Rachel Reeves is sweeping aside rules put in place to protect homeowners in the wake of the financial crisis in a move that experts warn could sow the seeds for a future catastrophe.

The move by the Chancellor is designed to help first-time buyers get on the property ladder and families to upsize.

But fears are growing that it could make buying a home even less affordable by driving up house prices and encouraging borrowers to overextend at a time when budgets are strained and home repossessions are rising.

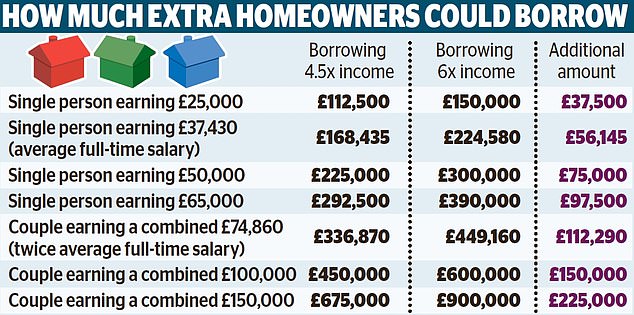

Under new plans revealed yesterday, Reeves, along with the Bank of England and financial watchdogs, cleared the path for more homeowners to borrow six times their income, instead of the typical four and a half times.

A couple on average salaries will be able to borrow £112,290 more than they can at present. The shake-up follows a government-backed move to increase 5 per cent deposit mortgages and banks easing mortgage stress tests. More lenders are also introducing measures that let family or friends give a helping hand.

‘We’re not making homes more affordable, we’re just making debt more accessible,’ warned Ravesh Patel of mortgage broker Reside Mortgages. ‘That’s a dangerous road to go down, especially when interest rates are still high.’

Borrowing boost: New plans clear the path for more homeowners to borrow six times their income, instead of the typical four and a half times

Why are people so worried?

A larger loan will increase monthly mortgage payments and this could lead to more people struggling to afford their mortgages – and ultimately a rise in homes being repossessed by banks and building societies.

Latest official figures show mortgage repossession claims rose by 31 per cent year-on-year in the first three months of the year – even before the latest rule relaxation.

Meanwhile, mortgage arrears grew 8.4 per cent in the final three months of 2024 compared to the same period of 2023 to reach £22.1billion.

The lending restrictions now being unpicked were introduced after the financial crisis, and were credited with helping borrowers avoid getting into financial difficulty when the Covid pandemic lockdowns struck and then when interest rates spiked.

Reeves’ decision to allow greater borrowing follows a succession of moves by banks over the past year to pare back lending rules designed to protect homeowners.

These include easing the mortgage stress test, designed to ensure borrowers can afford to pay their monthly loan even if rates rise significantly.

What is the rule change?

Reeves has allowed banks and building societies to relax a rule imposed in 2014, which says that only 15 per cent of their mortgages can amount to more than 4.5 times the borrowers’ income.

This rule allowed banks to lend more to some borrowers, but kept a lid on riskier lending and limited how many homeowners could stretch their finances.

The change will see more people able to borrow up to six times their salary, opening the door to homes that are tens or even hundreds of thousands of pounds more expensive than their current budget allows.

For example, a couple both earning the average full-time wage of £37,430 would previously have been limited to a loan of £336,870 at 4.5 times salary, but at six times income they could borrow £449,160.

A higher-earning family with a combined income of £100,000 could see their borrowing raised from £450,000 to £600,000.

This would of course lead to more expensive monthly mortgage payments.

Rates are around 4.5 per cent for the typical first-time buyer. On a 30-year mortgage, a couple with average earnings who borrow £336,870 at 4.5 times income would pay £1,707 per month, while at six times income or £449,160 they would repay £2,276 per month.

Borrowers with small deposits tend to pay higher rates and so would pay considerably more interest.

The Bank of England had already cleared the way for Reeves’ announcement, saying in a report last month that this relaxing of rules should be allowed.

However, it warned that across the whole lending market super-sized mortgages should remain within the 15 per cent limit.

The Prudential Regulation Authority and Financial Conduct Authority are reviewing the plans but lenders can drop the 15 per cent threshold immediately.

Weren’t the rules for a reason?

The limit on large mortgages was put in place in 2014 as one of a series of measures intended to prevent another financial crisis by ensuring that borrowers are not overextended.

From the late 1990s until 2007, the housing market was booming and mortgages were easily accessible – even to those with no deposit or poor credit.

Interest-only mortgages were common, and borrowers could ‘self-certify’ income, promising the bank they could afford to repay without proper checks.

At the same time, banks such as Northern Rock had been ‘securitising’ these mortgages – selling an interest in them to outside investors. They used the money from this to give out more mortgages, instead of using deposits from savers.

But in 2007, the credit crunch hit and as mortgages dried up and rates soared, house prices began to fall – reducing by about 20 per cent in two years.

Homeowners with 100 per cent mortgages, or smaller deposits, were left in negative equity – where their mortgage value exceeded what the home was worth.

Borrowers struggled to remortgage due to stricter borrowing rules, those on variable interest rates saw their repayments skyrocket and, combined with job losses, this meant some had their homes repossessed.

Although rules are still stricter than before the financial crisis, increasing the amount that homeowners can borrow reverses some of these measures and heightens the risk that they would struggle to pay their loans if their personal finances faced a shock or if interest rates rose or house prices fell.

Martin Stewart, director at mortgage broker London Money, says the risk this time around is not that banks will collapse, but that borrowers who take on big loans won’t cope if their circumstances change – especially given rising taxes and elevated household bills have led to stretched budgets.

‘The rules previously brought in were designed to prevent another banking crisis. This time around, via the cost-of-living crisis and increased taxation, we are more at risk of a consumer crisis than anything else,’ he says.

Nicholas Mendes, mortgage technical manager at broker John Charcol, says that, among buyers who have already taken advantage of six times salary borrowing, there have been very few who have got into trouble.

‘We haven’t seen borrowers defaulting on their mortgages like some of the critics predicted,’ he adds.

However, experts warn that, if borrowing limits are stretched even further, repossession could be a risk – particularly because mortgage rates are still much higher than many are used to.

Threshold: Chancellor Rachel Reeves (pictured) has allowed banks to relax a rule which says that only 15% of their mortgages can amount to more than 4.5 times the borrowers’ income

How lenders made borrowing easier

Several lenders have already been offering bigger loans to some customers, including Nationwide.

Its ‘helping hand’ deal allows some first-time buyers to borrow up to six times their income with deposits as low as 5 per cent, and the mutual says 57,000 customers have used it since 2021.

After Reeves’ changes, it says it can offer this to more customers. From today, first-time buyers can apply for the mortgage with a £30,000 salary, down from £35,000, and couples with a £50,000 combined salary, down from £55,000.

As recently as the pandemic, banks withdrew 5 per cent mortgages from the market because of worries about falling house prices. But now they are offering more loans with 5 per cent deposits, or even smaller deposits, although the latter is only to a small minority.

Some brokers fear that extending 5 per cent deposit mortgages could do more harm than good. After all, it would not take much of a fall in house prices for such borrowers to fall into negative equity.

Aaron Strutt, mortgage broker at Trinity Financial, says: ‘There is no doubt a six times salary mortgage for someone on £30,000 buying a new build home with a 5 per cent deposit could be seen as risky.’

However, the flip side of that argument is many young people are paying sky-high rents every month, in many cases more than the equivalent mortgage.

Lender Skipton’s ‘track record’ mortgage allows renters with a good credit record to use their payment history to get a mortgage with zero deposit.

Separately, banks have been slackening the financial ‘stress tests’ carried out when someone applies for a mortgage.

Since the crash, lenders have scrutinised fixed rate borrowers’ finances to ensure they could afford the lender’s standard variable rate, plus 1 per cent.

As standard variable rates are much higher than fixed and tracker rates, this means borrowers taking mortgages at 4 per cent or less would routinely be tested against a rate of 8 per cent or more.

Following a change in Bank of England guidance in March, mortgage lenders are no longer required to do this and major lenders, including Halifax, HSBC, NatWest and Nationwide, have slashed their stress test rates.

This has boosted borrowing by tens of thousands of pounds for some customers but could also result in a house price spike according to the estate agent Savills, which has said it could cause values to jump by up to 7.5 per cent in the next five years.

Cautious: Evidence from some brokers suggests first-time buyers are already wary of over-stretching themselves

Why has Reeves acted now?

Making it easier for first-time buyers to purchase a home was one of Labour’s election promises – especially for those who struggle to save a large enough deposit.

Plus, it needs people to be able to afford to buy the 1.5 million homes it promised to build by the end of its first five-year term.

Boosting house-building would also be a much-needed shot in the arm for the wider economy and would create jobs.

Strutt says: ‘The Government needs to do something to make it look like it is helping younger people and those on lower incomes to get on the property ladder. People are fed up with renting and not being able to borrow enough money.’

But evidence from some brokers suggests first-time buyers are already wary of over-stretching themselves.

Mendes says that, when offered the chance to borrow six times their salary, most turn it down due to the higher costs.

‘Some people predicted a flurry of first-time buyers. But when we discuss borrowing six times salary with customers, they often look at the costs and decide against it,’ he says.

‘Higher mortgage rates make a bigger loan a lot more expensive, and customers are more likely to adjust their expectations and opt for a cheaper property or area instead.’

Will it make homes more expensive?

Making it easier to get a bigger mortgage could drive up house prices, exacerbating the challenge for first-time buyers and home movers.

Patel said: ‘It might help a few more buyers squeeze onto the ladder, but in reality, it just stretches them further financially.’

Some have suggested that supporting younger people to save for a deposit, for example by expanding the limits of the Lifetime Isa scheme, would be more helpful.

Samuel Mather-Holgate, managing director at Orchard Financial Advisers, says: ‘Bigger boosts for deposit saving would have been more beneficial to borrowers.

‘A way of helping stuck renters to save whilst renting would be a welcome change, too.’