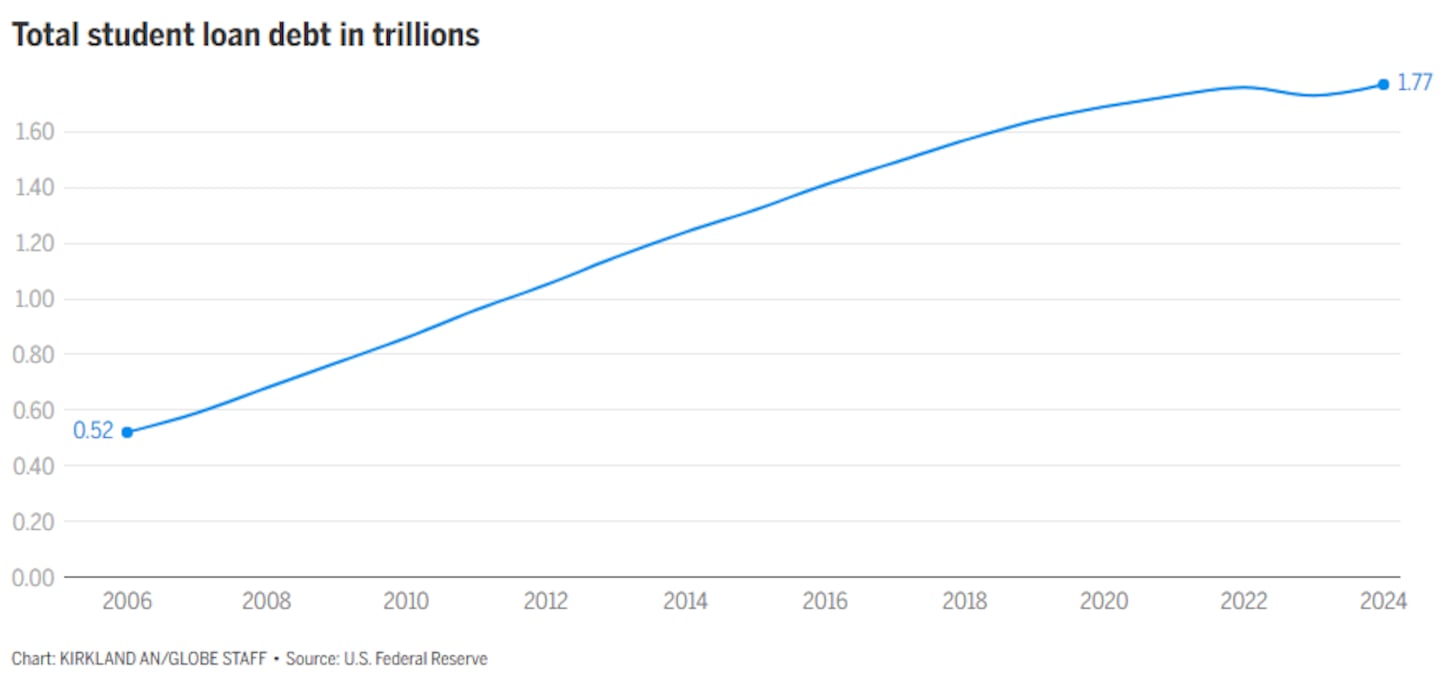

Here’s what these changes mean for borrowers around the country, and why student debt is both a product of and helps to exacerbate the racial wealth gap.

There are new limits on federal student lending

- Federal student loans for graduate professional degrees, such as medical and law school, will be capped $50,000 a year, or $200,000 total.

- Parent PLUS loans, used by caregivers to borrow for their children’s undergraduate degree, will be capped at $20,000 a year, $65,000 total.

- Grad PLUS loans will be eliminated. Graduate students will still be able to borrow federal student loans, but will be capped at $20,500 annually, $100,000 total.

- Federal student loan borrowers will now have a lifetime limit, considering undergraduate and graduate education, of $257,500 in federal student loans.

- Students who have full-ride scholarships will no longer be eligible for Pell Grants, which is federal aid that does not need to be repaid. However, Pell Grants will now be available for job training programs, including at community colleges.

