Cisco has been busy genning up product releases, news stories, and hype this at its annual conference, Cisco Live, hosted this week in San Diego. But this is only part of a bigger thing has been happening: Investors have been bidding up shares in Cisco over the past few months in the hope that a larger transformation is being driven by new President and Chief Product Officer Jeetu Patel.

Cisco shares are up 10% this year to date. It’s not a coincidence that Cisco shares have recently hit new 52-week highs on the back of heavy product-focused strategy spearheaded by Patel, who was promoted to streamline Cisco’s product divisions last year and then promoted again to President last month. Investors and Cisco observers have noticed.

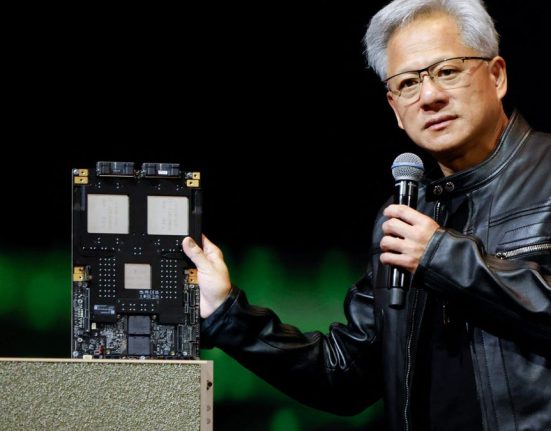

The rise in Cisco’s fortunes has also followed a Secure AI Factory deal that Cisco struck with Nvidia in March, which integrates AI infrastructure products, coupling Nvidia’s GPUs with Cisco’s networking and Silicon One proprietary chip.

The Satya Moment May Be Here

In short, after years of stagnation on the product front, Cisco may now be undergoing meaningful change, catalyzed by Patel. Cisco sources say that it’s a conscious move reminiscent of the transformation driven by Microsoft CEO Satya Nadella, who took over from former Microsoft CEO Steve Ballmer in 2014 and pivoted the company toward innovation in cloud infrastructure and AI—bringing investors huge returns as Microsoft shares have appreciated 1,000% under the leadership of Nadella.

Several sources have confirmed with me that it’s a topic of discussion inside Cisco. After all, Nadella is considered a hero in the Silicon Valley Indian-American community. Sources say that Patel, a fellow Indian-American business executive, has looked up to Nadella as a role model.

Cisco watchers have noticed.

“This is Cisco’s Satya Nadella moment,” said Steve Mullaney, the former CEO of networking startup Aviatrix as well as a former Cisco executive, in an interview. “This is what they need in these times. You need a product leader, and that’s Jeetu. I agree with his phrase that Cisco can become unrecognizable. It’s been all there, all along, waiting for Jeetu to bring it out.”

How Patel’s Rise Evolved

So why Patel, and why now? Critics have pointed out that Cisco has been in need of major fixes, which my firm Futuriom has detailed from end-user research over the past few years. Big customers have been grousing about perennial problems, such as a proliferation of operating systems, bloated product portfolios, and Cisco’s sales-driven culture. CEO Chuck Robbins was even at one point rumored to be on the chopping block.

“A core criticism from enterprises on Cisco’s networking portfolio has been the lack

of integration between the products, operating systems, and management platforms,” says a note about Cisco Live announcements from William Blair analysts Sabastien Naji and Jason Ader. “Cisco looked to address these criticisms, announcing that is has unified the management plane for its Catalyst and Meraki portfolios as well as for its

Nexus (NX-OS) and ACI data center networking product lines.”

The new direction is also the result of a reorg started by Cisco to address these shortcomings, and Patel has been a big part of it. The rise of Patel gained momentum last fall, when Cisco announced a layoff of 7% of staff and the elevation of Patel to head of all Cisco’s product divisions. That’s when Patel pushed for more work on product integrations and leveraging Cisco’s gigantic installed base. These initiatives have borne fruit, and Patel was elevated to President and Chief Product Officer.

Investors may be welcoming this refreshing change. Cisco CEO Chuck Robbins has been a steady executive, but he never delivered anything spectacular on the innovation side. Cut from the same cloth as his predecessor John Chambers, Robbins is a solid communicator and sales leader whose strategy has been based on M&A. But a product visionary and technology integration expert he is not.

The former Cisco President Gary Steele, who was rumored to be Robbins’ successor, left the company in March to become CEO of Shield AI, paving the way for Patel’s further rise and elevation to President. Sources told us that Steele’s decision to leave was based on his perception that there was more upside to running an AI startup, but that paved the way for Patel’s rise inside Cisco, where he is clearly being positioned as the next CEO.

Patel is a different sort of leader. His message has been one of product innovation and integration—long weaknesses of Cisco’s. This week at Cisco Live he has demonstrated his handiwork, being ever-present in Cisco’s launches of new technology and product segments, including the AI infrastructure products with Nvidia as well as important new networking releases and updates, such as Nexus 9000.

