Property taxes across the U.S. have been surging in step with home values over the past five years, exacerbating the ongoing housing affordability crisis and hitting senior homeowners on fixed incomes the hardest.

In several states and the District of Columbia, senior residents already benefit from property tax exemptions, credits and freezes that try to lighten the financial burden on their shoulders. But in seven states, proposals to offer bigger relief to older homeowners and even abolish property taxes are moving through the legislatures this year, as the issue is spurring a GOP-led revolution across the country.

Why It Matters

Home values skyrocketed during the pandemic buying frenzy, when people spurred by historically low mortgage rates engaged in ruthless bidding wars to snatch the limited supply of homes available in the market. This, in turn, brought up property tax bills across the country, which are based on the value of one’s home.

While homeowners have benefited from the value of their real estate assets inflating in recent years and now sit on record-high equities, higher property taxes have brought up the cost of homeownership in a way that has hurt older homeowners on fixed incomes the most.

Many GOP-led states across the country are now trying to lower property taxes or even abolish them, with Florida—which has a high percentage of retirees in its population—leading the nationwide movement, despite widespread concerns over the impact these attempts could have on local governments and the public services they fund.

What To Know

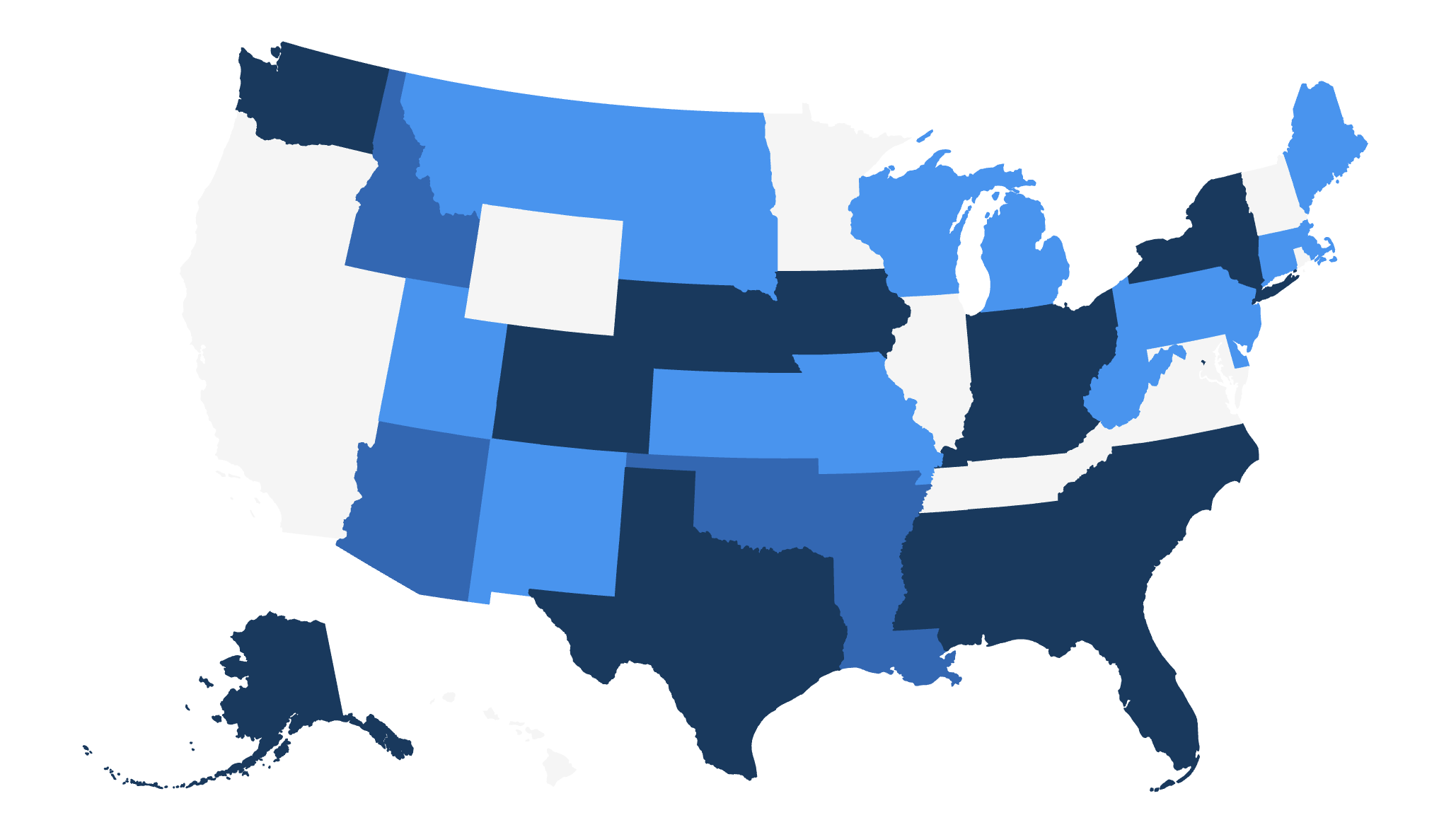

Fifteen states, and the District of Columbia, currently offer property tax exemptions to their older residents, though the type of relief they give—and their requirements—vary from state to state. These states are Alabama, Alaska, Florida, Georgia, Indiana, Iowa, Kentucky, Mississippi, Nebraska, New York, North Carolina, Ohio, South Carolina, Texas, Washington and the District of Columbia.

In Alabama, senior homeowners are exempted from paying property taxes at the state level, while they still may get a bill from the county.

In Alaska, homeowners aged 65 and older do not have to pay the first $150,000 of their home’s assessed value. In Colorado, senior homeowners are exempt from paying 50 percent of the first $200,000 in value of their primary residence.

Florida homeowners aged 65 and older can benefit from a property tax exemption of up to $50,000, while in Georgia qualifying seniors can receive a $4,000 exemption from county taxes and in Indiana they can get their home’s assessed value cut by $14,000.