Borrowers will now have only two ways they can pay off their federal student loans:

- Enroll in a standard payment plan, with fixed monthly payments based on the initial amount borrowed.

- Enroll in the Repayment Assistant Plan, with variable monthly payments based on income.

Whereas borrowers facing economic hardship, such as lost income, can currently defer payments for up to three years without accruing interest, under the changes, borrowers facing economic hardship can only pause payments for nine months within a 24 month period. Interest will be accrued during this time.

Changes to lending and paying of debt will go into effect July 1, 2026.

What are the current interest rates for federal student loans?

According to Federal Student Aid, an office of the U.S. Department of Education:

- Undergraduate student loans are 6.39% fixed interest rate

- Graduate or professional student loans are 7.94% fixed interest rate

- Grad PLUS and Parent PLUS loans are 8.94%

What other changes are on the horizon?

President Trump aims to eliminate President Biden’s SAVE Plan, which put a pause on loan repayments and eliminated interest accruals for approximately 8 million student borrowers, by July 2028. In the meantime, borrowers enrolled in the SAVE Plan will begin accruing interest again on August 1. Payments on the principal remain paused.

What options do current student loan borrowers have?

If borrowers are considering changing plans or consolidating their loans in light of these changes, Natalia Abrams, founder and president of the Student Debt Crisis Center, advises them to speak to an adviser before moving forward, especially to make sure they understand the details of a new plan and the implications of consolidation.

Abrams suggests saving as much documentation as possible, both from the student loan service provider and studentaid.gov. Contact information should always be updated on studentaid.gov.

For the millions of borrowers who have or are expected to default in the coming months, Abrams stresses: There are options.

For example, borrowers can enter loan rehabilitation, which Abrams warns can require lengthy negotiation but can offer a way to restart repayments rather than having wages or tax returns garnished. Loan consolidation essentially halts the default, by starting a new loan with a new repayment plan.

How does student debt relate to the racial wealth gap?

Groups that have been under-represented in higher education — Black and brown Americans and women — are more likely to rely on student debt for college, graduate and professional school. That’s in part because they have less generational wealth to tap into, making them more dependent on loans.

Students of color are also targeted by and overrepresented at private, for-profit institutions that cost more, have lower graduation rates and worse job outcomes. Once under-represented students take on debt, less generational wealth and racial and gender pay gaps makes those loans harder to pay off.

To give a sense of the disparity: According to the Education Data Initiative, a research organization, Black college students owe an average of $25,000 more in student loan debt when they graduate than their white counterparts. The gap widens further as loans linger. Four years after graduation, thanks to interest, penalties, lower wages and relatively limited family wealth, Black students owe an average of 188 percent more than white students.

Disparities in lending reach back decades and hinge on federal lending policies. Racial minorities, particularly Black Americans, were explicitly excluded from government-backed and subsidized mortgage programs that were pivotal in helping white families build wealth.

People who have been historically excluded from credit have fewer assets and worse credit scores, making them more vulnerable to high-priced, high-risk loans. For example, the sub-prime mortgage crisis that kicked off the 2008 economic crisis primarily impacted Black, brown and low-income families. According to the Debt Collective, an advocacy group, Black and brown families lost 50% of their collective wealth in the wake of the crisis.

Across Massachusetts, while white households are the most likely to hold mortgage debt — a means by which to increase their family assets — Black households are most likely to hold vehicle and student debt, which can harm credit scores and the ability to build generational wealth.

According to the Student Borrower Protection Center, the unequal burden of student debt “fuels economic, gender, and racial inequality, inhibits asset accumulation, accelerates wealth gaps, and carves out a generational divide that, even in the best of circumstances, will take decades to erase.”

Resources for federal student loan borrowers

The Student Debt Crisis Center offers resources to help students navigate student debt. They also respond to emails from borrowers and hold monthly Zoom workshops about the evolving situation. Their next workshop is in August.

The National Consumer Law Center is based in Boston. They offer a series of videos on student loans.

This story was produced by the Globe’s Money, Power, Inequality team, which covers the racial wealth gap in Greater Boston. You can sign up for the newsletter here.

Mara Kardas-Nelson can be reached at mara.kardas-nelson@globe.com.