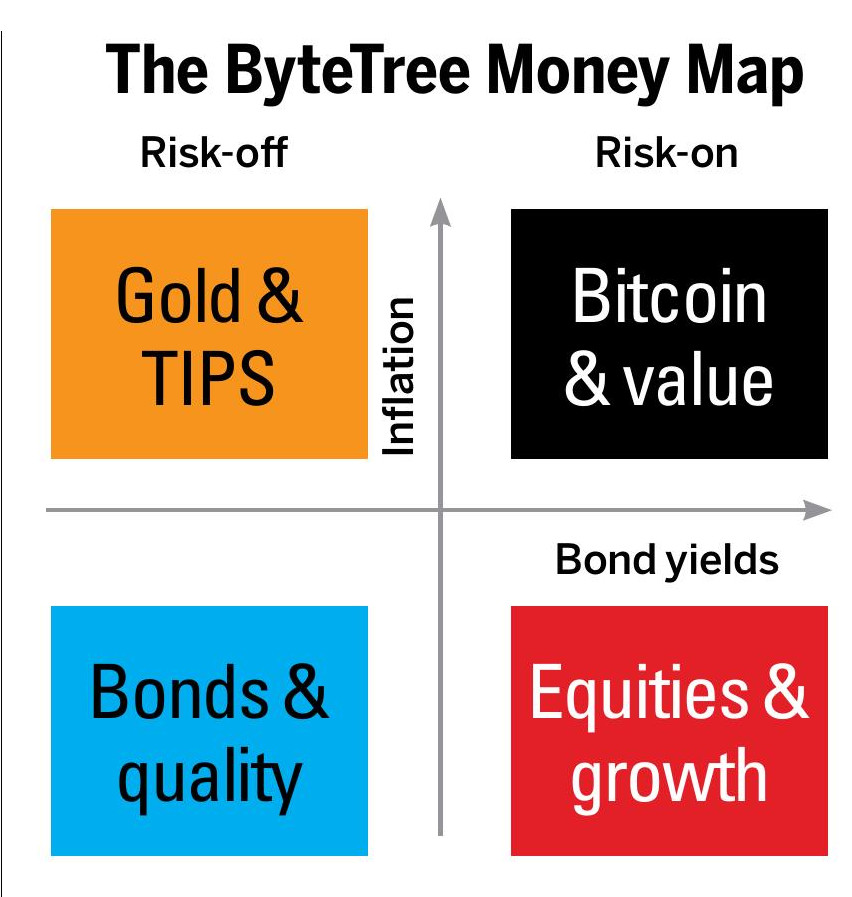

Investors in 2025 are either anxious or happy. The anxious believe investing is all about costs. Buy some cheap trackers, and in the long run, you’ll do fine with minimal effort. The happy are active investors who have avoided the largest stocks. It is an anomaly for the largest stocks to lead the market (1929, 1972, 1999 excepted), and following the crowd into richly valued areas doesn’t end well.

As an active manager, I have found 2025 rewarding mainly because my portfolios pursued value outside the US. A weak dollar has meant US equities have lagged the world. US equities have delivered zero returns in sterling this year, and the MSCI World index, with 70.3% exposure to the US, is up just 2.4% including dividends. Contrast that with the FTSE 100, up 12%, or the pan-European EuroSTOXX, up 20% this year. US exceptionalism has once again been exaggerated.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter