (SAND)

The Sandbox (SAND) is showing signs of a technical breakout as interest surges following a major LAND sale. SAND’s price rose by nearly 3% in the last 24 hours, while technical analysts have spotted a bullish double bottom forming on the charts. The price is currently testing resistance at $0.42. If this level is broken, it could open the door to a move toward $0.60, especially with improving volume and market sentiment.

The GBM LAND Auction, which concluded on July 22, is one of the largest ever conducted by The Sandbox, driving a wave of demand for virtual assets in its ecosystem. This event likely positively impacted its demand since SAND is required for ecosystem transactions.

On the technical front, the MACD line is slightly above the signal line, indicating the early stages of bullish crossover potential. The RSI sits at 54.84, neutral but with upward space before reaching overbought levels. Meanwhile, Fibonacci retracement levels identify resistance at $0.3266 and $0.3081, suggesting that breaking above these can open stronger upside paths.

Refer a Friend, Earn a 5% Reward 👥

During the Training Grounds LAND Sale, enter a valid LAND Owner’s username and both you and your referrer will receive a 5% SAND reward 💸

Grow the community 🌷https://t.co/0nrdqGDuMJ

— The Sandbox (@TheSandboxGame) July 25, 2025

Additional incentives, such as the 5% SAND reward referral campaign during the Training Grounds LAND Sale, also contribute to increased engagement. However, future gains may depend on validation of the $0.42 breakout and whether post-sale activity sustains interest in The Sandbox.

Whale accumulation patterns and Bitcoin dominance, currently at 60.29%, may also affect whether SAND has the strength to become the next cryptocurrency to explode.

