Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

There are thousands of crypto coins, from bitcoin and ethereum to litecoin and solana. Just the sheer number of available cryptos can seem overwhelming when you’re new to investing.

The top 10 cryptocurrencies listed below hold a utility or store-of-value thesis and a market cap greater than $5 billion. Cryptos with at least $5 billion in market cap are typically more stable, with greater institutional adoption.

1. Cardano (ADA)

Market Cap: $22.51 billion

7-Day Change: -3.64%

Price News: As of 9:11 a.m. ET, the price of cardano, or 1 ADA, traded at $0.64. Cardano’s highest 52-week intraday price was $1.32 on Dec. 2, 2024.

Cardano: Cardano is a next-generation blockchain platform that aims to improve the limitations of earlier blockchains like bitcoin and ethereum. ADA pioneered proof-of-stake validation to reduce environmental impact and supports smart contracts and dApps like ethereum.

Cardano’s ADA token has had relatively modest growth compared to other major crypto coins. In 2017, ADA’s price hovered around In 2017, ADA’s price hovered $0.02. As of June 13, 2025, its price traded at $0.64, an increase of 2,837%.

Pros:

- Energy-efficient consensus model.

- Focus on real-world use cases.

Cons:

- Slow rollout of features compared to rivals.

- Smaller dApp ecosystem.

Market Dominance: 0.69%

2. BNB (BNB)

Market Cap: $91.73 billion

7-Day Change: 0.17%

Price News: BNB, or 1 BNB, traded at $651.10, as of 9:11 a.m. ET. The highest intraday price that BNB reached in the past year was $793.35 on Dec. 4, 2024.

BNB: Originally launched to pay trading fees on the Binance exchange, BNB has grown into a utility token used for transactions, payments and dApps within the Binance ecosystem.

As an added perk, users can get a discount on trading fees when using BNB on a Binance crypto exchange. But there’s also the utility aspect. The token can be used to pay for transaction fees on the BNB Smart Chain, which supports smart contracts and dApps.

From $0.12 in July 2017 to $651.10 on June 13, 2025, BNB has soared by 565,085%.

Pros:

- Binance’s growing ecosystem.

- Ongoing quarterly coin burns to reduce supply.

Cons:

- High reliance on Binance’s success.

- Regulatory scrutiny of centralized exchanges.

Market Dominance: 2.81%

3. Bitcoin (BTC)

Market Cap: $2.08 trillion

7-Day Change: 0.81%

Price News: Bitcoin stood at $104,862.92 per coin as of 9:11 a.m. ET, with its annual high being $111,970.17 on May 22, 2025.

Bitcoin: Created in 2009 by the pseudonymous Satoshi Nakamoto, bitcoin is the original and most recognized cryptocurrency.

The “OG” of crypto runs on a decentralized blockchain network. The network uses an energy-intensive, proof-of-work consensus system. On the network, miners validate transactions on the chain by solving complex puzzles. For each validated block, miners earn a reward of 3.125 BTC per block, currently worth $327,696.64.

The proof-of-work consensus model is often criticized for its carbon footprint. The U.S. Energy Information Administration estimates that crypto mining, which bitcoin uses, represents up to 2.3% of U.S. electricity consumption. BTC has risen from roughly $0.06 in September 2017 to around $104,862.92 as of June 13, 2025 with a staggering increase of 169,589,626%.

Pros:

- Viewed as a “digital gold” and a store of value.

- High liquidity and market stability relative to other coins.

Cons:

- High energy consumption due to the proof-of-work system.

- Slower transaction speed and higher fees compared to newer networks.

Market Dominance: 63.91%

4. Polkadot (DOT)

Market Cap: $6.05 billion

7-Day Change: -3.31%

Price News: Polkadot’s price was $3.82 at 9:10 a.m. ET. Its highest point in the past year came on Dec. 4, 2024, when it hit $11.60.

Polkadot: Launched by ethereum co-founder Gavin Wood in 2020, polkadot is designed to unify previously siloed blockchains.

