Join Our Telegram channel to stay up to date on breaking news coverage

Cathie Wood’s $13 trillion AI prediction drives investor optimism toward technology stocks and new crypto listings. Her Ark Investment report suggests AI will significantly revolutionise software development costs by 2030. This technological advancement creates favourable conditions for blockchain projects seeking strategic market positioning.

Confluent and Datadog represent critical infrastructure companies supporting AI development and data streaming technologies. Real-time data processing capabilities become essential for modern software applications and business operations. These market developments signal increased institutional confidence in technology-driven investment strategies and innovations.

New Cryptocurrency Releases, Listings, & Presales Today

$SNORT empowers traders with a fast Telegram bot and robust scam protection. $1.88M presale and media coverage amplify its growth and market traction.

1. TAC Protocol ($TAC)

TAC Protocol bridges Ethereum’s DeFi applications with Telegram’s billion-user base through a Layer 1 blockchain, enhancing accessibility without complex bridges or wallets. Its TON-specific CrossChain Layer enables seamless EVM dApp integration, preserving user experience. For instance, hybrid apps like Curve pools unlock TON’s liquidity for yield opportunities. Also, its $11.5 million funding reflects strong investor confidence. Hence, TAC’s innovative bridge positions it as a top portfolio contender. Its seamless DeFi integration captivates investors seeking high-growth opportunities.

TON’s lack of native EVM access limits DeFi potential, fragmenting liquidity, and complicating user interactions. TAC resolves this by enabling Ethereum dApps to operate natively on TON. Furthermore, complex bridges and multi-wallet flows deter mainstream users, which TAC simplifies via Telegram MiniApps. For example, TAC’s interoperability reduces technical barriers, fostering diverse applications. Also, TON’s isolated developer environment hinders community growth, which TAC’s EVM compatibility addresses. Therefore, TAC unlocks TON’s full potential for scalable DeFi. Its focus on user accessibility enhances its investment appeal.

TAC enables hybrid applications, such as staking TON in yield vaults or accessing tokenised assets via Curve. Cross-chain dApps support Uniswap-like functionality with TON wallet access. Furthermore, automation features like cross-chain voting and rebalancing strategies enhance functionality. For instance, MiniApps integrate engagement-based token unlocks, blending finance with fun. Also, TAC’s interoperability fosters innovative consumer and DeFi use cases. Therefore, its versatility makes it a compelling portfolio addition. Investors value its user-centric design for mass adoption.

TAC’s partnerships with Sign, Curve, and Goldsky ensure robust token distribution, liquidity, and blockchain indexing, fueling growth. It $11.5 million in funding from Hack VC underscores market trust in its vision. Furthermore, integration with IPOR’s gForce Vault offers 20% APY, attracting yield-focused investors. For example, these alliances enhance TAC’s scalability within Telegram’s vast user base. Also, its focus on seamless DeFi access drives adoption. Therefore, TAC’s strategic partnerships make it a high-potential investment. Its innovative infrastructure inspires portfolio growth confidence.

Summoning $TAC claimers: you got your rewards, now what? 🤔

Access the gForce Vault, powered by @ipor_io’s tech stack, to maximize your $TAC rewards with 20% APY through gTAC LST.

Hurry! Deposits in the gForce vault are capped and will only be open for 10 days post-TAC public…

— TAC (🫰,✨️) (@TacBuild) July 15, 2025

Recently, TAC launched the gForce Vault, offering 20% APY on $TAC rewards via IPOR’s technology. Deposits are capped and open for 10 days post-launch. This high-yield opportunity sparks rapid investor interest.

TAC’s ability to integrate TON’s user base with Ethereum’s DeFi creates a unique market niche that appeals to both retail and institutional investors. Its cross-chain capabilities enable seamless asset flows, enhancing liquidity across ecosystems. For instance, developers can leverage TAC to build scalable apps without rewriting code for TON. Furthermore, its focus on Telegram’s mobile-first users ensures broad accessibility, driving adoption. Also, high-yield opportunities like the gForce Vault attract DeFi enthusiasts. Therefore, TAC’s market positioning makes it a standout for portfolio growth. Its innovative vision captures investor excitement for future DeFi trends.

