Infographics: TBS

“>

Infographics: TBS

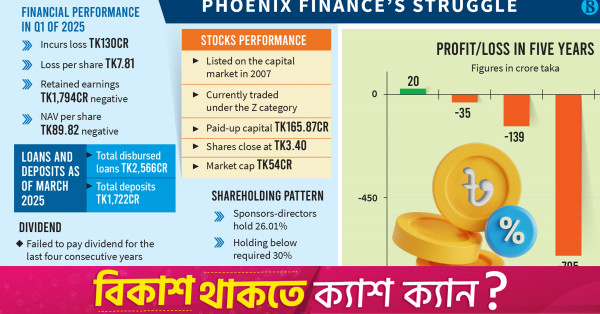

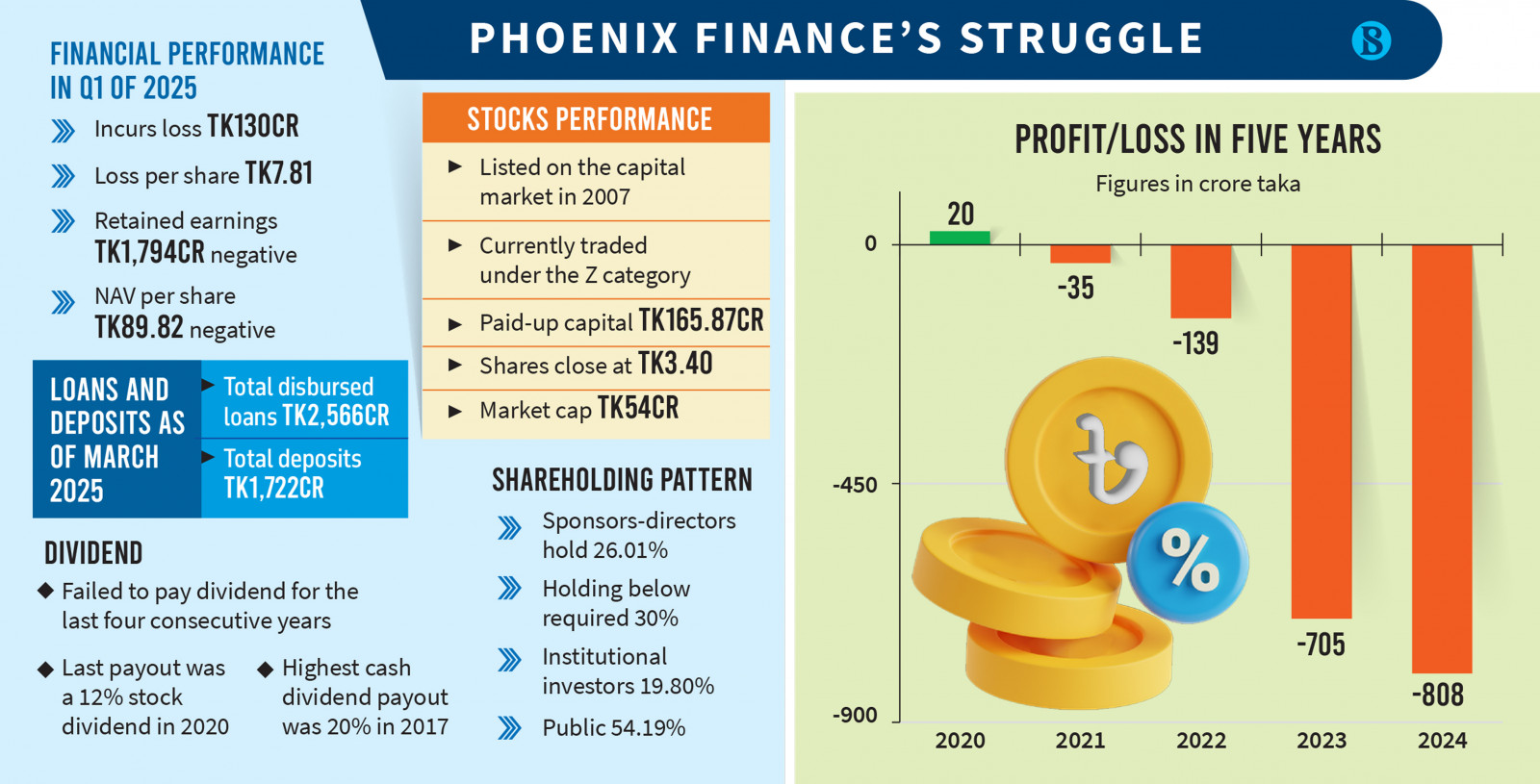

Phoenix Finance and Investments Ltd has incurred a staggering cumulative loss of Tk1,817 crore from 2021 to March 2025, primarily due to the fallout from major loan scams, according to company insiders.