Polkadot’s network facilitates the transfer of tokens and data between major chains like ethereum and bitcoin. At the core of polkadot are parachains–customizable, independent blockchains that offload processing demand while leveraging polkadot’s security infrastructure.

Polkadot’s price when it launched in August 2020 was $2.79. Today it trades at $3.82 for a gain of 37%.

Pros:

- Enables confidential computing for sensitive data (such as health records).

- A unique network that supports scalability and specialization.

Cons:

- Complex architecture.

- Still a developing ecosystem compared to ethereum.

Market Dominance: 0.19%

5. Ethereum (ETH)

Market Cap: $306.81 billion

7-Day Change: 2.27%

Price News: Ethereum traded at $2,541.48 as of 9:11 a.m. ET. The highest price in the last 12 months was $4,106.96, reached on Dec. 16, 2024.

Ethereum: Ethereum harnesses a powerful blockchain platform for building decentralized applications, known as dApps. This crypto was the brainchild of Vitalik Buterin, created to apply blockchain technology to programmability.

So, how is ethereum used in the programming world? Well, developers use ethereum for smart contracts—self-executing agreements coded directly onto the blockchain. There are many use cases for dApps—they can be applied to finance, supply chain management and more.

Ether is the native coin on the network. Developers use ETH to pay “gas” fees. These fees compensate network validators for their computational work in completing transactions and smart contracts. From $2.83 in August 2015 to about $2,541.48 as of June 13, 2025, ETH has grown by 89,692%.

Pros:

- Large developer ecosystem.

- A vast array of tokens and services use the ethereum network.

Cons:

- Scaling challenges (aka large volumes of traffic can cause bottlenecks).

- High gas fees.

Market Dominance: 9.41%

6. Litecoin (LTC)

Market Cap: $6.36 billion

7-Day Change: -1.82%

Price News: Litecoin traded at $83.79 as of 9:11 a.m. ET. Its yearly high was $146.61 on Dec. 5, 2024.

Litecoin: Launched in 2011 by former Google engineer Charlie Lee, litecoin is often referred to as “digital silver” to bitcoin’s “digital gold.” Built on bitcoin’s source code, litecoin offers faster block times at 2.5 minutes per block compared to bitcoin’s 10 minutes. Like bitcoin, litecoin uses a proof-of-work consensus and undergoes halving events. It’s worth mentioning that LTC has a capped supply of 84 million coins. Currently, there are 76.0 million LTC in circulation.

LTC is up 1,849% since launching in April 2013.

Pros:

- Faster transactions than bitcoin.

- Long-standing credibility and network stability.

Cons:

- Limited innovation compared to newer blockchains.

- Faces stiff competition from faster networks.

Market Dominance: 0.20%

7. Solana (SOL)

Market Cap: $76.26 billion

7-Day Change: -4.38%

Price News: At 9:11 a.m. ET, 1 SOL was priced at $145.02. The highest price that solana hit in the last year was $294.33 on Jan. 19, 2025.

Solana: Solana is designed for speed and scalability, using a hybrid proof-of-stake and proof-of-history system to process thousands of transactions per second.

SOL is recovering developer and user activity despite its well-known network outages of the past. Fans of solana will believe it’s a good alternative to ethereum, rivaling its competitor in terms of speed and cost factors.

Since its launch in 2020, Solana has risen to $145.02 as of June 13, 2025, for a gain of 65,818%.

Pros:

- Active DeFi and non-fungible token ecosystems.

- Innovative consensus model.

Cons:

- Periodic network outages and stability issues.

- Centralization concerns due to validator control.

Market Dominance: 2.34%

8. TRON (TRX)

Market Cap: $25.94 billion

7-Day Change: -2.01%

Price News: As of 9:11 a.m., 1 TRX was worth $0.27. Its highest value in the past year occurred on Dec. 3, 2024, hitting $0.44.

TRON: Tron originally launched in 2017 on the ethereum token network until it moved to its own chain. Its proof-of-stake consensus makes it energy efficient, while TRX, its native token, fuels transactions and smart contracts.

