An Illinois tax consultant was sentenced this week to 42 months in prison for a scheme to fraudulently obtain over $3.6 million in small-business loans through COVID-19 disaster loan programs, according to the Justice Department.

Farooq Khan, 31, submitted at least 30 fraudulent applications for loans under the Coronavirus Aid, Relief, and Economic Security (CARES) Act Paycheck Protection Program (PPP) and COVID-19 Economic Injury Disaster Loan (EIDL) for his company Hannan Tax Services. The programs were enacted by the Small Business Administration (SBA), according to court documents, the department said Monday.

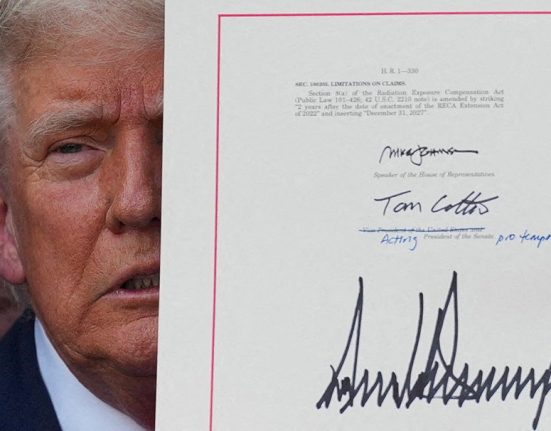

The CARES Act was a $2.2 trillion economic stimulus bill passed by Congress under President Trump in March 2020. Its goal was to provide economic assistance to American families and small businesses financially affected by the pandemic.

Khan caused about $3.6 million to be fraudulently distributed by the SBA and PPP lenders. He also unsuccessfully attempted to obtain at least an additional $588,900 in loans through other EIDL applications for nonexistent companies. He personally obtained about $1.2 million of the fraudulent loans. He pleaded guilty to one count of wire fraud in February and was ordered at sentencing to pay over $3.6 million in restitution, also according to the department.

He owned and operated the tax-preparation company Hannan Tax Services in Chicago and knowingly submitted fraudulent claims from about May 2020 through October 2021 through Hannan Tax.