In Iowa, homeowners aged 65 and older receive an exemption of $6,500 of the taxable value of their properties. In Kentucky, the exemption for qualifying homeowners is $49,100 of their home’s assessed value, while in Mississippi it is $7,500.

In Nebraska, seniors can receive a property tax exemption on their primary residences depending on their income levels. In New York, qualifying senior homeowners can receive an exemption of up to 50 percent of their home’s assessed value; a similar deal exists in North Carolina, where older homeowners receive an exemption of $25,000 or 50 percent of the home’s assessed value, whichever is greater.

The state of Ohio exempts $26,200 of assessed value for qualified senior homeowners, while South Carolina exempts the first $50,000 in fair market value.

Texas does not have a state property tax, which are levied instead by local governments and school districts. The state currently requires school districts to offer an extra $10,000 exemption for senior homeowners, while local governments may offer an additional exemption of at least $3,000.

Finally, Washington has three different tiers of exemptions for older homeowners based on their combined disposable income, while the District of Columbia reduces property tax by 50 percent for qualifying seniors.

Five more states—Arizona, Arkansas, Louisiana, Oklahoma and Idaho—offer property tax freezes to senior homeowners this year, locking in the tax amount they owe to protect them against instability.

Another 17 provide their older homeowners tax credits, including Connecticut, Delaware, Kansas, Maine, Massachusetts, Michigan, Missouri, Montana, New Jersey, New Mexico, North Dakota, Pennsylvania, South Dakota, Tennessee, Utah, West Virginia and Wisconsin.

What People Are Saying

Assaf Harpaz, an assistant professor at the University of Georgia School of Law, previously told Newsweek: “Property tax bills, which typically rise over time due to higher assessed property values, can be particularly burdensome for those individuals.

“These pressures can be compounded by additional age-related expenses such as increased health-care costs.”

He added: “Property taxes fund vital public services such as education, law enforcement, local government, health, and infrastructure. Exempting a large group from property tax liability reduces the tax base, which generally means either increasing the tax burden on remaining taxpayers or cutting public services.”

Christopher Berry, a professor at the University of Chicago, told Newsweek: “It is very common for states to provide some kind of property tax relief for seniors. However, I am not aware of any other state fully exempting residents over 70 (or any other age) from paying property taxes altogether.

He added: “For seniors, the benefit is to protect them from potential increases in property taxes that might make staying in their home unaffordable. Many seniors are on fixed incomes; when their home values increase, their incomes don’t increase to help offset increases in property taxes. In some cases, such increases in property taxes could force a senior to have to sell and move.”

What Happens Next

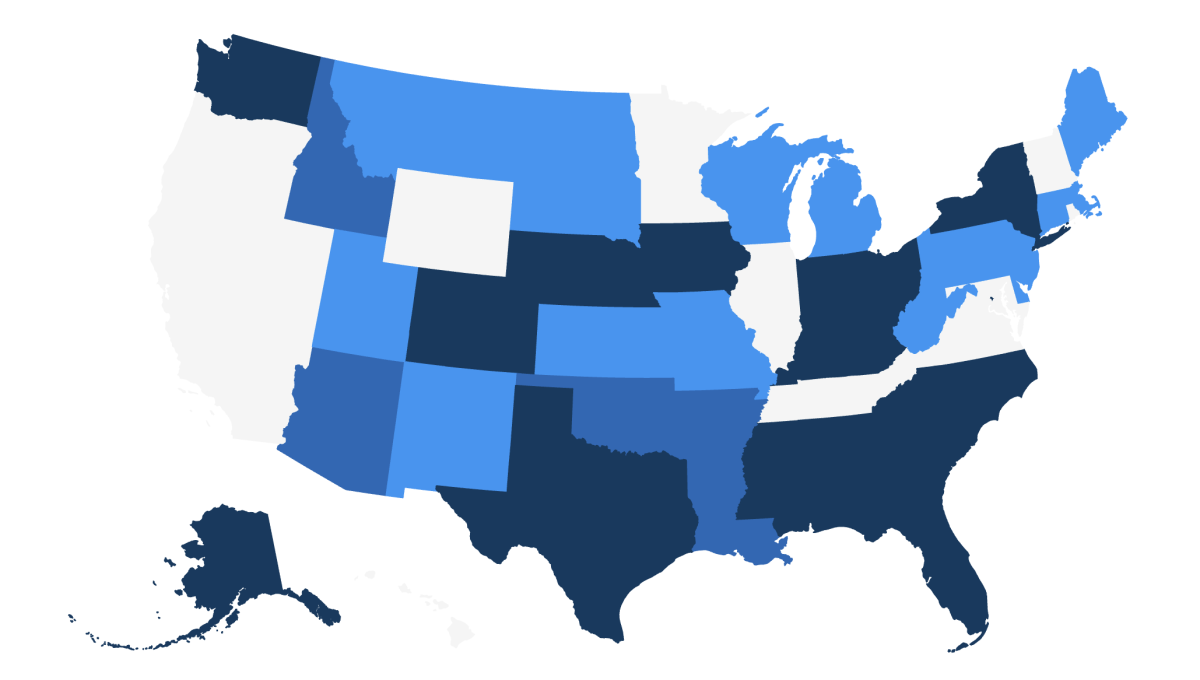

Seven states are currently trying to pass legislation that would drastically reduce property taxes for older homeowners or eliminate them entirely. In Maine, LD 1541 would abolish property taxes for seniors. In Michigan, SB 292 would exempt seniors over the age of 70 from paying property taxes.

In Minnesota, HF 403 would provide a homestead tax credit to homeowners aged 65 and above. In Ohio, the grassroot movement Citizens for Property Tax Reform is trying to push for a constitutional amendment that would abolish property taxes in the state.

In Oklahoma, SB 1144 would freeze property taxes for senior homeowners in the state, who are an estimated 100,000. In Oregon, HB 3755 would introduce a 5-percent exemption for seniors, while in Texas, SB 4 and 23 would increase the existing exemption from $100,000 to $140,000.

Realtor.com