One of the original premises of the crypto was to help original content creators receive income for their work. The platform supports smart contracts and dApps.

TRX has grown from $0.0019 in 2017 to about $0.27 as of June 13, 2025.

Pros:

- Low-cost transactions.

- Strong presence in the entertainment and gaming sectors.

Cons:

- Leadership under Justin Sun.The Securities and Exchange Commission charged Sun in 2023 for manipulating the supply of TRX.

- Fewer institutional use cases than competitors.

Market dominance: 0.80%

9. XRP (XRP)

Market Cap: $126.24 billion

7-Day Change: -0.77%

Price News: XRP’s market price stood at $2.15 as of 9:11 a.m. ET, with a 12-month high of $3.39 set on Jan. 16, 2025.

XRP: XRP was created by Ripple Labs to facilitate fast and low-cost, cross-border payments. It acts as a bridge between currencies, enabling instant transfers with minimal fees.

Unlike bitcoin and other mined cryptos, XRP tokens enter circulation whenever Ripple chooses to sell coins. For that reason, there are concerns over the centralized nature that controls XRP supply. XRP hit $2.15 on June 13, 2025, up 36,436% since August 2013.

Pros:

- Strong use case in global finance.

- Backed by institutional partnerships.

Cons:

- Ripple co-founder Chris Larsen, worth $7.6 billion, owns a sizable portion of XRP.

- Centralization concerns due to Ripple’s control over XRP supply.

Market dominance: 3.87%

10. Lido Staked ETH (stETH)

Market Cap: $23.04 billion

7-Day Change: 2.34%

Price News: Lido Staked ETH was priced at $2,539.41 at 9:11 a.m. ET, with its highest intraday level over the past year being $4,092 on Dec. 16, 2024.

Lido Staked ETH: It’s true to its name of being a token with a skated ETH value. StETH allows ethereum holders to earn staking rewards while keeping their assets liquid. One of the drawbacks of “normal” ethereum staking is you need 32 ETH ($81,327) to stake and it has varying lock-up periods. According to Coinbase Exchange, lock-up periods range from a few hours to a few days.

The perk of StETH is accruing staking rewards and liquidity on DeFi platforms. But StETH’s large share of staked ETH has raised concerns about decentralization. That said, stETH remains a popular option for crypto investors seeking passive income. StETH has grown from $594 in December 2020 to about $2,539.41 as of June 13, 2025. The token attempts to mirror ETH’s price.

Pros:

- Earns staking rewards while staying liquid.

- Can be used across major DeFi protocols.

Cons:

- Centralization concerns due to Lido’s dominance.

- Subject to Ethereum performance.

