A leaked memo from the CEO of AI company Anthropic revealed a troubling, but potentially unavoidable, conundrum facing artificial intelligence companies: securing investments from wealthy leaders in the Middle East and potentially funding dictators.

Anthropic’s ethical reversal

The plan was leaked in an internal Slack message sent by CEO Dario Amodei to the company’s employees. Amodei acknowledged the ethical complications of his decision but insisted that it was necessary to stay competitive in the cutthroat world of AI innovation.

“There is a truly giant amount of capital in the Middle East, easily $100B or more,” Amodei wrote. “If we want to stay on the frontier, we gain a very large benefit from having access to this capital. Without it, it is substantially harder to stay on the frontier.”

This is an about-face from Anthropic’s previous stance on Middle East money. In 2024, the company declined investments from Saudi Arabia, citing national security concerns, per CNBC. However, it later accepted a buyout of its 8% stake in bankrupt crypto firm FTX by a UAE investment firm.

Amodei is fully cognizant that this shift may be perceived as hypocritical. In his 2024 essay titled “Machines of Loving Grace,” he wrote, “Democracies need to be able to set the terms by which powerful AI is brought into the world, both to avoid being overpowered by authoritarians and to prevent human rights abuses within authoritarian countries.”

A narrow path with soft edges

To avoid what he calls “AI-powered authoritarianism,” Amodei insisted that any Gulf state investments would be “narrowly scoped” and “purely financial,” preventing investors from gaining “leverage” over the company. However, he acknowledges that this solution is not foolproof.

“The implicit promise of investing in future rounds can create a situation where they have some soft power, making it a bit harder to resist these things in the future,” he wrote. “In fact, I actually am worried that getting the largest possible amounts of investment might be difficult without agreeing to some of these other things.”

AI’s race to the bottom

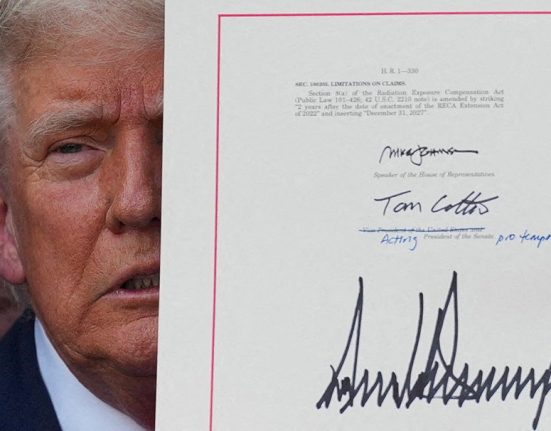

It may be difficult for Amodei to maintain such standards, however, without falling behind his competitors. In President Trump’s tour of the Middle East in May, he was accompanied by Elon Musk, Sam Altman, Nvidia chief Jensen Huang, and other big tech investors — excluding Anthropic.

In January, OpenAI launched a $500 billion data center with backing from a UAE state-owned investment group. Around the same time, Saudi Arabian government-owned AI company Humain announced the purchase of 18,000 Nvidia GB300 chips along with deals with AMD and AWS.

Amodei describes the risk of accepting foreign investments as a “race to the bottom where companies gain a lot of advantage by getting deeper and deeper in bed with the Middle East.” Without a unified industry stance, he argued, “we’re now stuck with it as an individual company.”

“That puts us at a significant disadvantage, and we need to look for ways to make up some of that disadvantage while remaining less objectionable,” he added. “I really wish we weren’t in this position, but we are.”