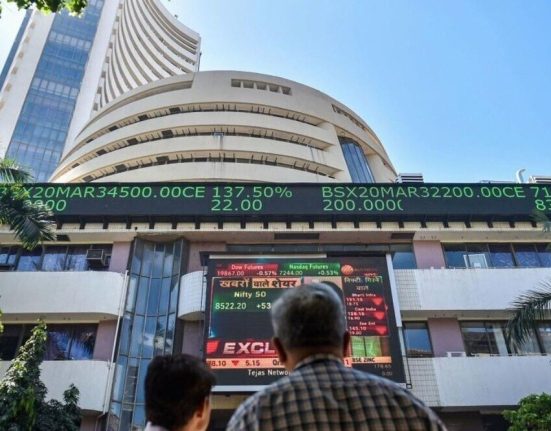

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. For example, long term Oversea-Chinese Banking Corporation Limited (SGX:O39) shareholders have enjoyed a 78% share price rise over the last half decade, well in excess of the market return of around 24% (not including dividends). However, more recent returns haven’t been as impressive as that, with the stock returning just 17% in the last year, including dividends.

So let’s assess the underlying fundamentals over the last 5 years and see if they’ve moved in lock-step with shareholder returns.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Oversea-Chinese Banking moved from a loss to profitability. That would generally be considered a positive, so we’d hope to see the share price to rise.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Oversea-Chinese Banking’s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Oversea-Chinese Banking, it has a TSR of 130% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

Oversea-Chinese Banking shareholders gained a total return of 17% during the year. But that was short of the market average. On the bright side, the longer term returns (running at about 18% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It’s always interesting to track share price performance over the longer term. But to understand Oversea-Chinese Banking better, we need to consider many other factors. For instance, we’ve identified 1 warning sign for Oversea-Chinese Banking that you should be aware of.