Market dominance: <.01%

Cryptos to Buy Now or Watch

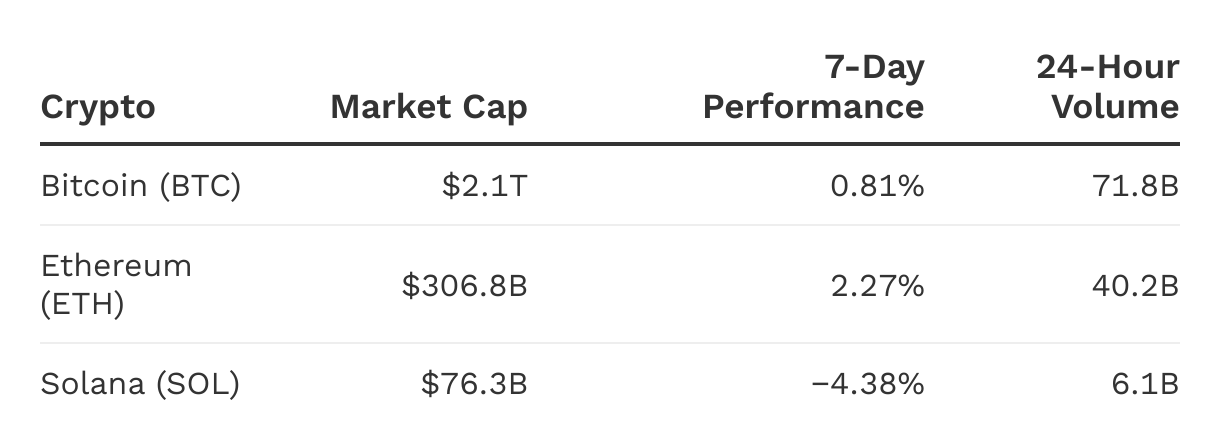

We filtered cryptocurrencies by utility or store of value, alongside trading momentum and other metrics, such as seven-day performance and 24-hour trading volume.

Our momentum screen for the best cryptos to buy or watch right now in the table below is ordered by 24-hour volume. These cryptos are not stablecoins, which are pegged to stable assets, nor are they wrapped—tokenized versions that run on nonnative blockchains—or liquid staking coins, which are given in return for staking.

3 Cryptos With Momentum

If you’re new to buying crypto, especially altcoins (anything other than bitcoin), it’s important to research and invest carefully. The screen we’ve built helps highlight cryptos with momentum. But it’s still up to you to look into each one and decide whether it makes sense for your risk tolerance and investment goals.

Nic Puckrin, analyst and founder of The Coin Bureau, an educational platform for all things cryptocurrency and blockchain, highlights, “Bitcoin is the gold standard, the ‘risk-off’ crypto, while altcoins are much more volatile and risky.”

Methodology

To determine our list of top cryptocurrencies, we applied a series of screeners designed to highlight assets that demonstrate both market momentum and a credible underlying thesis. Our methodology focuses exclusively on cryptocurrencies with an investment thesis—projects whose value is expected to appreciate over time as adoption and utility grow.

Market Capitalization:

We used market capitalization as a primary screening tool. Bitcoin and ethereum, widely recognized as the “gold and silver” of crypto, currently hold the largest market caps, at $2.1 trillion and $306.8 billion, respectively, together accounting for approximately 73% of the total cryptocurrency market.

But our focus extends beyond the top two. To capture promising but relatively stable projects, we looked at crypto assets in the midcap to large-cap range. Given crypto’s higher volatility, we chose a more conservative cutoff: screening only for projects with a market cap of at least $5 billion.

Market Momentum:

We evaluated whether a cryptocurrency has shown positive performance over the past seven days with high 24-hour trade volumes. These metrics help us to identify assets with current investor interest and potential growth.

Investment Thesis:

We considered the fundamental purpose of each crypto asset. For example, bitcoin is widely recognized as a store of value, whereas ethereum serves as a platform for decentralized applications, including smart contracts and NFTs. For that reason, we excluded:

- Stablecoins

- Wrapped cryptocurrencies

- Liquid staking cryptos

- Meme coins

How Does Cryptocurrency Work?

Cryptocurrencies are various forms of digital money that are usually based on blockchain technology. Blockchain technology allows most cryptocurrencies to exist as “trustless” forms of transactions. This means there is no centralized authority overseeing the transactions on a cryptocurrency’s blockchain.

Why Are There So Many Cryptocurrencies?

Cryptocurrency is an emerging area with more than 17,000 crypto coins in existence as of June 2025, according to Coingecko.

While some cryptos function as currencies, others are used to develop infrastructure. For instance, in the case of ethereum or solana, developers are building other cryptos on top of these platform currencies, and that creates even more possibilities and cryptos.

How To Choose the Best Crypto To Invest In

When choosing the best cryptocurrency to invest in, it is important to consider your individual goals, investment timeline, and risk profile, just as you would with any investment. Additionally, you should do your due diligence to make sure that any crypto project you are interested in is legitimate and secure.

In general, investors should consider the following when evaluating crypto:

- Market capitalization.

- Liquidity

- Security

- Use case

Investors should focus on cryptocurrencies that “solve problems, have strong infrastructure or legal positioning, and are building with the next wave of adoption in mind,” says Pablo Gerboles Parrilla, founding director of Alive DevOps, a software development company.

