CNN

—

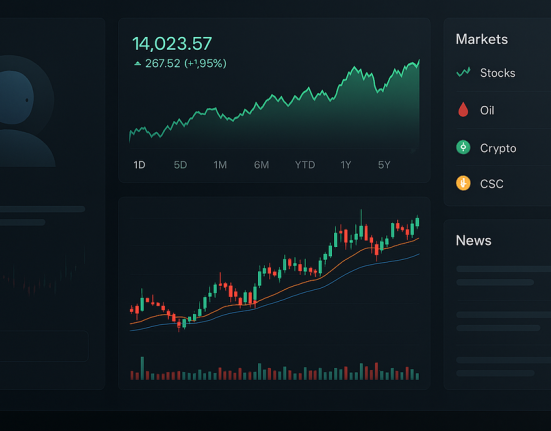

Homebuyers in the US may soon be able to use cryptocurrency assets to strengthen their mortgage application, according to Bill Pulte, who oversees housing giants Fannie Mae and Freddie Mac.

“After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage,” said Pulte, who heads up the Federal Housing Finance Agency, in a social media post.

The policy represents a reversal for Fannie and Freddie, the two entities under government conservatorship that guarantee more than half of America’s mortgages. A few years ago, during President Joe Biden’s administration, both Fannie and Freddie issued guidance stating that a homebuyer’s income paid in cryptocurrency could not be used to qualify for a mortgage, “due to the high level of uncertainty associated with cryptocurrency.”

During President Donald Trump’s first administration, he was largely skeptical of crypto. He has since embraced digital currencies, though. Trump has his own branded digital token and his family owns a stake in a crypto venture called World Liberty Financial.

Pulte’s directive would benefit prospective homebuyers who may not want to exchange their cryptocurrency holdings into US dollars in order to qualify for a government-backed mortgage. It comes at a time when home sales prices continue to rise nationally — reaching a record high for the month of May — and average mortgage rates remain stubbornly elevated.

Last month, Trump said he planned to take Fannie and Freddie public, potentially ending 17 years of federal government conservatorship over the two companies, which play a central role in America’s housing finance system by providing liquidity to the mortgage market.

However, some experts warn that any plan to take the two public could lead to higher borrowing costs for homebuyers.

Fannie and Freddie buy mortgages from lenders and repackage them for investors. The fear is that without a government guarantee of a bailout (like the one provided to Fannie and Freddie during the 2008 financial crisis), lenders might demand higher rates to compensate for the added risks.

It is unclear whether accepting cryptocurrencies, a highly volatile asset class, as income in mortgage considerations would alter how investors would perceive risks associated with Fannie and Freddie if the companies were to go public.

Pulte directed the entities to prepare proposals regarding the acceptance of cryptocurrency as an asset for mortgages. The proposals will then need to be approved by the board of directors and the FHFA before taking effect, according to Pulte’s directive.

In his directive, Pulte said Fannie and Freddie should “consider additional risk mitigants per their own assessment, including adjustments for market volatility.”