With the Indian equity market rallying in the last couple of years, momentum investing has become quite popular in India.

Samco Asset Management Private Ltd. launched its first actively managed momentum fund – Samco Active Momentum Fund – in July 2023.

Many other fund houses have also launched momentum funds that are either actively managed or passively managed index funds. The index funds following a momentum index are a bit older.

Before we get to the top momentum mutual funds to consider, let’s understand them a bit…

What is Momentum Investing?

It’s an investment strategy capitalising on the positive momentum in a stock or financial instrument.

It’s based on the idea that an upward or downward price trend will continue to for a certain period before reversing.

This strategy takes into consideration psychological biases and market sentiments that can drive stock prices. Investments are usually made in stocks exhibiting strong upward price momentum.

The operational performance of a company, as well as technical indicators, are also used in momentum investing.

Momentum investing is also dynamic because stocks showing positive price momentum today may not continue to do so in the future. In other words, the stocks that could be classified as ‘momentum stocks’ today may not be tomorrow.

Mutual funds following a momentum investing strategy have attracted investors due to their ability to generate high returns in a bullish market.

That said, while momentum mutual funds offer potentially good returns during an upward trend, the wealth creation journey is not without challenges.

During periods of market downturns and/or high volatility, a momentum mutual fund’s performance could be negatively impacted.

In this editorial, we will take you through the potentially the best momentum mutual funds in India to consider.

Keep in mind, most schemes have been recently launched. Among the actively managed momentum mutual funds, none of them have completed even two years. Hence, we haven’t considered them.

Among the passively managed momentum funds, there are only 7 out of 24 that have completed two years. Most have been launched recently.

Out of the 7, here are the top three based on performance…

#1 Edelweiss Nifty Midcap150 Momentum 50 Index Fund

Launched in November 2022, this scheme has an AUM of Rs 9.91 billion (bn) as per the May 2025 portfolio.

Edelweiss Nifty Midcap150 Momentum 50 Index Fund aims to provide returns before expenses that closely correspond to the total returns of the Nifty Midcap150 Momentum 50 Index, subject to tracking errors.

The Nifty Midcap150 Momentum 50 Index tracks the performance of the top 50 companies within the Nifty Midcap 150 selected based on their ‘normalised momentum score’.

The normalised momentum score for each company is determined based on its 6-month and 12-month price return, adjusted for volatility.

The stock weights are based on a combination of the stock’s normalised momentum score and its free-float market capitalisation.

Currently, the top constituents of this index include names such as BSE (7.7%), Max Healthcare Institute (4.8%) and Coforge (4.7%), as per the May 2025 factsheet.

The top 3 sectors of this index are financial services (22.8%), healthcare (16.4%), and information technology (13.1%).

The fund has 61.2% allocation to largecaps and 38.8% in midcaps. The fund does not have any exposure to smallcaps.

Tracking this index, Edelweiss Nifty Midcap150 Momentum 50 Index Fund over 2 years has clocked a compounded annualised growth rate (CAGR) of 30.9%. Given that the fund tracks the midcap index, the risk has also been high.

Due to a tracking error, it has underperformed the benchmark total return index (TRI), which delivered a CAGR of 31.8%.

The fund’s expense ratio is 0.38% under the direct plan.

#2 Tata Nifty Midcap 150 Momentum 50 Index Fund

This scheme was launched in October 2022 and today has an AUM of Rs 9.09 bn as per the May 2025 portfolio.

Tata Nifty Midcap 150 Momentum 50 Index Fund scheme also aims to provide returns, before expenses, that are commensurate with the performance of the NIFTY Midcap 150 Momentum 50 Index (TRI), subject to tracking error.

The underlying Index aims to capture the swift movement of midcap stocks across sectors.

Over 2 years, this scheme delivered a CAGR of 30.3%. Due to higher tracking error, the return of the fund is 1.6% lower than the NIFTY Midcap 150 Momentum 50 -TRI. So, the risk is also high.

