Rajendra Maganbhai Patel Vs ACIT (ITAT Ahmedabad)

ITAT Ahmedabad held that funds remitted from foreign sources into NRE accounts are not taxable in India unless there is material to establish that they originate from taxable Indian income. Accordingly, exemption u/s. 10(4) of the Income Tax Act granted.

Facts- The assessee is a Non-Resident Indian and citizen of UK. On the basis of information available in ITBA system, the AO issued notice u/s 148 of the Act to the assessee. The assessee submitted return of income for both the years in response to notice u/s 148 of the Act. On the basis of information submitted by the assessee in response to notice u/s. 143(2) / 142(1) of the Act and show-cause notice, AO issued a draft assessment order proposing addition on account of unexplained credits to NRE accounts of the assessee. DRP directed the AO to delete some additions as explained. Based on the directives of DRP AO confirmed some additions. Being aggrieved, the present appeal is filed.

Conclusion- Held that the AO’s additions cannot be sustained merely on the basis of NRE credits without proving that the original source of funds was taxable in India. As held in judicial precedents like Nitin Mavji Vekariya (461 ITR 18) and Bhavesh Chandrakantbhai Bhatt (8240 of 2024), NRE deposits sourced from foreign remittances are beyond Indian taxation. In the absence of material establishing that the credits were from an Indian taxable source, the additions are legally unsustainable. Considering all the facts, legal precedents, and provisions of Section 10(4) of the Act, it is evident that funds remitted from foreign sources into NRE accounts are not taxable in India unless there is material to establish that they originate from taxable Indian income.

FULL TEXT OF THE ORDER OF ITAT AHMEDABAD

Both these appeals by the assessee pertain to Assessment Years (AYs) 2013-14 and 2015-16 and are directed against the final assessment orders passed by the Assessing Officer [hereinafter referred to as “AO”] under Section 147 r.w.s. 144C(13) of the Income Tax Act, 1961 [hereinafter referred to as “the Act”], pursuant to the directions of the Dispute Resolution Panel [hereinafter referred to as “DRP”]. The core issue in both the appeals concerns the addition made by the AO on account of credits in the assessee’s Non-Resident External (NRE) bank accounts.

Facts of the case:

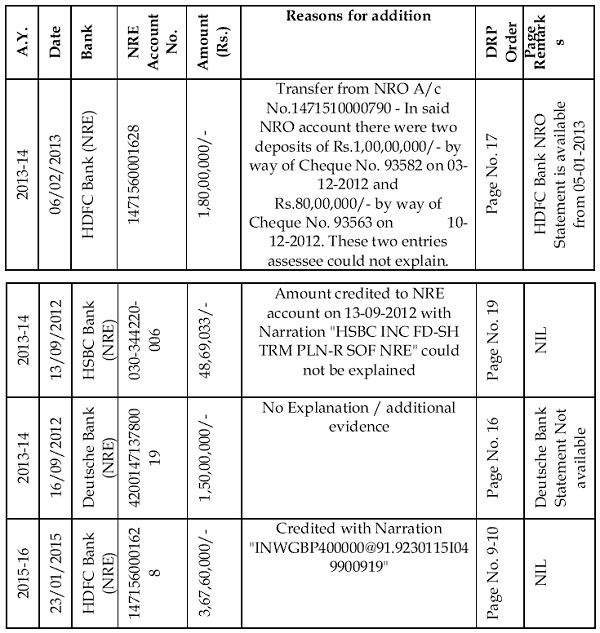

2. The assessee is a Non-Resident Indian and citizen of UK. The assessee had not filed his returns of income for both the assessment years under consideration. On the basis of information available in ITBA system, the AO issued notice u/s 148 of the Act to the assessee. The assessee submitted return of income for both the years in response to notice u/s 148 of the Act. On the basis of information submitted by the assessee in response to notice u/s. 143(2) / 142(1) of the Act and show-cause notice, the AO issued a draft assessment order proposing addition on account of unexplained credits to NRE accounts of the assessee. DRP directed the AO to delete some additions as explained. Based on the directives of DRP AO confirmed some additions. Following is the tabulated summary of the assessments in case of both the years:

| Particulars | AY 2013-14 | AY 2015-16 |

| Date of Notice u/s 148 | 31.03.2021 | 31.03.2021 |

| Date of Filing of return in response to Notice u/s 148 | 30.04.2021 | 30.04.2021 |

| Returned Income | Rs. 5,79,019/- | Rs. 77,421/- |

| Key Information from ITBA System | ||

| – Investments in Mutual Funds | Rs. 5,62,67,313/- | Rs. 14,36,26,449/- |

| – TDS Return Payments to Non-Residents | Rs. 9,50,243/- | Rs. 10,47,988/- |

| – Time Deposit with Banking Co. | Rs. 11,76,46,084/- | NIL |

| – Credit Card Payments: | Rs. 3,04,662/- | Rs. 3,96,515/- |

| Addition Proposed by AO in Draft order | Rs. 4,69,37,210/- | Rs. 3,77,60,000/- |

| Additions Directed by DRP – (Unexplained NRE Credits) | Rs. 3,79,69,033/- | Rs. 3,67,60,000/- |

| Order of AO Section Invoked – Date of Order | 147 r.w.s.144C(13) – 29-12-2022 | 147r.w.s.144C(13) – 06-01-2023 |

| Additions Made by AO | Rs. 3,79,69,033/- | Rs. 3,67,60,000/- |

| Final Assessed Income | Rs. 3,85,48,052/- | Rs. 3,68,40,733/- |

3. As the assessee was not satisfied with the orders of AO passed u/s 147 r.w.s. 144C(13) of the Act, the assessee preferred an order before us with following grounds of appeal:

In ITA No. 105/Ahd/ 2023 for AY 2013-14

1.0 ADDITION OF RS. 3,79,69,033/- ON ACCOUNT FUNDS RECEIVED IN NRE ACCOUNT:

1.1 On the facts and circumstances of Your Appellant’s case and law, the ld.AO has made addition of Rs.3, 79,69,033/- for the failure to prove source of funds received in NRE Bank accounts. ld.AO as well as Hon’ble DRP failed to appreciate the fact that source of fund along with source of source was properly explained. ld.AO as well as Hon’ble DRP failed to appreciate the fact that entire money was transfer from one account to other account and therefore source was very well explained. The action of ld. AO is totally arbitrary and not in accordance with provisions of law.

1.2 Your appellant prays that Your Honor be pleased to hold the action of ld. AO unjustified and delete the impugned addition. Your appellant craves leave to add, to amend and / or alter the above referred grounds.

Your appellant craves leave to add, to amend and / or alter the above referred grounds.

In ITA No. 106/Ahd/2023 for AY 2015-16

1 ORDER PASSED U/S 147 R.W.S. 144C(13) OF THE ACT IS BAD-IN‑ LAW:

1.1 On the facts and in the circumstances of your appellant’s case and in law, the order passed by Id. AO u/s 147 r.w.s. 144C (13) of the Act is bad-in-law in as much as Id. AO while framing assessment order derived extra territorial jurisdiction to tax money earned in any country outside India by NRI. Such action of Id.AO is totally devoid of the provisions of Income Tax Law in India and therefore assessment order itself is bad in law.

1.2 Your appellant, therefore, prays before your Honor to hold so now and quash the order passed by Id. AO.

2 Rejection of Additional Evidence:

2.1 On the facts and circumstances of Your Appellant’s case and law, The Id.AO failed to appreciate the fact that all explanation and evidences were produced before Hon’ble DRP but ignoring the above mentioned facts and also without verifying record rejected the claim of your appellant rejected the claim stating that “During the course of DRP proceedings, no explanation/additional evidence was produced before the Hon’ble DRP in this regard. Hence, though the assessee has given explanation in this regard, no verification/comments are offered as directed by the DRP”.

2.2 Your appellant, therefore, prays before your Honor to hold so now and quash the order passed by Id. AO.

3. ADDITION OF RS. 3,67,60,000/- ON ACCOUNT FUNDS RECEIVED IN NRE ACCOUNT:

3.1 On the facts and circumstances of Your Appellant’s case and law, The Id.AO has made addition of Rs. 3,67,60,000/- for the funds received in NRE Bank accounts. Further the said fund is introduced by appellant in his NRE account from his foreign bank account.ld.AO failed to appreciate the fact that inward remittances in NRE account has to be necessarily from abroad and for non-residents, any funds brought into India into NRE account does not become tayable irrespective of the fact whether such NRI has filed its tax return in his country of residence. The action of Id. AO is totally arbitrary and not in accordance with provisions of law.

3.2 Your appellant prays that your Honor be pleased to hold so now and direct the ld. AO to delete the addition made on this account.

Your appellant craves leave to add, to amend and / or alter the above referred grounds.

4. Since the issues involved in both these appeals are common, we heard them together and dispose of the same by way of a common order for the sake of convenience.

5. During the course of the hearing before us, the Authorized Representative (AR) submitted that the additions made by the AO were solely on account of credits in the NRE account, which are not subject to tax as per the provisions of Section 10(4) of the Act. The AR further emphasized that the assessee’s non-resident status is an admitted fact, and throughout the assessment and DRP proceedings, the assessee had duly explained all credits appearing in the NRE accounts.

6. The Departmental Representative (DR), on the other hand, referred to the DRP’s order in case of AY 2013-14, stating that the assessee had failed to establish the source of a credit entry of Rs.1,80,00,000/- in the HDFC Bank NRE account on 06-02-2013. As per the bank statement, this amount was transferred from the assessee’s own NRO account with HDFC Bank, where two cheques of Rs. 1 crore and Rs. 80 lakhs were deposited on 03-12-2012 and 10-12-2012, respectively. The DR also pointed out that the DRP concluded that two additional credit entries remained unexplained—one for Rs.1,50,00,000/- credited in Deutsche Bank on 16-09-2012 and another for Rs.48,69,033/- credited in HSBC Bank on 13-09-2012.

7. In response, the AR argued that all entries had already been explained during the proceedings. He contended that if the NRO account was the subject matter of concern, then the AO should have examined and, if required, made the addition at the NRO account level instead of adding the amount based on the NRE account credit. The AR reiterated that since the AO made the addition based on credits in the NRE account, such an addition is unsustainable as per Section 10(4) of the Act. The AR placed reliance on judicial precedents from the Hon’ble Gujarat High Court, which support the assessee’s claim that credits in an NRE account sourced from foreign remittances are beyond the reach of taxation under Indian law. Following are the judicial precedents relied on –

– Nitin Mavji Vekariya Vs. ITO – (2024) 461 ITR 18.

– Bhavesh Chandrakantbhai Bhatt Vs. ACIT – Special Civil Application No. 8240 of 2024.

– Anilkumar Ramabhai Patel Vs. ITO – Special Civil Application No. 9497 of 2024.

8. We have carefully considered the rival submissions, perused the evidence on record, and studied the relevant legal provisions and precedents cited. The issue before us is whether the various credits in the assessee’s NRE bank accounts during the year under consideration were correctly added as unexplained income by the AO, or whether the assessee has successfully explained those credits such that they are not liable to tax.

8.1. At the outset, we note that the assessee’s status as a Non-Resident Indian (NRI) during the year is not in dispute, and it is also undisputed fact that the bank accounts in question are NRE accounts maintained by the assessee.

8.2. The AR, during the course of proceedings before us, contended that the addition made by the AO on account of credits in the NRE account is not sustainable in law. The AR submitted that credits in an NRE account are governed by Section 10(4) of the Act. The AR emphasized that the AO and DRP have failed to appreciate that an NRE account itself is a foreign exchange-designated account, and funds credited therein originate either from foreign remittances or permissible transfers as per FEMA regulations. The AR stated that the AO has incorrectly made additions based on credits in the NRE account. In particular, the AO should have verified the credit entries in the NRO account from where certain transfers were made to the NRE account instead of directly taxing the NRE credits. The AR argued that if the AO doubted the source of funds in the NRO account, the addition should have been made at that stage, not at the NRE account level, which is contrary to settled legal principles.

8.3. We verified the disputed credits in NRE bank account which are tabulated below –

8.4. From the paper book submitted before us, we observed that the all the relevant bank statements are not available in the paper book.

8.5. We have noted the submission of the assessee before DRP and found that the funds deposited in the NRE account were primarily sourced from proceeds of pharmacy business sales in the UK between 1992 and 2006, redemptions of FCNR deposits and mutual funds previously invested in India, inter-account transfers within India from existing NRE accounts, and remittances from foreign bank accounts. The assessee emphasized that a sum of GBP 400,000/- was transferred on 22-01-2015 from JP Morgan Chase Bank, NA to the HDFC NRE account, forming part of the addition made by the AO. To substantiate this, the assessee furnished remittance certificates issued by HDFC Bank, which were ignored by the AO.

8.6. We note that the transfer amounting to Rs.1,80,00,000/- from the NRO account to the NRE account maintained with HDFC Bank was sourced from the assessee’s NRO account, where two prior deposits of Rs.1 crore on 03-12-2012 and Rs.80 lakh on 10-12-2012 were made. Given these facts, it becomes crucial to examine whether the initial credits in the NRO account were from taxable income or capital receipts.

8.7. We also note that the amount credited to the NRE account on 13-09- 2012, with the narration “HSBC INC FD-SH TRM PLN-R SOF NRE”, remained unexplained by the assessee during the assessment and DRP proceedings. However, both the AO and DRP orders explicitly mention the narration from the bank statement, indicating that the credit represents proceeds from a short-term fixed deposit (FD) redemption. Given that an NRE FD redemption typically originates from previously tax-exempt foreign remittances, this entry is self-explanatory and can reasonably be treated as explained. Consequently, the addition made on this account appears unsustainable, as the source of funds is inherently linked to a legitimate financial transaction rather than unexplained income.

8.8. The transaction dated 16/09/2012, involving a credit of Rs.1,50,00,000/- in the Deutsche Bank (NRE) account (A/c No. 420014713780019), remains unexplained, as no supporting explanation or additional evidence has been provided by the assessee. Furthermore, the bank statement for Deutsche Bank is not available in the paper book submitted during the course of hearing before us. Given the lack of documentary support, this transaction requires further verification by the AO to determine the actual source of funds.

8.9. Regarding the inward remittance of Rs.3,67,60,000/- (GBP 400,000) dated 23/01/2015 in HDFC Bank (NRE) account, the assessee stated that these funds were accumulated from the sale proceeds of pharmacy businesses in the UK between 1992 and 2006. The last store was sold in 2006- 07, and a portion of the proceeds was transferred to India. The assessee transferred GBP 950,000 to India on 12/11/2008, with the majority of these funds invested in FCNR deposits and mutual funds. As per the submission, this inward remittance of GBP 400,000 was part of the tax-paid funds accumulated over the years and repatriated to India. Based on the detailed explanation and supporting documents submitted before the DRP and given that the bank statement itself confirms the nature of the transaction, this inward remittance is adequately explained and does not require further verification.

8.10. The judicial precedents relied on by the assessee establish that foreign remittances into NRE accounts are not taxable under Indian law. However, all three cases involved quashing of reassessment proceedings under Section 148A, whereas the present case involves a completed assessment under Section 147 r.w.s. 144C(13) of the Act after a full-fledged inquiry. Therefore, while the substantive principles remain relevant, the procedural distinction limits their direct applicability in challenging the assessment in the present appeal.

8.11. Section 10(4) of the Act provides an exemption for certain incomes earned by a Non-Resident Indian (NRI) in India. The relevant provision i.e. Section 10(4) (ii) is as follows:

in the case of an individual, any income by way of interest on money standing to his credit in a Non-Resident (External) Account in any bank in India in accordance with the Foreign Exchange Management Act, 1999 (42 of 1999), and the rules made thereunder:

Provided that such individual is a person resident outside India as defined in clause (w) of section 2 of the said Act or is a person who has been permitted by the Reserve Bank of India to maintain said Account.

8.12. We have noted the key elements of the applicable provisions, accordingly, it applies to individuals who maintain an NRE account in an Indian bank, interest earned on funds deposited in an NRE account is exempt from income tax in India and the exemption is applicable only if the individual qualifies as a “Person Resident Outside India” under FEMA, 1999 or has specific RBI permission to maintain an NRE account. This provision ensures that income earned outside India and deposited into an NRE account remains free from Indian taxation. The assessee in the present case is an NRI, and the additions made by the AO pertain to credits in NRE accounts maintained with HDFC Bank, Deutsche Bank, and HSBC Bank. The assessee has claimed exemption under Section 10(4)(ii) of the Act, arguing that the credited funds originated from foreign sources and should not be taxed in India. The AO made additions based on credits in the assessee’s NRE account, treating them as unexplained income. However, as per Section 10(4) of the Act, funds deposited in an NRE account are not subject to Indian taxation if they originate from foreign income. The assessee has provided documentation showing that the funds were either foreign remittances or redemptions of existing NRE deposits and hence should not be considered taxable under Indian law.

8.13. Based on the analysis of Section 10(4) of the Act, and the facts of the case, the following conclusions can be drawn:

– Credits directly originating from foreign remittances into the NRE account are exempt from taxation under Section 10(4) of the Act. The Rs.3,67,60,000/- credited on 23-01-2015 in HDFC Bank (NRE) is a foreign remittance from the UK and should be deleted from the assessed income. The Rs.48,69,033/- credited on 13-09-2012 in HSBC Bank (NRE) is a redemption of an NRE fixed deposit, which is also tax-free under Section 10(4).

– Transfers from an NRO account to an NRE account require verification of the original source in the NRO account. If the source of the NRO account deposit was an earlier foreign remittance, Section 10(4) of the Act applies. If the NRO account contained taxable income earned in India, the AO’s action may be justified to the extent of taxable income. The transactions of Rs.1,80,00,000/- (HDFC Bank, 06-02-2013) and Rs.1,50,00,000/- (Deutsche Bank, 16-09-2012) need further verification.

8.14. The AO’s additions cannot be sustained merely on the basis of NRE credits without proving that the original source of funds was taxable in India. As held in judicial precedents like Nitin Mavji Vekariya (461 ITR 18) and Bhavesh Chandrakantbhai Bhatt (8240 of 2024), NRE deposits sourced from foreign remittances are beyond Indian taxation. In the absence of material establishing that the credits were from an Indian taxable source, the additions are legally unsustainable.

8.15. Considering all the facts, legal precedents, and provisions of Section 10(4) of the Act, it is evident that funds remitted from foreign sources into NRE accounts are not taxable in India unless there is material to establish that they originate from taxable Indian income.

8.16. In AY 2013-14, the addition of Rs.48,69,033/- credited on 13-09-2012 in HSBC Bank (NRE) is deleted, as it represents a redemption of an NRE fixed deposit, which qualifies for exemption under Section 10(4). However, the addition of Rs.1,80,00,000/- in HDFC Bank (NRE) and Rs.1,50,00,000/- in Deutsche Bank (NRE) requires further verification by the AO to ascertain whether the original source of funds in the NRO account was from taxable income or tax-free foreign remittances.

8.17. For AY 2015-16, the addition of Rs.3,67,60,000/- credited on 23-01-2015 in HDFC Bank (NRE) is deleted, as it is an inward remittance from JP Morgan Chase Bank, UK, and qualifies for exemption under Section 10(4) of the Act. Accordingly, the appeal for AY 2013-14 (ITA No. 105/Ahd/2023) is partly allowed for statistical purposes, with a direction to the AO for further verification. Since there are no pending verifications or unresolved issues for this year, the appeal for AY 2015-16 (ITA No. 106/Ahd/2023) is allowed in full.

9. In the combined result, the appeal of the assessee in ITA No.105/Ahd/2023 for AY 2013-14 is partly allowed for statistical purposes, whereas the appeal of the assessee in ITA No.106/Ahd/2023 for AY 2015-16 is allowed in full.

Order pronounced in the Open Court on 4th March, 2025 at Ahmedabad.