2. Snorter ($SNORT)

Snorter, a Telegram-based trading bot, combines meme coin excitement with powerful tools to uncover market gems for retail traders. Its Solana RPC infrastructure delivers fast, secure swaps, outpacing competitors. Also, features like automated sniping and honeypot protection simplify trading. Its presale, raising $1.88 million, signals strong investor enthusiasm. Furthermore, media coverage in NewsBTC and CoinPedia elevates its visibility. Hence, Snorter’s accessible design makes it a top portfolio pick. Its trading efficiency excites investors seeking high returns.

Meme coin trading overwhelms retail traders with bots, honeypots, and fragmented tools like Raydium. Snorter’s Telegram bot streamlines workflows, leveling the competitive field. Furthermore, MEV and scam risks deter newcomers, but Snorter’s scam protection mitigates threats. For example, one-tap wallet creation and protected swaps enhance accessibility. Also, juggling multiple apps frustrates traders, which Snorter’s consolidated interface resolves. Therefore, Snorter empowers users in volatile markets. Its focus on simplicity strengthens its investment potential.

Snorter’s limit orders, stop-loss settings, and copy-trading enable strategic trading without constant monitoring. Its portfolio dashboard delivers real-time profit and loss insights within Telegram. Furthermore, automated sniping executes buys instantly upon liquidity detection, avoiding failed trades. For instance, scam protection scans tokens for malicious code before trading. Also, its 0.85% execution fee undercuts competitors, boosting profitability. Therefore, Snorter’s robust tools make it a standout for portfolio diversification. Investors value its performance-driven approach in new crypto listings.

Recently, Snorter distributed 25 million $SNORT rewards to its community. The contract ensures reliable token allocation for active users. This initiative boosts engagement and investor loyalty.

Snorter’s presale, raising $1,882,935.69 at $0.0981 per token, reflects growing market traction. Its features in CryptoDaily and CoinSpeaker amplify credibility among traders. Furthermore, Telegram integration aligns with meme coin community hubs, driving adoption. For example, copy-trading curated wallets guide novice investors effectively. Also, Solana’s high-speed infrastructure ensures scalability, enhancing growth potential. Therefore, Snorter’s market fit and media presence make it a compelling investment. Its innovative trading tools captivate portfolio builders.

