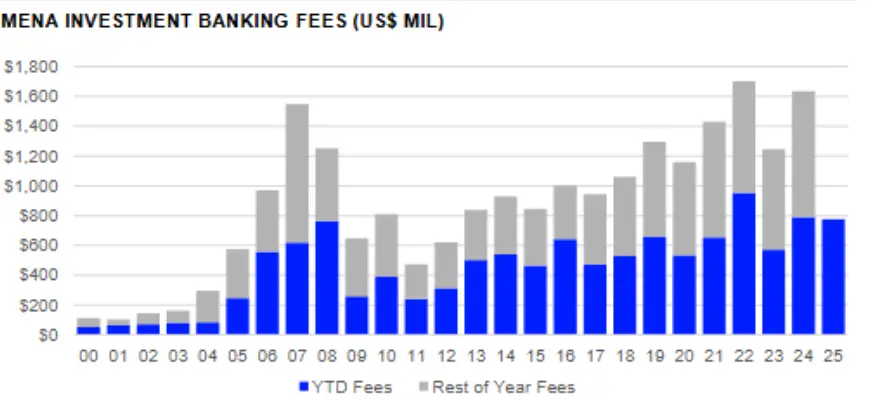

Investment banking fees in the MENA region dipped 2% year-on-year in the first half of 2025, according to a new LSEG Deals Intelligence report, during a period that saw elevated geopolitical tensions, oil price volatility and fears of a global trade war.

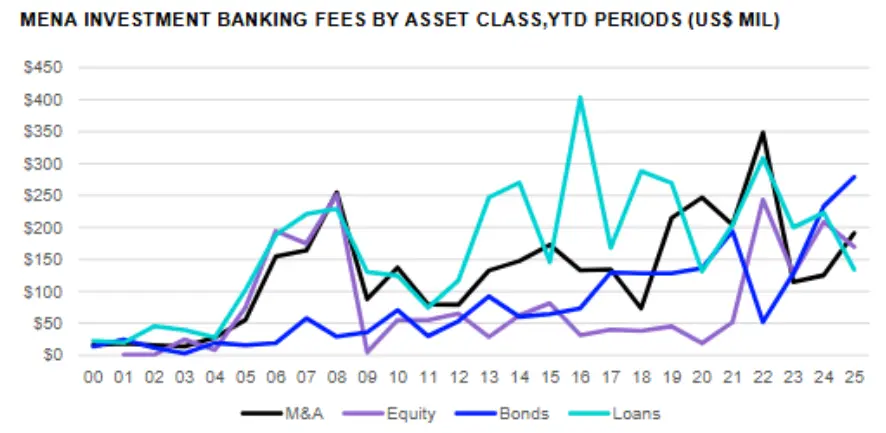

Equity capital markets were the most impacted, with underwriting fees declining 18% to $169.9 million, marking a two-year low, according to LSEG’s ‘MENA Investment Banking Review H1 2025’ data.

An estimated $773.7 million in investment banking fees were generated in MENA over the period, down from $790.28 million in H1 2024, with HSBC Holdings taking the top spot with $64 million in H1 fees or a 6% year-on-year increase.

JP Morgan took second place, with $56 million in banking fees, signifying a 65% year-on-year increase, followed by Citi coming in third, generating $50.8 million in fees and a 55% increase over H1 2024.

Rise in issuances

The LSEG report also revealed a 20% rise in debt capital markets’ underwriting fees to $278.9 million in the first half of 2025, hitting an all-time high.

The MENA region saw a record surge in bond issuances, totalling $86.8 billion during the first half of 2025, and indicating a 17% rise in value over last year, besting all previous first half tallies.

Advisory fees earned from completed mergers and acquisitions (M&A) transactions totalled $191 million, 52% more than the value registered last year at this time and the highest first-half total since 2022, LSEG data revealed, which was buoyed by robust dealmaking in MENA, reaching $115.5 billion in value in the first half of 2025 or a 149% increase compared to the same period last year.

The largest completed deal in the region involved Scopely, a US-based firm backed by Saudi Arabia’s Public Investment Fund, which signed a deal worth $3.5 billion to acquire the video game division of Niantic Labs.

In the region, Saudi edged out the UAE once again regionally, accounting for 41% of all MENA fees generated during the first half of 2025, followed by the UAE at 35% and Qatar at 7%.

According to LSEG, syndicated lending fees declined 40% compared to year ago levels to US$133.9 million, hitting a five-year low.

LSEG Investment Banking fees are imputed for all deals without publicly disclosed fee information.

(Reporting by Bindu Rai, editing by Seban Scaria)