A compelling alternative to traditional spreadsheets—with a learning curve.

Combining digital note-taking with financial tracking is a no-brainer, and Notion—nominally a productivity app—is appealing as a hybrid solution. Neither a dedicated budgeting app nor a simple spreadsheet, I find it occupies a unique middle ground that may be precisely what your financial planning needs.

After reading reviews praising Notion as a great tool for note-taking and creative projects, I wondered if its flexibility could help me solve my own financial organization challenges. As someone who prefers contextualizing my financial decisions with notes and visual cues, traditional spreadsheets often leave me switching between multiple apps. I decided to see if Notion could be the all-in-one solution for both number-crunching and narrative-based financial planning.

Template customization and usability

Notion’s template gallery offers a range of personal finance options, from simple expense trackers to comprehensive financial dashboards. The personal finance tracker template quickly became my favorite, providing a clean, intuitive layout with automatic date updating whenever new entries are recorded. This timestamps your financial journey, creating something of a spending journal alongside your raw data.

There’s no shortage of templates to choose from.

Credit: Meredith Dietz / Notion App

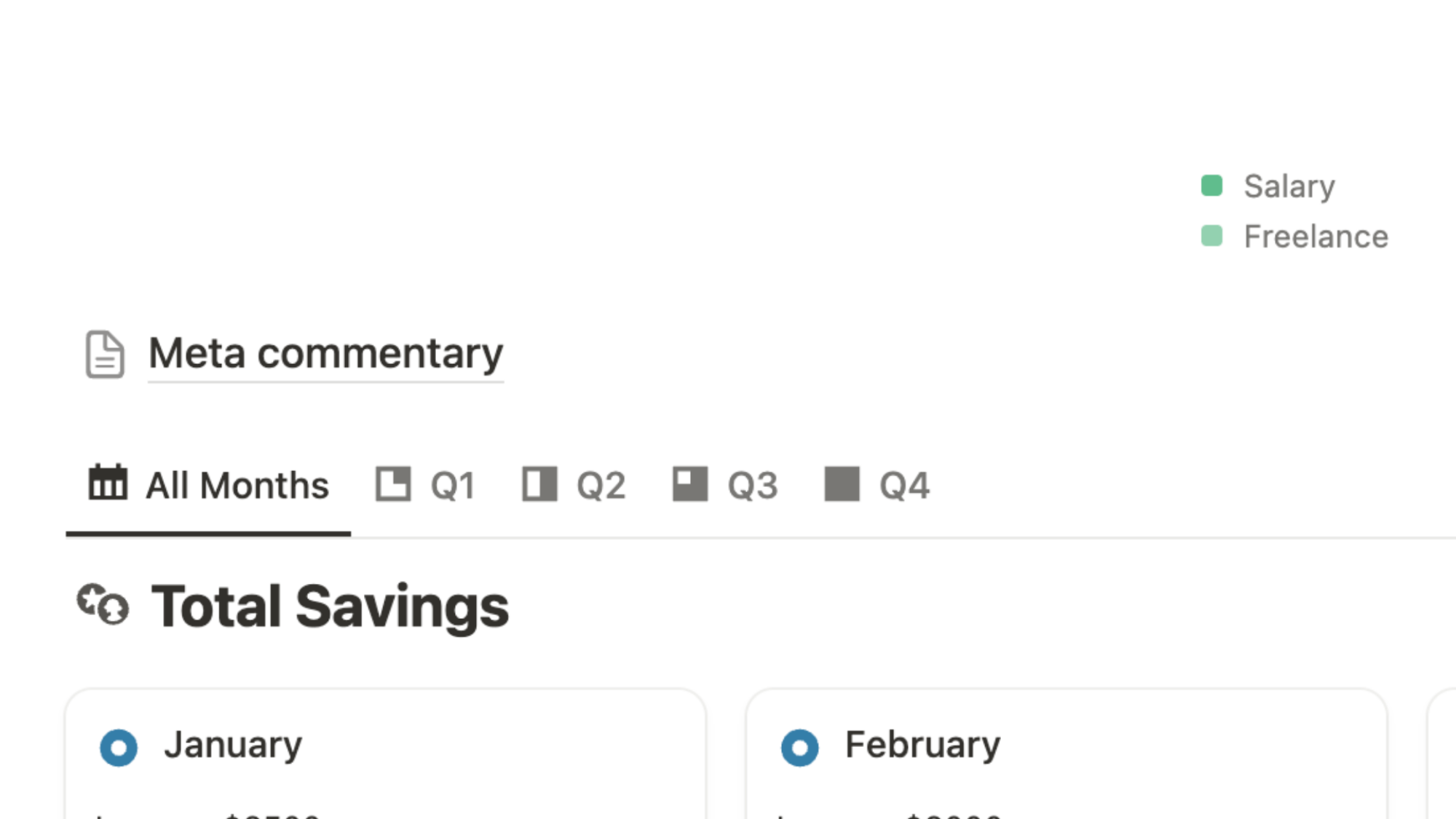

The template’s structure follows a logical flow—overview metrics at the top, with increasingly granular breakdowns as you scroll. This vertical organization feels more natural than jumping between spreadsheet tabs, giving you a holistic view of your finances in a single, scrollable page.

There are also the sort of perks you might find in a dedicated budgeting app, like automatic nudges to account for setting aside taxes on relevant income streams (a detail often overlooked in DIY spreadsheets). These small but significant features demonstrate Notion’s understanding of real financial planning needs.

Cost and value proposition

