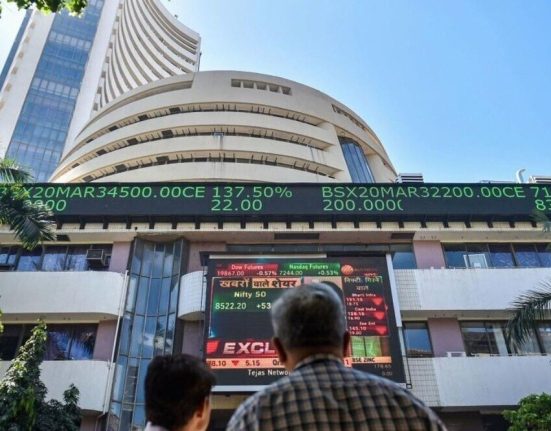

Generally speaking long term investing is the way to go. But that doesn’t mean long term investors can avoid big losses. Zooming in on an example, the NFON AG (ETR:NFN) share price dropped 50% in the last half decade. We certainly feel for shareholders who bought near the top. In contrast, the stock price has popped 9.8% in the last thirty days.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they’ve been consistent with returns.

Given that NFON only made minimal earnings in the last twelve months, we’ll focus on revenue to gauge its business development. Generally speaking, we’d consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over five years, NFON grew its revenue at 6.3% per year. That’s a fairly respectable growth rate. The share price, meanwhile, has fallen 8% compounded, over five years. That suggests the market is disappointed with the current growth rate. A pessimistic market can create opportunities.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that NFON has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling NFON stock, you should check out this FREE detailed report on its balance sheet.

NFON provided a TSR of 17% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that’s still a gain, and it is certainly better than the yearly loss of about 8% endured over half a decade. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we’ve spotted 1 warning sign for NFON you should know about.

But note: NFON may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.