3. Wall Street Pepe (WEPE)

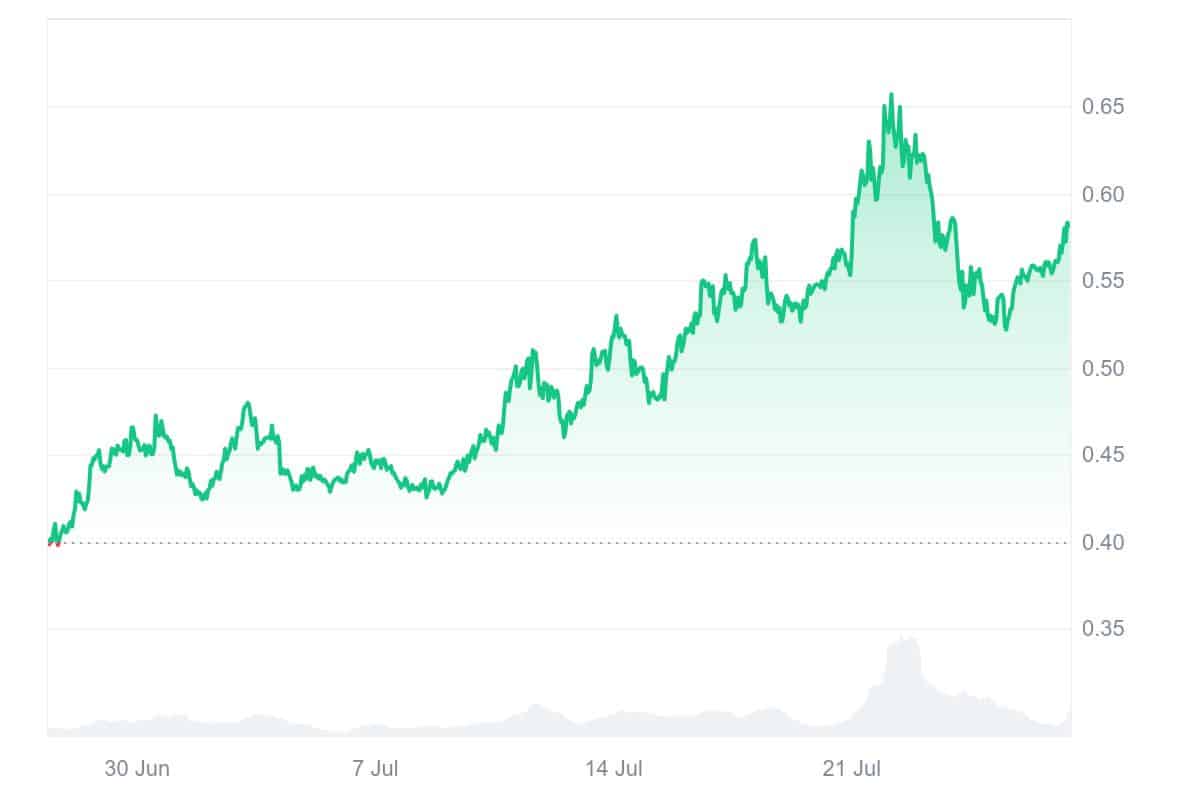

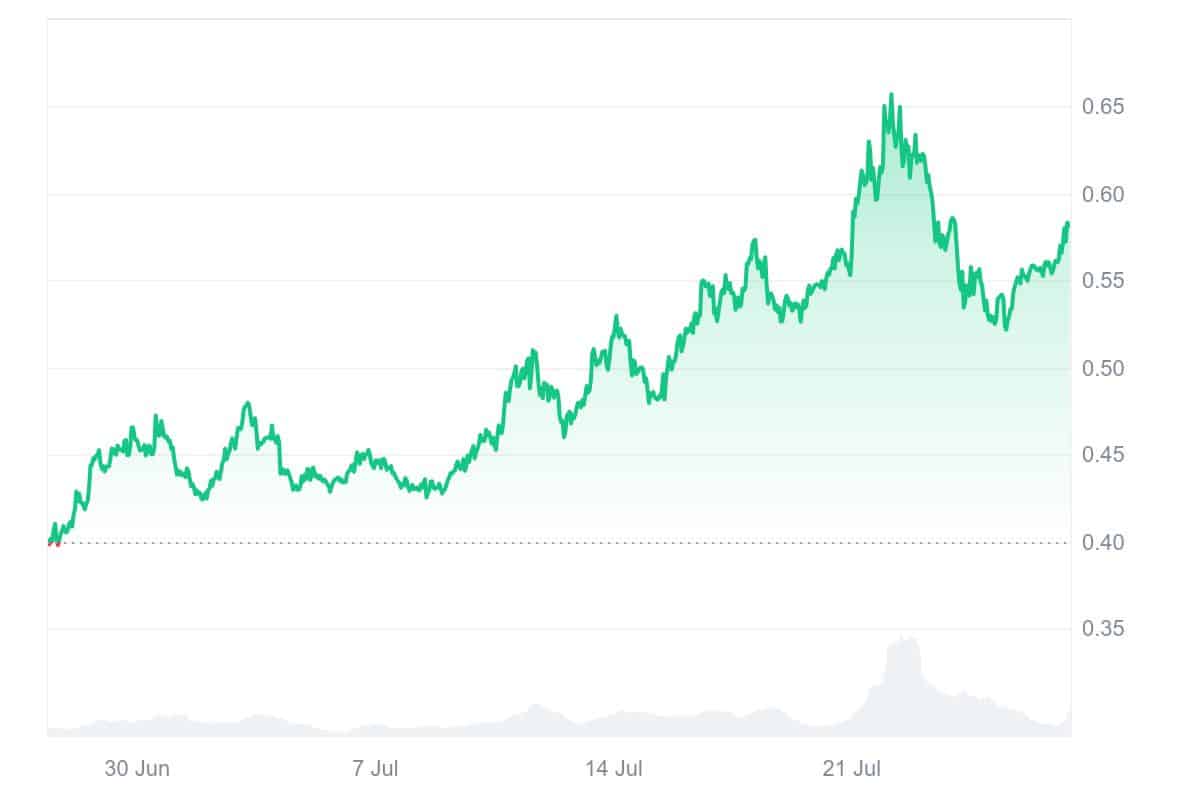

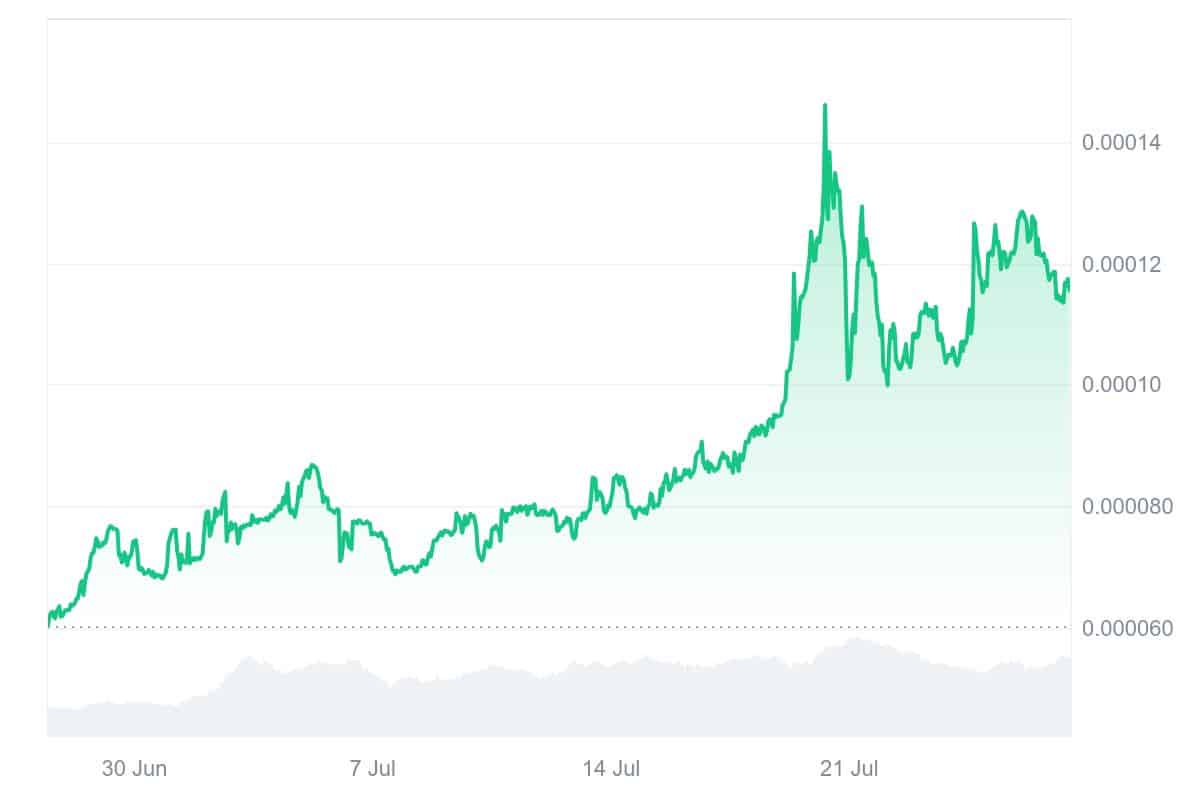

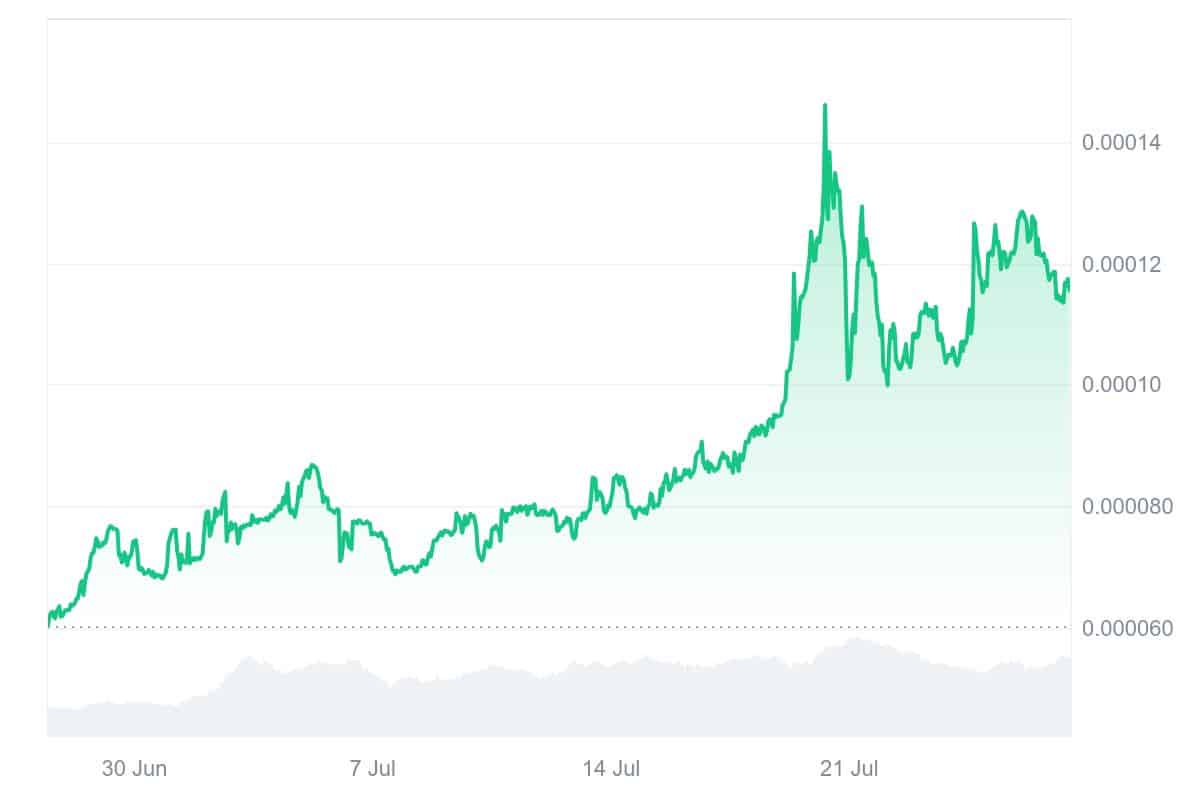

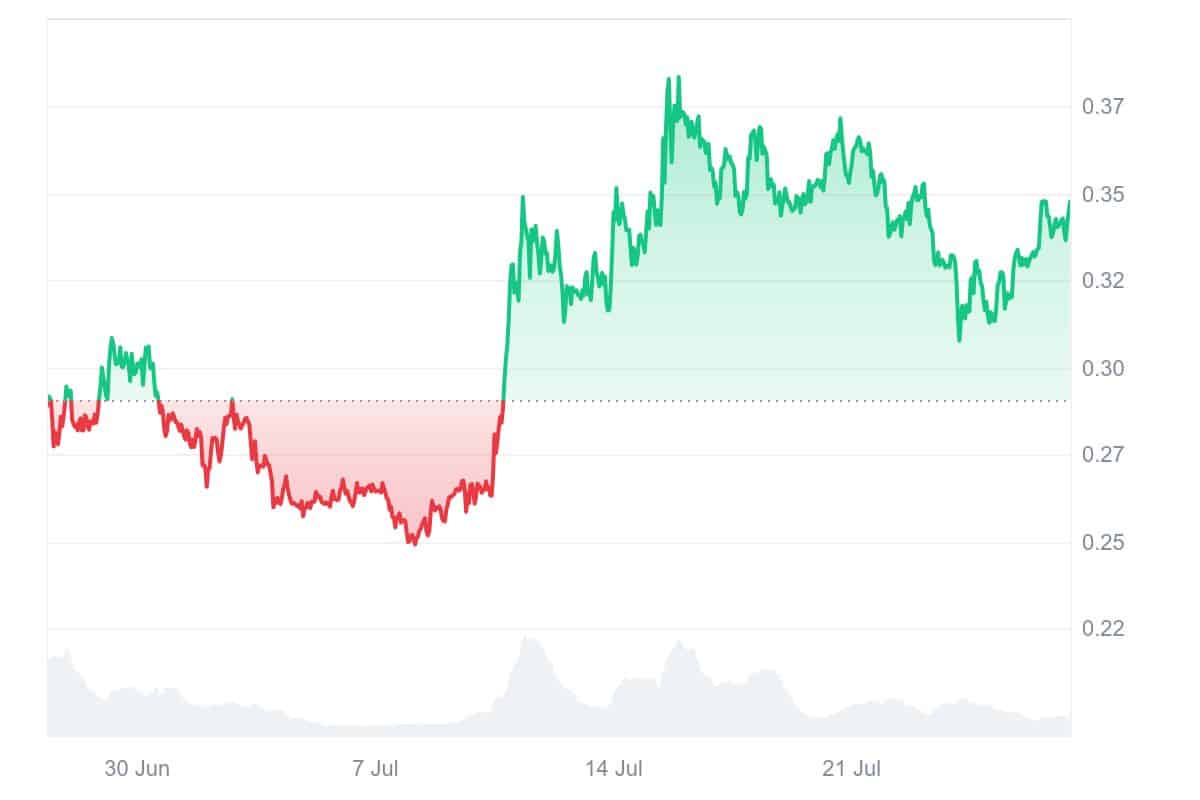

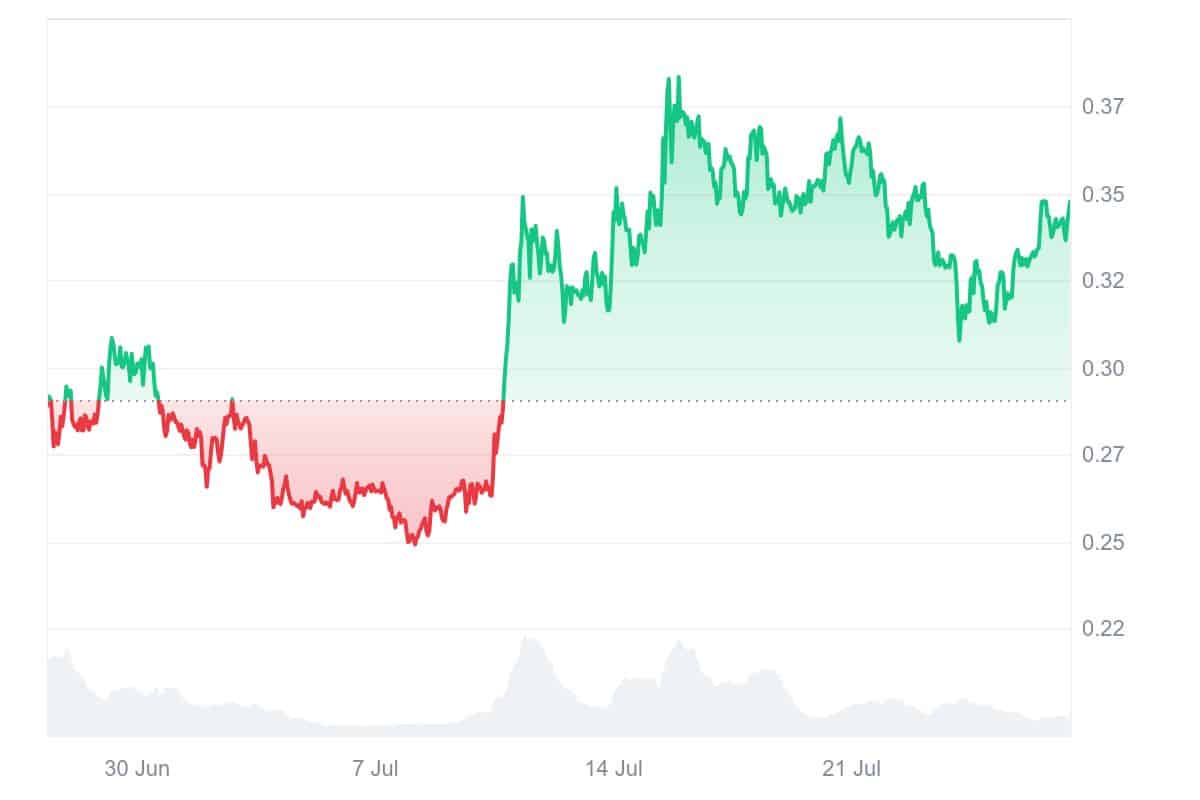

Wall Street Pepe (WEPE) has reemerged as one of the most talked-about meme coins of the moment, and with good reason. The