Cumax Wealth Manager Michael Lewis telling the company’s Spring Investment Forum at Terra Nova All-Suite hotel in St Andrew on Wednesday that its intention is to be the standard by which others are measured.

CUMAX Wealth Management is rolling out a series of new offerings aimed at expanding investment access and addressing gaps in long-term financial planning.

Among the new initiatives announced is the introduction of a registered retirement scheme, designed to address low participation in retirement investing.

“This is a significant problem. It means that children who grow up and are barely beginning to create generational wealth might end up having to use their financial resources to take care of their ailing parents,” Miguel Lewis, wealth manager at Cumax, said during the company’s Spring Investment Forum at Terra Nova All-Suite hotel in St Andrew on Wednesday.

He added that while caregiving remains an important cultural norm, strengthening the retirement system would allow each generation to build on the financial foundation left by the one before. While Cumax has yet to release full details of the scheme, executives confirmed that it will be launched later this year as part of the company’s long-term strategy to support wealth-building and financial independence.

Also announced at the forum was the introduction of a digital onboarding platform, part of Cumax’s ongoing digital transformation strategy. The platform, which is expected to launch in the coming weeks, is designed to streamline account setup by allowing clients to complete the process remotely. The new system will enable users to open investment accounts by submitting identification and fulfilling Know Your Customer (KYC) requirements entirely online.

Speaking with the Jamaica Observer, Maurice Wright, chief investment officer at Cumax, said the platform eliminates the need for in-branch visits and is intended to improve client convenience and operational efficiency.

“You can be in your home filling out the information, upload your ID and whatever other requirements, from the comfort of wherever you are,” he said.

The platform is currently undergoing final-stage testing. Wright noted that while the company is aiming to launch in the coming weeks, some minor delays may occur depending on the results of final user testing and system performance. Once launched, the system will apply to all new investment and savings accounts under Cumax’s portfolio.

“Our intention is not to be like anybody else in Jamaica, but to be the standard by which others are measured,” Lewis added.

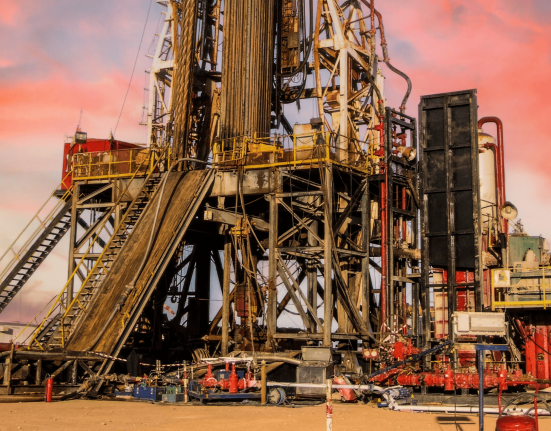

In addition to its upcoming retirement scheme and digital onboarding platform, Cumax is promoting access to the Canadian stock market — a feature it introduced in 2023 — as part of its broader diversification strategy. The company has ramped up promotion of the offering in light of recent global tariff developments, which have contributed to volatility in the US equities market.

Through its partnership with the Jamaica Stock Exchange (JSE), Cumax is currently the only local institution offering retail investors direct access to Canadian equities at a relatively low cost. The company says the option allows for exposure to sectors not typically available on the local exchange.

“The Canadian market opens up exposure to sectors not readily available through the Jamaican exchange. These include companies involved in precious metals, transportation, machinery, and a wide range of industrial and resource-driven sectors,” Wright said.

He explained that the Canadian market provides a valuable hedge, especially at a time when the US market is experiencing instability tied to shifting trade policies and economic leadership. While the US remains a key player globally, the Canadian market’s structure and sector mix offer alternative growth opportunities.

The offering is facilitated through a Canadian brokerage arrangement. CIBC Canada serves as the broker, while RBC acts as the settlement bank. The process is managed through the JSE platform, giving local investors the ability to engage with international markets in the same way they trade Jamaican securities.

“This makes it easy in, easy out, just like trading on the JSE,” Wright said. “It’s about giving clients broader access without complicating the process.”

He added that the Canadian market’s diversity — including oil, mining, commodities, cannabis, and industrial goods — positions it as a practical option for investors looking to build a more resilient, globally balanced portfolio.