At first glance, Notion’s pricing structure appears suspiciously generous. Most essential templates, like the basic expense tracker and “Budget 101” planner, are available for free. For casual users or those just starting their financial organization journey, this free tier is easily all you need.

The paid plans begin at $4/month for Personal Pro, extending to team and enterprise options for collaborative financial planning. Compared to dedicated financial apps like YNAB ($14.99/month) or Quicken Deluxe ($35.99/year), Notion’s approach offers more flexibility at a lower price point—though without specialized financial features like direct bank synchronization.

However, as the adage goes, “if you’re not paying, you’re the product.” This brings us to perhaps the most significant consideration with Notion for financial tracking: privacy.

Privacy and security considerations

Unlike dedicated financial apps with bank-level security, Notion isn’t end-to-end encrypted. This means, theoretically, company employees could access user content. For sensitive financial information, this presents a legitimate concern.

While I found immense value in Notion’s organization capabilities, I remained cautious in my testing about what specific information I included. Account numbers, full credit card details, and other highly sensitive data are better kept elsewhere. Instead, I focused on using Notion for tracking spending patterns, visualizing savings goals, and documenting financial decisions.

This privacy consideration places Notion in an interesting middle ground—more secure than a paper notebook you might leave lying around, but less secure than a dedicated financial service with advanced encryption. Your comfort level will depend on your specific security needs and the sensitivity of the information you plan to track.

Learning curve and user experience

While I found Notion more intuitive than expected, there’s undeniably a learning curve to making it work as a personal finance tool. The first hour or so involved considerable exploration to understand how different elements interact and how to customize views to my preferences.

What do you think so far?

Plenty of ways to visualize your data.

Credit: Meredith Dietz / Notion App

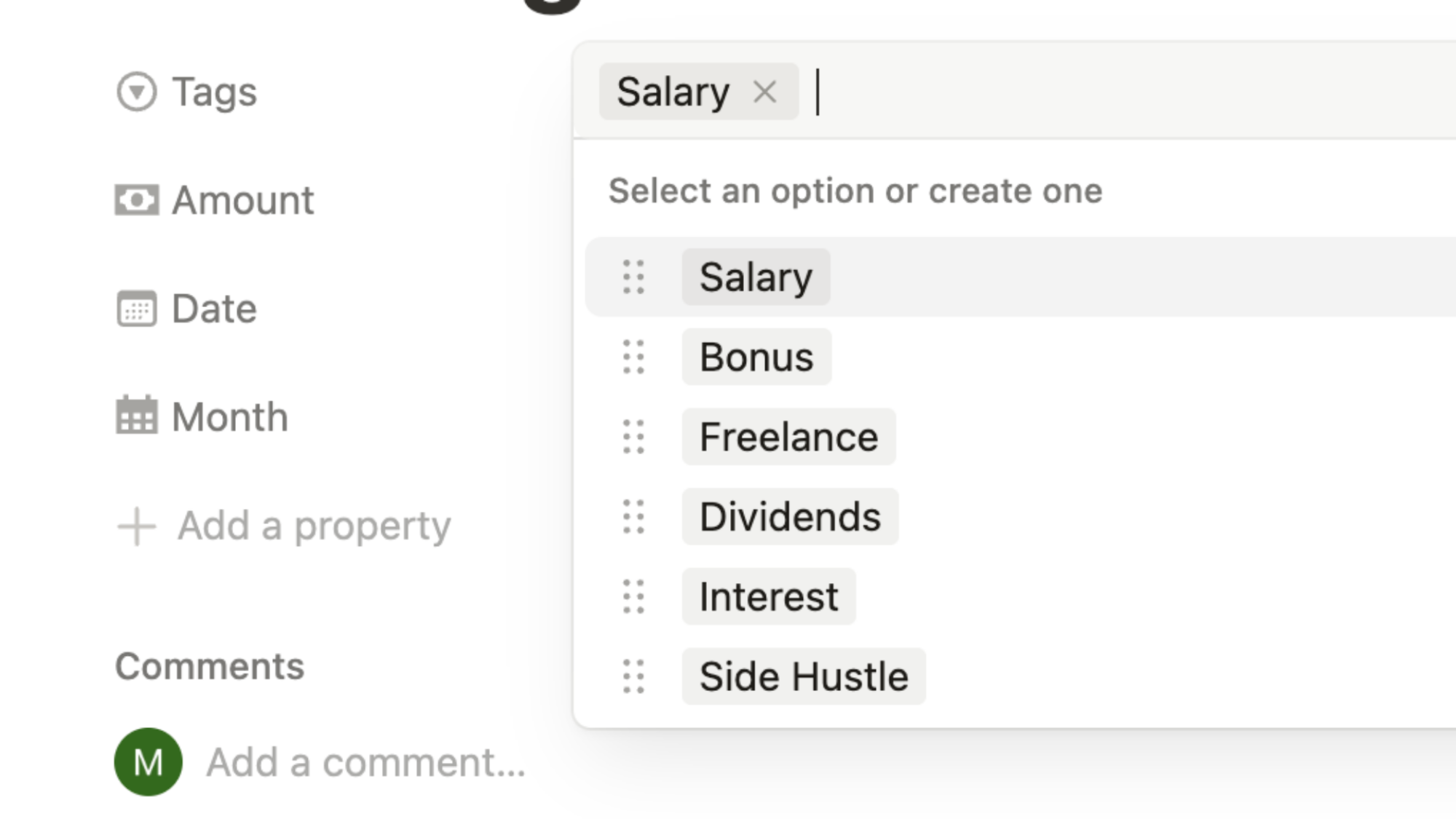

Adding tags to income sources or transforming expense data into various visualizations proved satisfying—once I learned how. The interface isn’t complex so much as feature-rich, requiring dedicated time to actually master. Unlike a simplified app that does one thing well, Notion offers dozens of ways to organize the same information.

I loved tagging my income sources, but there are a lot of features to get used to first.

Credit: Meredith Dietz / Notion App

For those with attention issues or limited time to invest in learning a new system, this could present a barrier. However, the payoff comes in having a highly personalized financial tracking system that works exactly how you think.

Beyond the numbers: Narrative financial planning

Perhaps Notion’s greatest strength for personal finance is its ability to combine quantitative tracking with qualitative thinking. By creating a dedicated page for financial meta-commentary, I could document thought processes, future plans, and contextual notes about my financial decisions.

I easily linked to a new page while working from my main interface.

Credit: Meredith Dietz / Notion App

Some of my genius thoughts.

Credit: Meredith Dietz / Notion App

This proved invaluable for someone who, like me, needs to externalize thinking before making financial decisions. When planning a vacation budget, for instance, I could brainstorm the full experience I wanted before assigning specific dollar amounts—keeping all related information in one connected workspace.

This narrative approach to finances addresses what many dedicated finance apps miss: money decisions are rarely just about numbers. They’re about goals, priorities, and life circumstances that require explanation and context. Notion excels at providing this holistic financial planning environment.

As a personal finance solution, Notion rocks for visual thinkers, narrative processors, and those who find traditional budgeting apps too restrictive. Its flexibility allows you to create a financial system that matches your thinking patterns, rather than forcing you to adapt to a predetermined structure.

At the same time, legitimate privacy concerns and a steeper learning curve make it difficult to recommend universally. Those managing complex financial situations with sensitive information might be better served by dedicated financial software with stronger security features. Meanwhile, users seeking absolute simplicity might find even Notion’s well-designed templates initially overwhelming.