Most crypto experts, whether they work on crypto education, blockchains or are the CEO of a crypto wallet company, will tell you not to jump on the latest “hot” crypto trend, especially when it comes to meme coins.

“Most meme coin investments are quick pump-and-dump schemes, so even experienced investors get burned. Instead, go for blue-chip cryptocurrencies, like bitcoin or solana, and never invest more than you can afford to lose. If you want to experiment with altcoins, treat them as a small experimental addition to your portfolio and diversify,” Puckrin advises.

How To Invest in Cryptocurrency?

You can buy cryptocurrencies through crypto exchanges, such as Coinbase, Binance or Gemini. In addition, some brokerages, such as Webull and Robinhood, also allow consumers to buy cryptocurrencies.

How Much Does It Cost To Buy Cryptocurrency?

How much it costs to buy cryptocurrency depends on several factors, including which crypto you are buying. Many small altcoins trade for a fraction of a cent, while a single bitcoin will cost you $104,863. However, many brokerages and exchanges now allow fractional trading, offering investors the option to buy a portion of a cryptocurrency.

There are also often costs and fees associated with having a crypto wallet and/or an account on a brokerage or crypto exchange. Be sure that you understand all of the costs associated with buying and holding any cryptocurrency before you invest.

Is Kraken the Right Crypto Exchange For You?

Find Out More About Their Offerings and Fees

Frequently Asked Questions (FAQs)

Part of what makes bitcoin so valuable is its scarcity as its maximum supply is limited to 21 million coins.

“Bitcoin’s value lies in its decentralization, scarcity and censorship-resistance. It can’t be controlled by any corporation or individual, which was the whole point of it. It was designed as a response to the 2008 financial crisis,” Puckrin says.

Currently, there are 19.9 million coins in circulation, as of June 13, 2025. To create supply, bitcoin rewards crypto miners with a set amount. To be exact, 3.125 BTC is issued when a miner has successfully mined a single block.

To keep the process in check, the rewards given for mining bitcoin are cut in half almost every four years. The last bitcoin halving event occurred in April 2024, when mining a block of bitcoin fell from 6.25 BTC to 3.125 BTC.

The limit of 21 million bitcoins is expected to be reached in 2040.

How does trading cryptocurrencies differ from trading stocks?

While you can invest in cryptocurrencies, they differ a great deal from traditional investments, like stocks. When you buy stock, you are buying a share of ownership of a company, which means you’re entitled to do things like vote on the direction of the company. If that company goes bankrupt, you may also receive some compensation once its creditors have been paid from its liquidated assets.

Buying cryptocurrency doesn’t grant you ownership over anything except the token itself; it’s more like exchanging one form of currency for another. If the crypto loses its value, you won’t receive anything after the fact.

There are several other key differences to keep in mind:

1 . Trading hours. Stocks are only traded during stock exchange hours, typically 9:30 a.m. to 4:30 p.m. ET, Monday through Friday. Cryptocurrency markets never close. So you can trade 24 hours a day, seven days a week.

2. Regulation. Stocks are regulated financial products, meaning a governing body verifies their credentials and their finances are matters of public record. By contrast, cryptocurrencies are not regulated investment vehicles, so you may not be aware of the inner dynamics of your crypto or the developers working on it.

3. Volatility. Both stocks and cryptocurrency involve risk; you can lose some or even all of the money you invest. However, stocks are directly linked to companies and generally rise and fall based on those companies’ performance. Cryptocurrency prices are more speculative. No one is quite sure of their value yet. That makes them much more volatile and affected by something as small as a celebrity’s tweet.

Are there cryptocurrency exchange-traded funds?

Given the thousands of cryptocurrencies in existence and the high volatility associated with most of them, it’s understandable you might want to take a diversified approach to investing in crypto to minimize the risk that you might lose money.

There are exchange-traded funds, or ETFs, that trade in both bitcoin futures and bitcoin’s spot price. The bitcoin ETF that is right for you, however, depends upon many factors, including your risk tolerance and investment horizon.