Some Cisco-connected sources say it’s definitely not a coincidence that Patel is being compared to Satya, as that’s part of the strategy and image being cultivated by the Cisco brass.

“I think Cisco thinks he’s Satya Nadella in the making,” says Mike Dvorkin, a former Cisco Distinguished Engineer and one of the creators of Cisco ACI, it’s software management platform.

Dvorkin says that Patel is “directionally correct” if he’s a potential successor to Robbins, but that so far Cisco has only made cosmetic changes to its gigantic portfolio. “The tech direction is set by Nvidia,’ he says. “Cisco is at best packaging Nvidia.”

Product Innovation at Cisco Live

Cisco Live has demonstrated the influence of Patel, who in some presentations has talked openly about the past perception of Cisco as a prolific M&A accumulator of startups that doesn’t work hard on integration after deals. And some of the new launches show this new focus.

Some of the key announcements at Cisco Live have included the introduction of a new centralized networking management dashboard, including Nexus Fabric and Nexus Dashboard; progress in integrating Cisco’s networking products with Nvidia; and a host of AI-driven management products for areas such as NetOps and security.

The launch of Nexus Fabric is addressing some long-needed fixes in integration of Cisco’s networking software, such as ACI. But that was just part of the news. More emphasis was placed on Cisco’s new partnership with Nvidia, announced earlier this year, as well as improvements in AI operations (AIOps) and network security integration.

Let’s hit on some of the examples:

AI Networking Platform. Cisco released more details about its partnership with Nvidia, which now looks like the linchpin of its AI networking strategy. The companies showcased their integration efforts in Cisco’s Secure AI Factory with Nvidia, including full-stack AI solutions supporting edge, RAG, training, and large-scale inferencing. A key technical element included the promise of 400G bidirectional (BiDi) optics in the second half of the year.

Networking Fabric Integration. The company announced Cisco Nexus Dashboard, which provides centralized datacenter network operations and automation across Nexus, MDS, and ACI fabrics. The goal is to provide network operators more flexibility as well as an integrated approach to managing VXLAN-EVPN and ACI fabrics.

AIOps and NetDevOps. Cisco is adopting AI for NetOps and NetDevOps, including Cisco AI Canvas, an “industry-first generative user interface” for real-time collaboration between network and security operations teams. The vendor also introduced Cisco AI Assistant, which provides conversational control across the Cisco suite.

Embedded Security. Cisco still has a complex array of security approaches and products, but it tried to shed light on further integrations of networking and security with Hypershield and Hybrid Mesh Firewall, which aim to embed security and policy control directly into network fabrics. For example, Cisco announced that it has extended Hybrid Mesh Firewall enforcement to the Cisco ACI fabric by integrating Cisco Secure Workload with Cisco ACI.

Patel’s Product Strategy: Integrate and Innovate

This new thrust demonstrates how Patel has implemented meaningful change as he has been given more authority. There’s more room to run. He’s focused the company on integrating internally where it makes sense and partnering externally where it’s necessary.

For investors, the partnership with Nvidia is a key element, because it’s elevating Cisco’s visibility in the AI category, where it can lean on Nvidia’s strengths in DPUs and generate more revenue from its own proprietary chip platform, Silicon One.

This AI strategy couldn’t come at a better time. It’s a huge opportunity, but the AI infrastructure boom has fueled enthusiasm the networking market and brewed up fierce competition among incumbents and startups alike. HPE is still holding out for a merger with Juniper, and Arista Networks continues to produce spectacular results on the back of AI infrastructure. In addition, a range of startups, including Arrcus, DriveNets, Aviz Networks, and Hedgehog are also getting in on the AI networking action as customers look for a wide range of solutions ranging from building massive AI pods to inferencing at the edge, as we recently detailed in our Networking for AI Infrastructure report.

Some Wall Street analysts have a similar take. Cisco has started addressing long-standing issues, but it has more work to do. William Blair’s analysts Sabastien Naji and Jason Ader think it’s a promising start, but they point out there’s a lot more work to do—and Cisco’s is still facing fierce competition from rivals, including Arista, which is perceived to be a more technically advanced company.

“While we see this as a step in addressing a longstanding criticism of Cisco’s networking products, many enterprise customers will need some convincing to remedy the perception that these products remain largely distinct,” says the investor note. “In our view, competitor Arista remains well positioned for share gains, given its single OS and management plane across campus and data center products.”

All of this shows the power of changes in leadership, and it has given Cisco investors new optimism. It’s only a start, but it’s a promising start. If Cisco can elevate its game in the gigantic markets of AI infrastructure, networking, and cybersecurity, this story has a lot more legs.

Futuriom provides paid research and marketing services to technology companies, with the goal of providing accurate insight into how cloud and AI infrastructure markets are evolving. These services include subscription research, custom research, and report sponsorships. In the past twelve months, Futuriom has not had a paid relationship with Cisco.