Ethereum-based frog-themed token has surged over 600% since June 1, climbing to its highest price in five months. Now trading at $0.0001233, WEPE is gathering fresh momentum as it prepares to launch on Solana, promising faster speeds, lower fees, and exposure to an entirely new crypto audience.

This multichain expansion marks a major evolution for the project. Rather than leaving Ethereum behind, the team is extending its ecosystem. Solana users can expect more than a copy-paste version; WEPE plans to introduce native staking, NFTs, and DeFi features optimized for Solana’s lightning-fast infrastructure.

The buzz around Wall Street Pepe didn’t begin with its listings. During its sold-out presale, WEPE raised over $70 million, attracting daily contributions of $1 million at its peak. That early success was no accident. The project’s branding, community strategy, and market timing connected with a broad audience, leading to a massive following across social media.

There’s only 1 option. 🐸⚔️ pic.twitter.com/922mWa2OQO

— Wall Street Pepe (@WEPEToken) July 25, 2025

What’s kept WEPE relevant post-launch is its exclusive Alpha Chat. In this members-only group, holders gain access to early trading insights and altcoin calls like PNUT, POPCAT, and PENGU. It’s a major utility feature that rewards active participation and gives holders a real edge.

With more centralized exchange listings and community perks on the way, WEPE is positioning itself for another wave of growth. If altseason really is around the corner, tokens like Wall Street Pepe, with strong fundamentals and viral appeal, could outperform.