The non-bank financial institution (NBFI) reported a loss of Tk35 crore in 2021, which rose to Tk138 crore in 2022 and surged to Tk705 crore in 2023. In 2024, the loss further increased by 15% to Tk808 crore. The trend continued in 2025, with a Tk130 crore loss in the January–March quarter alone.

As of the end of 2024, the loss per share stood at Tk48.73, up from Tk42.52 a year earlier. Due to persistent losses, the board of directors did not recommend any dividend for 2024 – marking the fourth consecutive year without a dividend – prompting the company’s downgrade to the Z category on the Dhaka Stock Exchange.

Currently, the company’s shares are trading at Tk3.40, significantly below the face value of Tk10, resulting in a market capitalisation far below its paid-up capital of Tk165.87 crore.

Owing to the massive losses, Phoenix Finance’s retained earnings have plunged to negative Tk1,794 crore, dragging its net asset value down to negative Tk89.82 — indicating that liabilities have far exceeded total assets.

Mohammed Mohsin, chairman of Phoenix Finance, declined to comment on the company’s performance, citing that he is currently on holiday. He requested to contact him on a work day.

A senior officer from the company, speaking on condition of anonymity, shared with The Business Standard that the company once enjoyed a strong reputation in the industry under the leadership of its late promoter, Deen Mohammad.

During his tenure, the company received the prestigious International Star Award for Quality (ISAQ) in the gold category from Business Initiative Directions, a renowned business organisation based in Madrid, he said.

“However, Deen Mohammad passed away in 2021, and prior to his death, he was unable to lead Phoenix Finance due to declining health,” he said.

The officer noted that his successor has not been able to fill his shoes, which ultimately led the company’s former managing director, Intekhab Alam, to allegedly become involved in loan scams. “This has resulted in a mounting burden of defaulted loans and a severe deterioration in the company’s financial health,” he said.

In December 2023, the Bangladesh Bank removed Intekhab from his position on charges of violations of lending regulations.

According to the central bank letter, Intekhab was found to be involved in the loan irregularities, which hampered depositors’ trust.

Loan irregularities at Phoenix Finance involving borrower companies SA Oil Refinery and Aman Cement Mills Unit-2, Monospool Paper Manufacturing Company, Mahin Enterprises Limited, Mc Steel Industries along with individual borrowers — Najma Parveen and Farhan Musharraf — prompted the central bank to order Phoenix Finance to conduct a thorough internal investigation and take decisive administrative and legal action against those implicated, said the letter.

The company has yet to publish its detailed financial report for the last year and the first quarter of 2025.

In the annual report for 2023, Phoenix Finance reported that its non-performing loan (NPL) ratio was 77.46% of total loan as on 31 December 2023, which was 23.23% in the previous year.

Its NPL was Tk2,104 crore in 2023, which was Tk625 crore in the previous year, according to the annual report.

Currently, Phoenix Finance is governed by two shareholder directors and two independent directors. Mohammed Mohsin serves as the chairman of the company, while Hyder Ali represents Phoenix Insurance as a nominated director.

Most listed NBFIs struggle

Country’s NBFIs have been grappling with soaring non-performing loans, a liquidity crisis, and a sharp decline in net interest margins in recent years.

Much of the sector’s distress stems from non-compliant firms plagued by mismanagement and embezzlement.

In contrast, top-tier NBFIs with strong corporate governance, sound strategies, and solid financials have set themselves apart— offering a stark contrast to struggling peers unable to repay depositors.

Of the 35 NBFIs in Bangladesh, 23 are listed on the stock exchanges. Among them, only 10 have published their financial results for 2024 so far.

Of these, just four – IDLC Finance, DBH Finance, IPDC Finance, and United Finance – reported profits for the year.

Among the 13 listed NBFIs yet to disclose their results, only LankaBangla Finance and National Housing are believed to have remained profitable, while the others have struggled due to poor governance and loan scandals.

According to the Bangladesh Bank report, NBFIs are burdened with non-performing loans, which reached 35.52% by the end of September 2024, with seven institutions reporting NPLs between 90% and 99%.

The total NPLs of 35 institutions amounted to Tk26,163 crore, with 19 institutions reporting NPLs exceeding 50%, according to Bangladesh Bank data. Compared to June 2024, NPLs increased by Tk1,452 crore in just three months.

Central bank officials said most NBFIs are practically non-functional, with seven near-defunct, and the remaining institutions, which have over 50% defaulted loans, are struggling.

Many financial institutions violated banking rules by disbursing loans to shell companies through forged documents, with several institutions’ irregularities highlighted in the central bank’s report.