The Trump administration’s fascination with cryptocurrency is now intersecting with the nation’s mortgage market.

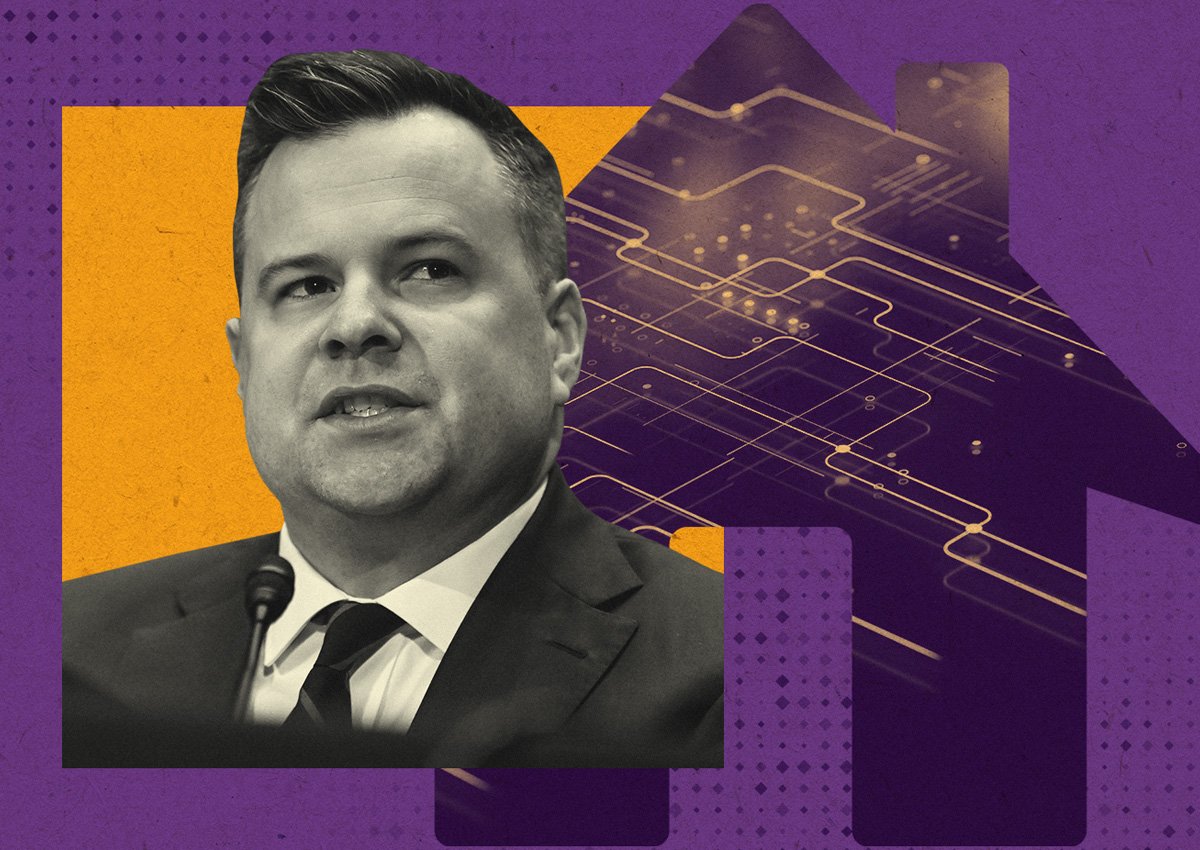

Federal Housing Finance Agency director Bill Pulte ordered Fannie Mae and Freddie Mac to begin considering the cryptocurrency assets of mortgage applicants, the Associated Press reported. The agencies are tasked with preparing a proposal for considering those assets when assessing risk of a candidate for a loan.

Only assets that can be tracked and stored on a U.S.-regulated centralized exchange would be eligible for consideration, according to Pulte’s order. That would still mark a shift from the assets typically eligible for consideration, such as stock investments and holdings deemed to be less volatile.

“This is a big win for advocates of cryptocurrencies who want crypto to be treated the same way as other assets are,” Redfin chief economist Daryl Fairweather told the publication.

Pulte also said mortgage risk assessments should not require the conversion of cryptocurrency into U.S. dollars.

The real impact of the order may prove limited. A National Association of Realtors survey found just 1 percent of those who made a down payment for a home purchase between July 2023 and June 2024 used proceeds from the sale of cryptocurrency. Nevertheless, it could lead to an expanded pool of crypto-enthusiastic buyers.

The policy shift comes as the futures of Fannie and Freddie hang in the balance. They’ve been under government conservatorship for nearly two decades, but there’s been a cacophony of noise about taking them private, a conversation President Donald Trump has only boosted during his second term, saying on Truth Social that it was time to release them.

It’s a situation that needs to be handled delicately, or else it risks throwing the mortgage market into a calamity; the two agencies back or hold $7.9 trillion in loans — about half of all American mortgages.

Read more

Fannie Mac, Freddie Mac blacklist 19 SF condos

More Fannie Mae departures as turmoil continues