As the housing market continues to evolve in the shadow of persistent inflation and shifting buyer behavior, this week’s economic data provides important clues for both policymakers and home shoppers.

Markets are closely watching the Federal Reserve for signals of a policy shift, but this week’s consumer price index report reinforced expectations that a rate cut in July is unlikely, even though it’s very likely that the decision to hold will not be a unanimous one. Inflation edged slightly higher, and while that uptick wasn’t dramatic, it nudged mortgage rates upward for the second week in a row.

That said, mortgage rates remain in familiar territory, fluctuating between 6.7% and 6.9% since mid-April. This week’s movement, though notable, falls within that recent range.

In the new-construction space, homebuilder confidence rose modestly in July, but remains subdued—well below the threshold of 50, which separates market expansion from contraction.

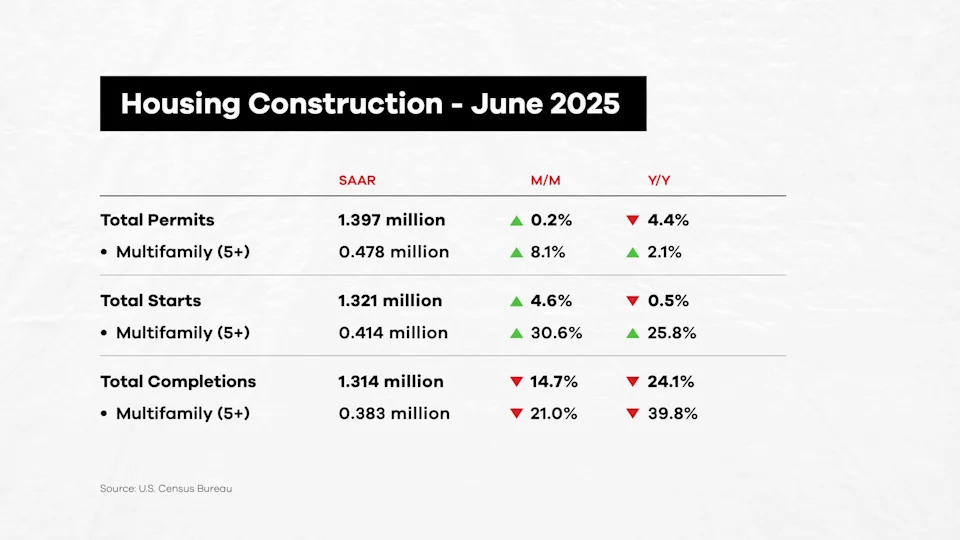

June homebuilding data showed a slight increase in permits and starts, driven largely by multifamily construction. However, single-family activity remains soft, with permits and starts hitting their lowest levels in more than 11 months. This continues to weigh on overall housing supply, but also reflects challenges that builders face from softening demand and rising costs of construction.

The Realtor.com® Weekly Housing Trends report paints a mixed picture. Home prices are holding steady, but the pace of active listing growth is slowing, as new listings rose just 1.3%—the smallest increase in at least 12 weeks.

This trend echoes findings from our June Housing Trends Report, which revealed that some sellers are becoming disillusioned with the 2025 market. This frustration might now be influencing seller behavior, contributing to softer inventory growth as summer progresses.

An interesting trend emerged in the 2025 Q2 Realtor.com Cross-Market Demand Report. While home shoppers have pulled back slightly from searching outside their local areas compared with last year, they are still far more likely to explore homes in other markets than they were before the COVID-19 pandemic.

This suggests Americans are continuing to cast wider nets in search of affordability and lifestyle upgrades. Unsurprisingly, large and expensive metro areas—such as San Jose, CA; Washington, DC; and Seattle—are seeing the biggest outflows, with prospective buyers eyeing smaller, more affordable regions.

June marked the 23rd consecutive month of year-over-year rent declines, according to the latest Rental Trends data from Realtor.com. However, the drop in costs remains modest—just about $50 below the 2022 peak, representing a savings of less than 3%.

Despite the ongoing decline in rents, buying remains more expensive than renting in nearly every major market. The sole exception? Pittsburgh, where current monthly costs now slightly favor homeownership over renting—a standout in today’s high-cost environment.

As inflation lingers and the Fed stays the course, housing dynamics remain in flux. Homebuyers and renters alike are navigating an uneven landscape marked by limited inventory, stretched affordability, and evolving lifestyle priorities. Understanding where opportunities lie will be essential for anyone looking to make a move this summer.