Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s historic surge past $121,000 creates unprecedented bullish momentum, encouraging accelerated new crypto listings. The cryptocurrency’s 60% market share dominance signals robust investor confidence across digital assets. Short position liquidations totalling $235 million demonstrate overwhelming market optimism and aggressive upward price movements.

President Trump’s endorsement of crypto rally “through the roof” validates institutional investment strategies significantly. Bitcoin treasury purchases and ETF inflows exceeding $15 billion drive sustained price appreciation expectations. Analysts predict $200,000 Bitcoin by 2025, fueling widespread market enthusiasm and investment decisions.

New Cryptocurrency Releases, Listings, & Presales Today

$BEST powers a growing wallet with low-fee swaps and crypto card perks. $13.8M presale and Cointelegraph buzz amplify its market appeal and traction.

1. Yala ($YU)

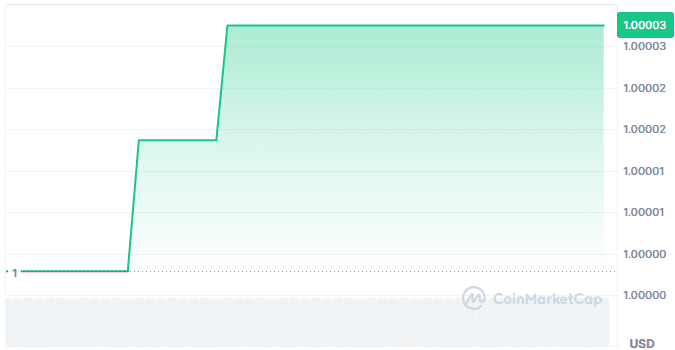

Yala’s Bitcoin-native liquidity solution enables BTC holders to mint $YU, a stablecoin unlocking DeFi and real-world asset yield opportunities without sacrificing custody. By leveraging Bitcoin’s unmatched security, Yala facilitates seamless cross-chain transactions, appealing to investors seeking stability. Furthermore, its overcollateralized minting ensures robust value protection, fostering trust among risk-averse users. For instance, users can stake $YU in lending protocols, generating high returns. Hence, Yala’s innovative bridge to DeFi positions it as a prime portfolio candidate. Its partnerships with Centrifuge and Polychain Capital enhance market credibility. This transformative potential captivates investors eyeing secure, high-yield prospects.

Bitcoin’s focus on security over complex financial logic limits its DeFi integration, isolating it from lucrative yield opportunities. Yala’s $YU stablecoin addresses this by enabling cross-chain participation in lending and staking. Furthermore, layer 2 solutions often compromise usability, but Yala’s MetaMint simplifies stablecoin creation for seamless access. For example, its decentralised Canonical Bridge ensures secure BTC transfers across diverse chains. Moreover, integration with real-world assets like tokenised real estate expands investment horizons. Therefore, Yala overcomes Bitcoin’s structural constraints, offering unmatched scalability. This unique value proposition strengthens its appeal for forward-thinking portfolios.

Yala’s partnerships with Centrifuge, Polychain Capital, and HashKey Capital amplify its market presence and investor confidence. Centrifuge’s expertise in real-world assets enriches Yala’s yield offerings, drawing institutional interest. Furthermore, Polychain’s $8 million seed investment supports scalable infrastructure, signalling strong growth potential. For instance, Alchemy Pay’s collaboration enables $YU spending in real-world commerce, enhancing utility. Also, Yala’s self-custody model resonates with Bitcoin maximalists valuing security. Therefore, these alliances drive adoption and long-term value. This positions Yala as a standout in new crypto listings for investors.

Yala x @AlchemyPay 💚💙

We are working with Alchemy Pay, a leading payment gateway bridging crypto and fiat, to bring $YU in the real world.

The Yala Yeti Card is coming 👀

Spend your $YU earned from your BTC in the real world, from coffee shops to commerce.

— Yala (@yalaorg) July 9, 2025

Recently, Yala partnered with Alchemy Pay to launch the Yala Yeti Card. This enables $YU spending in everyday commerce, from coffee shops to retail. Furthermore, this partnership enhances $YU’s real-world utility, driving mainstream adoption.

Yala’s modular architecture supports diverse use cases, including AMM liquidity provision and real-world yield via tokenised assets. Its insurance mechanism mitigates Bitcoin’s volatility risks, ensuring stable returns. Furthermore, the Yala Yeti Card allows $YU transactions at retail outlets, bridging crypto and fiat seamlessly. For example, users can spend $YU at coffee shops, boosting practical adoption. Additionally, its permissionless minting empowers users with financial autonomy. Therefore, Yala’s versatile applications make it a high-potential investment. Its visionary approach inspires confidence among growth-focused investors.

2. Pulsara ($SARA)

Pulsara, a DAO on the Coreum Blockchain, empowers decentralised governance and asset management through its $SARA token, fostering inclusive decision-making. Its high-speed infrastructure delivers low-cost transactions, ideal for enterprises and individual investors. Furthermore, the DAX exchange minimises slippage, ensuring efficient trading for users. For instance, MultiSig accounts provide secure transaction validation for corporate governance. Hence, Pulsara’s focus on accessibility and governance makes it a compelling addition to the portfolio. This innovative model excites investors seeking decentralised, scalable solutions.