The expense ratio of the fund is 0.43% under the direct plan.

#3 UTI Nifty200 Momentum 30 Index Fund

This is one of the oldest passively managed momentum mutual funds with the largest AUM of Rs 80.59 bn.

UTI Nifty200 Momentum 30 Index Fund tracks the Nifty200 Momentum 30 Index passively to achieve the investment objective of generating returns equivalent to the underlying index with a minimum tracking error.

The Nifty200 Momentum 30 Index itself aims to track the performance of 30 high-momentum stocks across large-cap and mid-cap stocks within the Nifty 200 Index.

From this, it selects the top 30 stocks with the highest normalised momentum score.

Stock weights are based on a combination of the stock’s normalised momentum score and its free-float market capitalisation.

Currently, the top constituents of this index include names such as Bharti Airtel (6.2%), Mahindra & Mahindra (5.3%), and Divi’s Laboratories (5.3%), among others.

The top 3 sectors of this index are information technology (22.9%), consumer services (16.1%), and healthcare (13.9%).

The fund has 89.2% allocation to largecaps and 10.8% to midcaps. The fund does not have any exposure to smallcaps.

The UTI Nifty200 Momentum 30 Index Fund has delivered a CAGR of 22.6% over 2 years.

Due to a tracking error, the fund has marginally underperformed the benchmark, which delivered a CAGR of 22.6%.

The expense ratio charged by the fund is 0.43% under the direct plan.

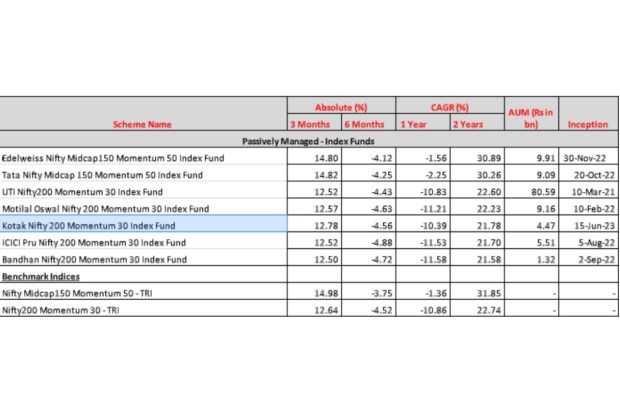

Performance of Passively Managed Momentum Funds

Data as of 20 June 2025. Point-to-point returns are calculated using the Direct Plan-Growth option, since most schemes do not have a longer performance track record. Returns over 1 year are compounded annualised. *Momentum mutual funds that have completed at least 2 2-year track record are considered. The list of schemes is not exhaustive. The top funds here are based on past returns. Please note that this table represents past performance. Past performance is not an indicator of future returns. The securities quoted are for illustration only and are not recommendatory. Speak to your investment advisor for further assistance before investing. Mutual Fund investments are subject to market risks. Read all scheme-related documents carefully. Source: ACE MF

Conclusion

Momentum mutual funds are an investment avenue to help you benefit from the positive momentum in a bull market.

Momentum-based strategies thrive on stable trends. In 2025, with nervousness due to looming geopolitical tensions and intense volatility, the risk involved is likely to be high going forward, particularly among midcaps and smallcaps.

It is not necessary that past returns delivered by momentum mutual funds will continue in the future. If the market remains rangebound or corrects, momentum mutual funds may struggle.

Remember, the fortune of momentum funds, particularly the passively managed index funds, depends on the performance of the underlying Index.

Thus, consider momentum mutual funds based on your risk profile, financial goals and time in hand to achieve those goals. Ensure that you have investment horizon is at least 5 years and keep your return expectations rational.

Ideally, you should not be depending only on momentum mutual funds but instead have a diversified portfolio comprising some of the best large cap funds, value funds, flexi caps, mid cap funds, aggressive hybrid funds, a multi-asset allocation fund, gold ETFs, and a liquid fund.

Be a thoughtful investor.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.