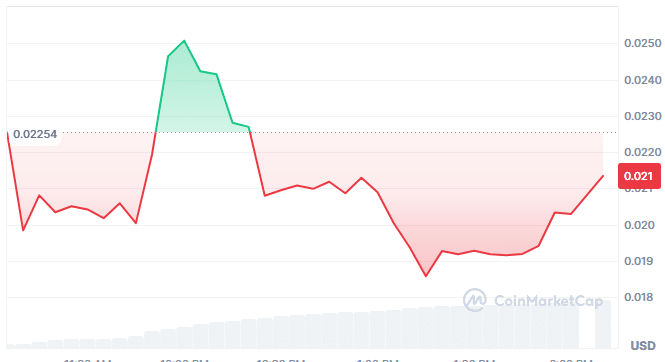

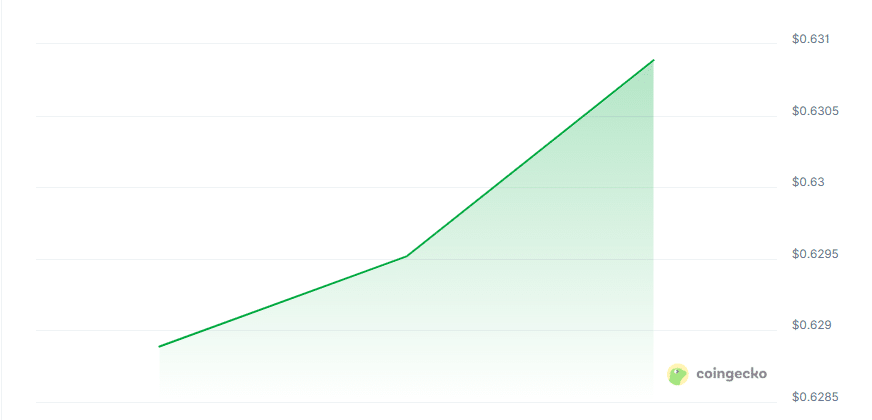

3. Websync ($WEBS)

Websync enables users to create and host censorship-resistant websites using a decentralised, code-free environment powered by IPFS and ENS. Its drag-and-drop editor simplifies website creation for non-technical users. Also, its partnership with Ascensum strengthens its growth strategy, enhancing visibility. By countering centralised hosting vulnerabilities, Websync ensures true digital ownership. Furthermore, VaultChat and ENSMail provide secure communication tools. Hence, Websync’s innovative model makes it a top portfolio contender. Its vision for a free internet inspires investor confidence.

Centralised hosting risks like shutdowns and data leaks threaten user autonomy, while domain renewals impose costly cycles. Websync’s IPFS hosting offers permanent, fee-free storage, eliminating these issues. Furthermore, technical complexity hinders decentralised site creation, but Websync’s editor simplifies the process. For example, ENS integration links sites to .eth domains effortlessly. Also, censoring sensitive content concerns users, which Websync’s decentralised approach counters. Therefore, Websync redefines web ownership, boosting its investment appeal. Its emphasis on user control attracts freedom-focused investors.

Websync’s website builder supports diverse use cases, from blogs to e-commerce, without requiring coding skills. IPFS ensures decentralised, resilient hosting for all websites. Furthermore, VaultChat and ENSMail enable users to have secure, wallet-linked communication. For example, no renewal fees ensure cost-free hosting indefinitely. Also, centralised providers track and sell user data, which Websync’s model prevents. Therefore, Websync offers a scalable solution for decentralised web creation. Its user-empowering features enhance its portfolio potential.

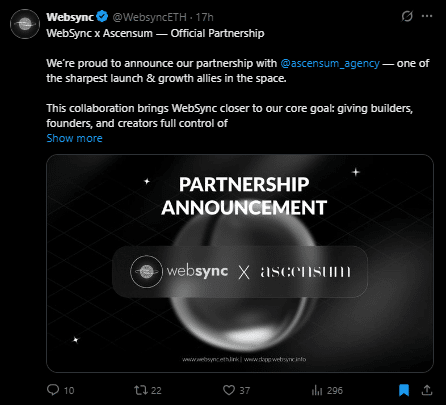

Recently, Websync partnered with Ascensum, a leading launch and growth agency. This collaboration advances Websync’s goal of empowering creators with full digital control. It strengthens market presence and user adoption.

Websync’s partnership with Ascensum amplifies its reach, attracting creators and developers to its decentralised vision. Its code-free builder lowers barriers, broadening its user base. Furthermore, IPFS and ENS integration ensure long-term reliability and ownership. For example, secure messaging tools like VaultChat appeal to privacy-conscious users. Also, Websync’s model counters censorship, resonating with freedom advocates. Therefore, its innovative approach makes it a strong portfolio addition. Its decentralised internet vision captivates forward-thinking investors.

Websync’s decentralised hosting aligns with the growing demand for censorship-resistant digital solutions, appealing to creators and privacy advocates. Its no-code builder democratizes web development, expanding its market reach. For instance, VaultChat’s secure messaging attracts users wary of centralised data leaks. Furthermore, its fee-free model disrupts traditional hosting, offering cost savings. Also, Ascensum’s partnership signals strong growth potential. Therefore, Websync’s innovative features make it a compelling portfolio choice. Its vision for a user-owned internet drives investor excitement.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage