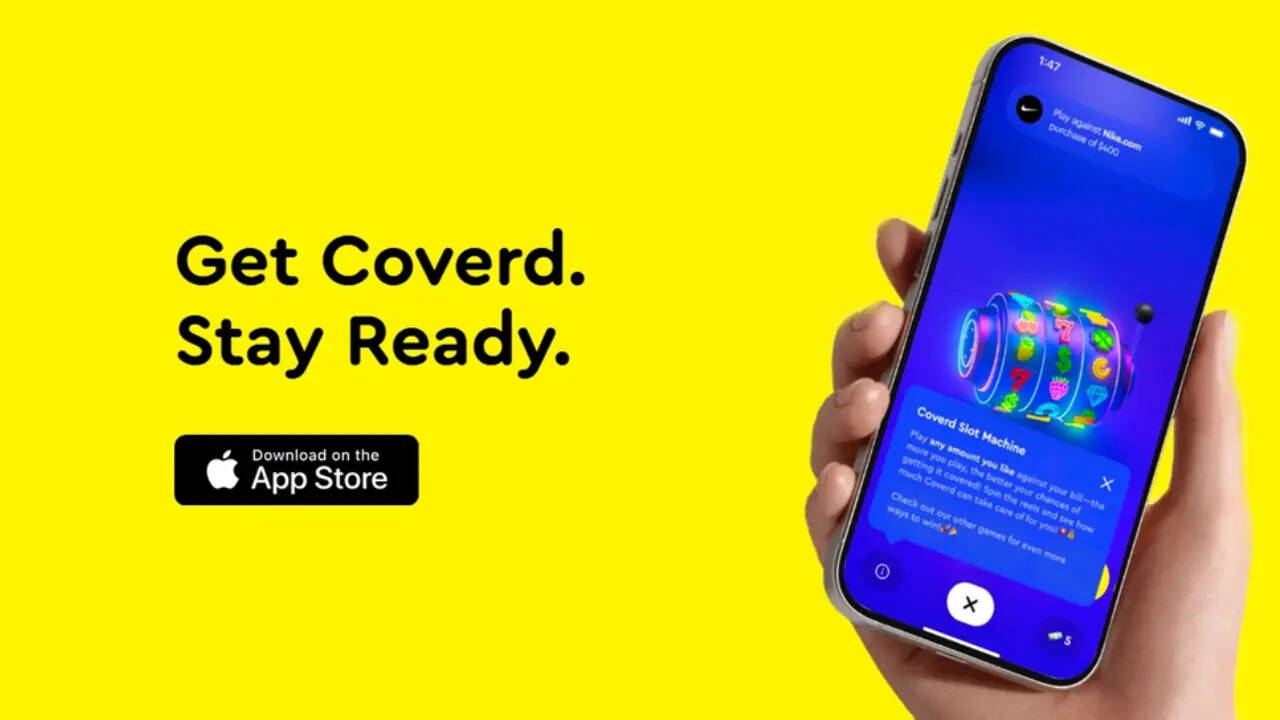

In a bold attempt to tackle the growing burden of credit card debt in the U.S., Coverd, a new fintech startup, is turning to an unlikely ally: mobile games. With consumer credit card debt soaring past $1.1 trillion, the company’s innovative approach blends financial wellness with gamified experiences to help users chip away at their balances—one spin, shuffle, or tap at a time.

Founded by a team of former engineers from Morgan Stanley, Hudson River Trading, and Google, Coverd aims to make financial progress feel less like a chore and more like a game. “Debt is stressful and overwhelming. We wanted to make the process of paying it off more approachable, even enjoyable,” says Eric Xu, co-founder of Coverd.

Here’s how it works: users download the Coverd app and purchase low-cost “practice coins.” With each purchase, they receive free sweepstakes entries known as “Coverd Cash,” which they can use to play engaging games like blackjack, slots, plinko, or roulette. Any winnings can then be redeemed directly toward paying down linked credit card balances or saved for future financial goals.

Importantly, Coverd is not a gambling app. It operates legally under U.S. sweepstakes laws, meaning users never wager real money. Instead, the app allows users to enter games via free or promotional entries, ensuring compliance while still offering a chance at real financial benefits.

At the heart of Coverd’s mission is a commitment to solving a massive, deeply rooted problem. Credit card debt in the U.S. has not only reached historic highs, but interest rates are also hovering near record levels. For many Americans, making minimum payments feels like treading water—Coverd’s creators believe it’s time for a new solution.

“Traditional finance tools often fail to engage users emotionally,” says Albert Wang, Coverd’s co-founder. “Our goal is to flip that script. We want to make financial progress feel exciting, something people look forward to.”

The app is already gaining traction, particularly among younger users who prefer interactive, mobile-first solutions to financial challenges. Gen Z and millennial users, often burdened with student loans and high-interest credit debt, are increasingly looking for alternatives to traditional budgeting apps or dull repayment plans.

Beyond its gameplay, Coverd includes built-in controls to prevent overspending and offers users the ability to set personal financial goals within the app. The company also plans to launch the Coverd Card, a credit card that will offer up to 100% cash back and automatic sweepstakes entries with every swipe.

Currently available in 38 U.S. states, Coverd is expanding as regulatory conditions permit. As the app grows, so does the potential for a new generation of debt relief—one that’s powered by technology, legality, and a whole lot of fun.

In a world where financial stress affects millions, Coverd is proving that sometimes, the best way to pay off debt might just be by playing a game.

(No Times Now Journalists are involved in creation of this article.)