Bitcoin has dropped slightly after hitting an all-time high of $123 per bitcoin last week (even as U.S. president Donald Trump issues a bullish bitcoin prediction).

Sign up now for CryptoCodex—A free newsletter for the crypto-curious

The bitcoin price, up 300% in just two years, has exploded onto Wall Street and into companies’ treasuries, with traders eyeing the “next big catalyst” for bitcoin and crypto that could come as soon as this week.

Now, as the Federal Reserve grapples with a deepening nightmare, companies are branching out from bitcoin to buy smaller cryptocurrencies, hoping to trigger what’s been called an “infinite money glitch” as the combined crypto market crosses $4 trillion.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

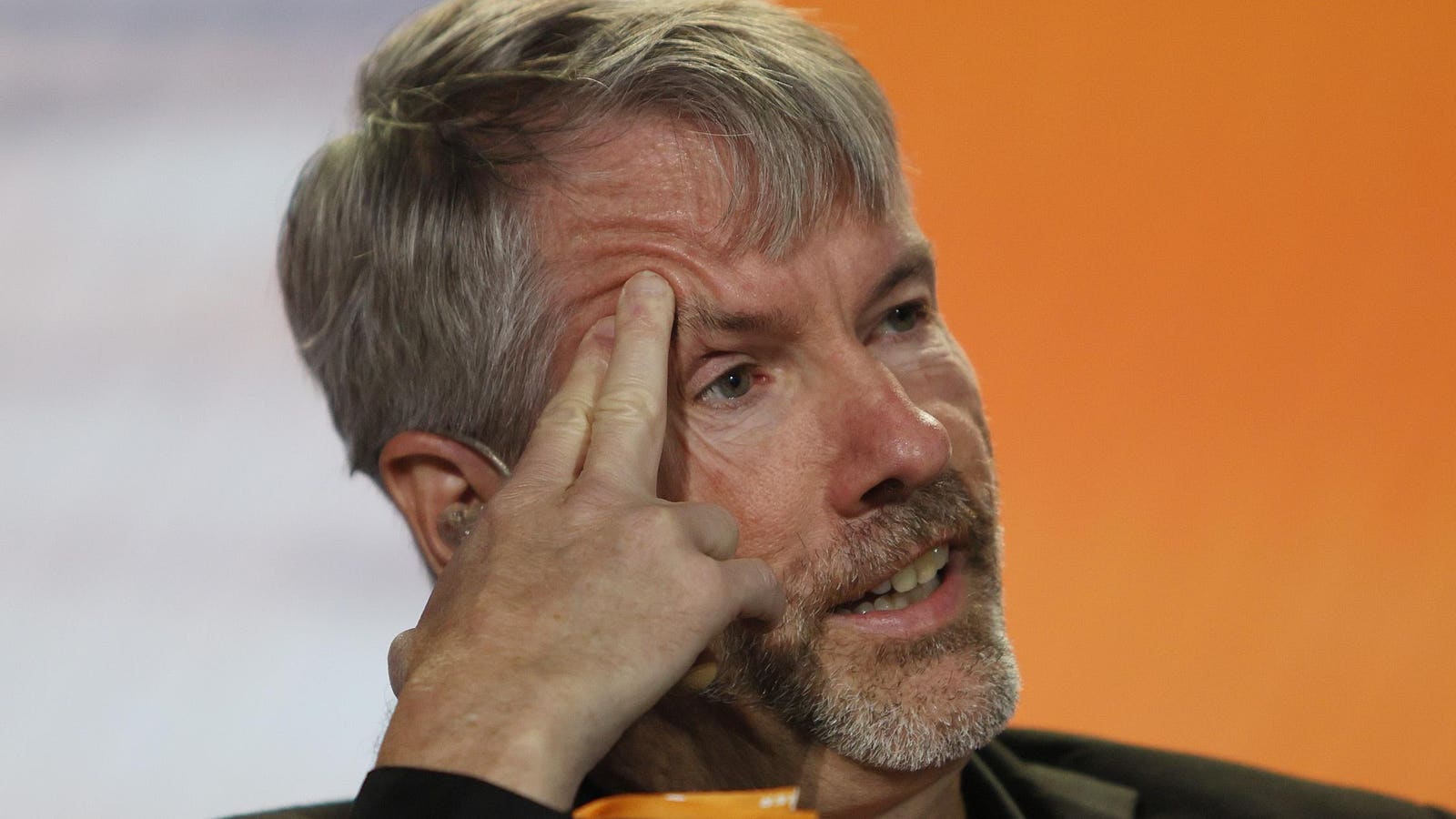

Strategy chief executive Michael Saylor has pioneered what’s been called an “infinite money glitch” … More

Since the summer of 2020, Michael Saylor has been buying up huge amounts of bitcoin via his company now known as Strategy, previously called MicroStrategy, through the issuance of corporate debt and share sales.

Strategy, which has seen its share price soar 3,500% in just five years, now holds just over 600,000 bitcoin worth $71 billion, nearly 3% of all the 21 million bitcoin that will ever exist, with dozens of copycat traders trying to emulate its bitcoin-buying plan.

“This financial engineering approach of utilizing debt and equity issuances, such as convertible notes and stock offerings, specifically to raise funds for continuous crypto asset acquisitions creates a ‘flywheel’ effect,” analysts with Animoca Brands Research said in a report, adding the so-called “infinite money glitch” pushed the bitcoin price higher, “enabling further capital raises to buy even more bitcoin.”

As companies branch out from bitcoin to apply the Strategy acquisition model to other cryptocurrencies, sometimes called altcoins, the “flywheel” could push their prices higher too.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has soared since Strategy began buying bitcoin in 2020.

“Applying this ‘flywheel’ model to altcoins might offer a more extended runway for growth and profitability compared to bitcoin,” Animoca Brands analysts wrote.

“While bitcoin’s market is more mature and its price discovery has undergone several major cycles, the vast and diverse altcoin market is still, in many respects, in its nascent stages,” the research noted.

This week, a company called The Ether Reserve that’s backed some major crypto companies and will be chaired by long-time ethereum developer Andrew Keys will list on the Nasdaq exchange through a merger with blank-check merger, expected to raise around $1.6 billion and hold 400,000 ethereum on its balance sheet.