4. Wormhole (W)

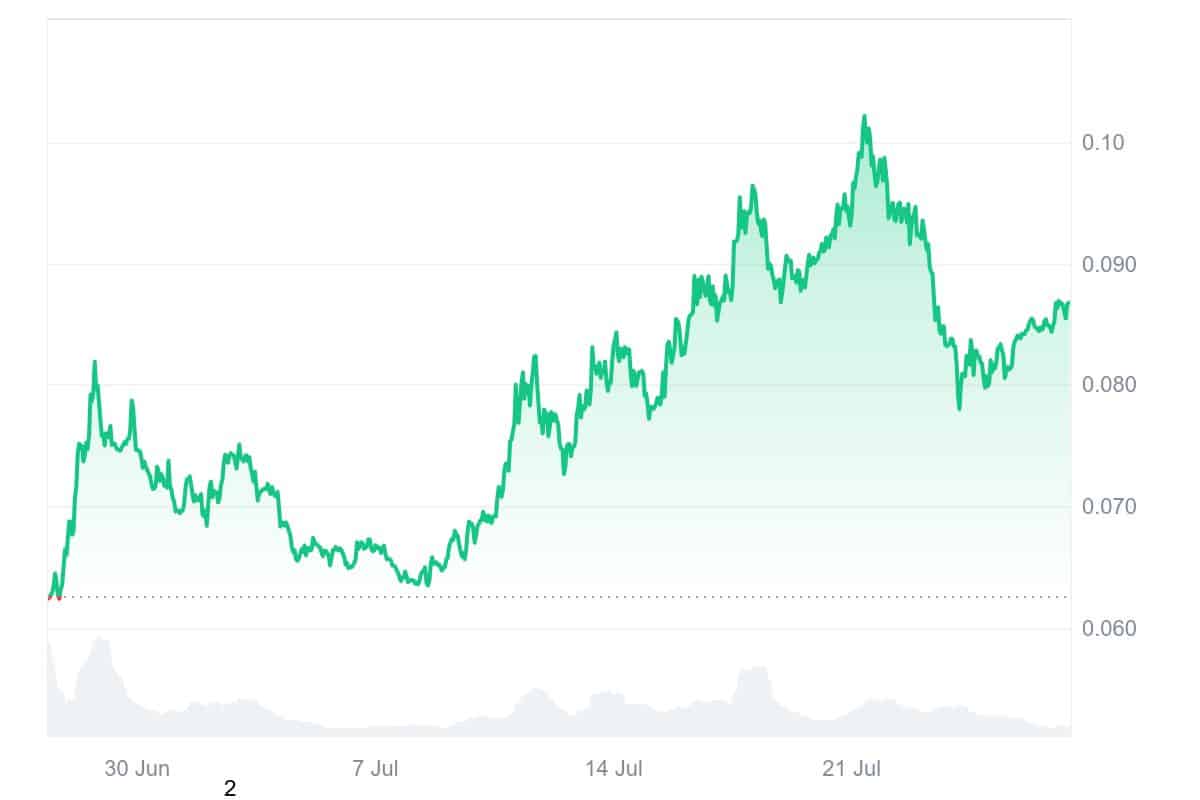

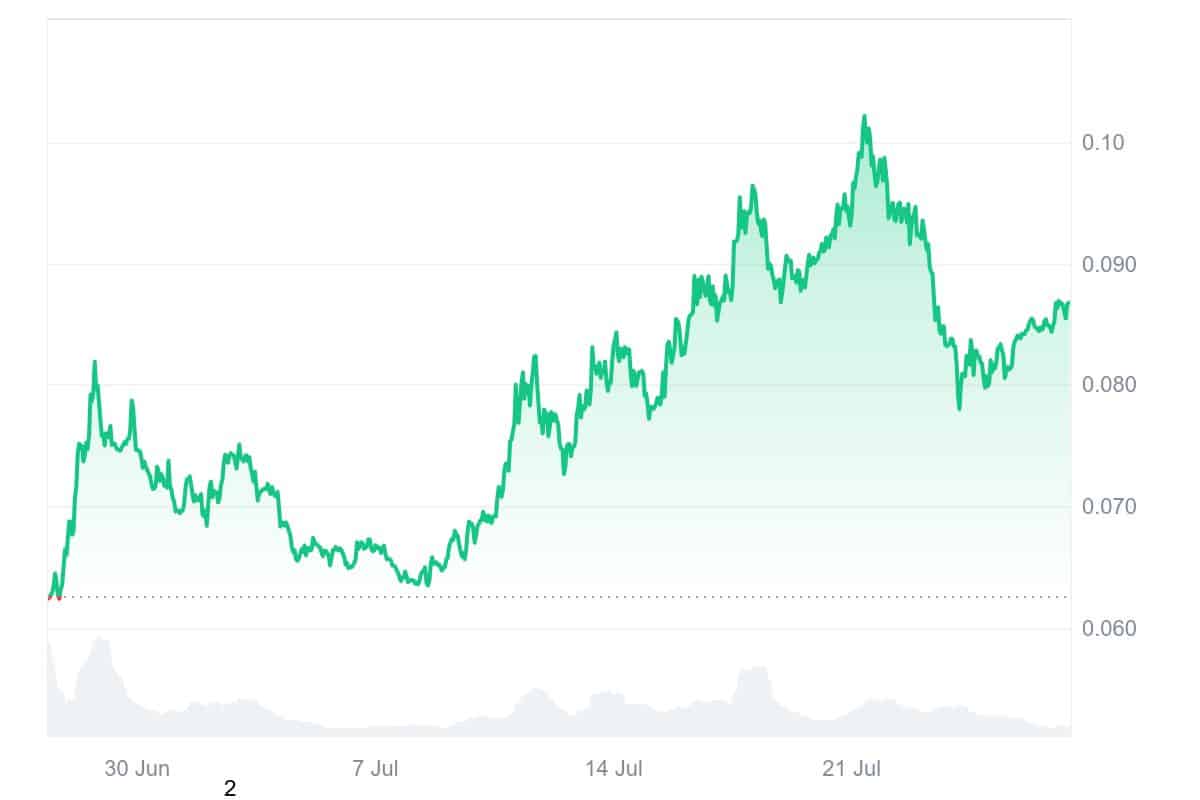

Wormhole (W) continues to attract institutional interest and could see rising adoption through real-world partnerships. One of the key recent developments is Centrifuge’s migration to Ethereum via Wormhole, a step that reflects increasing cross-chain usage.

Even more notably, JPMorgan and Wormhole have been mentioned together in asset management discussions, with the partnership viewed as a move toward safer and more efficient cross-chain tools. Projects like Franklin Templeton’s BENJI and Hamilton Lane’s funds also choose Wormhole, indicating growing institutional trust in the protocol.

From a technical perspective, W is trading above its 30-day simple moving average, currently around $0.0786, with a price of $0.0864. This supports a moderately bullish sentiment. However, the MACD histogram remains negative, suggesting that a decisive trend has not yet formed. RSI is neutral at around 53, while Fibonacci resistance is $0.0937. The pivot point near $0.0846 is currently holding as support, which helps build a short-term bullish case.

💥 @centrifuge V3 is live, launching on @ethereum, @plumenetwork, @base, @arbitrum, @avax, and @BNBCHAIN

Interoperability powered exclusively by @Wormhole. pic.twitter.com/Cvj1Thbmvq

— Wormhole (@wormhole) July 24, 2025

Despite solid fundamentals, metrics from the Altcoin Season Index (currently 44) and weak derivative activity (open interest down 2.66%) indicate that retail involvement remains low. The long-term outlook may hinge on Wormhole’s ability to continue growing across its multichain roadmap and expanding DAO participation.

If the platform can maintain its current pace of institutional adoption and launch new cross-chain tools with high utility, it could surprise markets with significant upside later in the quarter.

5. Sei (SEI)

