Alpaca Finance Ceases:- Alpaca, one of the most innovative protocols of BNB Chain, has decided to bring down the curtains on its operations.

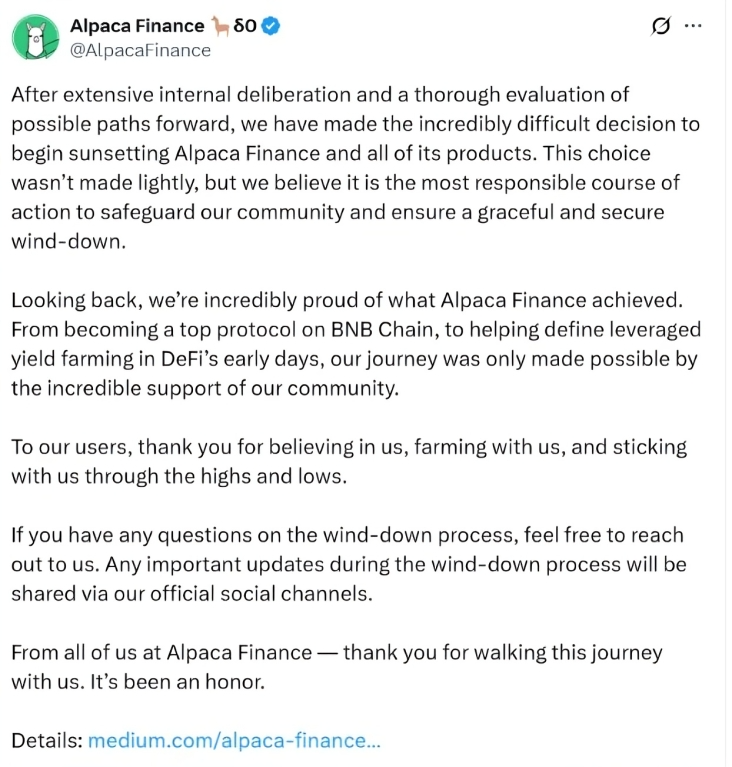

On Monday, Alpaca Finance announced its decision to sunset all protocol operations and affiliated products. This marks a tragic and regrettable end to one of DeFi’s early innovators.

The announcement exempifies the trajectory of how a once successful project can face downfall due to flawed business models.

With no VC funding, Alpaca went on to become the top BNB Chain protocol with the Total Value Locked (TVL) exceeding $900 million at its peak in early 2022. However, by May 2025, the TVL had declined sharply to stand at meagre $54.6 million. This is a massive drop of over 94%.

This article examines the reasons that led this once a star of DeFi into ruins.

Why Alpaca Finance Shut Down

This announcement of winding up of its operations by Alpaca Finance was somewhat predictable since April 25.

On April 25, the leading crypto Exchange Binance decided to delist the DeFi Protocol’s token $ALPACA. This came as the last survival blow to the already struggling Protocol.

After Binance’s delisting announcement, ALPACA’s price plunged by over 30%, dropping to around $0.11. Further, losing Binance which was its major liquidity source meant the token became harder to trade – decreasing chances of survival.

In its wind down announcement, Alpaca Finance revealed that it has been running at loss for over two years. This is evident as Alpaca relied primarily on fees generated from leveraged yield farming and perpetuals trading. As TVL dropped and user activity declined, fee income dried up.

This meant a massive reduction in fee-based revenue, especially since leveraged farming returns are closely tied to capital inflows. The increase in competititors on DeFi landscape further added to its woes.

As part of its winding process, it has stop all the Strategies under Automated Vaults (AV) immediately. It has also stopped lending and borrowing under its markets AF2.0 and AFI1.0. Its perpetual product Alperp has also been turned to reduce-only mode.

To Alpaca users and holders, unfortunately Binance decided to delist us in the coming weeks. However, please note that you can still trade ALPACA on the following exchanges: https://t.co/JJWZpZ3HpX… (click Markets tab)

Also, please note, our Market Maker had requested more…

— Alpaca Finance 🦙δ0 (@AlpacaFinance) April 25, 2025

Lessons Learnt For Other DeFi Protocols

To conclude, Alpaca Finance’s products could not survive even the bullish momentum of the market, particularly lending and perpetuals – the segments where its products operated.

Since the Q1 2025, the crypto lending sector is rebounding with the existing companies ramping up their services and new entrants emerging.

The year 2025 has also come as a breakout year for perpetual trading segment. However, it still maintains dominance of centralised exchanges such as Binance, OKX.

Thus, the cease of the Alpaca Protocol highlights the need for such Protocols to have diversified business model. The revenue streams must be open to survive the fluctuations of the market.

And in the time when there is a intensified competition from next-generation DeFi protocols, there is a constant need for businesses to constantly innovate and evolve.

Also Read: Robinhood Pushes Into RWA Market

Disclaimer: The content may include the personal opinion of the author and is subject to market conditions. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.