Piggybacking on previous comments from President Donald Trump, Federal Housing Finance Agency (FHFA) Director Bill Pulte said on social media that “Jay Powell needs to lower interest rates — enough is enough. President Trump has crushed Biden’s inflation, and there is no reason not to lower rates. The housing market would be in much better shape if Chairman Powell does this.”

But policymakers like Powell have publicly stated their intention to stay patient while the full economic impacts from Trump’s global tariff regime are measured. And last week’s Supreme Court decision that shielded Powell from a potential firing means the Fed chief is even less likely to be swayed by the president or administration officials.

Powell’s term as Fed chair ends in May 2026. A new leader who aligns more closely with Trump’s policy views is likely to be installed then, but other members of the Federal Open Market Committee have been firm in their desire to move slowly and cautiously before lowering the overnight rate.

“With inflation persistently running above the FOMC’s target and the labor market displaying resilience, the committee appears under little pressure to act, choosing instead to ‘wait for greater clarity’ on the impact of recently announced tariffs before easing monetary conditions,” First American Senior Economist Sam Williamson said in a statement after the Fed’s May meeting.

The Consumer Price Index (CPI) for April rose 2.3% year over year and 0.2% month over month. While these gains are relatively close to the Fed’s 2% annualized inflation target, some market observers believe that further price growth will show up in the May data that’s set to be released June 11 by the U.S. Bureau of Labor Statistics.

Employment is also running at a healthy clip as non-farm payrolls added 177,000 jobs in April, above consensus estimates of 130,000, while the jobless rate stayed unchanged at 4.2%. While Powell has previously said that the risks for higher unemployment are rising, he has also indicated that preemptively lowering rates to prevent job losses is not the prudent path for the Fed to take.

“We think our policy rate is in a good place to stay as we await further clarity on tariffs and ultimately the implications for the economy,” Powell said May 7.

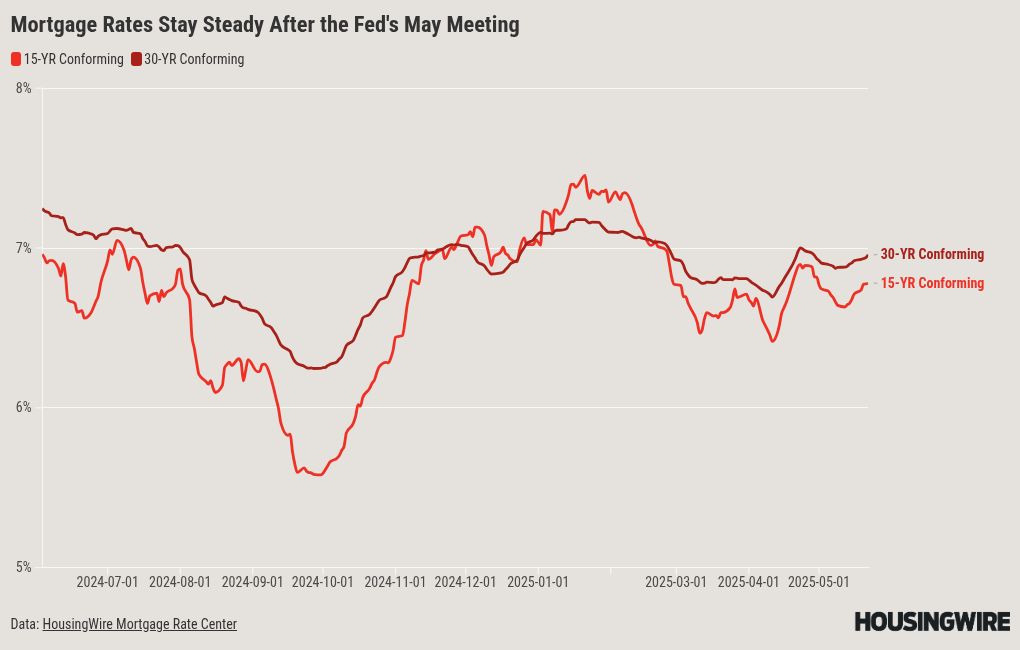

HousingWire Lead Analyst Logan Mohtashami noted over the weekend that the spread between the 10-year Treasury yield and the 30-year mortgage rate remains elevated above its historic average of 1.6% to 1.8%. But the current spread of 2.36% is considerably lower than the peaks of 2023 — and mortgage rates could be 75 basis points higher if those spreads were still in place.

Purchase loan application data from the Mortgage Bankers Association (MBA) has been trending positively for 16 straight weeks, Mohtashami added. Much of the higher demand is tied to government loan products through the Federal Housing Administration and U.S. Department of Veterans Affairs. FHA and VA loans currently represent about 30% of all applications.

The S&P CoreLogic Case-Shiller National Home Price Index for March showed 3.4% year-over-year growth, down from revised growth of 4% in February. For-sale inventory is up 32% from a year ago, according to Altos data, and the share of listings with a price cut has reached 38% — the highest level since July 2024.

A slower pace of price appreciation could entice more buyers to enter the market even as mortgage rates remain at the higher end of most 2025 forecasts.

“It is likely that home prices will not grow as fast this year as they have over the past couple of years,” Bright MLS chief economist Lisa Sturtevant said in a statement. “More inventory has been coming onto the market, which gives buyers more leverage and room for negotiation.”