Sei (SEI) has shown resilience in a volatile market, with recent developments pointing to growing utility and increased network activity. While the current Altcoin Season Index stands at 42, which signals mild strength in the altcoin market, SEI has outperformed several peers by focusing on technical improvements and regulatory recognition.

Analyst Ali Martinez noted that SEI is holding above its 10-day simple moving average within a descending channel. If it maintains this support, price targets near $0.49 could be in play. The RSI reads around 57.94 as of press time, showing strength without entering overbought territory. The MACD histogram remains negative, but price action is supported by both 7-day and 30-day SMAs. Additionally, the Fibonacci level at $0.356 is a near-term resistance point that SEI appears poised to test.

On the adoption front, SEI is leading all public blockchains with over 3.24 million active addresses, surpassing Ethereum and Bitcoin in that metric. This surge in activity may translate into a higher total value lock, especially after the recent launch of WYST. SEI is also gaining attention for its presence at Coinfest Asia 2025 and being selected for Wyoming’s Stable Token pilot, indicating increasing credibility in the institutional and regulatory sphere.

Native @USDC by @circle has arrived on Sei.

To tap into the world’s largest regulated digital dollar on the fastest L1, a lineup of Day 1 access partners are ready to go.

You can access native USDC on Sei today via the following platforms 👇https://t.co/guNBL9sp6H

— Sei (@SeiNetwork) July 24, 2025

SEI’s partnership with Circle for USDC integration further boosts its profile, and its Ethereum Virtual Machine compatibility broadens its appeal. If positive sentiment continues building after Coinfest and the platform sustains its active user base, SEI might achieve breakout momentum. With so many moving parts aligning, it could easily rank as the next cryptocurrency to explode.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage