Nearly half a million graduate students nationwide would each lose access to tens of thousands of dollars in school loans annually if the massive tax-and-spending bill before Congress becomes law.

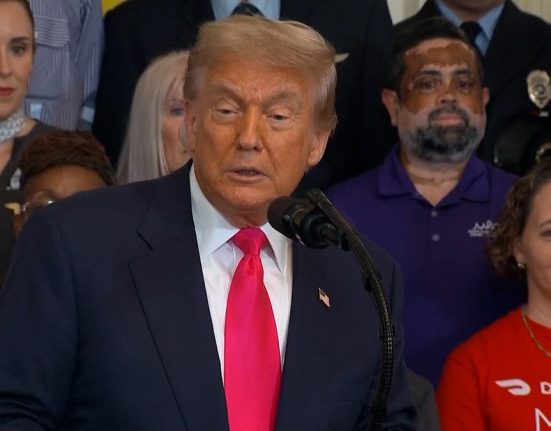

President Donald Trump’s signature proposal would eliminate a major form of federal financial aid for would-be lawyers, doctors and other professionals—the grad PLUS federal student loan program—which, since 2006, has allowed students to borrow up to the full cost of their schooling, less other financial aid.

One in five master’s graduates and about a quarter of STEM graduates in the country who take out loans rely on grad PLUS loans, according to the Department of Education’s National Postsecondary Student Aid Study of the 2019-2020 academic year.

Students who use grad PLUS loans took out on average nearly $32,000 in the federal loans last year, an Education Department data analysis by Bloomberg Government shows, and many would have to look for private loans to fill the gap.

Eliminating the loans would hit those with limited options the hardest—especially low-income students and those from minority communities, according to those fighting against this aspect of the bill.

Grad PLUS loans comprise about a third of all federal graduate loans disbursed, the data shows. More than 440,000 graduate students took out about $14 billion in grad PLUS loans last academic year.

Of the nearly 1,800 schools whose students took out grad PLUS loans last academic year, nearly one in five is a federally designated minority-serving institution, the data shows. About two-thirds of those serve Hispanic communities.

Republicans in Congress say eliminating the loans would save taxpayers money. A June 24 report from TransUnion said almost a third of federal student loan borrowers are delinquent on repaying their loans, the highest rate on record.

“Ending the program is a step toward reining in tuition inflation, encouraging greater participation from private lenders, and restoring much-needed accountability in how taxpayer dollars are spent on higher education,” Madison Marino Doan, policy analyst at the Heritage Foundation’s Center for Education Policy, said. Eliminating the grad PLUS loan program was in the Foundation’s Project 2025, a conservative blueprint with recommendations for Trump’s second term.

Opponents of the cuts said ending grad PLUS loans would put professional degrees out of reach for some students.

“Every time you erect a new barrier, it doesn’t always result in the student finding a way around it,” said Mark Kantrowitz, student aid expert and author of several books on the subject. “Sometimes it just stops them cold and they give up on their dreams.”

Today, graduate students looking to borrow for school in the US have two options for federal student aid: Direct Unsubsidized Loans, and grad PLUS loans, which are also unsubsidized. Direct Unsubsidized Loans for grad students are currently capped at $20,500 per year, with an aggregate limit of $138,500, which includes any undergraduate federal loans the borrower took out. The grad PLUS loans have a higher interest rate but have no aggregate limit.

The bill under consideration would eliminate grad PLUS loans and include a new $100,000 aggregate limit on Direct Unsubsidized Loans for master’s students. For professional students, including those in law school or medical school, the bill would allow up to $200,000.

The measure passed the Senate Tuesday on a 51-50 vote, with Vice President JD Vance casting the tie-breaking vote. The package now goes back to the House, which included a similar provision eliminating grad PLUS loans in its original version of the bill. Trump is pushing Congress to pass the final measure this week.

Current students would have some protection. The grad PLUS loan program termination would occur in July 2026, and students who have already taken out at least one grad PLUS loan would still be allowed to access the program for three academic years, or until the end of their program, whichever comes first.

Nova Southeastern University in Florida, designated as both a Hispanic and an Asian American and Native American Pacific Islander-Serving Institution, had nearly 7,100 students who received grad PLUS loans last academic year—the nation’s highest. Each student took out an average of nearly $47,000 in grad PLUS loans.

“These NSU graduate and professional students are being hired in high-demand professions. They are not defaulting on their loan obligations, and they are contributing significantly to our economy and to the health and well-being of the communities and industries they serve,” said NSU President and Chief Executive Officer Harry Moon. “As a culture and society, we must find a way to help finance the preparation of a capable and caring workforce in areas of greatest importance and need.”

Sen. Bill Cassidy, R-La., a physician and chairman of the Senate Health, Education, Labor and Pensions Committee, said eliminating grad PLUS loans could save students tuition money by putting “downward pressure on rising college costs.”

The cost of earning a graduate degree has risen 233 percent since 2000, according to a study by Georgetown University last year. The amount borrowed through grad PLUS loans has increased about 34% over the past decade, according to an October College Board trends report.

Eliminating grad PLUS loans and capping other unsubsidized graduate loans would save the federal budget $12 billion by fiscal year 2029 and $40.6 billion by fiscal year 2034, the Congressional Budget Office said in analyzing the original House-passed version of the bill. That measure included a $150,000 aggregate limit on Direct Unsubsidized Loans for professional students, compared to $200,000 in the Senate-passed bill that the House is now considering.

Opponents say poorer students would be pushed to take out private student loans, which can be predatory at times and more expensive or even out of reach for those without good credit.

The current interest rate for grad PLUS loans is 8.94%. According to the Education Data Initiative, private student loan interest rates generally ranged from 3.45% to 16.24% as of January.

Methodology:

Disbursed graduate PLUS loans data was sourced from the Department of Education Title IV Loan Volume reports for the Direct Loan Program and includes data as of the end of Q4 for the most recent complete academic year, 2023-2024. Federal Direct Consolidation Loans were excluded from the analysis. Data on minority-serving institutions was sourced from the Department of Education’s 2025 list of institutions that are eligible for Higher Education Programs. Institutions that were deemed ineligible for such programs but received a waiver were included as minority-serving institutions in this analysis.

Title IV of the Higher Education Act of 1965 allows schools to participate in federal student financial aid programs. Schools that are not Title IV schools and schools that did not report any disbursed graduate PLUS loans in academic year 2023-2024 were not included in the analysis. Averages were calculated from the total dollar amount disbursed for the academic year and the number of recipients.