Many blockchain projects struggle with centralised governance and scalability, undermining decentralisation and adoption. Pulsara’s DAO model enables transparent $SARA token voting, ensuring inclusive decision-making. Furthermore, Coreum’s energy-efficient blockchain effectively delivers fast transactions, addressing scalability concerns. For example, its token management system streamlines enterprise asset issuance and transfers. Additionally, intuitive interfaces lower accessibility barriers for non-technical users. Therefore, Pulsara resolves critical governance and performance issues. Its user-centric design enhances its potential as a high-growth investment.

Pulsara’s use cases, including decentralised trading and treasury management, cater to diverse investor and enterprise needs. Its AMM pools optimise price discovery, attracting active traders. Furthermore, developers can leverage Coreum.js SDK to build DApps, fostering innovation in DeFi and NFTs. For instance, community-governed treasury voting empowers token holders to shape financial decisions. Liquidity providers also earn $SARA rewards, incentivising active participation. Therefore, Pulsara’s versatile applications drive value and adoption. This makes it a top choice for portfolios seeking governance-focused projects.

🚀 New Proposal on #PulsaraDAX!

A liquidity pool for $DYDX / $SARA is being proposed. Review & cast your vote now!

🔗 https://t.co/TubeRhg1VZ#DAXProposal #SARA #DeFi pic.twitter.com/Pe0u0YQdyM

— Pulsara (@pulsara_io) July 9, 2025

Recently, Pulsara announced a TikTok giveaway series to boost community engagement. The countdown encourages users to follow for exclusive reward opportunities. Furthermore, this initiative underscores Pulsara’s commitment to accessibility and adoption.

CoreNest Capital’s partnership provides Pulsara with financial backing and strategic industry connections, enhancing its market position. This collaboration facilitates enterprise adoption, expanding Pulsara’s reach across blockchain sectors. Furthermore, its focus on customizable liquidity pools attracts users seeking tailored investment strategies. For example, its governance model aligns with the growing demand for decentralised decision-making. Additionally, Coreum’s scalability supports DApp development, drawing global developers. Therefore, Pulsara’s strategic alliances and use cases fuel its investment appeal. Its vision for inclusive governance inspires investor enthusiasm.

3. Best Wallet Token ($BEST)

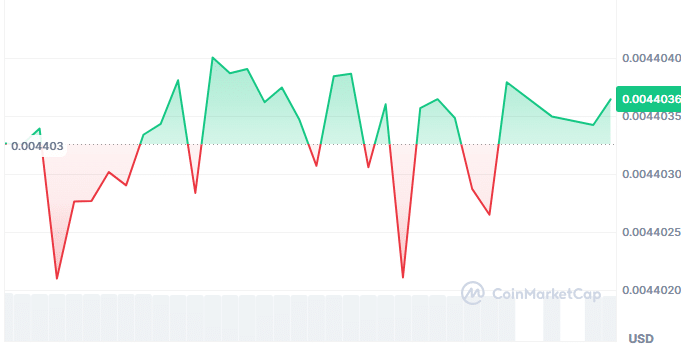

Best Wallet Token powers a non-custodial wallet with 50% monthly user growth, targeting 40% of the $11 billion wallet market by 2026. Its Best DEX aggregates over 50 exchanges for optimal swap rates and low fees. Furthermore, the Best Card enables crypto spending with cashback at Mastercard-accepting merchants. For instance, holding $BEST unlocks reduced costs and higher staking APY. Hence, Best Wallet’s accessible features make it a prime portfolio contender. Its media coverage in Cointelegraph and Cryptonews bolsters credibility. This growth trajectory captivates investors seeking user-friendly crypto solutions.

Complex wallet interfaces and high transaction costs hinder mainstream crypto adoption, frustrating users. Best Wallet’s intuitive app supports thousands of cryptocurrencies across 50 chains, simplifying asset management. Furthermore, its DEX optimises trades by aggregating liquidity for cost-efficient swaps. For example, cross-chain capabilities reduce fees, appealing to frequent traders. The Best Card integrates crypto into everyday transactions seamlessly. Therefore, Best Wallet effectively overcomes accessibility and cost barriers. Its user-focused design drives its potential as a high-value investment.

Best Wallet’s presale raised $13,882,528.90 at $0.025325 per token, reflecting strong market enthusiasm for its vision. Early access to trusted presales attracts investors seeking high-growth opportunities. Furthermore, staking $BEST offers elevated APY, encouraging long-term holding. For instance, cashback on Best Card purchases enhances user value and retention. Also, its non-custodial model prioritises security, appealing to cautious investors. Therefore, Best Wallet’s robust use cases make it a compelling portfolio addition. Its presale success underscores its market momentum and investor appeal.

🚫 What happens if you send crypto to the wrong address?

Blockchain transactions are permanent. Once confirmed, they cannot be reversed or canceled.

If you send crypto to the wrong address—or to an incompatible network—it’s likely gone for good. There’s no central authority to… pic.twitter.com/qZ36omDF5Q

— Best Wallet (@BestWalletHQ) July 10, 2025

Recently, Best Wallet emphasised the permanence of blockchain transactions. Sending crypto to incorrect addresses risks permanent loss, highlighting the need for user caution. Furthermore, this educational effort builds trust and engagement.

Media features in Techopedia, Bitcoinist, and Cointelegraph elevate Best Wallet’s visibility and trustworthiness among investors. These partnerships highlight its role in simplifying crypto transactions for mass adoption. Furthermore, cross-chain swaps and real-world spending broaden its appeal to diverse users. For example, Mastercard integration enables global usability for millions of merchants. Therefore, Best Wallet’s strong media presence and practical applications drive investment potential. Its accessible, high-yield features excite investors across markets.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage