The digital transformation of the banking sector in Uzbekistan is gaining momentum. More and more clients prefer to conduct financial operations online, choosing internet banking as the main channel of interaction with banks. Under these circumstances, it becomes especially important to understand which financial institutions offer the most convenient, secure, and technologically advanced solutions for remote services.

To this end, the international digital marketing agency The Digital Department conducted an independent study, which involved a comprehensive assessment of desktop internet banking systems of the largest financial organizations in Uzbekistan.

The main objective of the research was to identify the strengths and weaknesses of internet banking in terms of user experience, technological level, and system reliability. As noted by TDD analysts, the Uzbek banking market is undergoing active digitalization, and such analytical snapshots help banks more accurately assess their current position and develop strategies for the advancement of digital services in line with international standards.

The study did not aim to create a ranking of the “best banks.” Its goal was to objectively compare the level of maturity of digital solutions in the banking environment. The resulting evaluations and profiles provide a clear picture of the current state of desktop internet banking in the country, helping to identify the strengths and weaknesses of individual platforms.

Evaluation Criteria

The analysis was conducted based on the following seven key parameters:

• Functionality: breadth of available operations — from payments and transfers to deposits, loans, currency, and business services;

• Interface: convenience, navigation, visual accessibility;

• Security: presence of modern protection measures — two-factor authentication, biometrics, secure connection;

• Speed and Stability: system performance under normal and high load;

• User Support: availability of communication channels and quality of customer service;

• User Feedback: platform reputation in open sources and user experience;

• Technological Advancement: availability of APIs, update frequency, integration of innovative solutions.

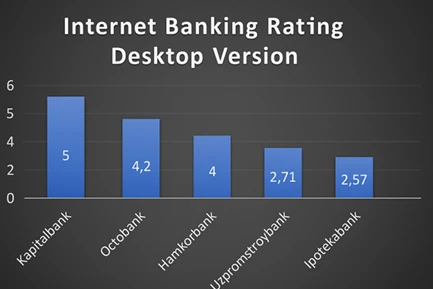

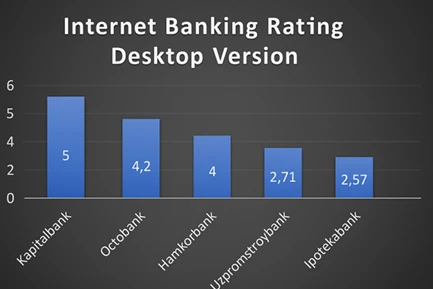

Results and Ranking

Based on the analysis, all five banks demonstrated a complete and balanced level of digital service development:

- Kapitalbank — 5.0

- Octobank — 4.2

- Hamkorbank — 4.0

- Uzpromstroybank — 2.71

- Ipotekabank — 2.57

General Conclusion

The study confirmed that the level of development of desktop internet banking in Uzbekistan remains uneven. Some banks are rapidly moving toward full digitalization, actively implementing modern technologies, improving interfaces, and expanding functionality. Others are limited to a basic set of services without paying enough attention to user experience and technological capabilities.

Kapitalbank confidently holds a leading position thanks to its balanced combination of wide functionality, high security, and a mature digital platform.

Octobank shows strong potential: a modern approach, fintech orientation, and a solid technological foundation make it a promising player.

Hamkorbank offers a stable and versatile solution suitable for various categories of clients — both individuals and businesses.

Uzpromstroybank and Ipotekabank, despite having basic functionality, significantly lag behind in key digital parameters — from interface quality to security and technological sophistication. These platforms require substantial upgrades to meet the expectations of modern users and industry standards.

Kapitalbank

Functionality

Kapitalbank offers one of the most thoughtfully designed and feature-rich internet banking systems in Uzbekistan. Clients have access to a full range of operations: transfers between their own and external accounts, card top-ups and blocking, loan applications, and deposit openings.

The system supports internal currency exchange, payments for government and utility services, as well as taxes and fines. Business clients benefit from extended features such as automatic report exports, multi-account management, bulk payments, and integration with accounting software.

Interface

The platform’s design is modern and minimalist. The interface is intuitive even for beginner users. All key functions are located on the main dashboard, and navigation is implemented with minimal transitions.

Kapitalbank places great emphasis on UX/UI: the menu structure is logical, dark and light themes are supported, and users can personalize the toolbar. The platform adapts to different screen sizes and user habits.

Security

Kapitalbank has implemented a multi-level security system. It uses HTTPS connections, two-factor authentication (via Google Authenticator, SMS, PUSH notifications), and login monitoring by IP address and device.

Biometric authentication (Face ID / Touch ID) and digital signature are also supported. In case of suspicious activity, the system initiates re-verification.

Speed and Stability

The platform demonstrates high performance and reliability. Even during peak loads (e.g., salary payment days), the system remains stable and responsive.

An added advantage is the ability to save operation drafts, minimizing the risk of data loss due to internet disruptions.

Support

Kapitalbank’s support service is available through all major channels: online chat, 24/7 hotline, Telegram bot, and a feedback form in the personal account. Chat operator responses are typically received within 5–10 minutes. Most requests are resolved on the first contact.

Clients can track the status of their requests and receive assistance for specific transactions.

User Feedback

The platform receives high marks for stability, extensive functionality, user-friendly interface, and responsive support. Users especially appreciate the ability to open deposits and apply for loans remotely, as well as saving templates for recurring operations. Issues are usually of a technical nature specific to individual users.

Technological Advancement

Kapitalbank actively invests in digital technology. The platform is regularly updated with new features and optimized processes. Implemented solutions include API integrations, subscriptions, cashback programs, and AI-based tools for expense analysis.

The desktop version is fully synchronized with the mobile bank, ensuring a seamless user experience.

Average Score: 5.0

Kapitalbank represents a benchmark in digital banking. It is one of the most functional and technologically advanced platforms in the country, with an intuitive interface, strong security, and prompt customer service.

Octobank

Functionality

Octobank offers a confident and stable set of features in its desktop internet banking version. Clients can manage their accounts and cards, make transfers between their own and external accounts, pay for services, and create payment orders.

The system supports currency transactions, displays up-to-date exchange rates, and allows for the creation of templates for recurring payments. Business clients have access to bulk payments, report exports, and tax and contract-related settlements.

Interface

Octobank’s interface is designed in a modern, minimalist style aligned with best practices in fintech design. The interface structure is logical and user-friendly, facilitating quick navigation. The platform is tailored for convenient execution of core functions in just a few clicks.

Security

Octobank ensures reliable data protection through encrypted HTTPS connections and transaction confirmation via SMS and email codes. Additional levels of access control and verification are provided for corporate clients, making the platform suitable for business financial management.

Speed and Stability

The platform delivers stable and fast performance for all standard operations. It confidently handles page loading, user action responses, and payment processes in everyday usage scenarios.

Support

Octobank’s support service is available through online chat, hotline, and a feedback form. Depending on the time of request, users may receive assistance from either a chatbot or a human operator. Support functions correctly and provides comprehensive answers to user inquiries.

User Feedback

Clients respond positively to the bank’s modern approach, highlighting the interface’s convenience and its focus on business needs. Templates and the ability to quickly configure payment operations are especially appreciated.

Technological Advancement

Octobank confidently positions itself as a digital-first bank. The system supports API integrations and scalability, with a technical foundation for further development and connection to external solutions. Its approach to digital architecture is forward-looking.

Average Score: 4.2

Octobank is a modern and flexible solution in the digital banking segment. The bank emphasizes reliability, convenience, and support for business tasks, evolving its platform in line with current digital trends.

Hamkorbank

Functionality

Hamkorbank offers a wide range of features for both individual and corporate clients. Available options include account-to-account transfers, payment of government and utility services, currency operations, deposit openings, and loan applications.

For businesses, the system supports managing settlement accounts, generating reports, tax and bulk payments. Templates and automation of recurring operations are also implemented.

Interface

The interface is clearly and concisely organized. Key functions are placed on the home screen, and navigation is simple and intuitive. The visual design meets modern standards and adapts properly to different device types.

The system is not overloaded with unnecessary elements, supports language switching, and allows for smooth multitasking. Even users with minimal digital skills can quickly learn to use the platform.

Security

Hamkorbank uses reliable protection methods: secure HTTPS connection, two-factor authentication via SMS and PUSH notifications, and monitoring of suspicious activity.

For legal entities, digital signature functionality is available. All actions are logged in the system, and transaction confirmation is mandatory.

Speed and Stability

The platform operates with high speed, the interface responds quickly, and pages load without delays. Even during peak periods, the system remains stable.

Scheduled updates are conducted at night and do not interfere with user operations.

Support

Customer support is available via chat, feedback form, and phone. The average response time is 10–20 minutes. If needed, specialized experts are involved in resolving issues.

The support service operates almost around the clock, which is especially convenient for business clients.

User Feedback

Users highlight the system’s stability, reliability, well-designed interface, and broad functionality. Some requests include faster chat response and the addition of advanced analytics tools.

Overall, Hamkorbank is perceived as a universal and modern solution.

Technological Advancement

The platform is actively evolving: regular updates are released, and new features are added. API integrations have been implemented, and accounting system compatibility has been optimized.

Hamkorbank focuses on digital transformation and partnerships with fintech platforms.

Average Score: 4.0

Hamkorbank provides a well-balanced internet banking experience for both individuals and businesses. The platform is functional, secure, stable, and regularly updated. Support is accessible through multiple channels, and the interface is intuitive.

Uzpromstroybank

Functionality

The functionality of Uzpromstroybank’s internet banking is limited to basic operations. Users can perform transfers between accounts, pay for utility and government services, view account statements, and create payment orders.

However, important features are missing—such as online deposit opening, loan applications, investment products, or automation of recurring payments. The platform lacks the flexibility that has become standard in modern digital banking solutions.

Interface

The visual and navigational aspects of the interface are outdated. The design is overloaded with information, the menu structure takes time to get used to, and navigation between sections is not always logical. The lack of adaptation to modern UX/UI principles makes the platform difficult to use, especially for new users.

Security

The system provides a basic level of protection: login, password, and SMS codes for transaction confirmation. More advanced methods—such as two-factor authentication via apps, biometrics, device management, or digital signatures—are not available. This reduces trust among advanced users and businesses.

Speed and Stability

The platform’s performance leaves much to be desired. During periods of high load, users may experience slowdowns while performing transactions, delays in statement access, and issues with payment orders. Maintenance updates are carried out without prior notification, which can lead to temporary system unavailability.

Support

Support is available only during standard working hours and is limited in terms of communication channels. The average response time ranges from 30 minutes to several hours. Most technical issues require a visit to a bank branch, reducing the convenience of remote service.

User Feedback

Public reviews are mostly neutral to critical. Users note the outdated interface, limited functionality, and lack of modern features. The absence of a robust mobile and web integration also causes dissatisfaction.

Technological Advancement

The platform’s technological development is slow. New solutions are rarely implemented, and updates are infrequent. There are no APIs, and the level of automation is low. The digital infrastructure needs modernization to meet current market standards.

Average Score: 2.71

Uzpromstroybank needs a digital platform overhaul. An outdated interface, weak functionality, and a lack of modern technologies limit user capabilities and reduce the bank’s competitiveness compared to more progressive players.

Ipotekabank

Functionality

Ipotekabank’s internet banking offers a limited set of features. Users have access to basic operations such as transfers between accounts, payments for utility and other standard services, viewing balances, and transaction history.

However, important functions are missing, including online deposit openings, loan applications, subscription management, or investment products. There is also no support for setting up recurring payments, making the platform less flexible.

Interface

The interface requires modernization. It is visually overloaded with outdated elements, not adapted to modern UX/UI standards, and poorly scales across different devices. Users encounter difficulties navigating and locating key functions, especially in the initial stages of use.

Security

The system uses the minimum acceptable level of security. Access is granted via login and password, and transaction confirmation is only available via SMS. There is no support for two-factor authentication via apps, biometrics, or digital signatures, which reduces the platform’s trustworthiness among more demanding users.

Speed and Stability

The platform performs inconsistently. Users frequently face delays in loading information, as well as freezes and errors when navigating between sections. During peak usage, system failures may occur, and updates are made without prior notification.

Support

Customer support is limited. Requests are processed slowly, phone calls are difficult to get through, and some issues can only be resolved by visiting a physical branch. This significantly lowers the overall convenience of service.

User Feedback

Public feedback is mostly cautiously critical. The main complaints relate to the inconvenient interface, technical instability, and lack of modern features. Some clients prefer to use the mobile app, viewing the desktop version as outdated.

Technological Advancement

The platform is developing slowly. Updates are irregular, and the introduction of new features is nearly non-existent. There are no API integrations, and automation is minimal. The interface lags behind not only competitors but also the bank’s own mobile application.

Average Score: 2.57

Ipotekabank is in need of a comprehensive digital transformation. Limited functionality, an outdated interface, and a weak technological base make the platform unappealing for users accustomed to modern digital services.